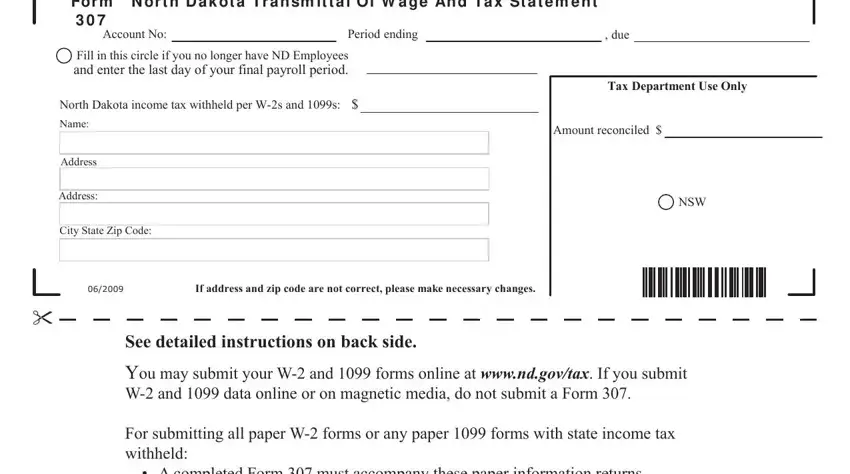

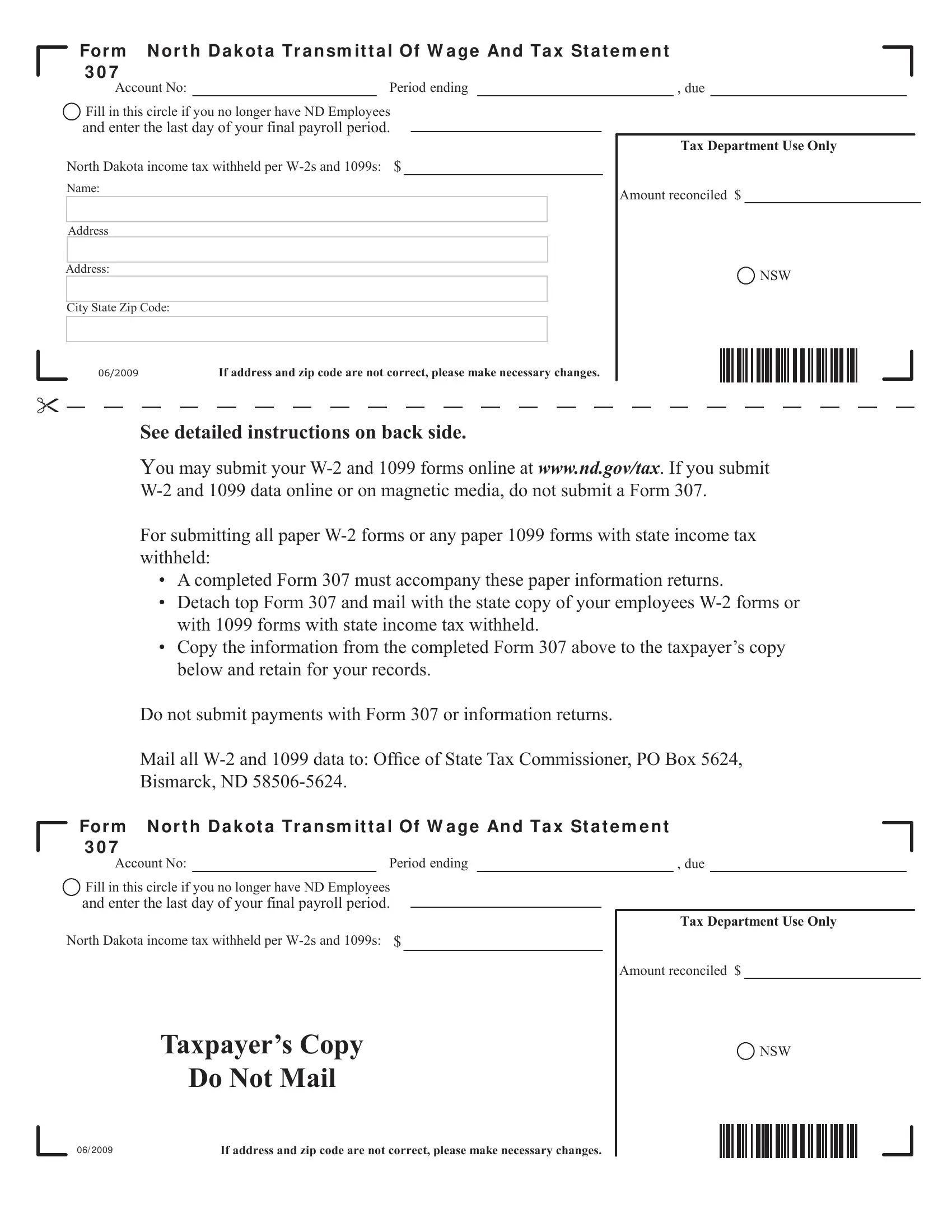

For m N or t h D a k ot a Tr a n sm it t a l Of W a g e An d Ta x St a t e m e n t 3 0 7

Account No: |

|

Period ending |

Fill in this circle if you no longer have ND Employees

and enter the last day of your final payroll period.

North Dakota income tax withheld per W-2s and 1099s: $

Name:

Address

Address:

City State Zip Code:

, due

T x Dep rtment UVe Only

Amount reconciled $

NSW

|

If ddreVV nd zip code re not correct, ple Ve m ke neceVV ry ch nJeV. |

See detailed instructions on back side.

You may submit your W-2 and 1099 forms online at www.nd.gov/tax. If you submit

W-2 and 1099 data online or on magnetic media, do not submit a Form 307.

For submitting all paper W-2 forms or any paper 1099 forms with state income tax withheld:

•A completed Form 307 must accompany these paper information returns.

•Detach top Form 307 and mail with the state copy of your employees W-2 forms or with 1099 forms with state income tax withheld.

•Copy the information from the completed Form 307 above to the taxpayer’s copy below and retain for your records.

Do not submit payments with Form 307 or information returns.

Mail all W-2 and 1099 data to: Offi ce of State Tax Commissioner, PO Box 5624,

Bismarck, ND 58506-5624.

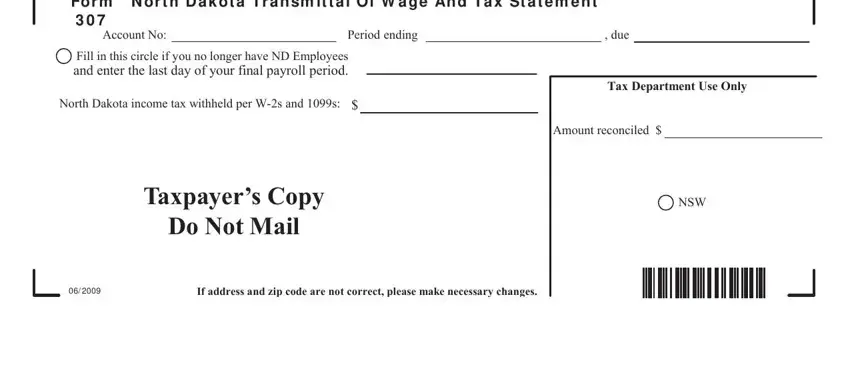

Fo r m N or t h D a k ot a Tr a n sm it t a l Of W a g e An d Ta x St a t e m e n t 3 0 7

Account No: |

|

Period ending |

Fill in this circle if you no longer have ND Employees

and enter the last day of your final payroll period.

