The University of the State of New York

The State Education Department

Office of the Professions

Division of Professional Licensing Services

www.op.nysed.gov

Instructions for Completing Verification of Experience by Supervisor Form 4B

NOTE: Send these instructions with the Form 4B to each supervisor.

Who can complete this form? A certified public accountant licensed in one of the U.S. jurisdictions who is properly licensed and registered or authorized to practice in the jurisdiction of their principal place of business. If a CPA supervisor was not properly licensed or registered or authorized to practice in the state where they practiced, the experience cannot be accepted. The CPA must have acted in a supervisory capacity to the applicant in the same employing organization.

What is acceptable experience? An applicant must present evidence, satisfactory to the State Board for Public Accountancy, of full-time experience providing accounting services or advice involving the use of accounting, attest, compilation, management advisory, financial advisory, tax or consulting skills under the supervision of a certified public accountant as indicated above. Acceptable experience may be earned in a public accounting firm, government, not-for-profit, private industry or an educational institution. Internships may not be accepted toward the experience requirement if it is used to meet the degree requirements or listed for academic credit on the transcript.

Full and part time experience. Full-time employment is considered to be a 5-day work week with 35-40 hours per week, excluding overtime. Acceptable part-time (no fewer than 20 hours per week) experience will be considered on the basis of one week of experience for every two weeks worked. Part-time experience requires supporting documentation that indicates the number of hours worked for each week during the duration. Supporting documentation may include time cards, billing reports, excel spreadsheets, etc. An average of part time work will not be accepted.

How much experience must be certified on Form(s) 4B?

●Initial license: 150 semester hour education requirements - must document at least 1 year of acceptable full-time experience (or the part-time equivalent as described above).

●Initial license: 120 semester hour education requirements - must document at least 2 years of acceptable full-time experience (or the part-time equivalent as described above) unless the applicant submits acceptable transcripts and is approved as meeting the 150 semester hour education requirements. See 150 semester hour requirement above.

●Endorsement of a CPA license issued in another state - must document 4 years of full time experience (or the part-time equivalent as described above) since the out-of-state license was issued and within the last 10 years. Applicants who hold a license issued by another state who cannot document 4 years of post-license acceptable experience are not eligible for licensure by endorsement and may be processed as an initial applicant for licensure. Do not list experience prior to the applicant's date of licensure listed in Section 1.

●Foreign Endorsement - must document 4 years of full time experience (or part-time equivalent as described above) since the foreign license was issued and within the last 10 years. The experience must be certified by a U.S. CPA as described above. Do not list experience prior to the applicant's date of licensure listed in Section I.

●Applicants for an initial license based on 15 years of experience in lieu of meeting the education requirements - must document at least 15 years of acceptable full time experience (or the part-time equivalent as described above).

Instructions for Completing Item 7, A-K

Indicate the applicant's service(s) performed during the attested experience.

A.Independent Audit: Includes experience where the applicant was involved:

1.in examining financial statements of clients where the application of generally accepted auditing standards has been employed for the purpose of expressing an opinion that the financial statements are presented in accordance with generally accepted accounting principles; or

2.in examining financial statements of clients when certain auditing procedures have been applied but a disclaimer is expressed, including Statements on Auditing Standards (SASs), Statements on Standards for Attestation Engagements (SSAEs), and Statements on Quality Control Standards (SQCSs).

The preparation of a client’s related income tax returns and management letters by the applicant who participated in the examination of the financial statements may also be included in this category. Involvement in the examination of the financial statement is mandatory for including these tax preparation and management letter activities in the audit category.

B.Compilations and Reviews: The independent preparation of financial statements from the books of account without audit, including compilations as defined by Statements on Standards for Accounting and Review Services (SSARS), and performing related services in which the applicant has demonstrated a knowledge of generally accepted accounting principles.

