|

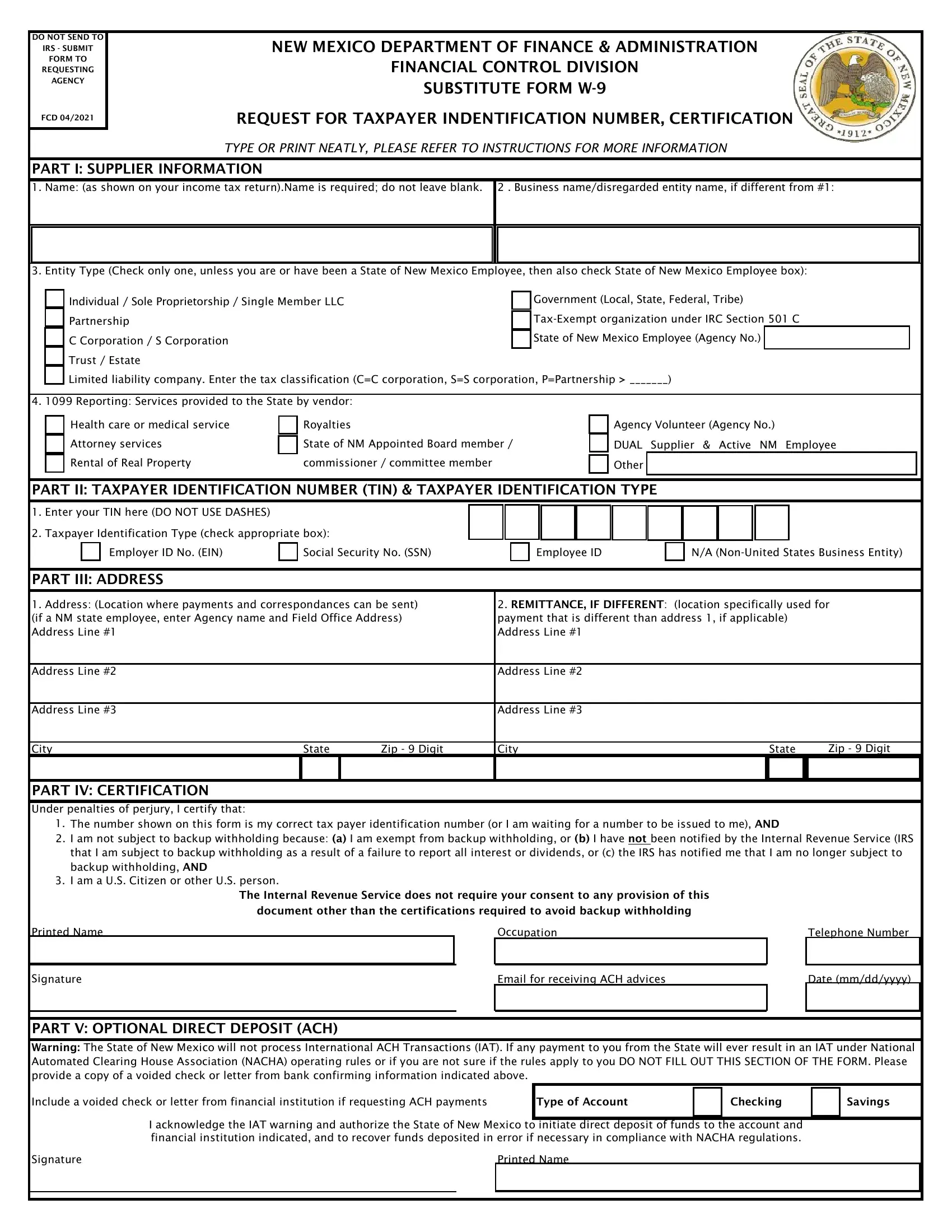

DO NOT SEND TO |

|

|

NEW MEXICO DEPARTMENT OF FINANCE & ADMINISTRATION |

|

|

|

|

|

|

IRS - SUBMIT |

|

|

|

|

|

|

|

|

|

FORM TO |

|

|

|

|

|

|

|

FINANCIAL CONTROL DIVISION |

|

|

|

|

|

|

REQUESTING |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AGENCY |

|

|

|

|

|

|

|

SUBSTITUTE FORM W-9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FCD 04/2021 |

|

REQUEST FOR TAXPAYER INDENTIFICATION NUMBER, CERTIFICATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TYPE OR PRINT NEATLY, PLEASE REFER TO INSTRUCTIONS FOR MORE INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART I: SUPPLIER INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. Name: (as shown on your income tax return).Name is required; do not leave blank. |

2 . Business name/disregarded entity name, if different from #1: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

