The New York Commercial Rent Tax (CRT) form, specifically the CR-Q1 for the first quarter of the 2014/15 tax period, is an essential document for businesses operating within New York City. This form applies to the tax period from June 1, 2014, to August 31, 2014, and is due by September 22, 2014. It requires detailed information about the business, including names, addresses, business telephone numbers, Employer Identification Numbers (EIN), or Social Security Numbers (SSN), alongside specific details about the rented premises. The form meticulously calculates the commercial rent tax due based on the base rent paid, applicable deductions, and tax rates for different rent classes. It also outlines provisions for tax credits under certain conditions, aiming to ensure businesses pay the correct amount of tax. Moreover, the form encourages electronic filing as a convenient, secure, and efficient method of submission. Importantly, it emphasizes accuracy in reporting, as inaccuracies can lead to disallowed deductions, stressing the importance of careful completion and compliance with the New York City Department of Finance’s guidelines.

| Question | Answer |

|---|---|

| Form Name | Ny Commercial Rent Tax Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | nyc cr q3 form, cr q3 2020, new york city department of finance cr q3 form, nyc cr q3 2020 |

|

NEW YORK CITY DEPARTMENT OF FINANCE |

||

|

|

||

FINANCE |

FIRST QUARTER |

COMMERCIAL RENT TAX RETURN |

|

2014/15 |

ApplicableforthetaxperiodJune1,2014toAugust31,2014ONLY |

||

|

|||

|

|

|

PLEASE PRINT OR TYPE:

Name:

_________________________________________________________________________________

Address (number and street):

_________________________________________________________________________________

City and State: |

Zip: |

_________________________________________________________________________________ |

|

Business Telephone Number: |

|

Employer

Identification

Number .............................

Social

Security

Number....................

ACCOUNT TYPE |

COMMERCIAL RENT TAX |

|

|

|

|

|||

ACCOUNT ID |

|

|

|

|

|

|

|

|

PERIOD BEGINNING |

|

|

|

|

|

|

||

PERIOD ENDING |

|

|

|

|

|

|

||

DUE DATE |

|

|

|

|

|

|

||

Federal Business Code .

PLEASE READ THE INSTRUCTIONS CAREFULLY SO THAT YOU PAY ONLY THE RIGHT AMOUNT OF TAX. COMPLETE THIS RETURN BY BEGINNING WITH PAGE 2, BUT DO NOT MAIL PAGE 2 OR OTHER ATTACHMENTS