North Dakota income tax withheld per W-2s and 1099s: $

Taxpayer’s Copy

Do Not Mail

, due

Tax Department Use Only

Amount reconciled $

NSW

06/ 2009 |

If address and zip code are not correct, please make necessary changes. |

Instructions

Who Must File Information Returns with Form 307

•An employer subject to North Dakota’s income tax withholding law, whether or not the employer withheld North Dakota income tax. The employer must submit a copy of each W-2 that the employer is required to fi le with the Social Security Administration.

•Any person who voluntarily withheld North Dakota income tax from a payment for which the person is required to fi le a Form 1099 with the Internal Revenue Service. The person must submit a copy of each Form 1099 reporting a payment from which North Dakota income tax was withheld.

•Paper Form 307 must be completed and returned to the Offi ce of State Tax Commissioner even though you may have closed your account during the tax year.

•Corrections to W-2 forms should be made using Federal Form W-2C. Instructions can be found on the Social Security Administration web site at www.socialsecurity.gov/employer/w2cinfo.htm. Paper forms can be obtained by calling the Internal Revenue Service

at 1-800-829-3676. A paper copy of Federal Form W-2C should be submitted with the state Form 307 to the Offi ce of State Tax Commissioner.

Requirement to File Electronically or on Magnetic Media

You must submit the W-2 and 1099 forms electronically or on magnetic media if (1) you are required to fi le them electronically or on magnetic media with the Internal Revenue Service, and (2) the quantity of forms to be fi led with North Dakota is 250 or more. You are encouraged to file electronically or on magnetic media if the number of forms to be fi led with North Dakota is less than 250. You will fi nd detailed information about fi ling electronically or on magnetic media in our Income tax guideline: Information returns, which is available on our web site at www.nd.gov/tax. Click on Income Tax Withholding and then Publications.

How to Complete Form 307

Form 307 is mailed to all employers registered to withhold North Dakota state income tax from wages or other payments and to employers that are not required to register but have previously submitted information returns as required by law. Form 307 is not required to be filed if information returns are submitted electronically or on magnetic media. When submitting all paper W-2s or any paper 1099 forms that have state income tax withheld, enter the total North Dakota state income tax withheld (as shown on Forms W-2 or 1099) in the dollar line of the Form 307, attach an adding machine tape totaling the North Dakota withholding amount, and submit your paper information returns with the completed Form 307. Copy the information from the completed Form 307 to the Taxpayer’s Copy section and retain this portion of the form for your records.

•If you no longer have employees and do not have information returns to submit, fi ll in the circle indicating you do not have employees, enter the date of your last payroll, and mail the Form 307 to the Tax Commissioner.

•If you submit your information returns on paper, you must complete and submit a Form 307 and a copy of all W-2 forms or any 1099 forms with state income tax withheld. All paper W-2 and 1099 forms must be separated before submitting.

•If you fi led and submitted North Dakota income tax withholding under more than one identifi cation number during the reporting year, please submit a letter with this information.

•Mail magnetic media to: Offi ce of State Tax Commissioner, 600 E. Boulevard Ave., Dept. 127, Bismarck, ND 58505-0599.

•Mail Form 307 with paper information returns to: Offi ce of State Tax Commissioner, PO Box 5624, Bismarck, ND 58506-5624.

When to File

If Still in Business: W-2 and 1099 data (and Form 307 if required) must be fi led with the Offi ce of State Tax Commissioner on or before February 28 of the following year.

If Out of Business: W-2 and 1099 data (and Form 307 if required) must be fi led at the same time you file your fi nal Federal Forms W-3 and W-2 with the Internal Revenue Service

Forms and Assistance

If you have questions or need forms, you may contact the Income Tax Withholding Section at (701)328-1248. The speech and hearing impaired may call through Relay North Dakota at 1-800-366-6888. You may also obtain forms and guidelines on our web site at

www.nd.gov/tax or by writing to our offi ce at the above address. |

I N ST R U CT ION S REV ISED 1 0 / 2 0 0 9 |