Certified Public Accountant Form 4BInst, Page 1 of 2, Rev. 9/20

C.Internal, Management, or Government Audit: Includes all audit activities that are not conducted independently or to determine that financial statements are presented in accordance with generally accepted accounting principles, such as:

1.objective analysis of internal controls and evaluation of risk related to an organization's governance, operations and information systems;

2.structured review of the efficiency/effectiveness of an organization's systems and procedures;

3.review of corporate or individual tax returns on behalf of a governmental entity;

4.any audit activities conducted by an employee of a governmental entity.

D.Forensic Accounting: The application of accounting skills at a level to determine issues such as: fraud; criminal investigations; estimates of losses, damages and assets related to potential legal cases.

E.Bookkeeping Services and Internal Financial Statement Preparation: Preparing books of original entry, preparing payrolls, checks, and posting to subsidiary ledgers. Posting to the client's general ledger in connection with preparing financial statements should be classified as bookkeeping services. Providing general accounting services to an employer or client is considered bookkeeping.

F.Tax Preparation or Tax Advice:

1.Preparing corporation, fiduciary, partnership and individual tax returns from information compiled by others, or from unaudited data furnished by clients.

2.Preparing payroll tax reports, sales and similar tax returns.

3.Researching tax law; tax planning for clients; preparing protests, Tax Court petitions, and briefs; and representing clients before taxing authorities.

4.Examining tax returns.

5.Providing information and advice on tax issues to clients or an employer.

6.Estate planning for clients.

G.Management Advisory Services:

1.Designing and installing accounting, cost or other systems for a client or employer, when not related to an extension of auditing assignments.

2.Any other management advisory services provided for a client or employer.

H.Financial Advisory Services: Includes a range of financial analysis and advice for either a client or employer including:

1.Financial management activities;

2.Pension management;

3.Securities analysis;

4.Personal Financial Planning.

I.Consulting (Includes a range of consulting services surrounding technological and industry experience.):

1.Business valuation.

2.Mergers and acquisitions.

3.Client training on accounting systems.

J.Teaching College Accounting: Preparation and delivery of accounting courses for academic credit at a regionally accredited 4 year degree granting college or university. Teaching by a full-time faculty member is considered to be full-time during the semester of course delivery. Adjunct faculty must deliver 9 or more credits of course work per semester to be considered "full-time." Teaching assignments must be certified by an accounting department chair or Dean who is licensed as a CPA.

K.Other Professional Services: Any other professional services for a client or employer that do not fit in the categories above. Do not list paid time off (PTO), Continuing Professional Education (CPE), Training or other non-billable time.

Instructions for Self-Verification of Experience

Only for Applicants Who Hold a CPA License Issued by Another State (Endorsement Applicants ONLY)

An applicant for licensure in New York, who is licensed in another state, may certify his/her own experience on Form 4B if:

1.he/she is working in private industry, government, or a not for profit and he/she does not have a US licensed CPA supervisor; or

2.he/she is working as a sole proprietor of a CPA firm in a state other than New York.

To self-verify experience on Form 4B the applicant must do all of the following:

●Provide his/her personal information in Section I: Applicant Information;

●Provide his/her professional credentialing information in Section II, Item 1;

●Detail his/her experience in Section 2, Items 2 - 10; and

●Sign the affidavit at the end of the form.