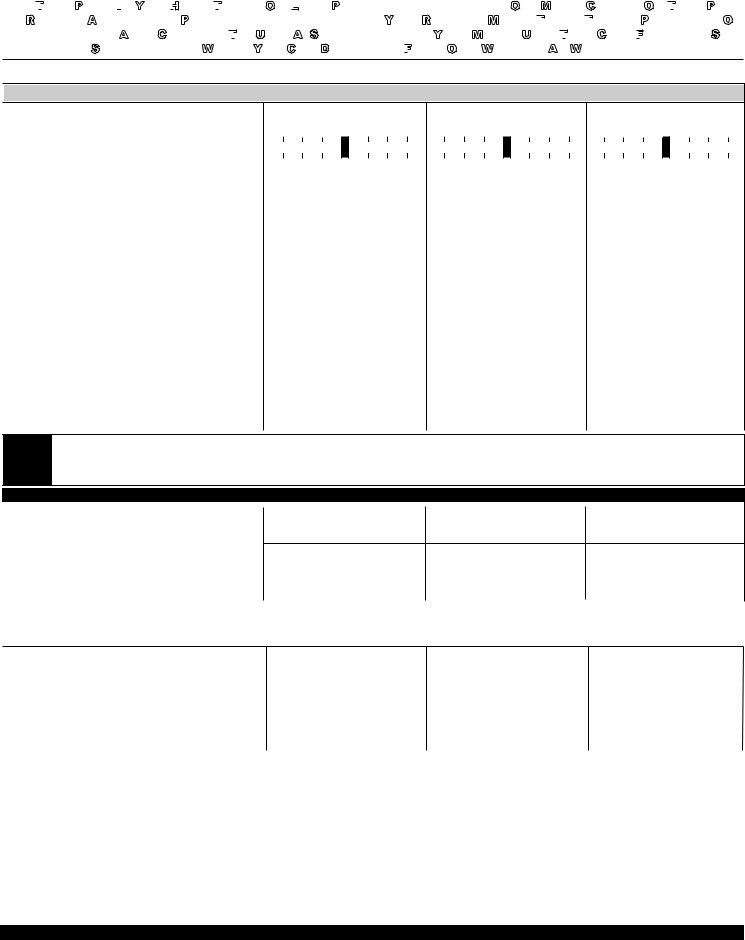

COMPUTATION OF TAX

|

|

|

|

|

|

|

|

|

|

▼ Payment Enclosed ▼ |

|

|

|

A. Payment - |

Payamountshown online4- Makecheck payableto:NYCDepartmentofFinance |

● |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LINE |

|

RATE |

|

NO. OF PREMISES |

TOTAL |

TAX |

|

|

TAX DUE: |

||

|

CLASS |

|

FOR EACH RATE CLASS |

BASE RENT |

RATE |

|

TOTAL BASE RENT X TAX RATE |

|||||

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

$0 to $62,499 (from page 2 - line 13) |

|

|

.00 |

0% |

1. |

0 |

0 0 |

|||

|

2. |

$62,500 and over |

|

|

.00 |

6% |

|

|

|

|

|

|

|

|

(from page 2 - line 14) |

|

|

2. |

|

|

|

|

|||

|

3. |

Tax Credit (from page 2, line 16) |

|

|

|

|

|

|

|

|

||

|

|

(see instructions) |

|

|

3. |

|

|

|

|

|||

|

4. |

TotalRemittanceDue(line 2 minus line 3). |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||||

|

|

Enter paymentamounton lineA,above |

.......................................................................................... |

|

|

4. |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DO NOT ATTACH PAGE 2 BASE RENT COMPUTATION SCHEDULES TO THIS PAGE.

ATTACH REMITTANCE ONLY.

DID YOUR MAILINGADDRESS CHANGE?

If so, please visit us at nyc.gov/financeand select “Business” in the left column. Select “Update/Change Business

Name orAddress” from the Online Tools. Update as required.

Mail this return with your payment to:

NYC Dept. of Finance, P.O. Box 3931, New York, NY

Make remittance payable to the order of “NYC DEPARTMENT OF FINANCE”. Payment must be made in U.S. dol- lars, drawn on a U.S. bank.

To receive proper credit, you must enter your correct Employer Identification Number or Social Security Number and yourAccount ID number on your tax return and remittance.

ELECTRONIC FILING

Register for electronic filing. It is an easy, secure and convenient way to file and pay taxes

For more information log on to nyc.gov/eservices

Form |

Page 2 |

USE THIS PAGE IF YOU HAVE THREE OR LESS PREMISES/SUBTENANTS OR, MAKE COPIES OF THIS PAGE TO REPORT ADDITIONAL PREMISES/SUBTENANTS. IF YOU REPORT MORE THAN THREE PREMISES OR SUBTENANTS, AND CHOOSE TO USE A SPREADSHEET, YOU MUST USE THE CRQ FINANCE SUP- PLEMENTAL SPREADSHEET, WHICH YOU CAN DOWNLOAD FROM OUR WEBSITE AT WWW.NYC.GOV/CRTINFO.

EACH LINE MUST BEACCURATELYCOMPLETED. YOUR DEDUCTION WILLBE DISALLOWED IF INACCURATE INFORMATION IS SUBMITTED.

