When you desire to fill out Llanishen, you won't have to download any sort of software - just try using our PDF editor. FormsPal team is dedicated to giving you the absolute best experience with our tool by continuously presenting new features and upgrades. Our editor has become even more intuitive with the latest updates! Now, editing PDF documents is a lot easier and faster than before. Here is what you'd have to do to begin:

Step 1: Click the orange "Get Form" button above. It'll open up our pdf editor so you could begin filling out your form.

Step 2: With this online PDF editor, you're able to do more than merely fill in forms. Try each of the features and make your docs appear professional with custom text incorporated, or optimize the original content to perfection - all that accompanied by the capability to incorporate just about any images and sign it off.

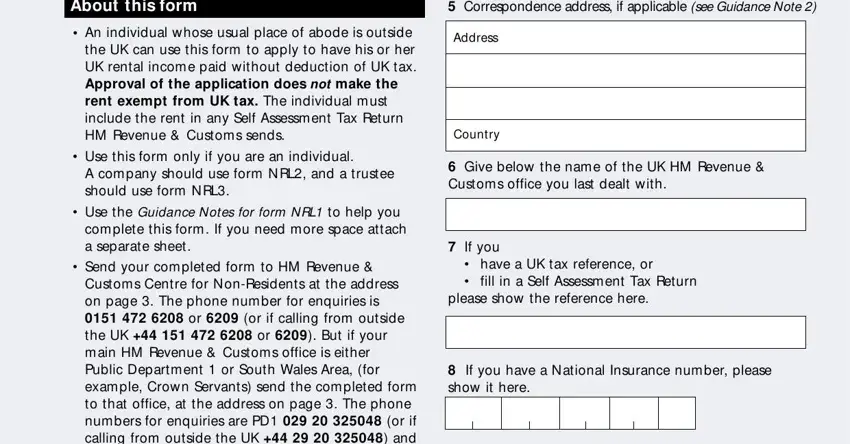

When it comes to blank fields of this specific document, here is what you should consider:

