NJ-630 |

Application for Extension of Time to File |

8-2020 |

New Jersey Gross Income Tax Return |

Read the instructions on both sides before completing this application. If all requirements are satisfied, an extension of 6 months will be granted for filing Forms NJ-1040, NJ-1040NR, and NJ-1080C. A 5½ month extension of time will be granted for filing Form NJ-1041 and NJ-1041SB.

An extension of time is granted only to file a New Jersey Income Tax return. There is no extension of time to pay tax due. Penalties and interest are imposed whenever tax is paid after the original due date. To be eligible for an extension, you must have paid at least 80% of the tax liability calculated on the New Jersey Income Tax return when filed. The 80% can be paid through withholdings, estimated payments, or a payment made with the extension application by the original due date. If the 80% requirement is not met, the extension will be retroactively denied, and penalty and interest will be im-

posed from the original due date of the return.

You must file this NJ-630 application if:

1.You are applying for an extension of time to file a New Jersey Income Tax return but you are not applying for a fed- eral extension; or

2.You are applying for both a federal and a New Jersey extension and are required to remit payment to the New Jer- sey Division of Taxation by the original due date of the return in order to have at least 80% of your actual tax liability (as calculated on your New Jersey Income Tax return when filed) paid.

You do not need to submit this NJ-630 application if:

1.You have paid at least 80% of your final tax liability by the original due date, and

2.You have applied for an automatic extension of time to file for federal purposes and you enclose a copy of the fed- eral Application for Automatic Extension (if filed by paper) with the final New Jersey return when filed.

The application for extension of time to file a New Jersey Gross Income Tax return (Form NJ-630) must be filed (post- marked) no later than the original due date of the return. Extension requests can also be filed online until 11:59 p.m. on April 15, 2021, at: www.njtaxation.org. If you are required to make a payment with your online extension application, the

payment must be made by e-check or credit card.

Before filing Form NJ-630:

1.Detach at perforation;

2.Fill out all requested information on the application, including your Social Security number (FEIN if estate or trust);

3.Make your check or money order payable to “State of New Jersey–TGI;”

4.Write your Social Security number (FEIN if estate or trust) and the tax year on your check, and;

5.Mail the application with your payment to the address of the application.

Taxpayers who file Form NJ-630 will not receive an approved copy. You will be notified by the Division of Taxa- tion only if your extension request is denied, but not until after your return is actually filed.

