By using the online tool for PDF editing by FormsPal, you'll be able to fill in or alter new jersey nexus questionnaire right here and now. We at FormsPal are aimed at giving you the best possible experience with our editor by consistently adding new functions and enhancements. Our tool has become much more user-friendly thanks to the newest updates! So now, filling out documents is easier and faster than before. To begin your journey, go through these easy steps:

Step 1: Click the orange "Get Form" button above. It is going to open up our pdf editor so you could begin filling out your form.

Step 2: The tool provides you with the capability to work with PDF files in many different ways. Improve it by including personalized text, correct existing content, and include a signature - all at your convenience!

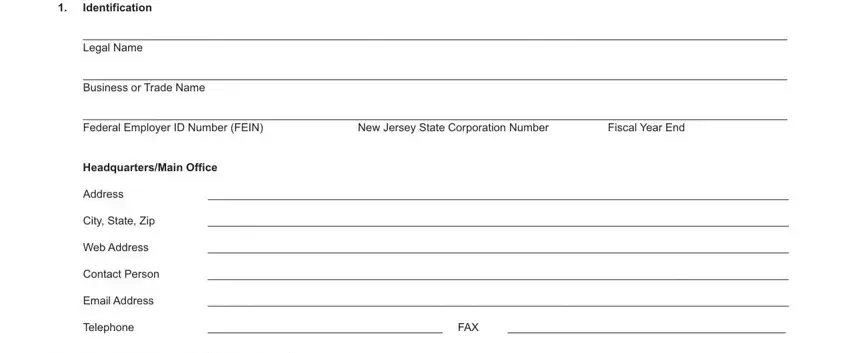

When it comes to fields of this specific document, here's what you should consider:

1. To begin with, while filling out the new jersey nexus questionnaire, beging with the page that features the next blanks:

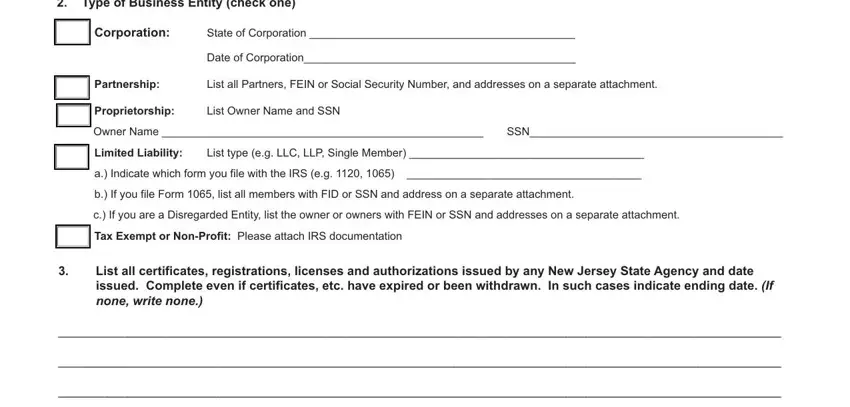

2. Immediately after the first section is filled out, proceed to enter the relevant information in all these: Type of Business Entity check one, Corporation, State of Corporation, Date of Corporation, Partnership, List all Partners FEIN or Social, Proprietorship, List Owner Name and SSN, Owner Name, SSN, Limited Liability, List type eg LLC LLP Single Member, a Indicate which form you file, b If you file Form list all, and c If you are a Disregarded Entity.

