You can fill out Ny It 203 Form easily with our online PDF tool. Our editor is continually developing to provide the very best user experience attainable, and that is due to our resolve for constant development and listening closely to customer opinions. Starting is simple! What you need to do is stick to the next easy steps down below:

Step 1: Simply click the "Get Form Button" at the top of this webpage to access our form editing tool. There you will find all that is necessary to fill out your file.

Step 2: This editor will let you work with your PDF file in various ways. Enhance it by writing your own text, adjust what's already in the PDF, and place in a signature - all possible in no time!

This document will need some specific details; in order to ensure accuracy and reliability, remember to take into account the subsequent recommendations:

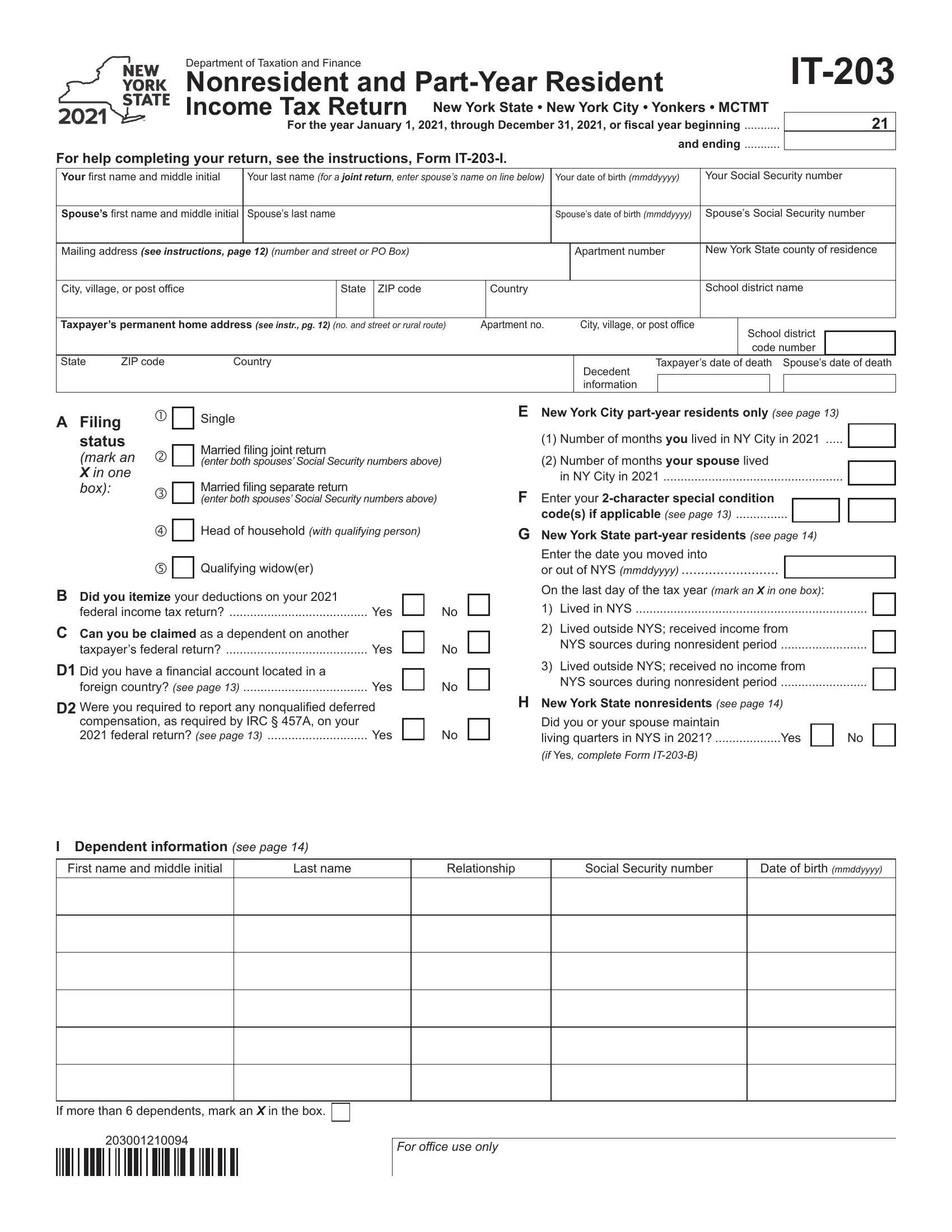

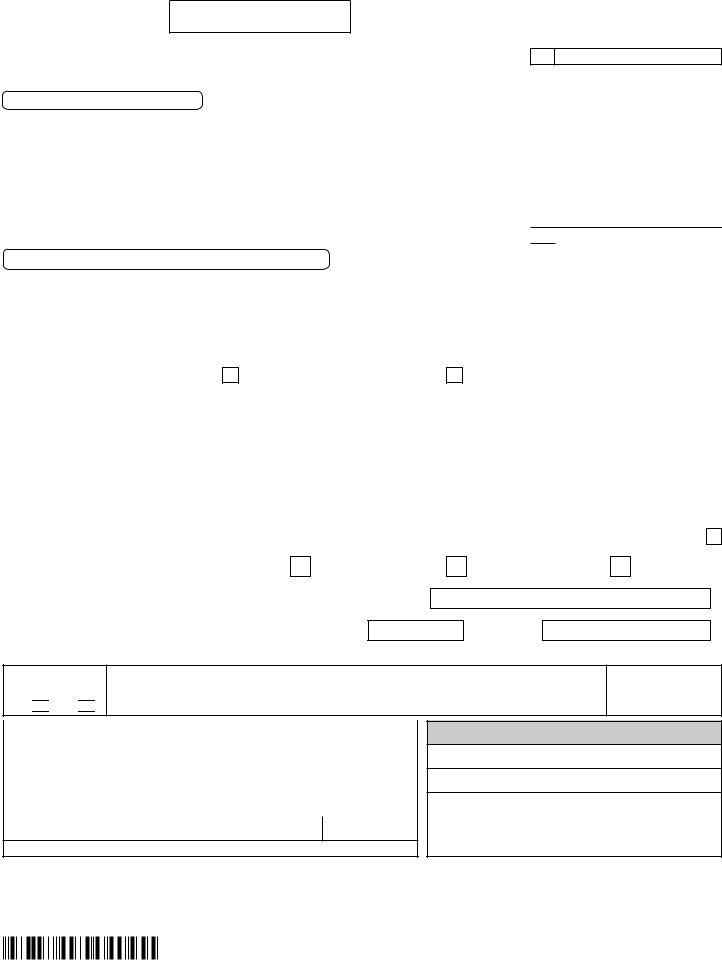

