non requesting subjects make can be completed in no time. Just make use of FormsPal PDF editing tool to perform the job promptly. Our team is committed to providing you with the ideal experience with our editor by constantly adding new capabilities and upgrades. With all of these updates, using our editor becomes better than ever before! Starting is effortless! All you need to do is take the next basic steps below:

Step 1: Hit the "Get Form" button in the top area of this page to access our PDF tool.

Step 2: The editor gives you the capability to work with almost all PDF forms in various ways. Modify it by writing customized text, correct what's originally in the file, and include a signature - all within the reach of a few clicks!

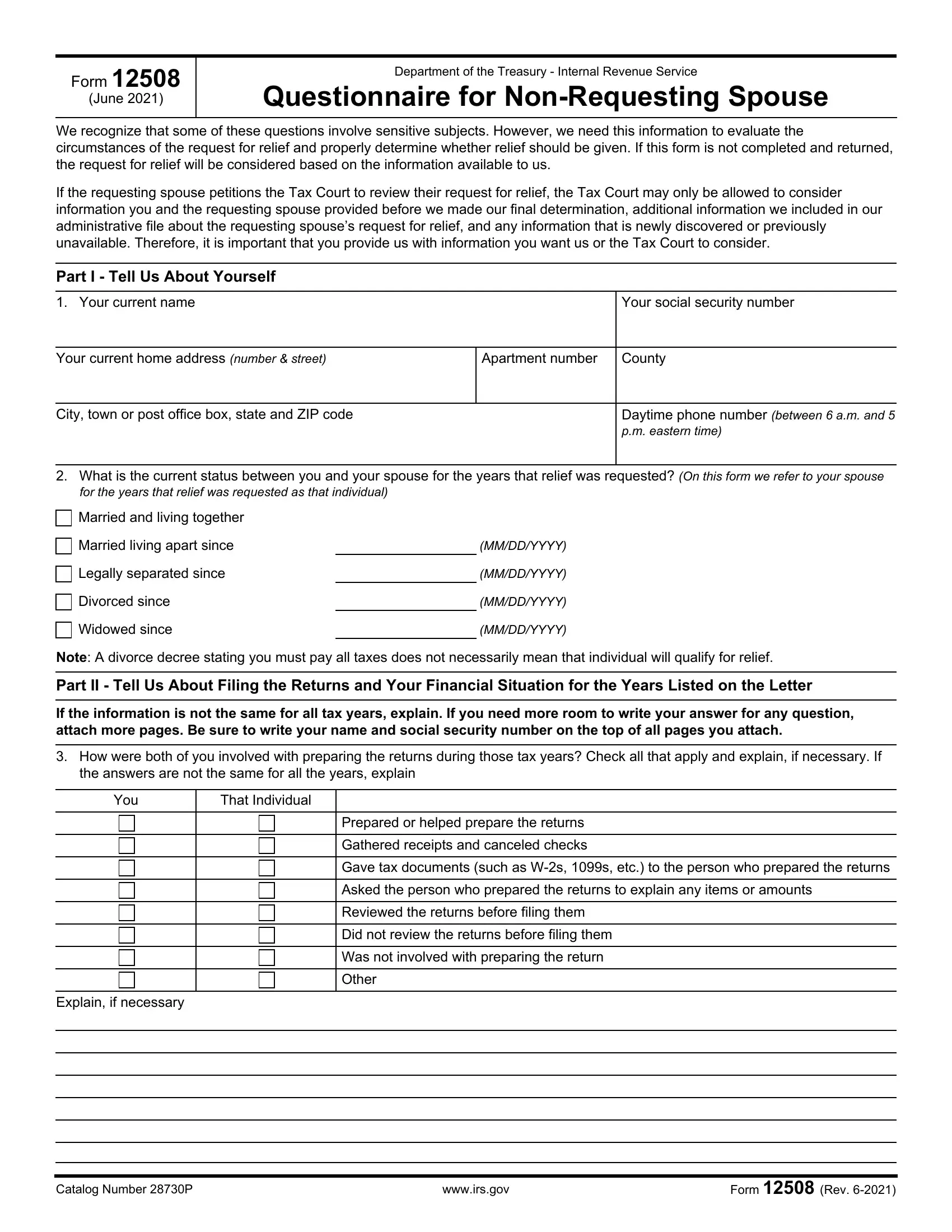

This PDF requires specific data to be entered, hence be certain to take whatever time to fill in exactly what is required:

