Dealing with PDF documents online is always a piece of cake with this PDF tool. Anyone can fill out Nyc 4S Form here effortlessly. In order to make our editor better and easier to work with, we consistently implement new features, with our users' suggestions in mind. All it requires is a few easy steps:

Step 1: Access the PDF file in our editor by clicking on the "Get Form Button" above on this page.

Step 2: The tool provides the capability to change your PDF form in various ways. Change it by writing personalized text, correct original content, and add a signature - all when it's needed!

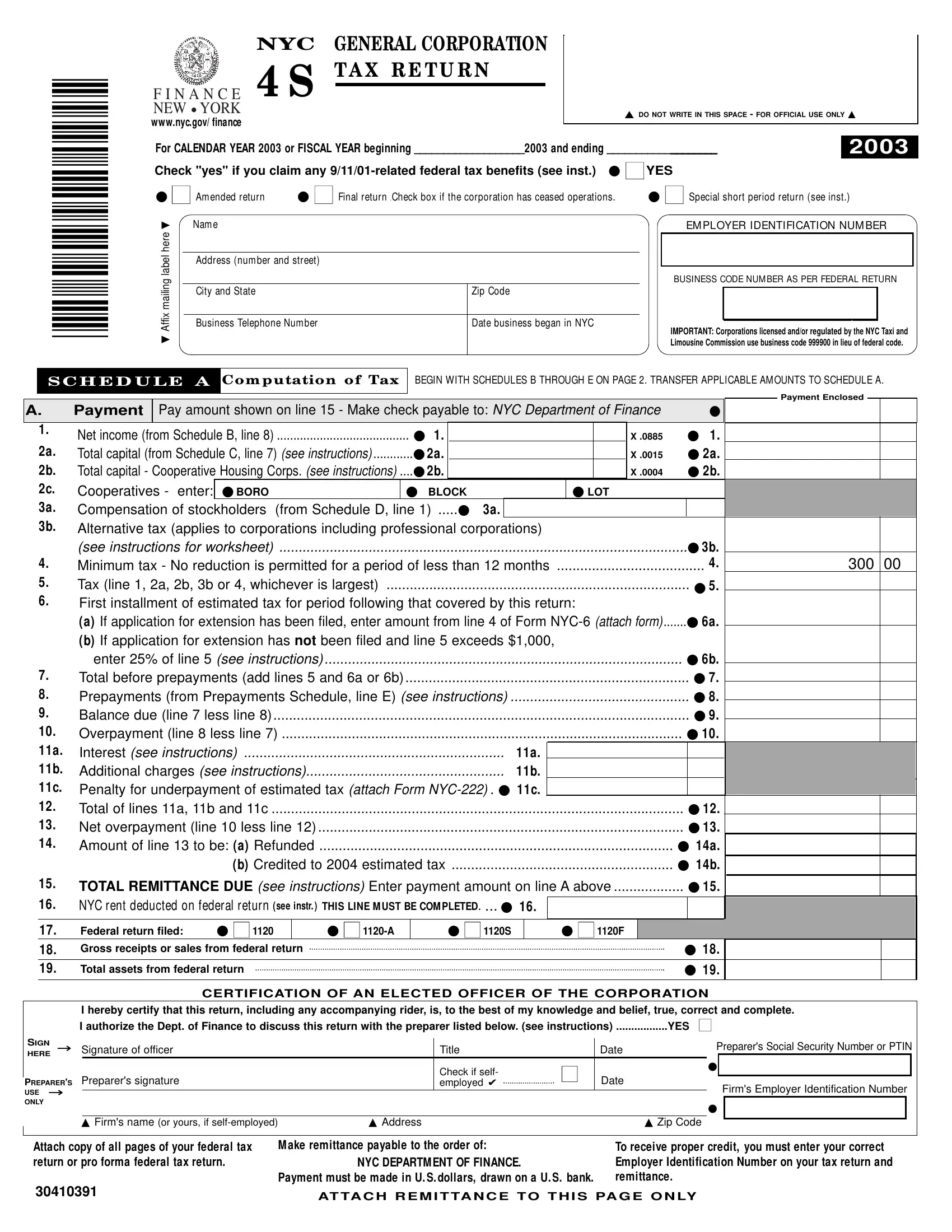

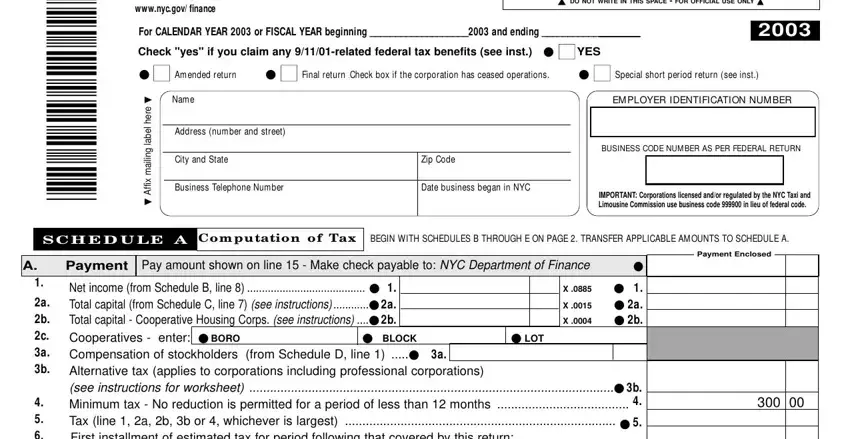

As for the blank fields of this specific form, this is what you should know:

1. When filling in the Nyc 4S Form, ensure to include all needed blanks in their relevant part. This will help to hasten the work, making it possible for your details to be handled quickly and correctly.

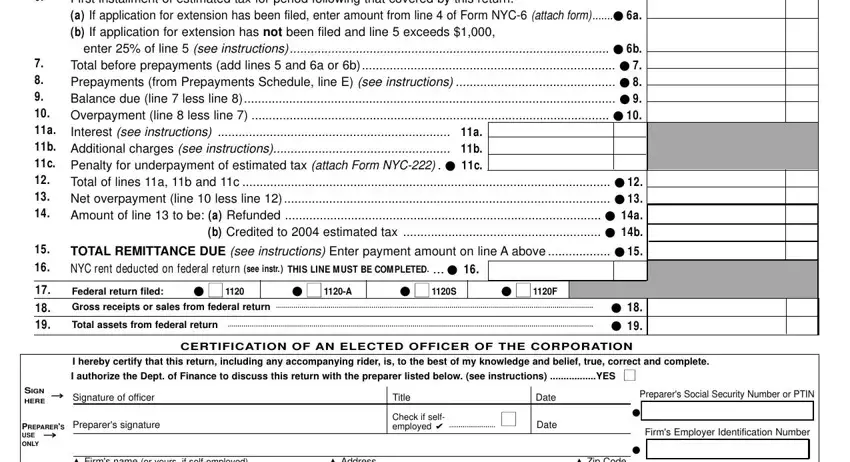

2. After this part is completed, go to type in the suitable details in all these: a b c, Payment Net income from Schedule B, enter of line see instructions, a b, TOTAL REMITTANCE DUE see, Gross receipts or sales from, Total assets from federal return, CERTIFICATION OF AN ELECTED, I hereby certify that this return, SIGN HERE, Signature of officer, Preparers signature, PREPARERS USE ONLY, Title, and Check if self employed.

It's easy to make an error while completing your Payment Net income from Schedule B, for that reason be sure to look again before you'll submit it.