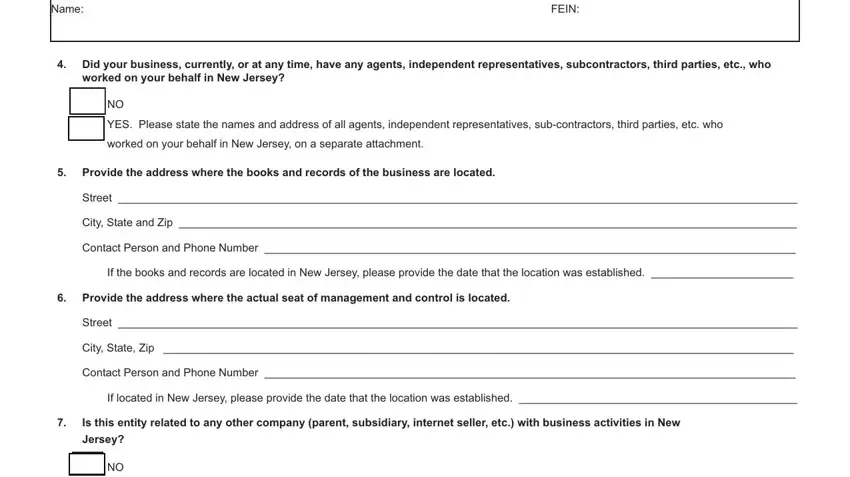

3. Completing Name, FEIN, Did your business currently or at, YES Please state the names and, worked on your behalf in New, Provide the address where the, Street, City State and Zip, Contact Person and Phone Number, If the books and records are, Provide the address where the, Street, City State Zip, Contact Person and Phone Number, and If located in New Jersey please is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

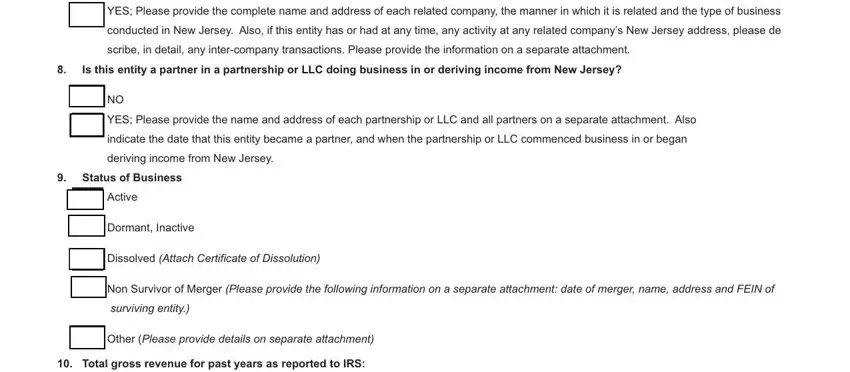

4. You're ready to complete this next portion! Here you will get these YES Please provide the complete, conducted in New Jersey Also if, scribe in detail any intercompany, Is this entity a partner in a, YES Please provide the name and, indicate the date that this entity, deriving income from New Jersey, Status of Business, Active, Dormant Inactive, Dissolved Attach Certificate of, Non Survivor of Merger Please, surviving entity, Other Please provide details on, and Total gross revenue for past fields to fill in.

Regarding deriving income from New Jersey and Dormant Inactive, make sure that you double-check them here. Both of these are the most important ones in this page.

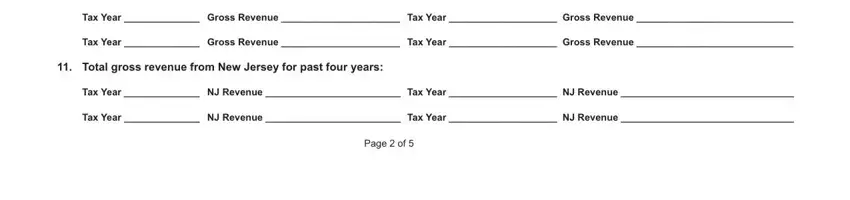

5. The pdf has to be finalized by filling out this area. Here there's a comprehensive listing of fields that require specific details for your document usage to be faultless: Tax Year Gross Revenue Tax Year, Tax Year Gross Revenue Tax Year, Total gross revenue from New, Tax Year NJ Revenue Tax Year NJ, Tax Year NJ Revenue Tax Year NJ, and Page of.

Step 3: Make certain the details are correct and then click on "Done" to finish the process. Sign up with FormsPal today and easily get access to new jersey nexus questionnaire, all set for download. All adjustments you make are preserved , making it possible to modify the file later if needed. At FormsPal.com, we endeavor to be sure that all of your information is maintained secure.