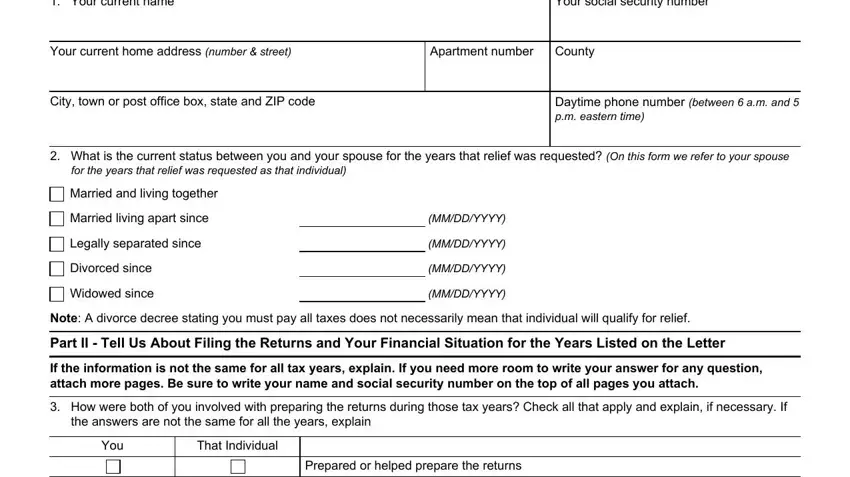

1. The non requesting subjects make will require specific information to be inserted. Ensure the following fields are finalized:

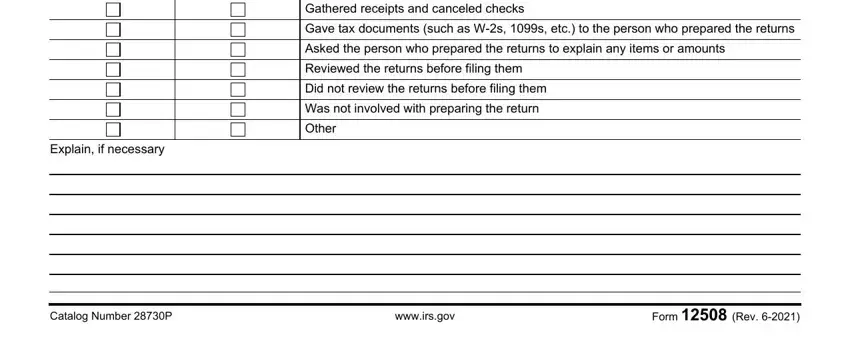

2. Immediately after this part is completed, proceed to enter the relevant details in these: Gathered receipts and canceled, Gave tax documents such as Ws s, Asked the person who prepared the, Reviewed the returns before filing, Did not review the returns before, Was not involved with preparing, Other, Explain if necessary, Catalog Number P, wwwirsgov, and Form Rev.

People often make mistakes when filling out wwwirsgov in this part. Don't forget to read again what you type in here.