1. When filling out the Ny It 203 Form, ensure to include all needed blank fields in the associated part. It will help to speed up the process, allowing for your details to be handled quickly and appropriately.

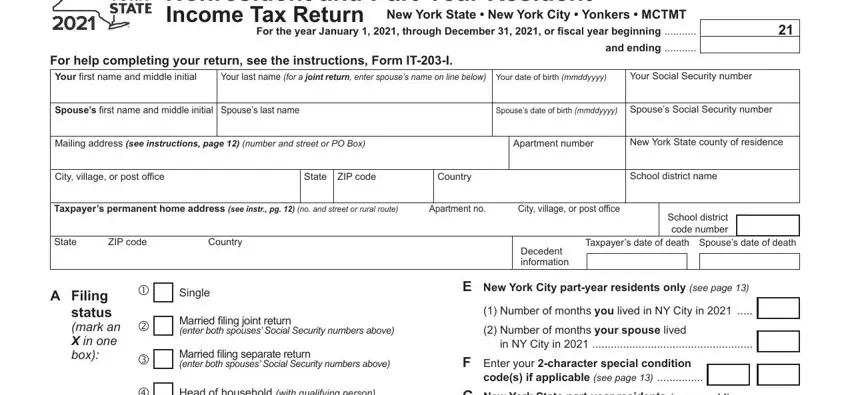

2. When this part is completed, you'll want to add the required details in Head of household with qualifying, Qualifying widower, B Did you itemize your deductions, federal income tax return Yes, taxpayers federal return Yes, C Can you be claimed as a, compensation as required by IRC A, foreign country see page Yes, G New York State partyear, Enter the date you moved into or, On the last day of the tax year, Lived in NYS, Lived outside NYS received income, Lived outside NYS received no, and H New York State nonresidents see so you're able to progress further.

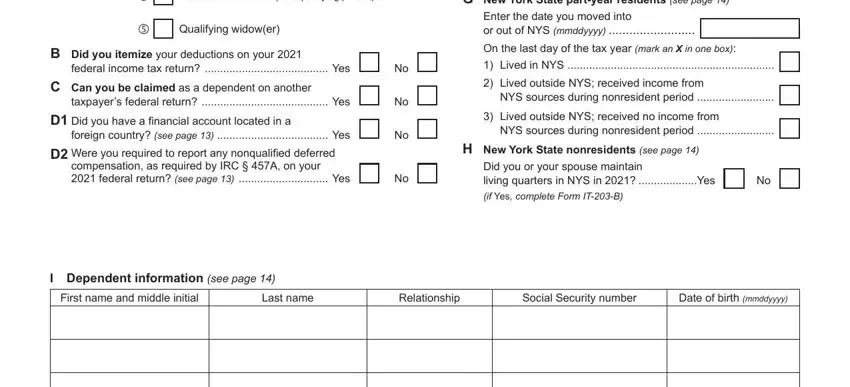

3. This next step is generally easy - complete all the empty fields in If more than dependents mark an X, and For office use only to complete this segment.

