Within the complex landscape of fiduciary obligations and tax responsibilities, the New Mexico FID-1 form emerges as a critical document for trustees and executors, underscoring the intricate process of filing fiduciary income tax returns. This form, designated for the 2019 tax year, requires submission to the New Mexico Taxation and Revenue Department by a deadline that aligns with traditional tax filing dates—April 15th for calendar year filers, and the 15th day of the fourth month following the fiscal year's close for those operating on a different cycle. The form encompasses a variety of sections aimed at capturing the complete financial picture of the estate or trust, including additions to and deductions from federal income, specific incomes like non-New Mexico municipal bond interest, and distributions to beneficiaries. Furthermore, it introduces considerations for amended returns, penalties on underestimated tax payments, and credits for taxes paid to other states. With options to report details related to direct deposit refunds and the presence of an important notice exempting certain grantor trusts, the FID-1 form encapsulates the complexities involved in adhering to fiduciary tax obligations in New Mexico. The complete and timely filing of this form, along with accurate computation of taxable income and understanding the distinctions between different types of trusts, becomes paramount for fiduciaries navigating tax duties on behalf of estates and trusts.

| Question | Answer |

|---|---|

| Form Name | Nm Fid 1 Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | nm fid 1, fid 1 tax, new mexico fid 1 instructions 2020, fid 1 new |

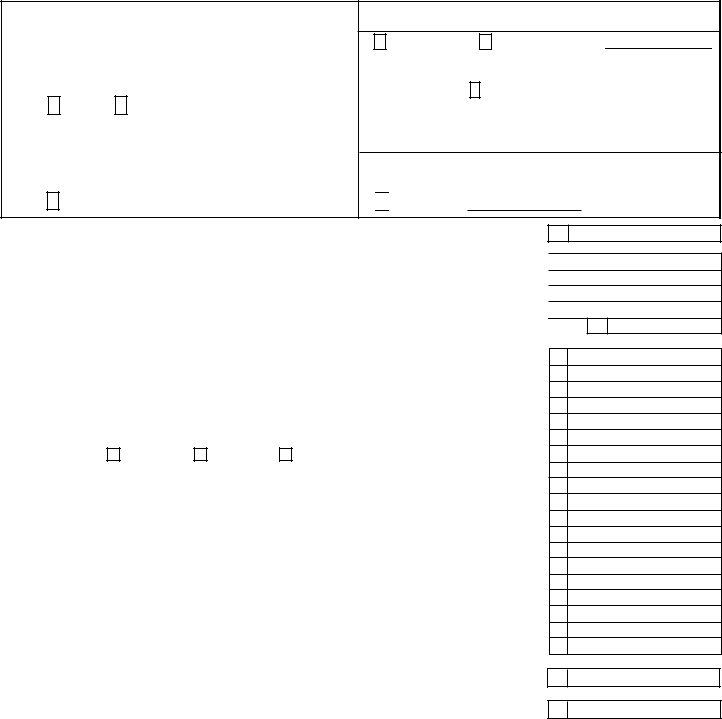

2019 |

NEW MEXICO |

*198080200* |

|

FIDUCIARY INCOME TAX RETURN

Mail the original return and tax due to the New Mexico Taxation and Revenue Department, P.O. Box 25127, Santa Fe, NM

A1

A3

A4

Name of estate or trust |

|

|

Name and title of fiduciary |

|

FOR DEPARTMENT |

|

|

|

|

|

|

|

USE ONLY |

|

|

A2 |

|

|

|

|

|

|

|

|

|

|

|

Address of fiduciary - (Number and street) |

City |

|

|

State |

Postal/ZIP code |

|

|

|

|

|

|

||

If foreign address, enter country |

Foreign province and/or state |

|

|

|||

|

|

|

|

|

|

|

B.DATE TRUST OR ESTATE CREATED. ____________________

C.If this is a final fiduciary return, enter liquidation or distribution date.

____________________

D.Has an adjustment to your federal taxable income for any prior year by the Internal Revenue Service not been reported to New Mexico?

YES |

NO |

If yes, you must submit an amended New Mexico return.