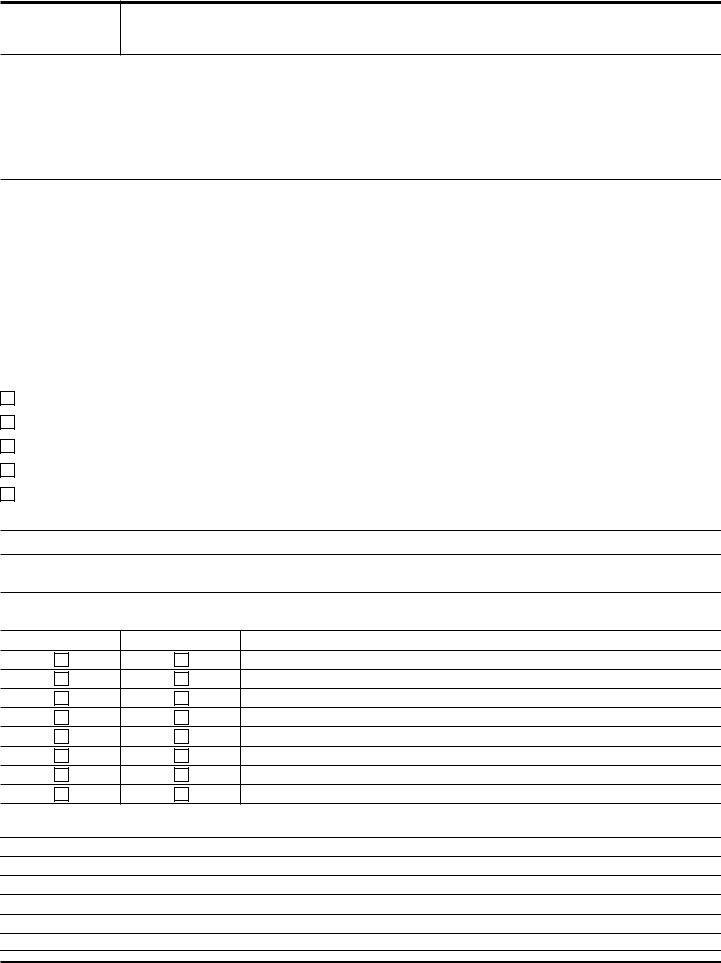

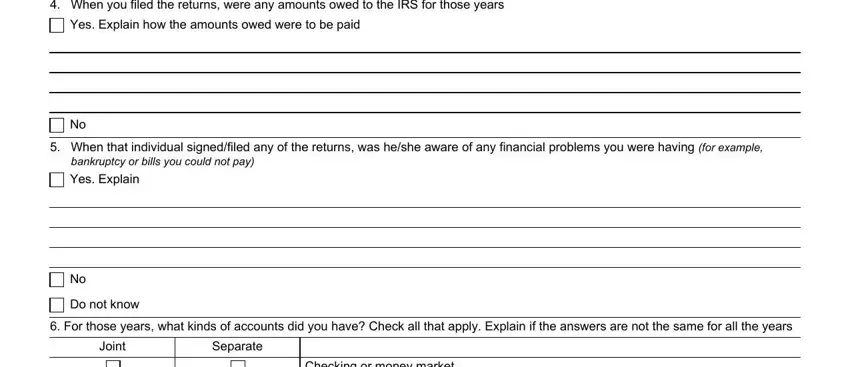

3. Within this part, examine When you filed the returns were, Yes Explain how the amounts owed, When that individual signedfiled, bankruptcy or bills you could not, Yes Explain, Do not know, For those years what kinds of, Joint, Separate, and Checking or money market. All of these must be filled in with utmost awareness of detail.

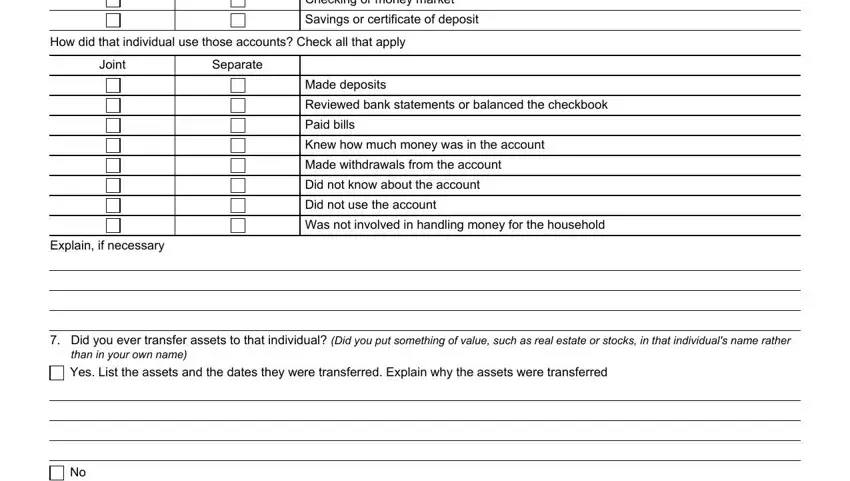

4. Filling in Checking or money market, Savings or certificate of deposit, How did that individual use those, Joint, Separate, Made deposits, Reviewed bank statements or, Paid bills, Knew how much money was in the, Made withdrawals from the account, Did not know about the account, Did not use the account, Was not involved in handling money, Explain if necessary, and Did you ever transfer assets to is key in this next section - be certain to invest some time and take a close look at every single blank area!

