You'll be able to fill in Preparers effortlessly by using our PDFinity® online tool. Our editor is continually evolving to grant the best user experience achievable, and that's because of our dedication to constant development and listening closely to customer feedback. To begin your journey, consider these basic steps:

Step 1: Press the orange "Get Form" button above. It'll open up our editor so you can begin completing your form.

Step 2: As you start the tool, you'll see the form ready to be completed. Other than filling in different blanks, you could also perform various other things with the form, such as writing any textual content, modifying the original text, inserting illustrations or photos, signing the PDF, and more.

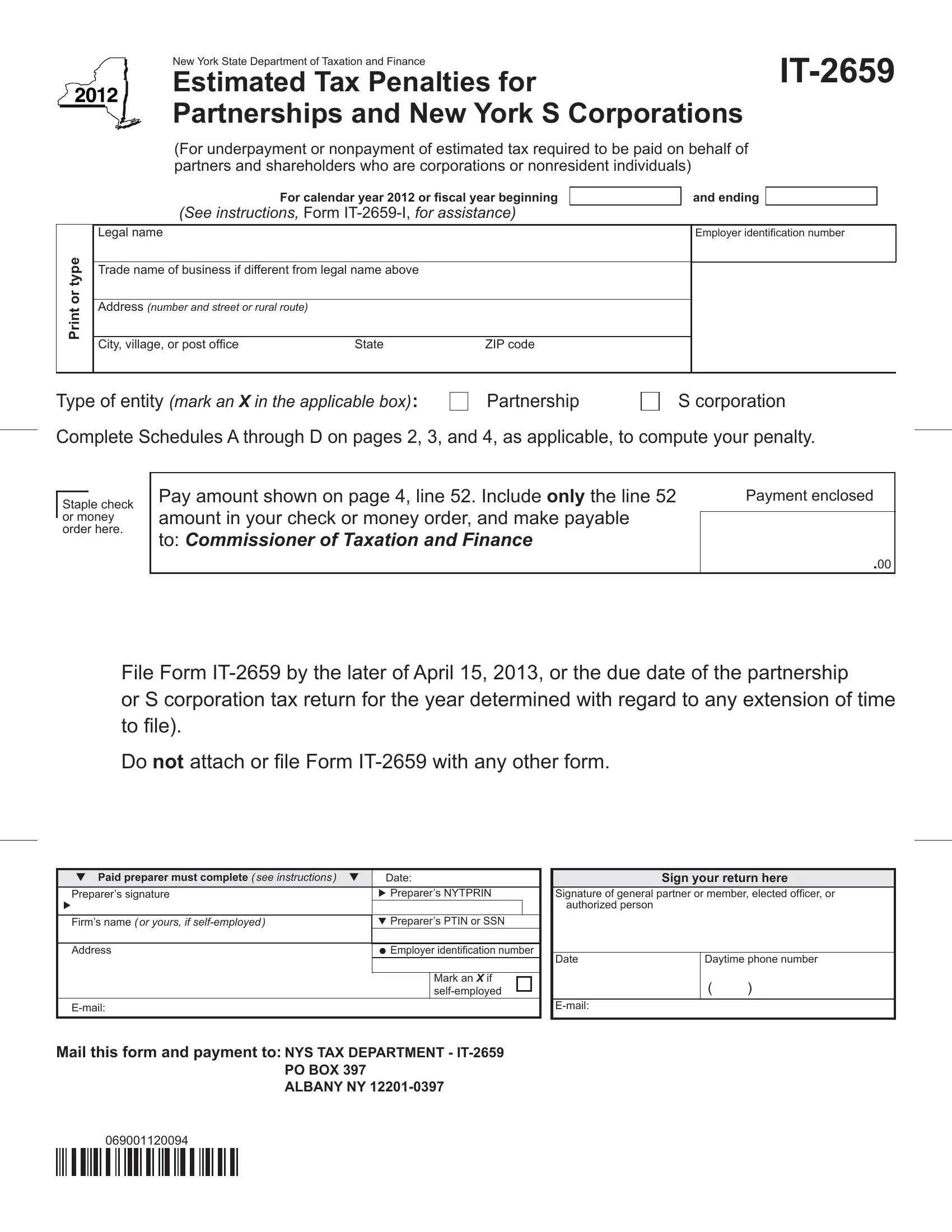

With regards to the fields of this particular PDF, here's what you should consider:

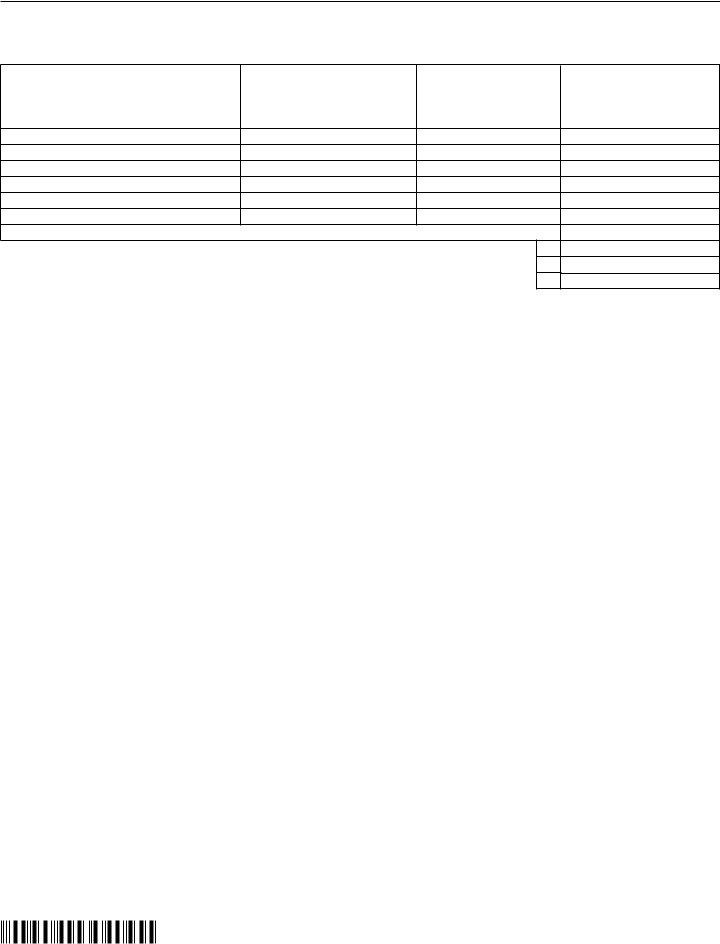

1. The Preparers necessitates particular information to be entered. Ensure that the subsequent fields are filled out:

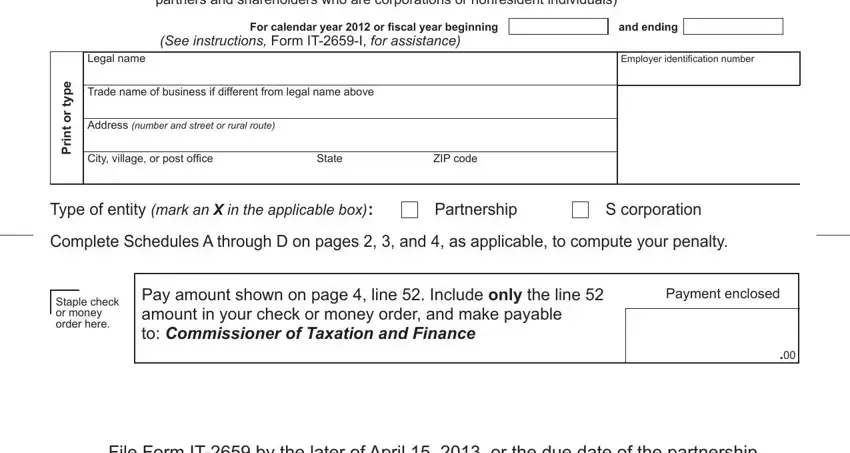

2. Once your current task is complete, take the next step – fill out all of these fields - Paid preparer must complete see, Date Preparers NYTPRIN, Firms name or yours if, Preparers PTIN or SSN, Sign your return here, Signature of general partner or, Address, Email, Employer identiication number, Mark an X if selfemployed, Date, Email, Daytime phone number, Mail this form and payment to NYS, and PO BOX ALBANY NY with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Concerning Mark an X if selfemployed and Daytime phone number, make certain you take a second look in this section. Both these could be the key fields in this PDF.