E.If you owe penalty on underpayment of estimated tax and you qualify for a special calculation method, enter 1, 2, 3, 4, or 5 in the box, and

ATTACH Form

Federal Employer Identification Number of estate or trust (Required)

F1 |

|

Calender year |

F2 |

Fiscal year beginning |

F3 |

|||||

|

|

ending |

and ending |

F4 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CHECK APPLICABLE BOXES |

|||||||

G1 |

|

Amended |

G2 |

Simple Trust |

G3 |

|

If a New Mexico resident |

|||

|

|

|

|

|

|

|

|

trust or estate, mark the box. |

||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

G4 |

|

ESTATE |

G5 |

|

Complex Trust |

G6 |

|

Grantor Trust |

||

|

|

|

|

|

|

|

|

|

|

|

EXTENSION OF TIME TO FILE. If you have a federal or New Mexico state extension, mark the box and enter the extension date.

H1 Extended to: H2

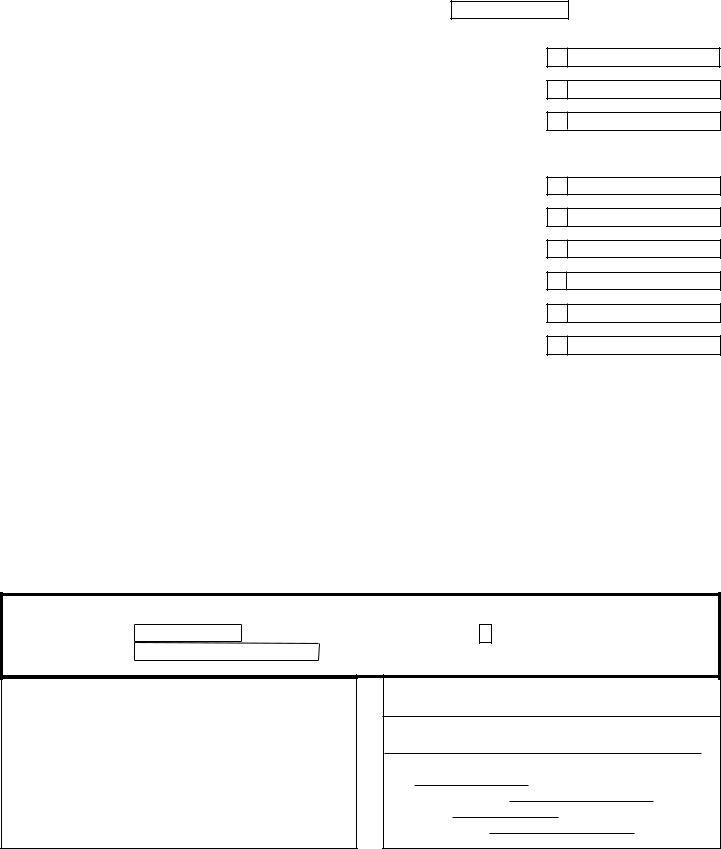

1. Federal taxable income of fiduciary (Sec. 641(c) federal taxable income ________________ )..............

1

2. |

.................................................................Additions to federal income (from |

+ |

2 |

|||

3. |

Deductions from federal income (from |

- |

3 |

|||

4. New Mexico taxable income. Add lines 1 and 2, then subtract line 3 |

= |

4 |

||||

5. Tax on line 4 amount. Use the Tax Rate Table in |

|

5 |

||||

6. |

.................................................New Mexico percentage of income (from |

|

|

|||

7. |

New Mexico income tax. Multiply line 5 by the percentage on line 6 and enter here. |

|

|

|||

|

If you do not need to complete Form |

7 |

||||

8. |

Tax on |

8 |

||||

9. |

Total New Mexico tax. Add lines 7 and 8 |

9 |

||||

10. |

Credit for taxes paid to another state (worksheet in instructions). Include other state return copy |

10 |

||||

11. |

Total credits applied against the income tax liability due (from |

11 |

||||

12. |

Net New Mexico income tax. Add lines 10 and 11, then subtract from line 9. Cannot be less than zero |