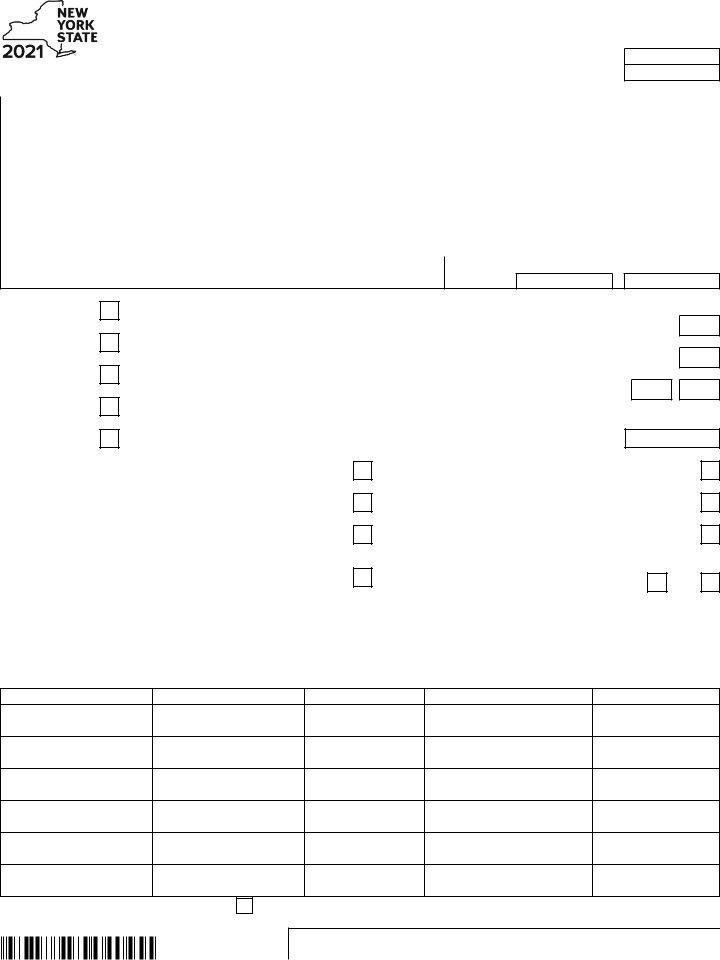

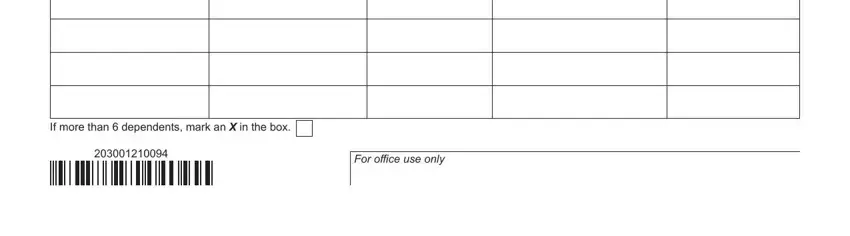

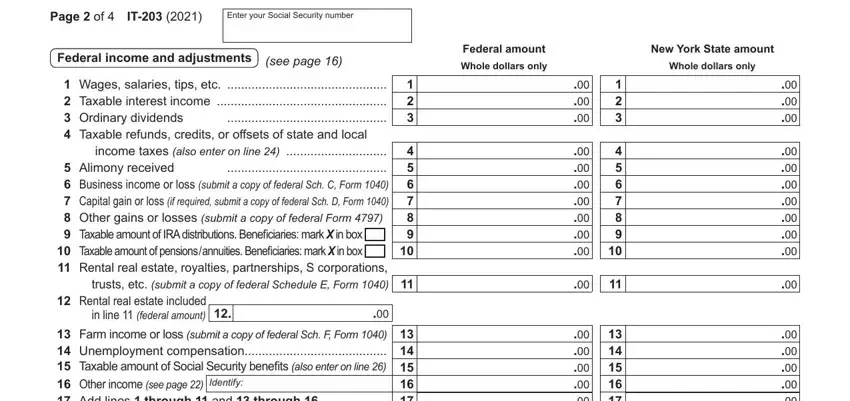

4. All set to complete this fourth segment! In this case you'll get these Page of, Enter your Social Security number, Federal income and adjustments, see page, Wages salaries tips etc Taxable, trusts etc submit a copy of, in line federal amount, Farm income or loss submit a copy, Federal amount, New York State amount, Whole dollars only, and Whole dollars only empty form fields to fill out.