Certified Public Accountant Form 4BInst, Page 2 of 2, Rev. 9/20

|

The University of the State of New York |

|

|

The State Education Department |

Certified Public Accountant Form 4B |

|

Office of the Professions |

|

Verification of Experience by Supervisor |

|

Division of Professional Licensing Services |

|

www.op.nysed.gov |

|

|

|

|

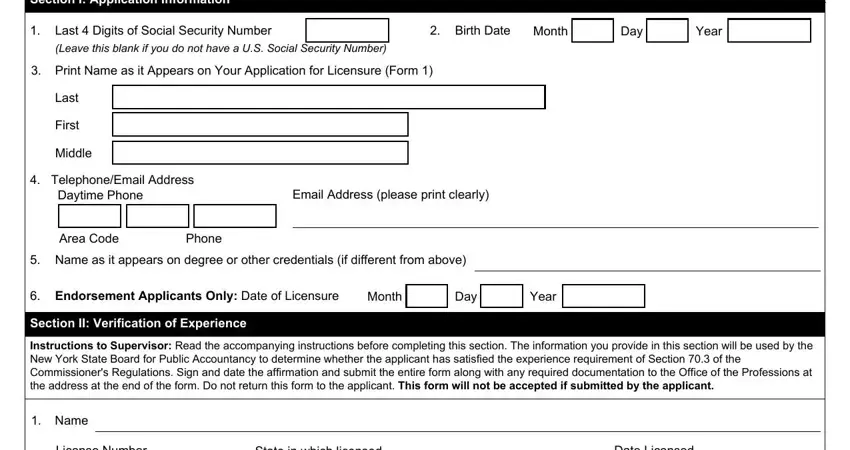

Applicant Instructions: Complete Section I before sending the form along with a copy of Instructions for Completing Verification of Experience by Supervisor (Form 4BInst) to your supervisor. Use a separate Form 4B for each supervisor you listed on Form 1. Ask your supervisor to complete Section II. The supervisor must submit the form directly to the address at the end of this form. This form will not be accepted if submitted by the applicant.

Section I: Application Information

1. |

Last 4 Digits of Social Security Number |

|

|

|

|

2. |

Birth Date |

Month |

|

Day |

|

Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Leave this blank if you do not have a U.S. Social Security Number) |

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Print Name as it Appears on Your Application for Licensure (Form 1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Telephone/Email Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Daytime Phone |

|

|

|

Email Address (please print clearly) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Area Code |

Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

Name as it appears on degree or other credentials (if different from above) |

|

|

|

|

|

|

|

|

|

|

6. |

Endorsement Applicants Only: Date of Licensure |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month |