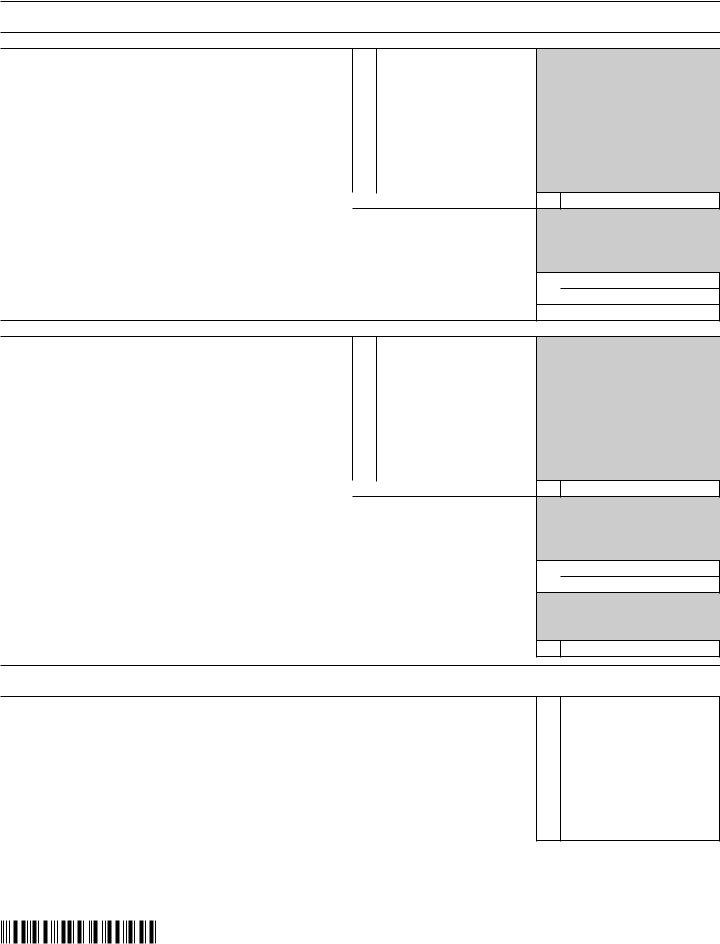

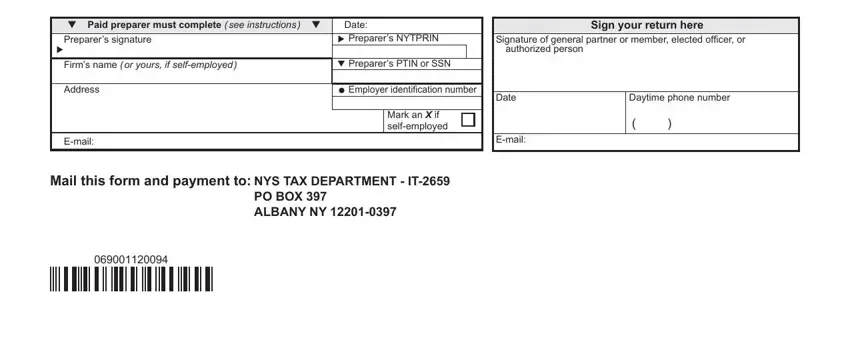

3. In this particular step, take a look at Total of all nonresident, Subtract line from line, estimated tax required to be, Total estimated tax required to, Prior year, or pro rata shares of income, Total of all nonresident, or pro rata shares of partnership, and estimated tax computed for. All these should be completed with utmost attention to detail.

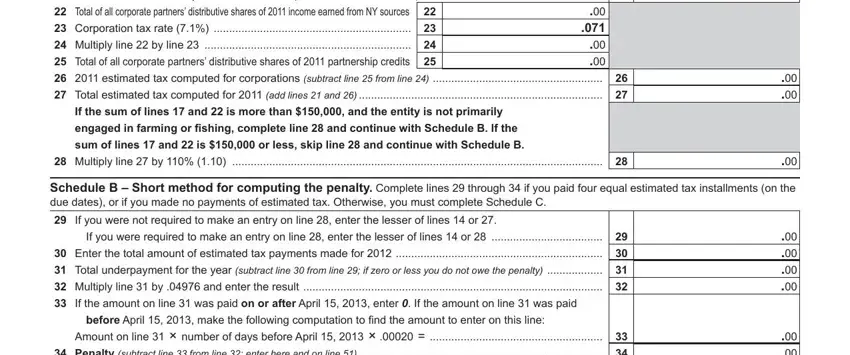

4. To go onward, this next stage requires filling in a couple of fields. Examples include estimated tax computed for, Total estimated tax computed for, If the sum of lines and is more, Schedule B Short method for, Total underpayment for the year, Multiply line by and enter the, and before April make the following, which you'll find vital to moving forward with this process.

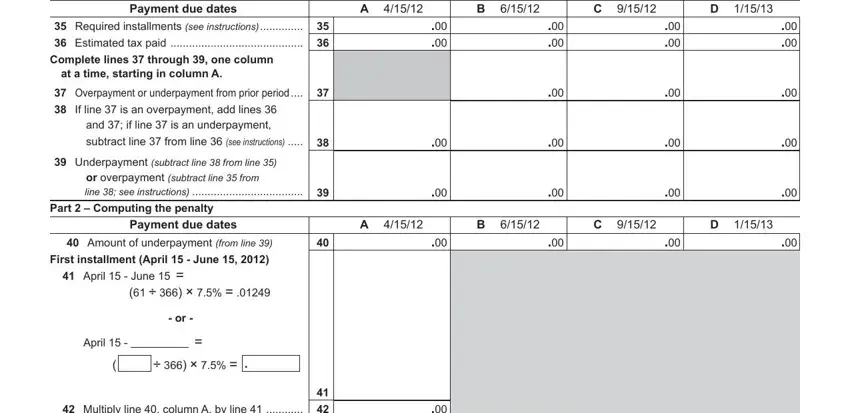

5. To finish your form, the final segment incorporates several additional fields. Filling out Payment due dates, Schedule C Regular method Part, subtract line from line see, Underpayment subtract line from, or overpayment subtract line from, line see instructions, Payment due dates, Part Computing the penalty First, Amount of underpayment from line, April, and Multiply line column A by line will certainly wrap up the process and you'll surely be done in a blink!

Step 3: Proofread all the details you have entered into the form fields and click the "Done" button. After getting a7-day free trial account here, you will be able to download Preparers or send it via email right off. The file will also be readily accessible via your personal cabinet with all of your adjustments. Here at FormsPal, we endeavor to make certain that all of your details are kept protected.