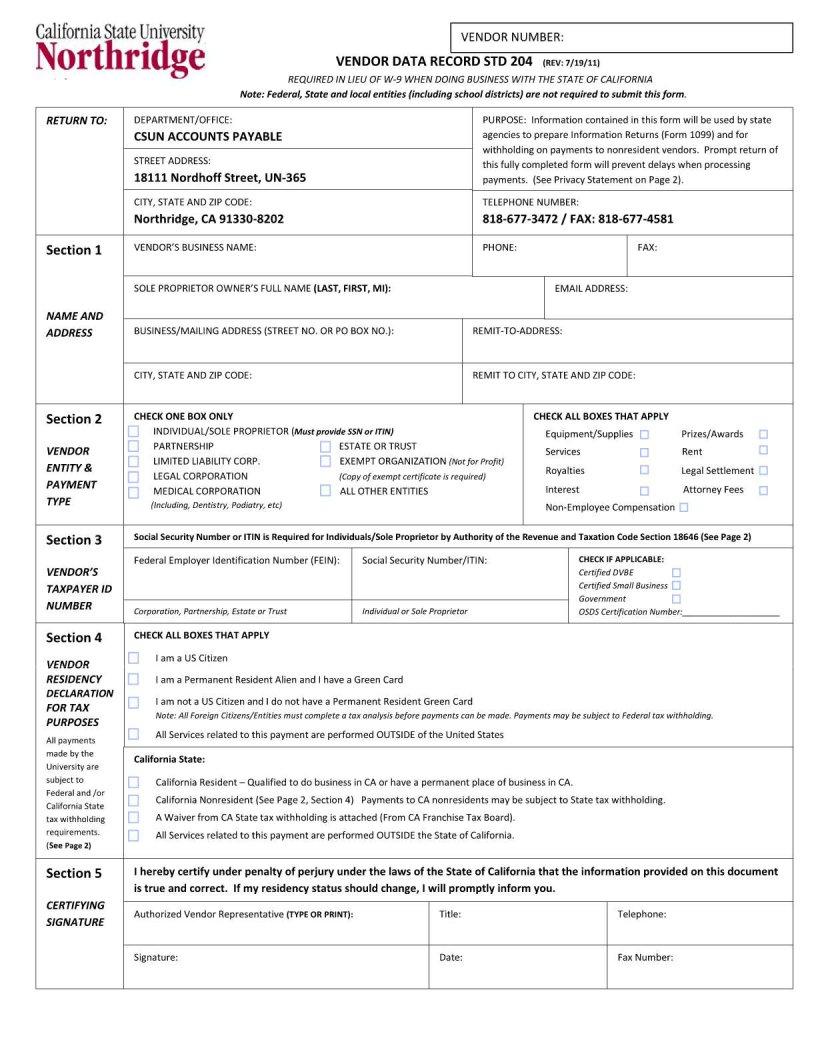

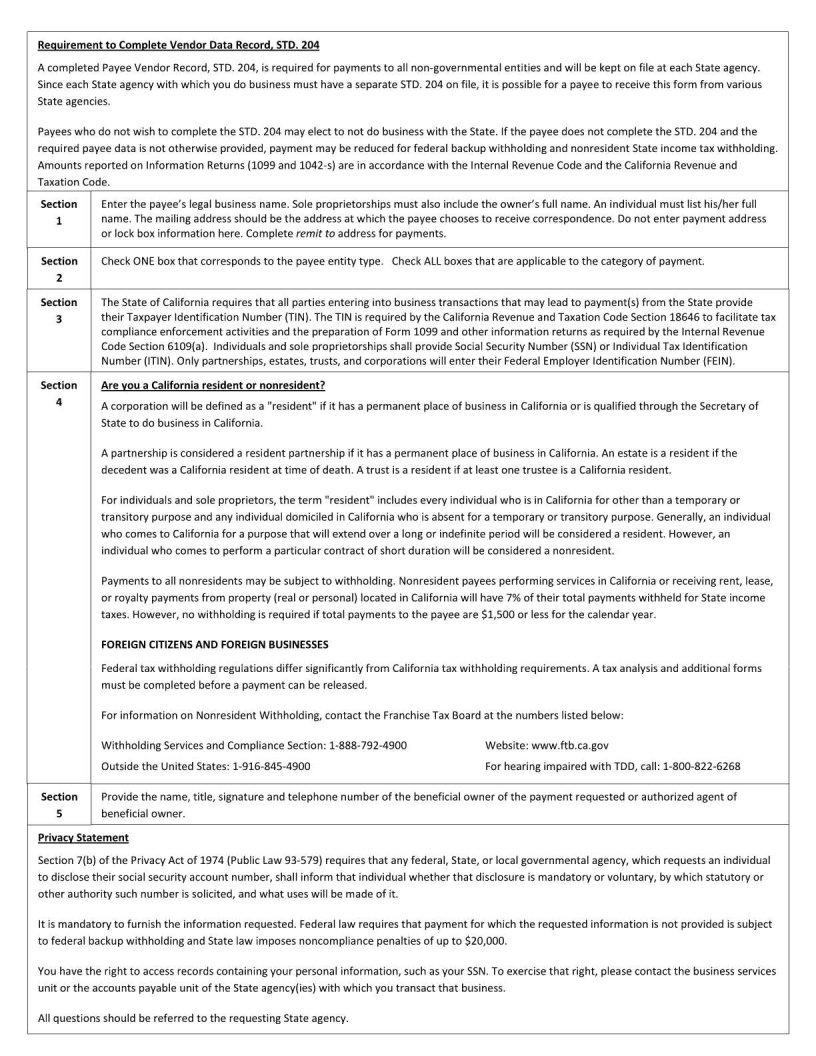

Filling out the Northridge Std 204 form is a critical step for vendors intending to do business with certain entities, setting a framework for smooth financial transactions. This document is essential for establishing the vendor’s payment and personal service information in a clear, officially recognized manner. It covers key areas such as payer directives, the scope of services provided, and banking details necessary for electronic funds transfer (EFT), which ensures that payments are made swiftly and securely. Additionally, the form is designed to house tax identification numbers and other particulars critical for compliance and reporting purposes. By completing this form attentively, vendors pave the way for a streamlined invoicing and payment process, thereby fostering a hassle-free business engagement. Its significance cannot be overstated, as it lays the groundwork for financial operations, and any inaccuracies can lead to payment delays or complications with tax authorities. Therefore, understanding each section and accurately providing the required information is paramount for a successful partnership.

| Question | Answer |

|---|---|

| Form Name | Northridge Form Std 204 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | nonresidents, ITIN, california, data |