12 |

||||

13. |

Total Payments. |

Estimated |

Extension |

Applied from prior year |

13 |

|

14. |

New Mexico income tax withheld not included on lines 15 and 16. Attach annual statements |

14 |

||||

15. |

New Mexico income tax withheld from oil and gas proceeds. Attach |

15 |

||||

16. |

New Mexico income tax withheld from a |

16 |

||||

17. |

Amount from lines 15 and 16 passed to beneficiaries (reported on Form |

17 |

||||

18. |

Total payments and tax withheld. Subtract line 17 from the sum of lines 13 through 16 |

18 |

||||

19. |

Tax Due. If line 12 is more than line 18, enter the tax due |

19 |

||||

20. |

Penalty. See instructions |

|

+ 20 |

|||

21. |

Interest. See instructions |

|

+ 21 |

|||

22. |

Total amount due. Add lines 19, 20, and 21 |

= 22 |

||||

23. |

Overpayment. If line 18 is more than line 12, enter the difference |

23 |

||||

|

23a. Amount of overpayment to apply to 2020 liability. Cannot be more than line 23 |

|

23a |

|||

|

23b. Amount of overpayment to refund. Subtract line 23a from line 23 |

|

23b |

|||

24.Total portion of tax credits to be refunded

(from

25. Total refund of overpaid tax and refundable credit due to you. Add lines 23b and 24 .....................................

6

_ _ _ . _ _ _ _%

Name of estate or trust as shown on Form |

*198090200* |

|

2019 |

|

|

NEW MEXICO FIDUCIARY INCOME TAX RETURN |

|

|

|

|

FEIN of estate or trust |

|

|

|

|

|

|

ADDITIONS TO FEDERAL INCOME FOR FIDUCIARY

1. Federal net operating loss carryover ...............................................................................

2. |

....................................................................... |

+ |

|

|

|

1

2

3. Total additions. Add lines 1 and 2, then enter on |

= |

|

DEDUCTIONS FROM FEDERAL INCOME FOR FIDUCIARY |

|

|

|

||

4. New Mexico net operating loss (Attach |

|

|

5. |

Interest income from U. S. government obligations |

+ |

6. Net capital gain deduction. See instructions |

+ |

|

|

|

|

7. |

Deduction for income set aside for future distribution from an estate or trust to a |

|

|

nonresident individual |

+ |

8. |

Total deductions. Add lines 4, 5, 6, and 7. Enter on |

= |

9.Total distributions of income to beneficiaries. Enter the amount reported on Schedule

3

4

5

6

7

8

9

Important: On Schedule

Annual Withholding of Net Income From a

* * * * IMPORTANT NOTICE * * * *

The fiduciary of any grantor trust required to file federal Form 1041 under the provisions of federal

regulation

!!REFUND EXPRESS !! HAVE YOUR REFUND DIRECTLY DEPOSITED. SEE INSTRUCTIONS AND FILL IN 1, 2, 3, AND 4.

RE1 |

1. Routing number: |

RE3 3. Type: Checking |

|

Savings |

|

||||

RE2 |

2. Account number: |

Enter X |

|

Enter X |

|

4.REQUIRED: WILL THIS REFUND GO TO OR THROUGH AN ACCOUNT LOCATED OUTSIDE THE UNITED STATES? If yes, you may not use THIS

refund delivery option. See instructions.

RE4 YES |

|

NO |

|

You must answer |

|

|

this question. |

||

|

|

|

|

I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer or an employee of the taxpayer) is based on all information of which preparer has any knowledge.

Taxpayer's signature

|

Signature of fiduciary or officer representing fiduciary |

Date |

|

|

|

|

|

|

Title |

Contact phone number |

|

|

|

|

|

Taxpayer's email address |

|

|

|

P1

P2

P3

P4

P5

Paid preparer's use only:

Signature of preparer if other than employee of the taxpayer |

Date |

Print preparer's name

FEIN

NM CRS Identification Number

Preparer's PTIN

Preparer's phone number

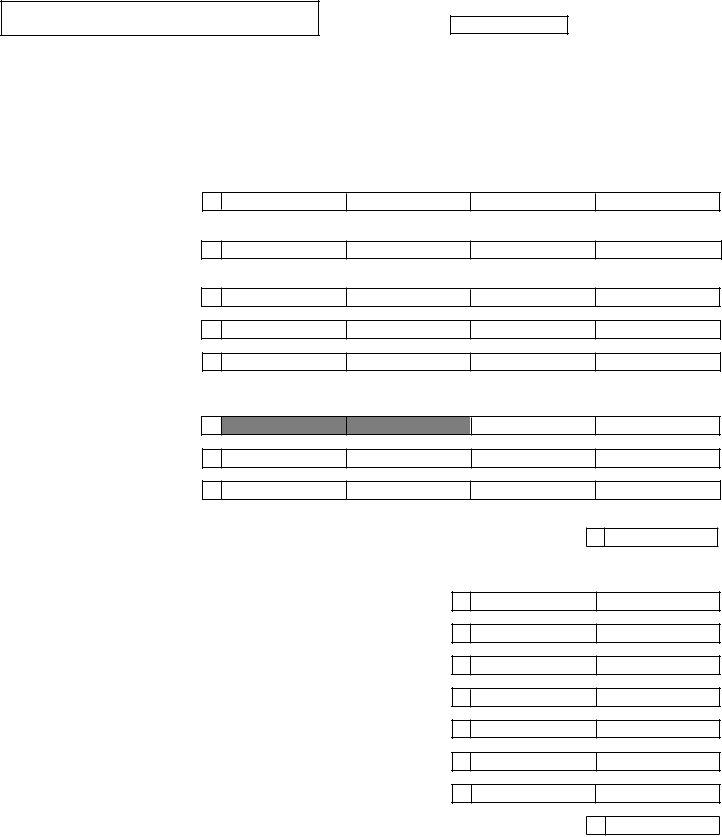

COMPUTATION OF NEW MEXICO PERCENTAGE |

*198180200* |

2019 |

|

Name of estate or trust as shown on Form

FEIN of estate or trust

ESTATES OR TRUSTS WITH INCOME FROM BOTH INSIDE AND OUTSIDE NEW MEXICO MUST COMPLETE THIS SCHEDULE.

NOTE: The separate accounting method may not be used by a business in New Mexico.

1.Dividends..........................................

2.Interest, including

3.Income from other fiduciaries,

S corporations, partnerships, and limited liability entities ......................

4.Rents and royalties...........................

5.Profit or loss from the sale or exchange of ASSETS...........................

6.Net business and farm income. Complete Form

2. See instructions. ...........................

7.Other income. Attach schedule ........

8.Total of lines 1 through 7.................

Column |

1 |

Column 2 |

Column 3 |

Column 4 |

Less related expenses/ |

||||

Gross |

|

distributions |

Net |

Allocation to New Mexico |

|

|

|

|

|

1

2

3

4

5

6

7

8

8a. Calculate allocation percentage for deductions. |

8a |

Divide line 8, column 4 by line 8, column 3 |

_ _ _ . _ _ _ _%

For lines 9, 10, and 11, multiply the amount in Column 3 by the percentage in line 8a to get the allocation to New Mexico in Column 4.

9. Deduction for exemption ................................................................................................

10. Deduction for distributions not shown above...................................................................

11. Other deductions. Attach schedule..................................................................................

12. Total of lines 9, 10, and 11...............................................................................................