Always be extremely careful while filling out Whole dollars only and Farm income or loss submit a copy, as this is the part where many people make mistakes.

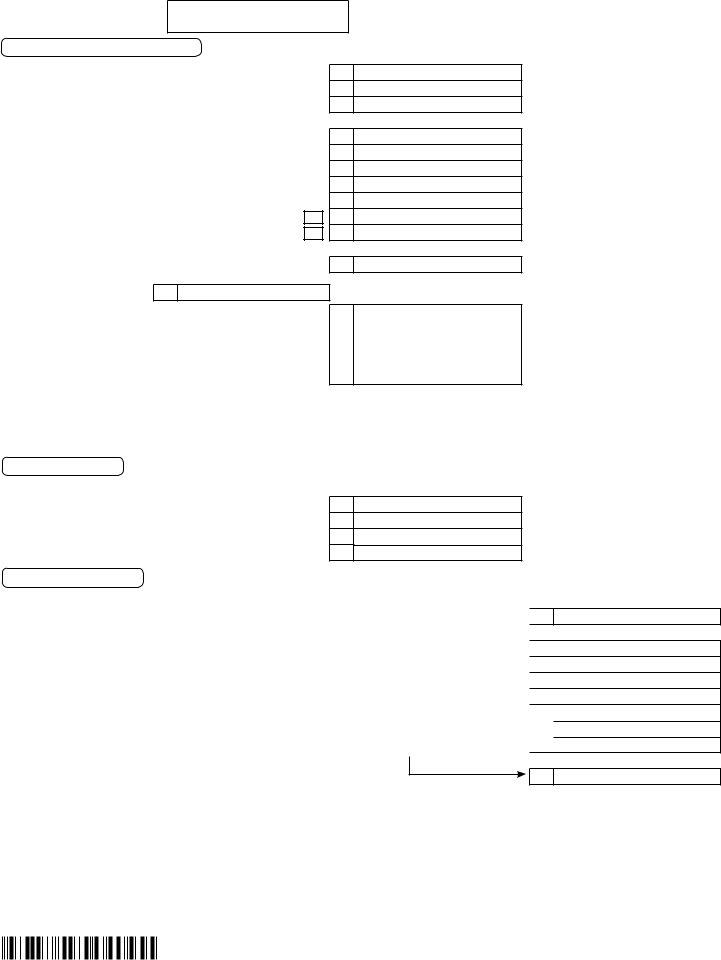

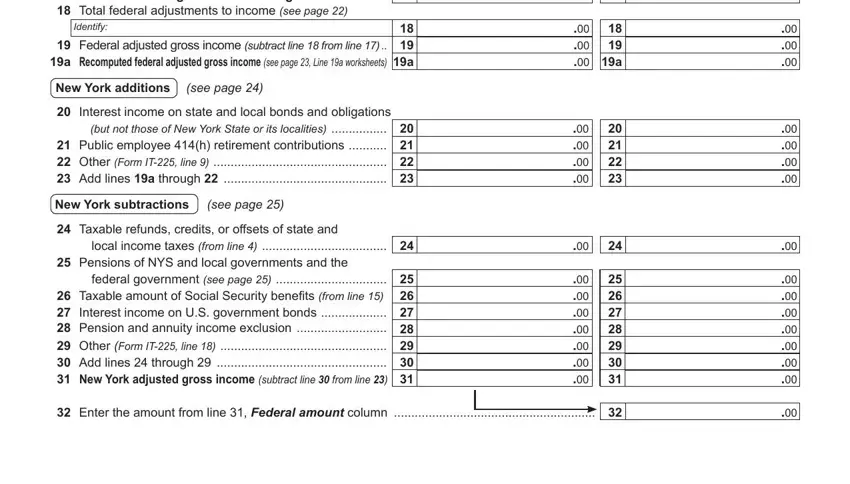

5. And finally, the following last subsection is what you will need to complete before finalizing the document. The blanks in this case include the next: Farm income or loss submit a copy, Identify, New York additions, see page, Interest income on state and, but not those of New York State or, New York subtractions, see page, local income taxes from line, Taxable refunds credits or, and Enter the amount from line.

Step 3: Before obtaining the next stage, double-check that all blanks were filled out properly. Once you establish that it is good, press “Done." Go for a 7-day free trial option with us and get direct access to Ny It 203 Form - downloadable, emailable, and editable from your FormsPal account page. We do not share any details that you use whenever working with documents at FormsPal.