Handling PDF files online is actually simple with this PDF editor. You can fill out it 201 form here with no trouble. In order to make our tool better and less complicated to use, we consistently design new features, taking into account feedback coming from our users. With some easy steps, you may start your PDF editing:

Step 1: Hit the "Get Form" button in the top part of this webpage to access our PDF tool.

Step 2: Once you start the PDF editor, you'll see the document all set to be filled in. Aside from filling in different fields, you may also do other sorts of things with the form, particularly adding any text, changing the original textual content, adding illustrations or photos, placing your signature to the form, and a lot more.

This document will need specific information; to ensure accuracy and reliability, you should adhere to the next suggestions:

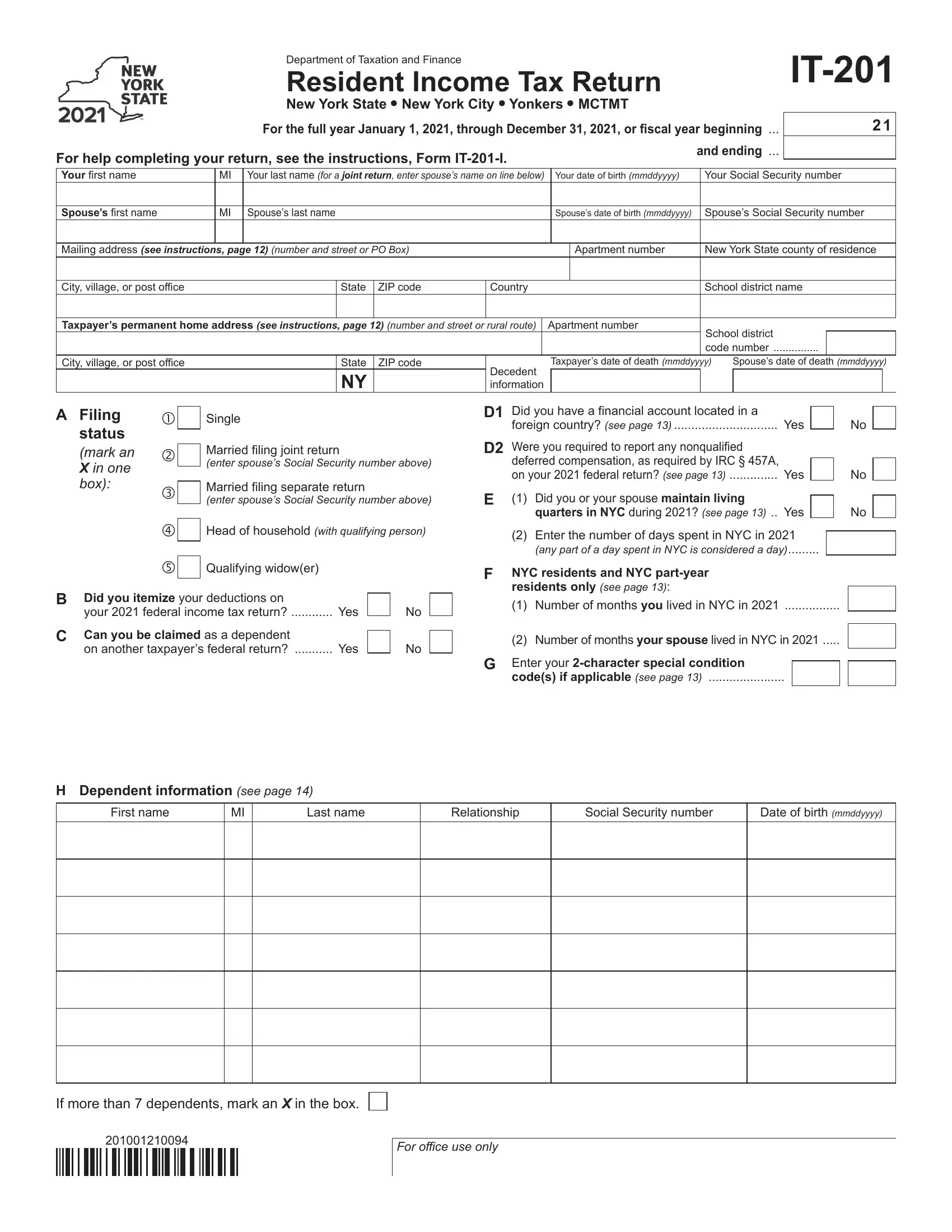

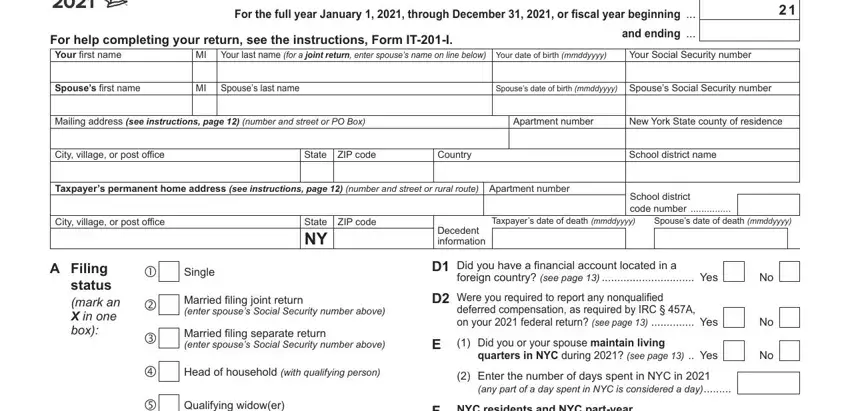

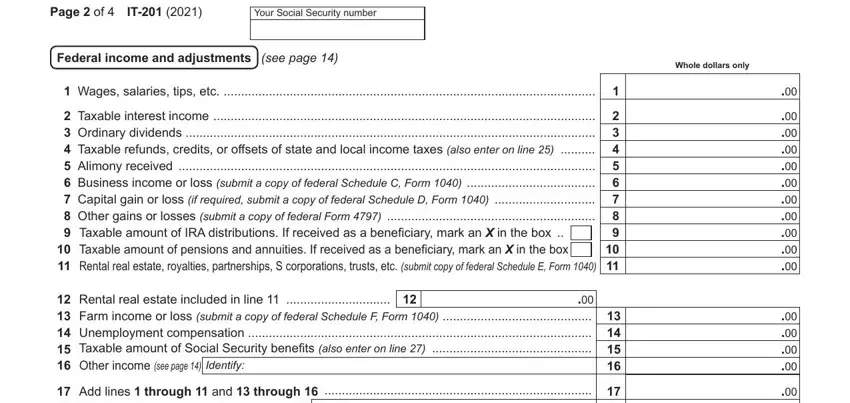

1. Begin filling out your it 201 form with a selection of essential blanks. Collect all the information you need and make sure there is nothing forgotten!

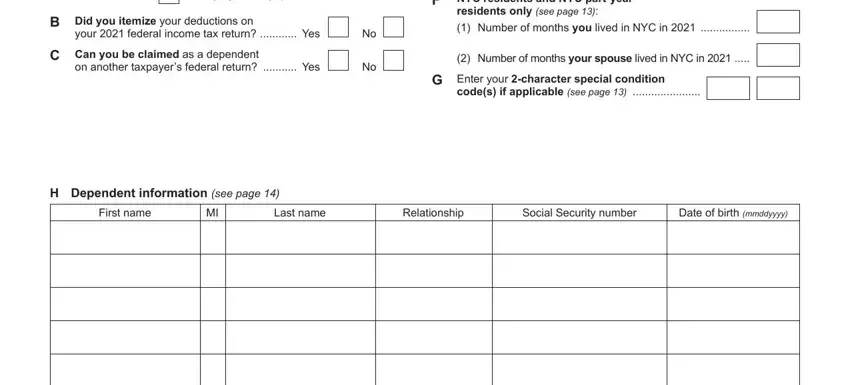

2. Your next step is to submit the next few fields: Qualifying widower, your federal income tax return, B Did you itemize your deductions, on another taxpayers federal, F NYC residents and NYC partyear, residents only see page Number, Number of months your spouse, G Enter your character special, codes if applicable see page, H Dependent information see page, First name, Last name, Relationship, Social Security number, and Date of birth mmddyyyy.

3. The following section is focused on If more than dependents mark an X, and For office use only - fill in each of these blank fields.