Cut Along Dotted Line

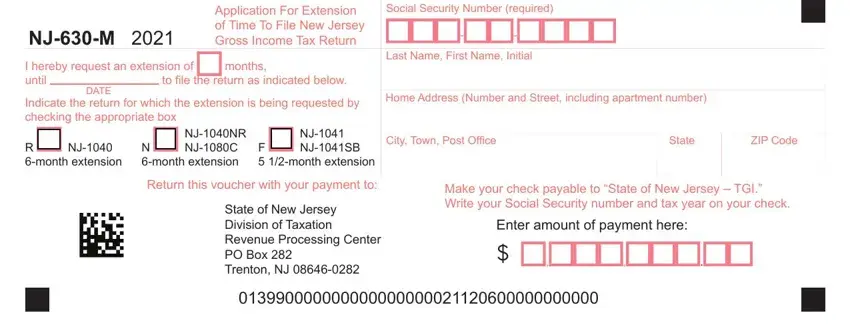

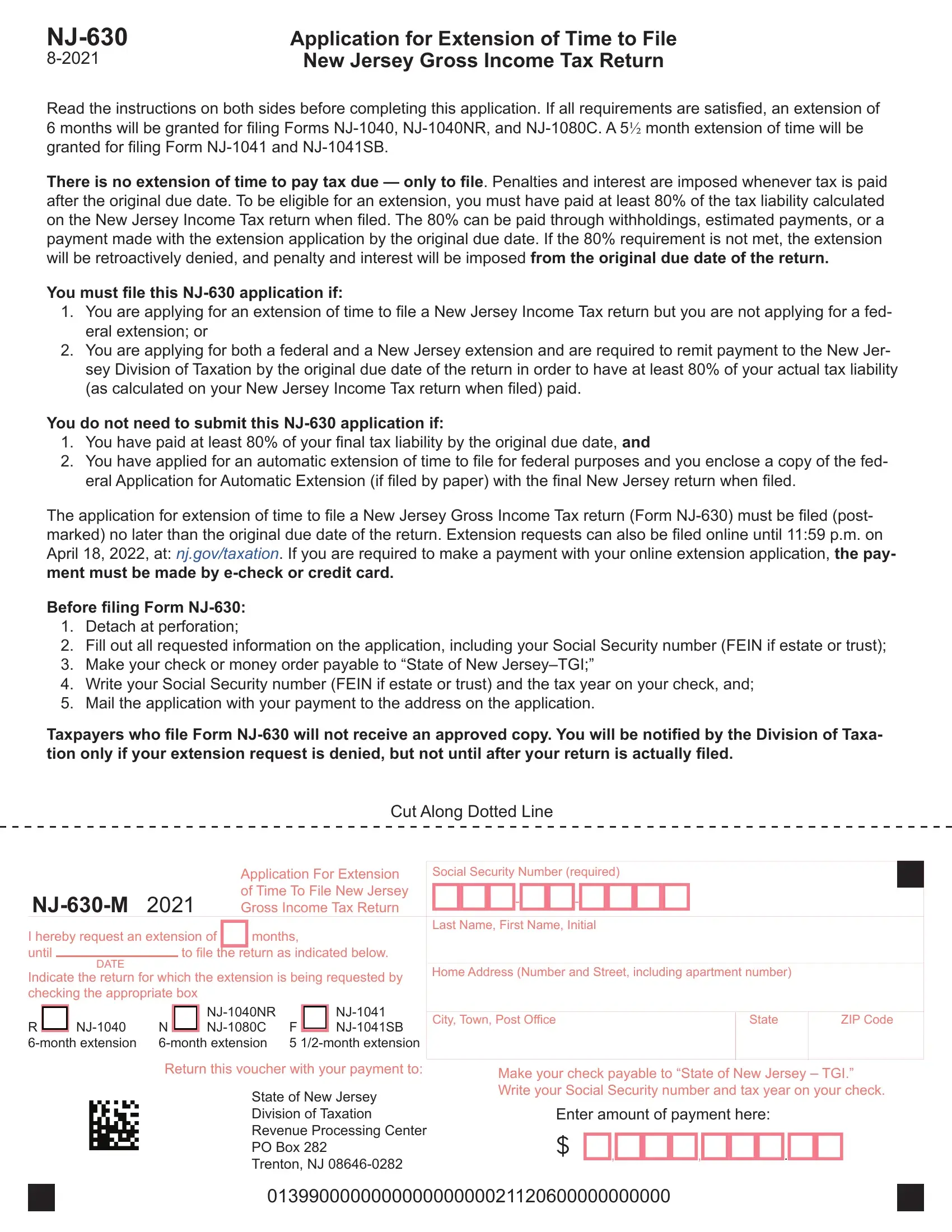

Social Security Number (required)

NJ-630-M |

2020 |

|

|

|

|

|

|

|

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last Name, First Name, Initial |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home Address (Number and Street, including apartment number) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NJ-1040NR |

|

|

|

NJ-1041 |

City, Town, Post Office |

|

State |

ZIP Code |

|

|

|

|

|

|

|

|

|

R |

|

NJ-1040 |

N |

|

NJ-1080C |

F |

|

|

NJ-1041SB |

|

|

|

|

|

|

|

|

|

|

6-month extension |

6-month extension |

5 1/2-month extension |

|

|

|

|

|

|

|

|

|

|

|

|

State of New Jersey |

|

Enter amount of payment here: |

|

|

|

|

|

|

|

|

Division of Taxation |

|

|

|

|

|

|

|

|

|

Revenue Processing Center |

|

$ |

|

|

|

|

|

|

|

|

|

|

PO Box 282 |

|

|

, |

, |

. |

|

|

|

|

|

|

|

Trenton, NJ 08646-0282 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

013990000000000000000020120600000000000

8-2020

Trusts and estates that obtain an automatic 5 1/2-month federal extension of time to file the fiduciary return will receive an automatic extension of time to file in New Jersey for the same period of time provided that at least 80% of the ac- tual tax liability (as calculated on Form NJ-1041 or NJ-1041SB when filed) is paid by the original due date of the re- turn and a copy of the federal Application for Automatic Extension (if filed by paper) is enclosed with Form NJ-1041 or NJ-1041SB when filed.

Persons in active service with the Armed Forces of the United States who may be prevented from filing by distance or injury or hospitalization arising out of such service will automatically receive a 6-month extension by setting forth the

reason for the extension on a statement enclosed with their return.

PENALTIES AND INTEREST

If the final return is not received by the extended due date, penalty and

interest will be calculated as if the extension had not been granted.

The penalty and interest charges for returns filed late and/or tax paid late are:

1.Late filing penalties of:

a.5% per month (or part of a month), up to a maximum of 25% of the balance of tax due with the return.

b.$100 per month (or part of a month) that the return is late.

2.Late payment penalty of 5% of any tax balance due.

3.Interest at the rate of 3 percentage points above the prime rate for every month (or part of a month) the tax is un- paid,compounded annually. At the end of each calendar year, any tax, penalties, and interest remaining due will become part of the balance on which interest is charged.

When filing your final Income Tax return be sure to include:

1.Payment of any tax due,

2.Late payment penalty of 5% of balance of tax due, if any, and

3.Interest calculated at the rate of 3 percentage points above the prime rate from the original due date of the return.

If you have questions, contact the Division of Taxation’s Customer Service Center at 609-292-6400.