|

Day |

|

Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

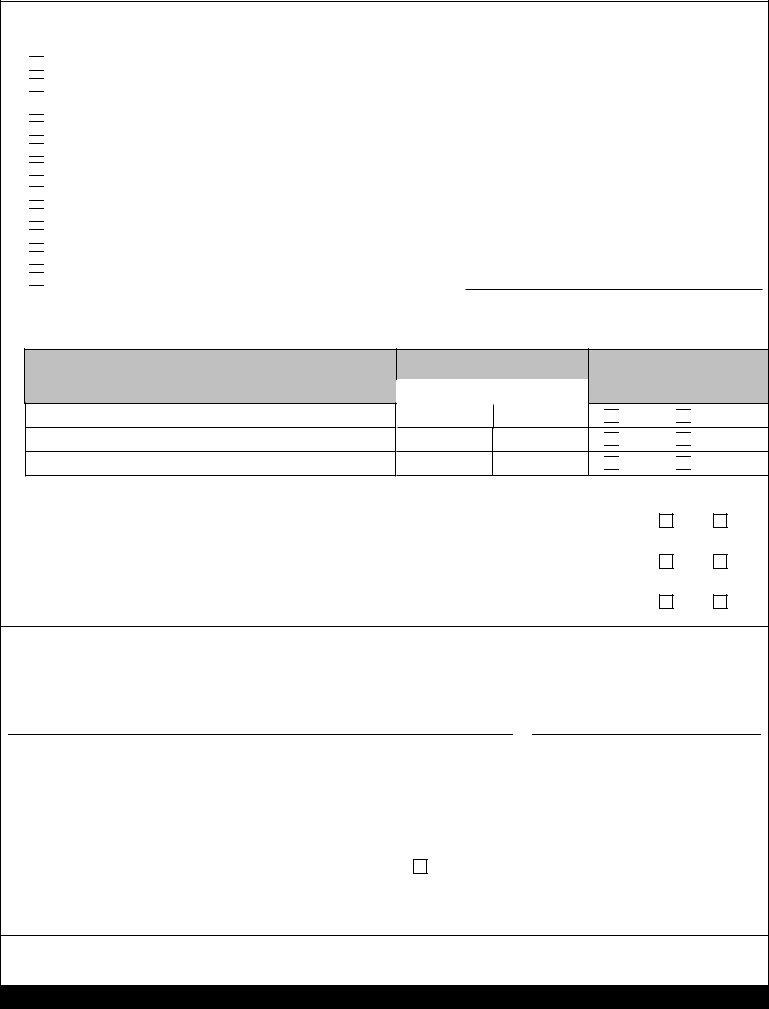

Section II: Verification of Experience

Instructions to Supervisor: Read the accompanying instructions before completing this section. The information you provide in this section will be used by the New York State Board for Public Accountancy to determine whether the applicant has satisfied the experience requirement of Section 70.3 of the Commissioner's Regulations. Sign and date the affirmation and submit the entire form along with any required documentation to the Office of the Professions at the address at the end of the form. Do not return this form to the applicant. This form will not be accepted if submitted by the applicant.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

License Number |

State in which licensed |

Date Licensed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

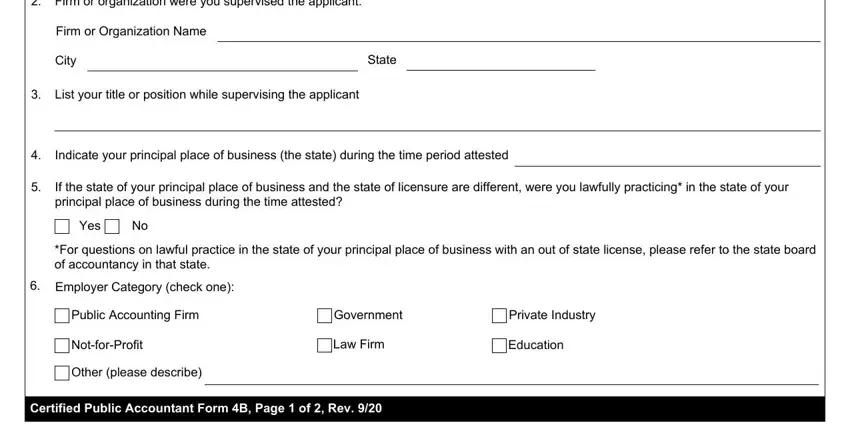

2. |

|

Firm or organization were you supervised the applicant. |

|

|

|

|

Firm or Organization Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

State |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

List your title or position while supervising the applicant |

|

|

|

|

|

|

|

|

|

|

4. |

|

Indicate your principal place of business (the state) during the time period attested |

|

|

|

|

|

|

|

|

5. |

|

If the state of your principal place of business and the state of licensure are different, were you lawfully practicing* in the state of your |

|

|

principal place of business during the time attested? |

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*For questions on lawful practice in the state of your principal place of business with an out of state license, please refer to the state board |

|

of accountancy in that state. |

|

|

|

|

|

|

|

|

6. Employer Category (check one): |

|

|

|

|

|

|

Public Accounting Firm |

|

Government |

|

Private Industry |

|

|

|

|

|

|

Not-for-Profit |

|

Law Firm |

|

Education |

|

|

|

|

|

|

Other (please describe) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Certified Public Accountant Form 4B, Page 1 of 2, Rev. 9/20