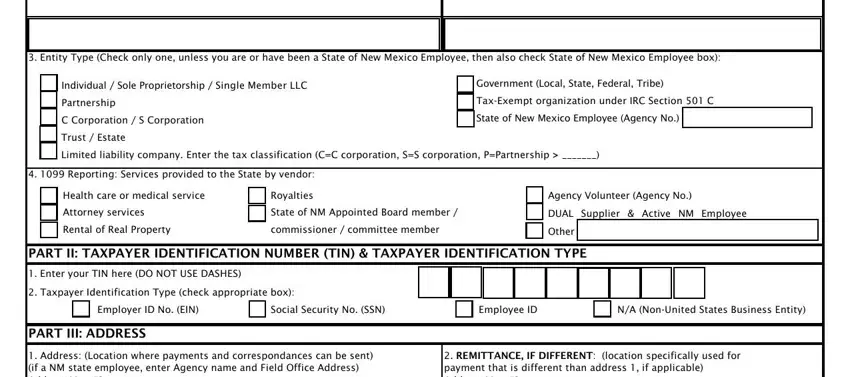

3. Entity Type (Check only one, unless you are or have been a State of New Mexico Employee, then also check State of New Mexico Employee box): |

|

|

|

|

|

|

|

|

Individual / Sole Proprietorship / Single Member LLC |

|

|

|

|

|

Government (Local, State, Federal, Tribe) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Partnership |

|

|

|

|

|

|

|

|

|

|

|

Tax-Exempt organization under IRC Section 501 C |

|

|

|

|

|

|

|

|

C Corporation / S Corporation |

|

|

|

|

|

|

|

|

|

|

|

State of New Mexico Employee (Agency No.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trust / Estate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Limited liability company. Enter the tax classification (C=C corporation, S=S corporation, P=Partnership > _______) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. 1099 Reporting: Services provided to the State by vendor: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Health care or medical service |

|

|

|

|

Royalties |

|

|

|

|

|

|

|

|

|

Agency Volunteer (Agency No.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DUAL Supplier & Active NM Employee |

|

|

|

Attorney services |

|

|

|

|

State of NM Appointed Board member / |

|

|

|

|

Rental of Real Property |

|

|

|

|

commissioner / committee member |

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART II: TAXPAYER IDENTIFICATION NUMBER (TIN) & TAXPAYER IDENTIFICATION TYPE |

|

|

|

|

|

|

1. Enter your TIN here (DO NOT USE DASHES) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. Taxpayer Identification Type (check appropriate box): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer ID No. (EIN) |

|

|

|

|

Social Security No. (SSN) |

|

|

|

Employee ID |

|

|

N/A (Non-United States Business Entity) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART III: ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. Address: (Location where payments and correspondances can be sent) |

2. REMITTANCE, IF DIFFERENT: (location specifically used for |

|

(if a NM state employee, enter Agency name and Field Office Address) |

payment that is different than address 1, if applicable) |

|

|

|

|

|

|

Address Line #1 |

|

|

|

|

|

|

|

|

Address Line #1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address Line #2 |

|

|

|

|

|

|

|

|

Address Line #2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address Line #3 |

|

|

|

|

|

|

|

|

Address Line #3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

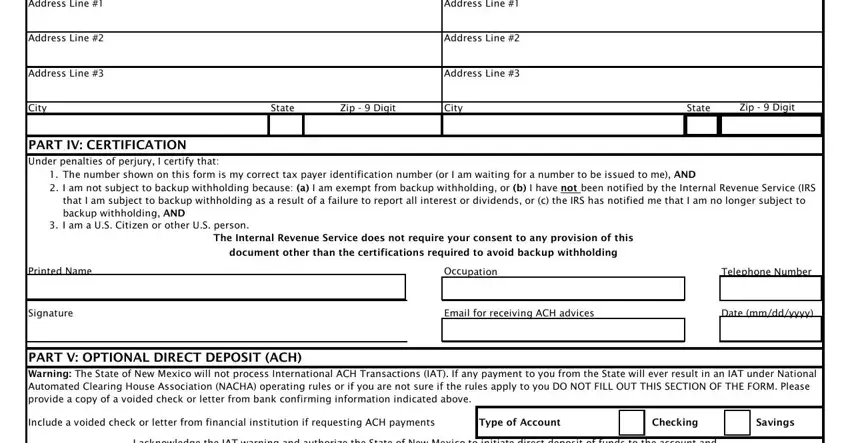

City |

|

|

|

|

State |

Zip - 9 Digit |

City |

|

|

|

|

|

State |

Zip - 9 Digit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART IV: CERTIFICATION

Under penalties of perjury, I certify that:

1. The number shown on this form is my correct tax payer identification number (or I am waiting for a number to be issued to me), AND

2. I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding, AND

3. I am a U.S. Citizen or other U.S. person.

The Internal Revenue Service does not require your consent to any provision of this

document other than the certifications required to avoid backup withholding

Printed Name |

|

|

Occupation |

|

Telephone Number |

|

|

|

|

|

|

|

Signature |

|

Email for receiving ACH advices |

|

Date (mm/dd/yyyy) |

|

|

|

|

|

|

|

|

PART V: OPTIONAL DIRECT DEPOSIT (ACH)

Warning: The State of New Mexico will not process International ACH Transactions (IAT). If any payment to you from the State will ever result in an IAT under National Automated Clearing House Association (NACHA) operating rules or if you are not sure if the rules apply to you DO NOT FILL OUT THIS SECTION OF THE FORM. Please provide a copy of a voided check or letter from bank confirming information indicated above.

