cbp form 5955 can be filled in without any problem. Just try FormsPal PDF editing tool to do the job without delay. The editor is consistently maintained by our staff, acquiring additional features and turning out to be greater. It merely requires a couple of basic steps:

Step 1: First of all, access the tool by clicking the "Get Form Button" at the top of this webpage.

Step 2: As you access the online editor, there'll be the form ready to be completed. Apart from filling in various fields, you can also do several other things with the form, such as writing any textual content, changing the initial textual content, inserting illustrations or photos, signing the document, and a lot more.

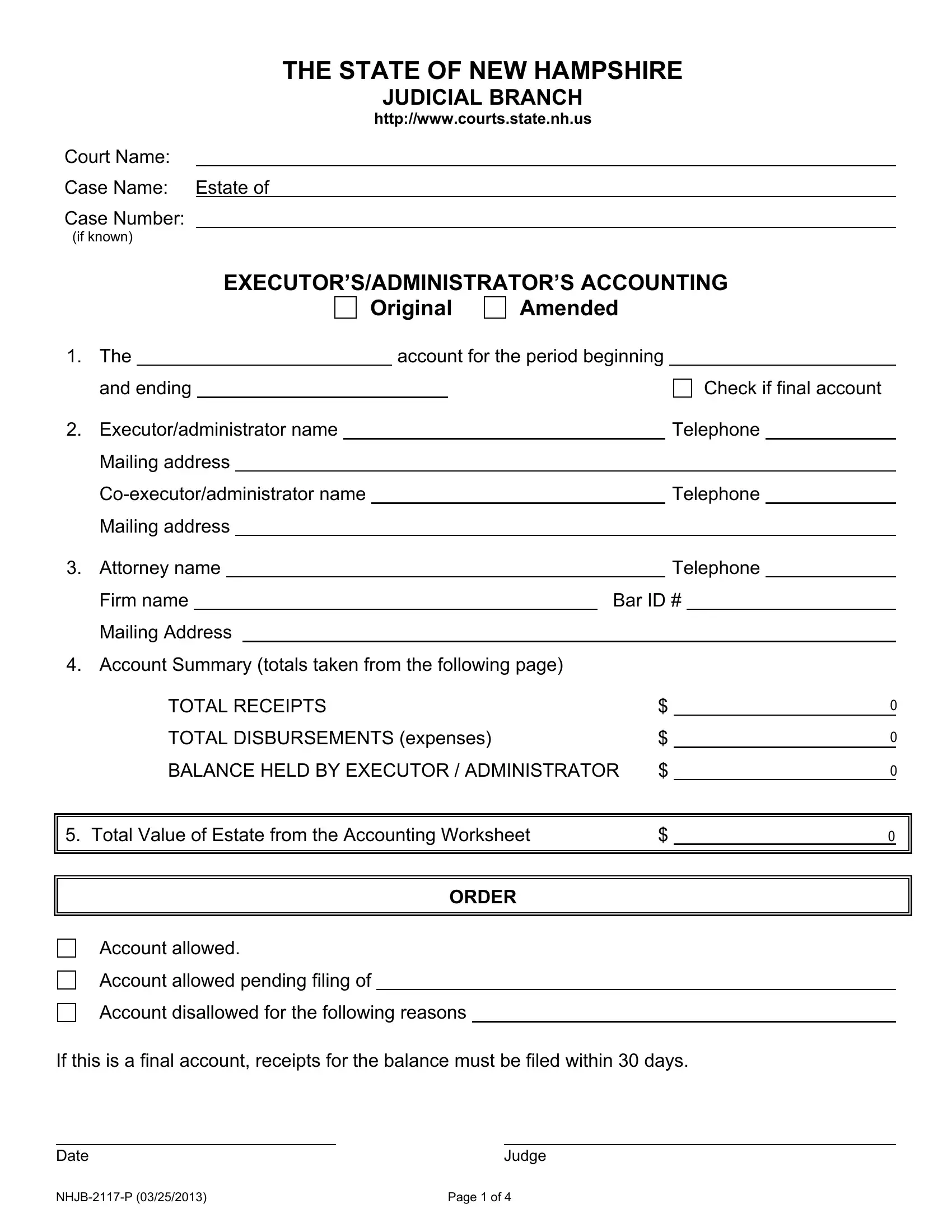

If you want to finalize this document, ensure that you provide the necessary information in every single field:

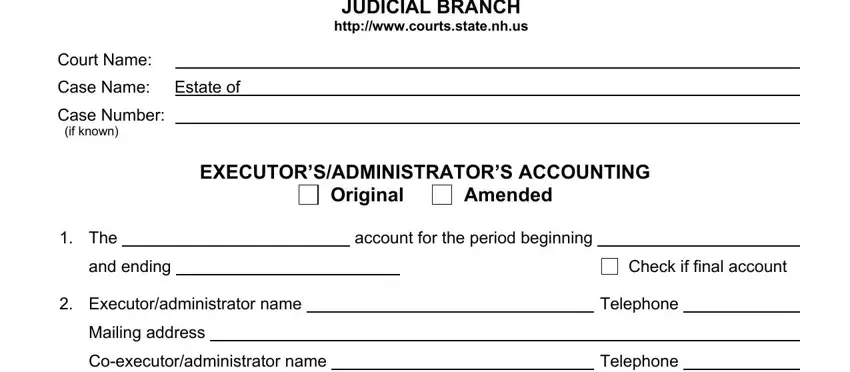

1. You will need to fill out the cbp form 5955 accurately, hence be careful while filling in the areas that contain all these fields:

2. Once your current task is complete, take the next step – fill out all of these fields - Mailing address, Attorney name, Firm name, Mailing Address, Telephone, Bar ID, Account Summary totals taken from, TOTAL RECEIPTS, TOTAL DISBURSEMENTS expenses, BALANCE HELD BY EXECUTOR, Total Value of Estate from the, ORDER, and Account allowed with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

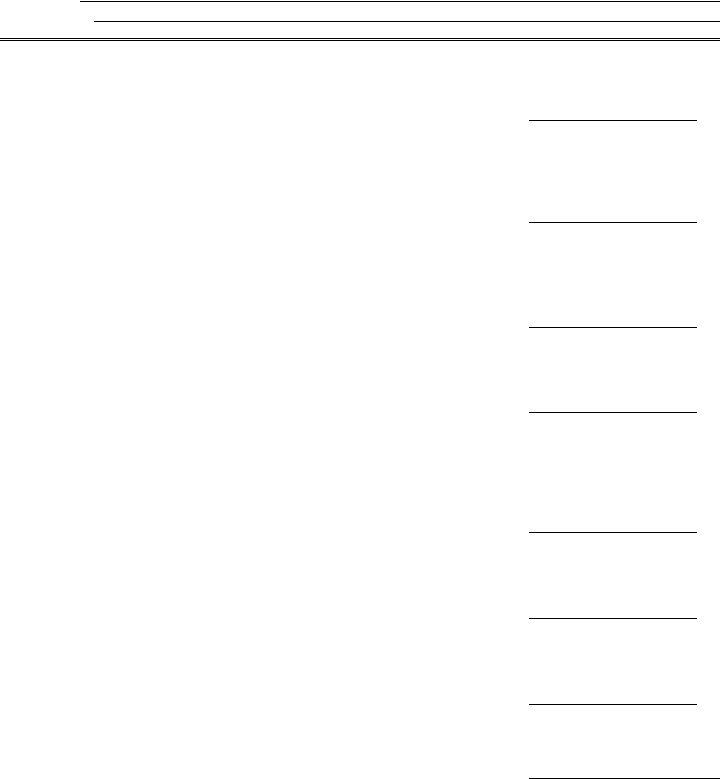

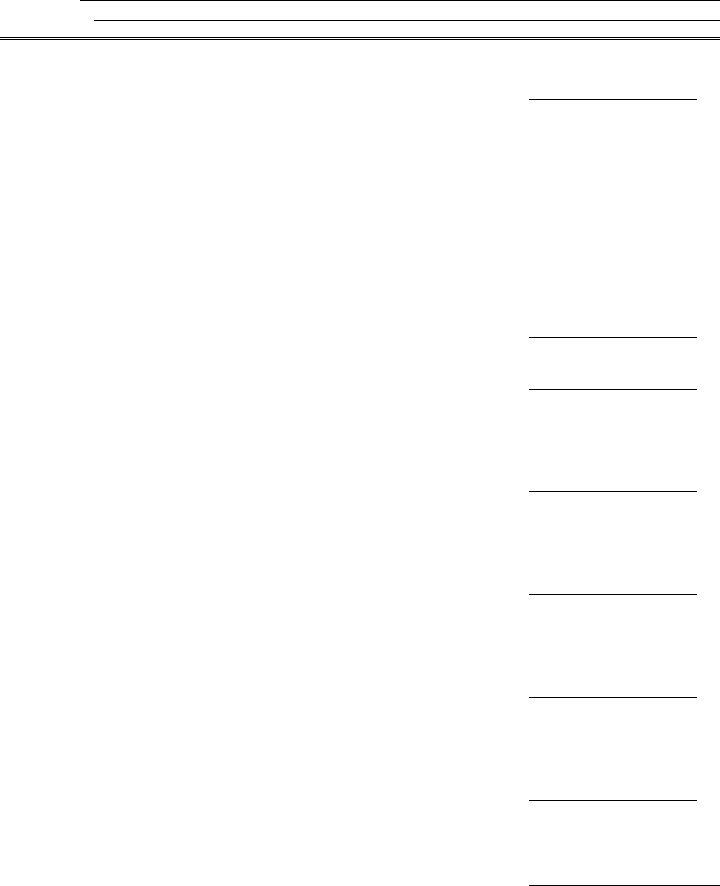

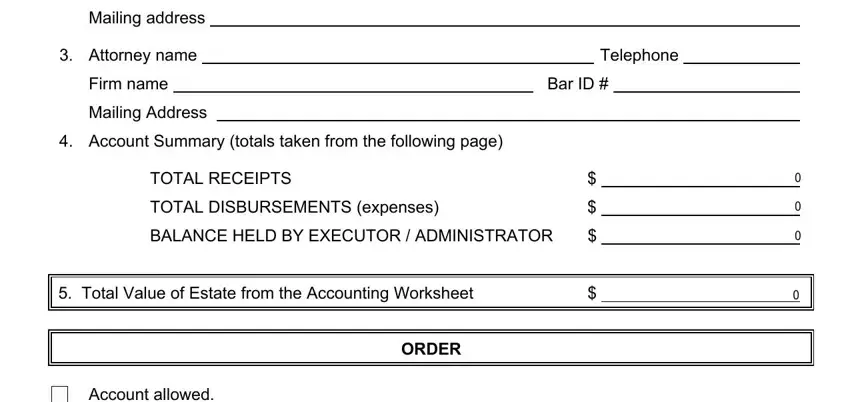

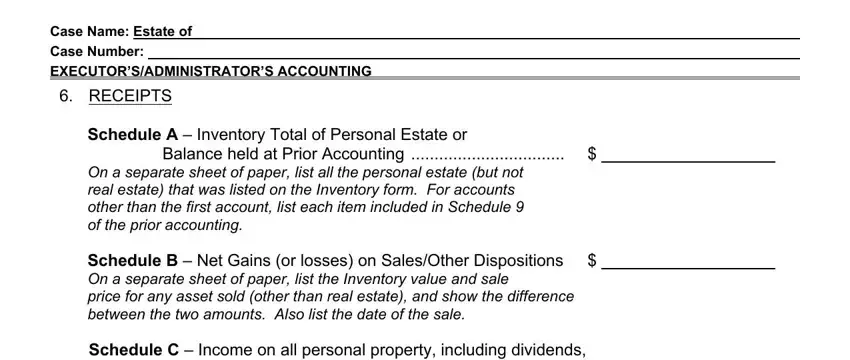

3. This subsequent section is pretty simple, Case Name Estate of, Case Number, EXECUTORSADMINISTRATORS ACCOUNTING, RECEIPTS, Schedule A Inventory Total of, Balance held at Prior Accounting, On a separate sheet of paper list, and Schedule B Net Gains or losses on - these blanks needs to be completed here.

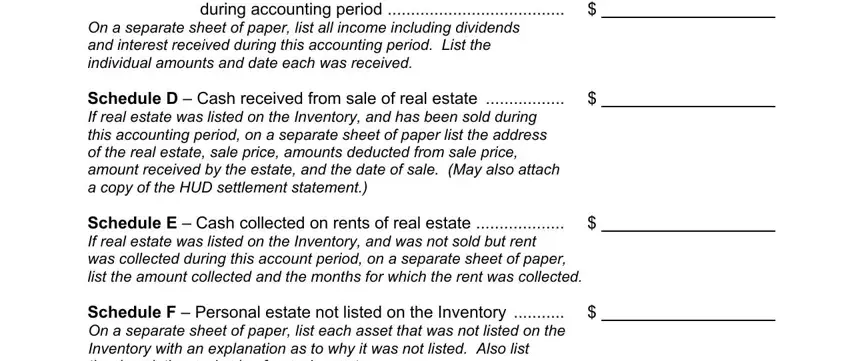