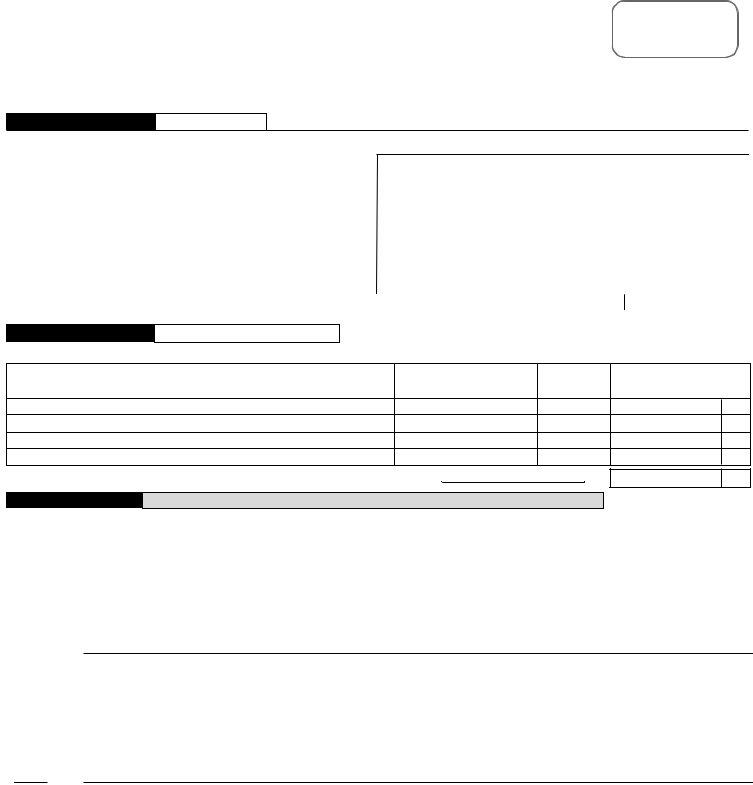

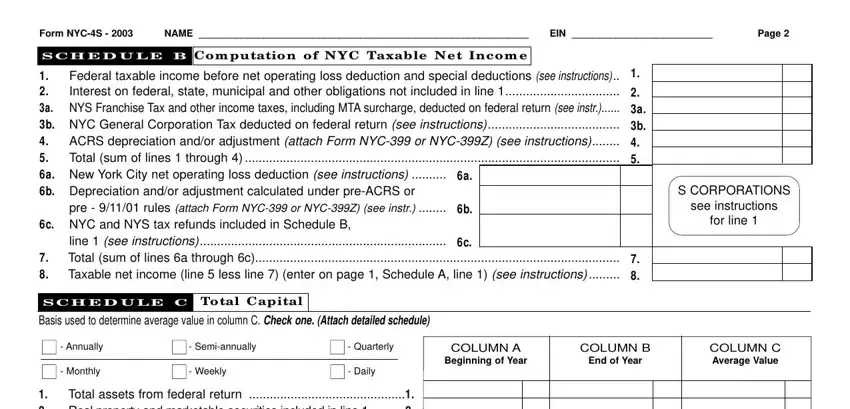

3. Completing Form NYCS, NAME, EIN, Page, S C H E D U L E B, Com p u tatio n o f N Y C Taxab le, Federal taxable income before net, pre rules attach Form NYC or, c NYC and NYS tax refunds included, line see instructions c Total sum, S C H E D U L E C To tal Cap ital, Basis used to determine average, S CORPORATIONS, see instructions, and for line is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

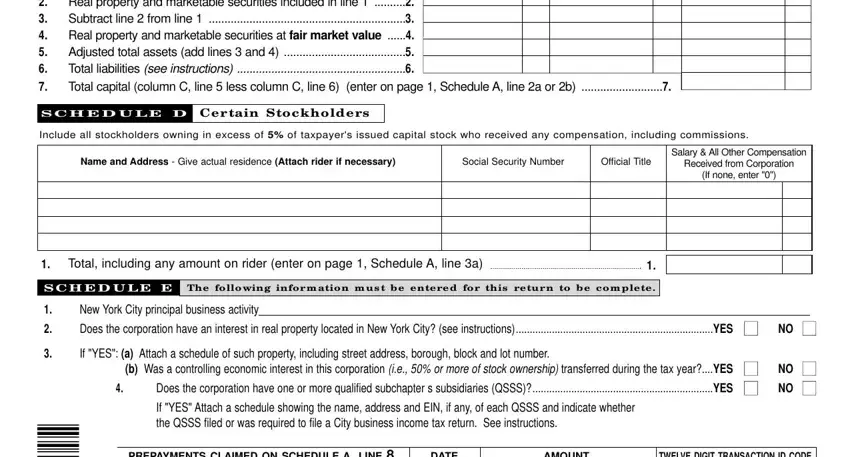

4. This next section requires some additional information. Ensure you complete all the necessary fields - Total assets from federal return, S C H E D U L E D Ce r tain S to c, Include all stockholders owning in, Name and Address Give actual, Social Security Number, Official Title, Salary All Other Compensation, Received from Corporation, If none enter, Total including any amount on, S C H E D U L E E The fo llowing, New York City principal business, If YES a Attach a schedule of such, b Was a controlling economic, and NO NO - to proceed further in your process!

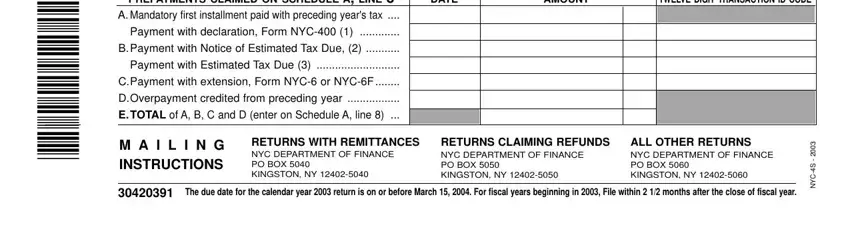

5. To wrap up your form, this final section features a number of extra fields. Filling out DATE, AMOUNT, TWELVE DIGIT TRANSACTION ID CODE, PREPAYMENTS CLAIMED ON SCHEDULE A, Payment with declaration Form NYC, B Payment with Notice of Estimated, Payment with Estimated Tax Due, CPayment with extension Form NYC, DOverpayment credited from, E TOTAL of A B C and D enter on, M A I L I N G INSTRUCTIONS, RETURNS WITH REMITTANCES NYC, RETURNS CLAIMING REFUNDS NYC, ALL OTHER RETURNS NYC DEPARTMENT, and The due date for the calendar year will certainly conclude everything and you will be done in a snap!

Step 3: Prior to obtaining the next step, make certain that blanks are filled in correctly. When you establish that it's correct, press “Done." Sign up with us now and instantly gain access to Nyc 4S Form, ready for download. All modifications made by you are kept , making it possible to modify the document later on if required. With FormsPal, you can complete documents without needing to get worried about database breaches or records being shared. Our protected software makes sure that your private details are maintained safely.