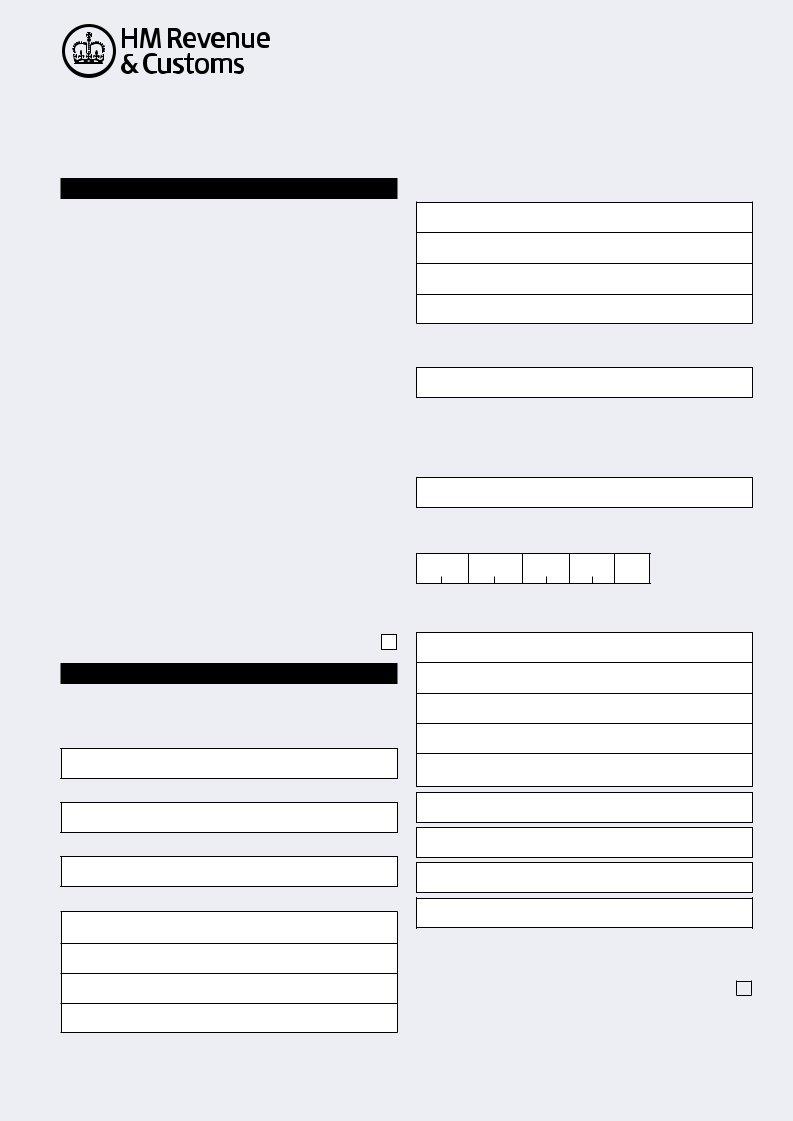

1. Begin completing your Llanishen with a group of major blank fields. Gather all of the information you need and ensure there's nothing neglected!

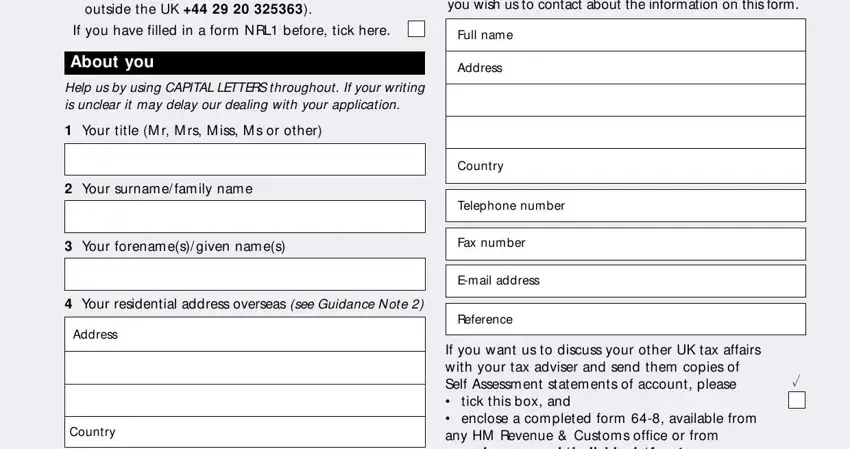

2. Just after this part is done, go on to type in the suitable details in these - Custom s Centre for NonResidents, If you have filled in a form NRL, About you, Help us by using CAPITAL LETTERS, Your title M r M rs M iss M s or, Your surnam e fam ily nam e, Your forenam es given nam es, Your residential address overseas, Address, Country, Details of your tax adviser or, Full nam e, Address, Country, and Telephone num ber.