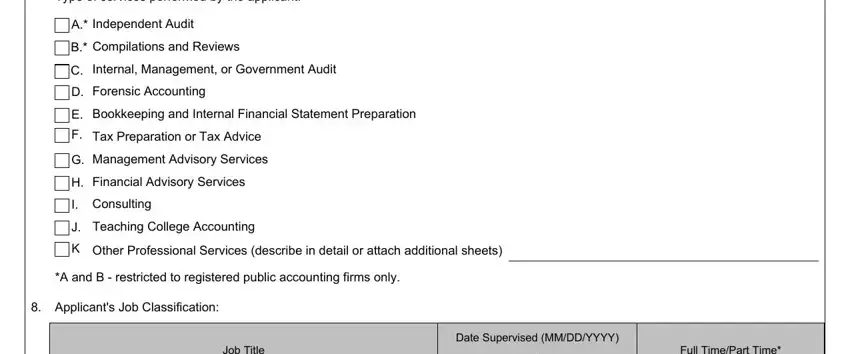

Items 7 - 11: Applicant's work experience record to which I am attesting and acted in a supervisory capacity:

7.Type of services performed by the applicant:

A.* Independent Audit

B.* Compilations and Reviews

C. Internal, Management, or Government Audit

D. Forensic Accounting

E. Bookkeeping and Internal Financial Statement Preparation

F. Tax Preparation or Tax Advice

G. Management Advisory Services

H. Financial Advisory Services

I. Consulting

J. Teaching College Accounting

K Other Professional Services (describe in detail or attach additional sheets)

*A and B - restricted to registered public accounting firms only.

8.Applicant's Job Classification:

Date Supervised (MM/DD/YYYY)

Full Time Part Time*

Full Time Part Time*

Full Time Part Time*

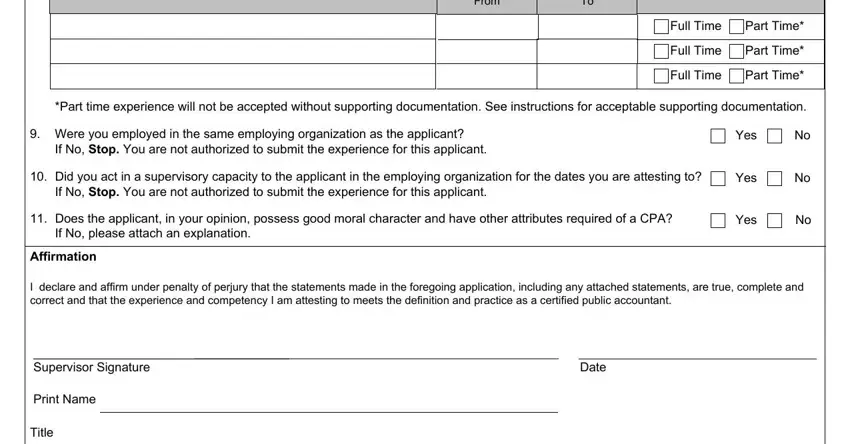

*Part time experience will not be accepted without supporting documentation. See instructions for acceptable supporting documentation.

9.Were you employed in the same employing organization as the applicant?

If No, Stop. You are not authorized to submit the experience for this applicant.

10.Did you act in a supervisory capacity to the applicant in the employing organization for the dates you are attesting to? If No, Stop. You are not authorized to submit the experience for this applicant.

11.Does the applicant, in your opinion, possess good moral character and have other attributes required of a CPA? If No, please attach an explanation.

Affirmation

Ideclare and affirm under penalty of perjury that the statements made in the foregoing application, including any attached statements, are true, complete and correct and that the experience and competency I am attesting to meets the definition and practice as a certified public accountant.

Supervisor Signature |

|

|

|

|

Date |

Print Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone |

|

|

|

|

|

|

|

|

|

|

Check here if you are attaching additional information |

Fax |

|

|

|

|

|

|

|

|

|

|

|

|

Email |

|

|

|

|

|

|

|

|

|

|

|

|

|

Return Directly to by mail: New York State Education Department, Office of the Professions, Division of Professional Licensing Services, CPA Unit, 89 Washington Avenue, Albany, NY 12234-1000, OR, Submit this form to the Department by E-mail at

DPLSExperience@nysed.gov.

Certified Public Accountant Form 4B, Page 2 of 2, Rev. 9/20