Include a voided check or letter from financial institution if requesting ACH payments |

|

Type of Account |

|

Checking |

|

Savings |

|

|

|

|

|

|

|

|

|

|

|

I acknowledge the IAT warning and authorize the State of New Mexico to initiate direct deposit of funds to the account and |

|

|

|

financial institution indicated, and to recover funds deposited in error if necessary in compliance with NACHA regulations. |

|

|

|

Signature |

Printed Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

Instructions for Completing this Form

This form substitutes for the IRS W-9 form. Complete this form if you will receive payment from the State of New Mexico and/or you are a vendor who provides goods and services to the State of New Mexico. To comply with the Internal Revenue Service (IRS) regulations regarding 1099 reporting, the State of New Mexico is required to collect the following information to be completed on the Substitute W-9 form. The information collected on this form will allow the State to confirm that our records contain the official name of your business, the Tax Identification Number (TIN) that the IRS has on file for your business and business type.

Check the appropriate box(s) that this form is to be utilized and fill in the corresponding section(s) indicated next to the box(s) checked.

PART I: VENDOR INFORMATION

1.Legal Business Name Enter the legal name as registered with the IRS or Social Security Administration.

2.DBA/Trade Name Individuals leave blank. Sole Proprietorships: Enter DBA (doing business as) name. All Others: Complete only if business name is different than Legal Name.

3.Entity Type Check ONE box which describes business entity. If a current, past, or becoming a state employee, please also mark the State of New Mexico Employee box and enter the Business Unit number for the agency. Also, provide the 6 digit employee ID as assigned in SHARE HCM in the Part II Taxpayer Identification Number (TIN) & Taxpayer Identification Type section and mark the Employee ID box.

4.1099 Reporting Check the appropriate box that applies to the type of services being provided to the State. If the type of service is not specifically stated, enter the type of service in the Other box.

PART II: TAXPAYER IDENTIFICATION NUMBER (TIN) & TAXPAYER IDENTIFICATION TYPE

1.Taxpayer Identification Number Enter TIN with no dashes in the boxes provided

a.TIN is always a 9-digit number. Provide the Social Security Number (SSN) assigned by the Social Security Administration (SSA) or the Federal Employer Identification Number (FEIN) assigned to the business or other entity by the Internal Revenue Service (IRS).

b.Employee ID is always a 6-digit number. Provide the employee ID assigned by the State of New Mexico for payroll processing in SHARE HCM.

2.TIN Identification Type Mark the appropriate box for the TIN provided above.

PART III: ADDRESS

1.Address Where correspondence, payment(s), purchase order(s) or 1099s should be sent.

a.Employees If a current employee, please provide this following:

i. |

Address Line #1: |

State Agency Name |

ii. |

Address Line #2: |

Field Office Mailing Address |

iii. |

Address Line #3: |

N/A |

b.CDBG When providing a Community Development Block Grant (CDBG) remittance address, enter CDBG on line #1 and entities remittance address in address line #2

2.Remittance Address If different than Address

3.Zip Code and Phone Number The 5 + 4 code will be required to be entered for all zip codes. If the last 4 digits are unknown, then 4 zeros (0) can be entered. Do not enter the “-“ as part of the zip code. When entering the phone number, only enter the 10 digit number. Do not enter the “( )” or “-“ as part of the phone number.

PART IV: CERTIFICATION

By signing this document you are certifying that all information provided is accurate and complete. The person signing this document should be the partner in the partnership, an officer of the corporation, the individual or sole proprietor noted under legal name above, or the New Mexico State Employee for which the vendor account is established.

Identifying information is required of the person signing the form.

PART V: OPTIONAL DIRECT DEPOSIT (ACH) You may elect to receive payments from the State of New Mexico through Automated Clearing House (ACH) direct deposit. Please provide a copy of a voided check or letter from financial institution with the banking information. Without one of the two items, ACH information WILL NOT be entered and payments will be made by warrant. Select the type of account being provided.

I Acknowledge Print name and sign to acknowledge the IAT warning and to authorize the State of New Mexico to initiate direct deposit of funds to your financial institution provided.

Privacy Act Notice Section 6109 requires you to furnish your correct TIN to persons who must file information