LINE |

DESCRIPTION |

PREMISES 1 |

PREMISES 2 |

PREMISES 3 |

||||

● 1a. |

Street Address ......................................................... 1a. |

|

|

|

|

|

|

|

1b. Zip Code ..................................................................1b. |

________________________________________________________________________________________ |

|||||||

1c. |

Block and 1d. Lot Number...................................1c/1d. ________________________________________________________________________________________ |

|||||||

|

|

|

1c. BLOCK |

1d. LOT |

1c. BLOCK |

1d. LOT |

1c. BLOCK |

1d. LOT |

● 2. |

Gross Rent Paid (see instructions) |

2. |

________________________________________________________________________________________ |

3. |

Rent Applied to Residential Use |

3. |

________________________________________________________________________________________ |

|

............................................. |

4a. |

________________________________________________________________________________________ |

●4b. Employer Identification Number (EIN) forKEEP THIS PAGE partnerships or corporations .....................................4b. ● 4b. EIN _____________________ ● 4b. EIN_____________________ ● 4b. EIN ____________________4a. SUBTENANT'S NAME

4c. Social Security Number for individuals |

4c. |

● 4c. SSN_____________________ ● 4c. SSN ____________________ ● 4c. SSN ____________________ |

|

4d. RENT RECEIVED FROM SUBTENANT |

|

|

|

|

(see instructions if more than one subtenant) |

4d. ___________________________________________________________________________________________________ |

|

5b. |

Commercial RevitalizationFORProgram |

YOUR RECORDS. |

|

5a. |

Other Deductions (attach schedule) |

5a. |

________________________________________________________________________________________ |

|

special reduction (see instructions) |

5b. |

________________________________________________________________________________________ |

6. |

Total Deductions (add lines 3, 4d, 5a and 5b) |

6. |

________________________________________________________________________________________ |

7.Base Rent Before Rent Reduction (line 2 minus line 6) ....7DO. ________________________________________________________________________________________NOT FILE

8.35% Rent Reduction (35% X line 7) ...........................8. ________________________________________________________________________________________

9. Base Rent Subject to Tax (line 7 minus line 8) ...........9. ________________________________________________________________________________________

If the line 7 amount represents rent for less than the full 3 month period, proceed to line 10a, or

NOTE If the line 7 amount plus the line 5b amount is $62,499 or less and represents rent for a full 3 month period, transfer line 9 to line 13, or If the line 7 amount plus the line 5b amount is $62,500 or more and represents rent for a full 3 month period, transfer line 9 to line 14

COMPLETE LINES 10 - 12 ONLY IF YOU RENTED PREMISES FOR LESS THAN THE FULL

........10a. Number of Months at Premises during the tax period |

10a. # of months |

10b. From: |

10a. # of months |

10b. From: |

10a. # of months |

10b. From: |

|

|

|

10c. To: |

|

10c. To: |

|

|

10c. To: |

11.Monthly Base Rent before rent reduction

(line 7 plus line 5b divided by line 10a) |

11. ________________________________________________________________________________________ |

12.Quarterly Base Rent before rent reduction

(line 11 X 3 months) |

12. ________________________________________________________________________________________ |

■If the line 12 amount is $62,499 or less, transfer the line 9 amount (NOT THE LINE 12AMOUNT) to line 13

■If the line 12 amount is $62,500 or more, transfer the line 9 amount (NOT THE LINE 12AMOUNT) to line 14

|

RATE CLASS |

TAX RATE |

|

|

|

13. |

($0 - 62,499) |

0% |

13. |

_______________________________________________________________________________________ |

|

14. |

($62,500 or more) |

6% |

14. |

_______________________________________________________________________________________ |

|

15.Tax Due before credit

(line 14 multiplied by 6%) |

15. |

|

16. Tax Credit (see worksheet below) |

16. |

_______________________________________________________________________________________ |

Note: The tax credit only applies if line 7 plus line 5b (or line 12, if applicable) is at least $62,500, but is less than $75,000. All others enter zero.

Tax Credit Computation Worksheet

■If the line 7 amount represents rent for the full 3 month period, your credit is calculated as follows:

Amount on line 15 X ($75,000 minus the sum of lines 7 and 5b) = _____________ = your credit

$12,500

■If the line 7 amount represents rent for less than the full 3 month period, your credit is calculated as follows:

Amount on line 15 X ($75,000$12,500minus line 12) = _____________ = your credit

TRANSFER THE AMOUNTS FROM LINES 13, 14 AND 16 TO THE CORRESPONDING LINES ON PAGE 1