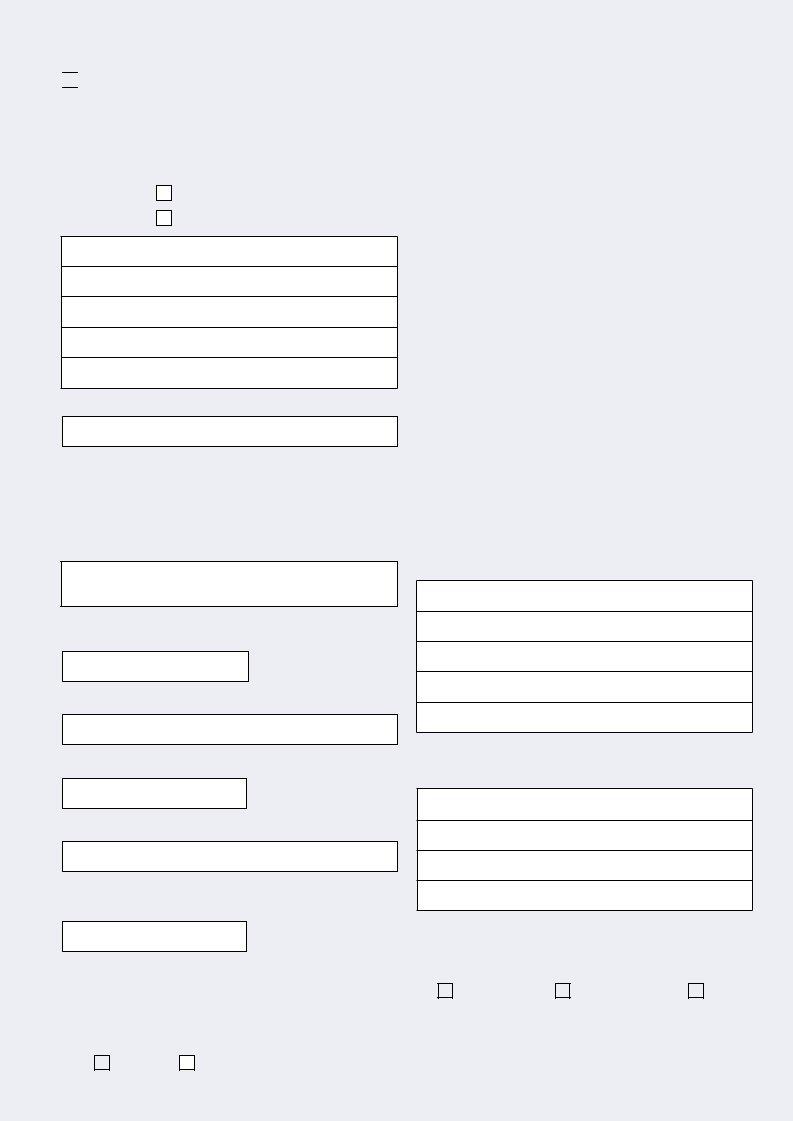

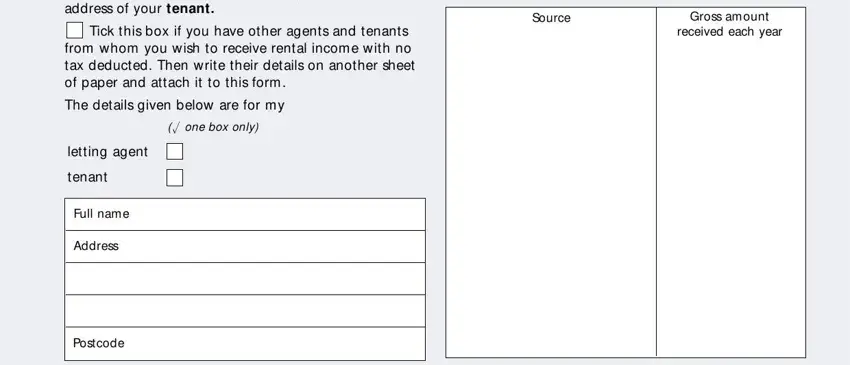

3. The third part is going to be hassle-free - fill in every one of the blanks in If you have a UK letting agent, Tick this box if you have other, The details given below are for m y, one box only, Source, Gross am ount, received each year, letting agent, tenant, Full nam e, Address, and Postcode in order to complete this process.

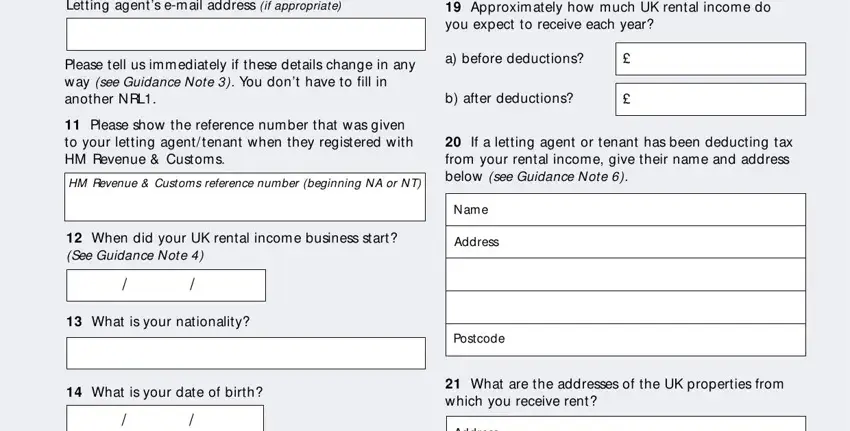

4. This next section requires some additional information. Ensure you complete all the necessary fields - Letting agents em ail address if, Approxim ately how m uch UK, Please tell us im m ediately if, a before deductions, b after deductions, Please show the reference num ber, HM Revenue Customs reference, If a letting agent or tenant has, When did your UK rental incom e, What is your nationality, Nam e, Address, Postcode, What is your date of birth, and What are the addresses of the UK - to proceed further in your process!

It's easy to make a mistake when filling out your Letting agents em ail address if, and so be sure you look again before you send it in.