4. Your next section requires your information in the following places: during accounting period, On a separate sheet of paper list, Schedule D Cash received from, Schedule E Cash collected on, and Schedule F Personal estate not. It is important to give all requested info to move forward.

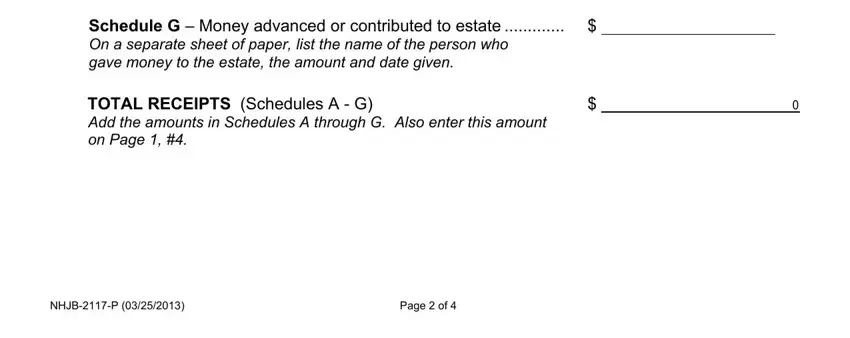

5. While you get close to the end of your document, there are actually a couple extra points to do. Mainly, Schedule G Money advanced or, TOTAL RECEIPTS Schedules A G Add, NHJBP, and Page of must be done.

People generally make errors when filling out Schedule G Money advanced or in this section. Don't forget to go over everything you type in here.

Step 3: When you have reviewed the information you filled in, press "Done" to conclude your form. Get hold of your cbp form 5955 the instant you join for a 7-day free trial. Immediately gain access to the form within your FormsPal cabinet, with any modifications and changes automatically kept! FormsPal provides protected form editing without data record-keeping or any type of sharing. Feel safe knowing that your details are in good hands with us!