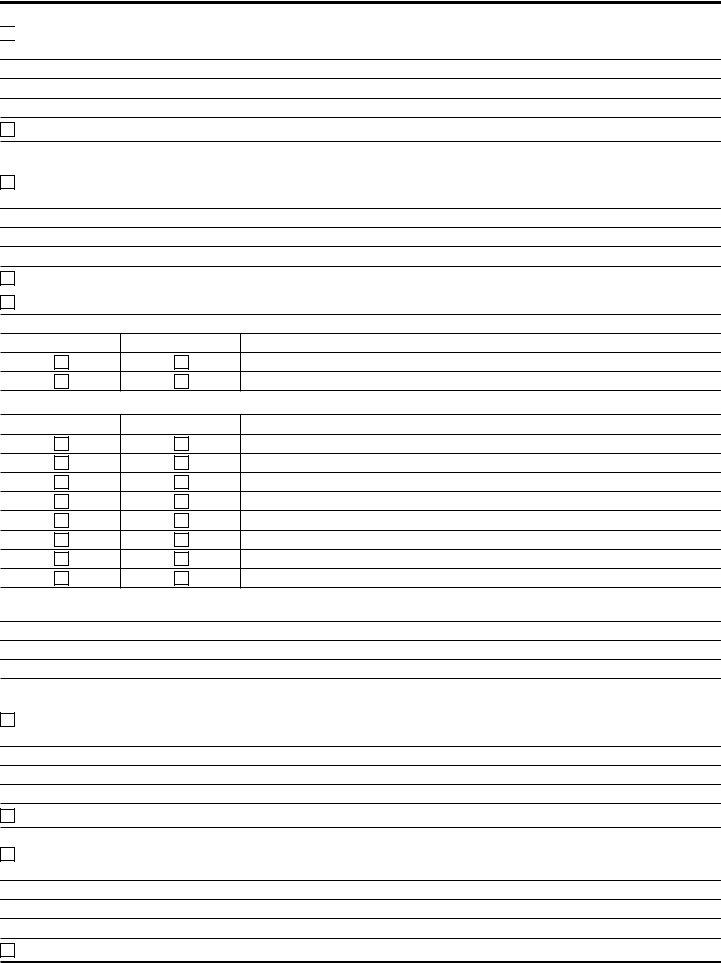

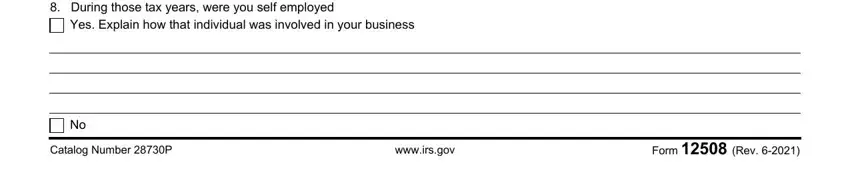

5. This form needs to be wrapped up by dealing with this area. Further one can find a detailed listing of blanks that require accurate details to allow your document usage to be accomplished: During those tax years were you, Yes Explain how that individual, Catalog Number P, wwwirsgov, and Form Rev.

Step 3: Once you have reread the information entered, click "Done" to conclude your FormsPal process. Acquire your non requesting subjects make as soon as you register here for a free trial. Instantly access the pdf document within your FormsPal cabinet, along with any edits and changes being automatically synced! When using FormsPal, you'll be able to fill out forms without stressing about data leaks or data entries getting shared. Our protected platform ensures that your private details are stored safe.