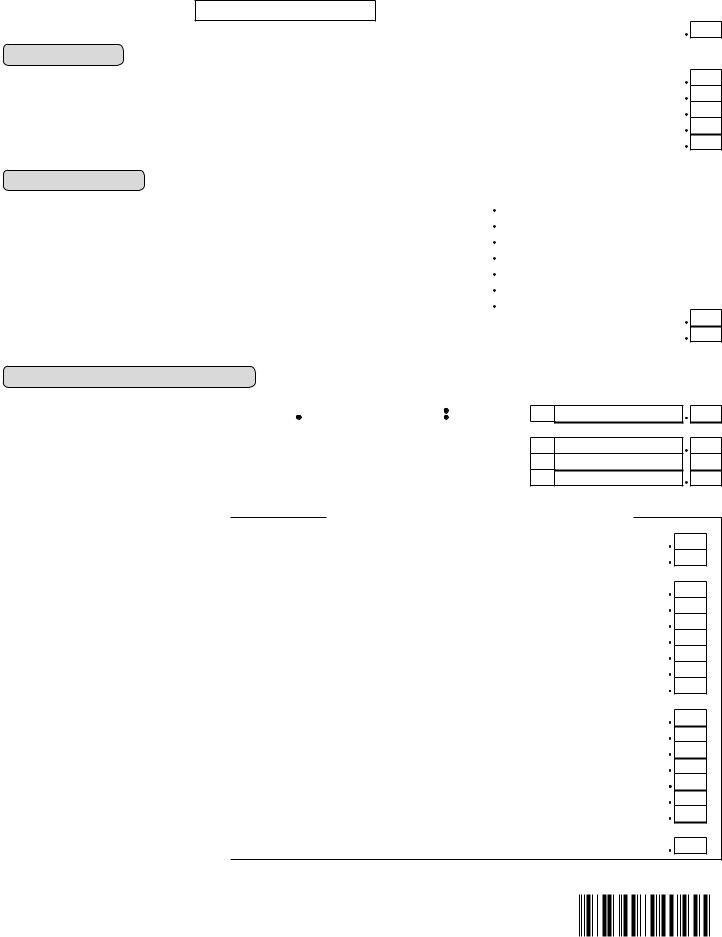

4. This next section requires some additional information. Ensure you complete all the necessary fields - Page of, Your Social Security number, Federal income and adjustments see, Whole dollars only, Wages salaries tips etc, Rental real estate included in, and Add lines through and through - to proceed further in your process!

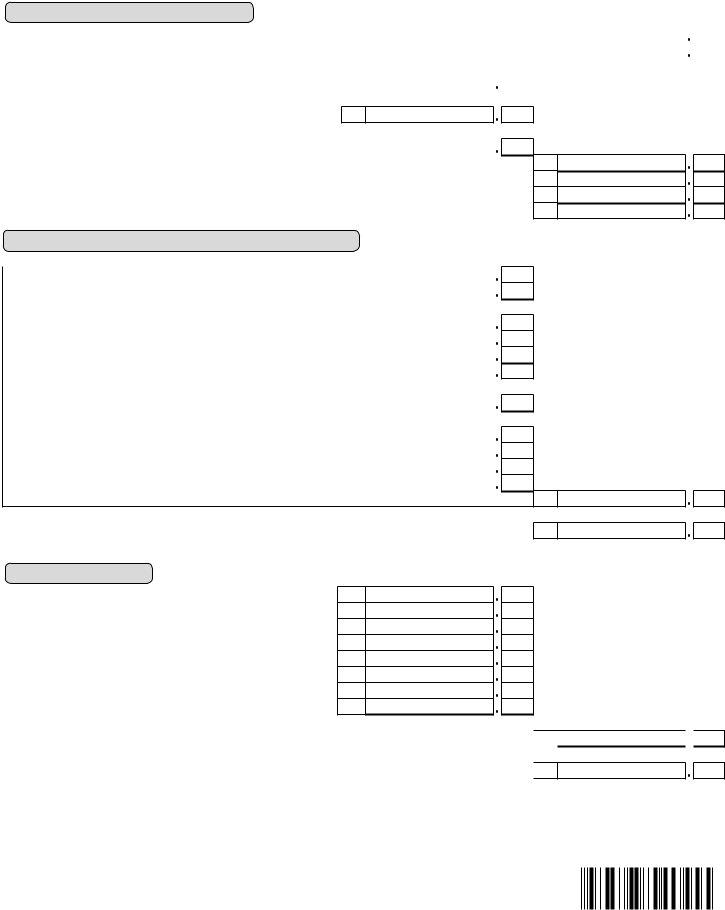

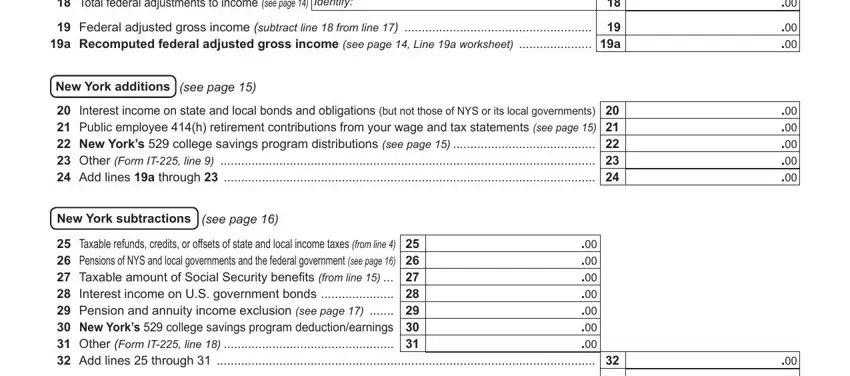

5. This final section to submit this form is essential. Ensure to fill out the necessary form fields, for instance Add lines through and through, New York additions see page, New York subtractions see page, and Taxable refunds credits or, before using the document. Failing to do this can give you a flawed and potentially invalid paper!

It's simple to get it wrong while completing your New York subtractions see page, consequently make sure to take another look before you send it in.

Step 3: Right after you've looked over the details you given, press "Done" to conclude your FormsPal process. Make a free trial subscription at FormsPal and gain instant access to it 201 form - download, email, or edit inside your FormsPal account page. At FormsPal, we endeavor to make sure that all your details are kept protected.