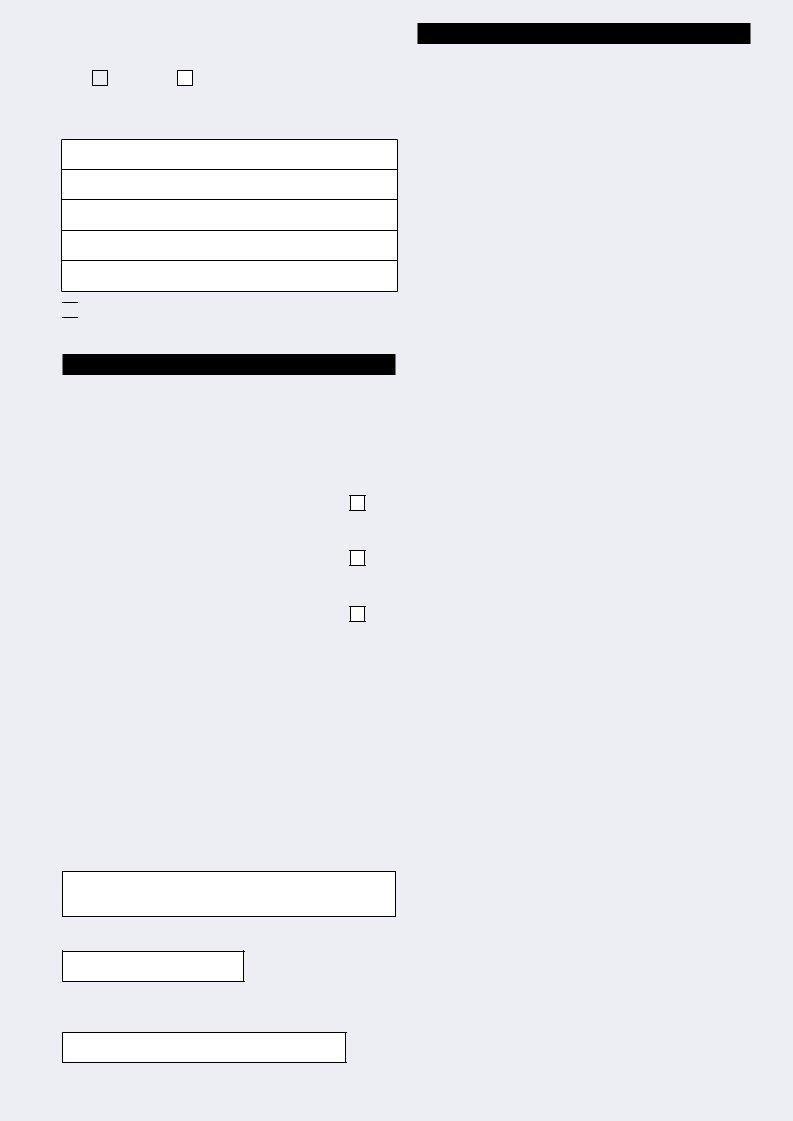

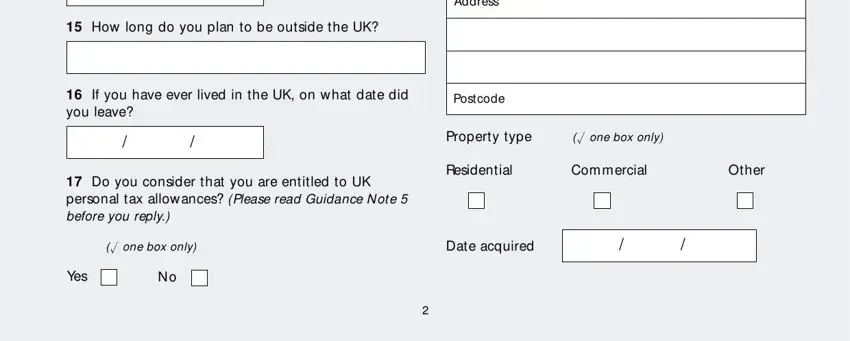

5. Lastly, this final segment is what you'll have to complete prior to using the PDF. The blanks under consideration are the following: How long do you plan to be, Address, If you have ever lived in the UK, Postcode, Property type, one box only, Do you consider that you are, one box only, Yes, Residential, Com m ercial, Other, and Date acquired.

Step 3: Ensure the details are right and click "Done" to complete the process. Go for a free trial subscription with us and gain instant access to Llanishen - which you'll be able to then begin using as you would like in your FormsPal account page. FormsPal ensures your information confidentiality by using a secure system that never records or distributes any sensitive information involved. Feel safe knowing your paperwork are kept confidential each time you use our editor!