13. Taxable income of estate or trust. Subtract line 12 from line 8........................................

14. Income from

15. Total income. Add lines 13 and 14..................................................................................

9

+10

+11

=12

13

+14

=15

16. New Mexico percentage of income. Divide line 15, column 4 by line 15, column 3. |

|

Calculate to four decimal places; for example, 22.6246%. Enter here and on |

16 |

_ _ _ . _ _ _ _%

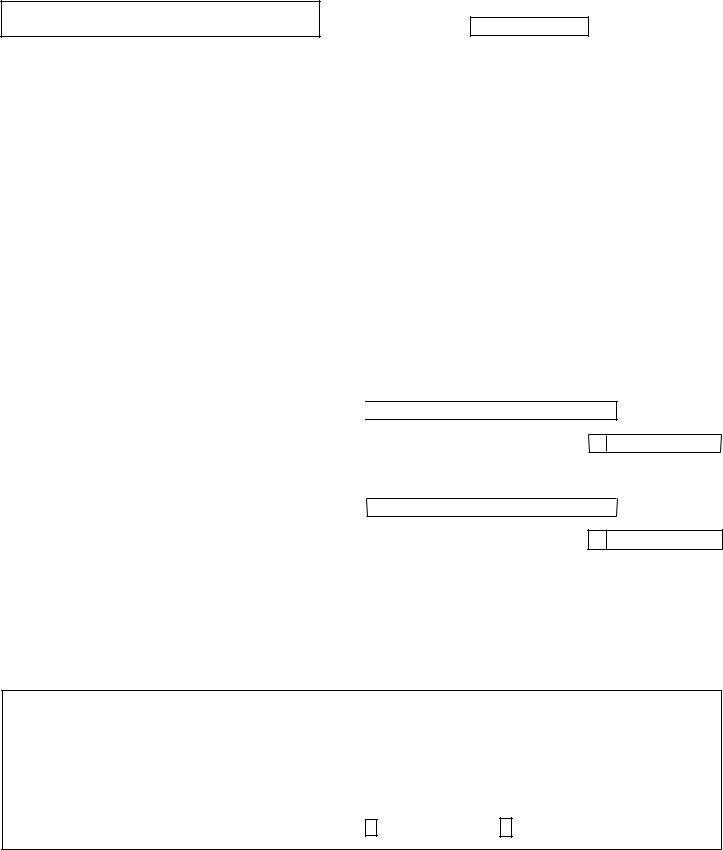

BUSINESS INCOME APPORTIONMENT FORMULA |

*198190200* |

2019 |

|

Name of estate or trust as shown on Form

FEIN of estate or trust

ESTATES OR TRUSTS WITH INCOME FROM BOTH INSIDE AND OUTSIDE NEW MEXICO MUST COMPLETE THIS SCHEDULE.

SEE INSTRUCTIONS BEFORE COMPLETING THIS SCHEDULE.

Calculate each percentage below to

four decimal places; for example, 22.6246%.

|

|

Column 1 |

Column 2 |

|

Percent |

|

PROPERTY FACTOR |

|

Everywhere |

Inside New Mexico |

|

Inside New Mexico |

|

Average annual value of inventory |

1a |

|

|

|

|

|

Average annual value of real property |

1b |

|

|

|

|

|

Average annual value of personal property |

1c |

|

|

|

|

|

............................Rented property. Multiply annual rental value by 8 |

1d |

|

|

|

|

|

Total property |

1e |

|

|

|

|

|

|

|

|

|

|

|

|

...................................................1. Property factor. Divide Total property, Column 2 by Column 1 and then multiply by 100 |

|

1 |

_ _ _ . _ _ _ _% |

|||

PAYROLL FACTOR

Wages, salaries, commissions, and other compensation |

2a |

|

|

|

|

||

of employees related to apportionable income |

|

|

|

.........................................................................2. Payroll factor. Divide Column 2 by Column 1 and then multiply by 100 |

+ |

||

SALES FACTOR |

|

|

|

Gross receipts |

3a |

|

|

3. Sales factor. Divide Column 2 by Column 1 and then multiply by 100 |

............................................................................ |

+ |

|

2_ _ _ . _ _ _ _%

3_ _ _ . _ _ _ _%

4. TOTAL of lines 1, 2, and 3 |

............................................................................................................................................ |

|

|

= |

4 |

_ _ _ . _ _ _ _% |

Count of factors |

4a |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. Average New Mexico Percentage. Divide line 4 by the number of factors entered in line 4a |

|

|

|

|||

......................... |

5 |

_ _ _ . _ _ _ _% |

||||

Have you changed your reporting of any class or type of allocated or apportioned income from the way it was reported in

a prior taxable year? |

|

YES |

|

No |

This entity submitted written notification of its election to use one of the special methods of apportionment of business

income for tax year ending _______________. The effective date of the election is |

________________. See instructions. |

Month/Day/Year |

Month/Day/Year |

Mark the box indicating the special method elected.

Manufacturers

Headquarters Operation