It is possible to fill in nys 1 form printable form effortlessly using our online editor for PDFs. In order to make our editor better and less complicated to work with, we consistently develop new features, with our users' suggestions in mind. It merely requires several basic steps:

Step 1: First, open the editor by pressing the "Get Form Button" in the top section of this webpage.

Step 2: As soon as you access the PDF editor, you will see the document made ready to be completed. Besides filling out different blank fields, you may also perform some other things with the PDF, including adding your own text, editing the initial text, inserting illustrations or photos, placing your signature to the document, and much more.

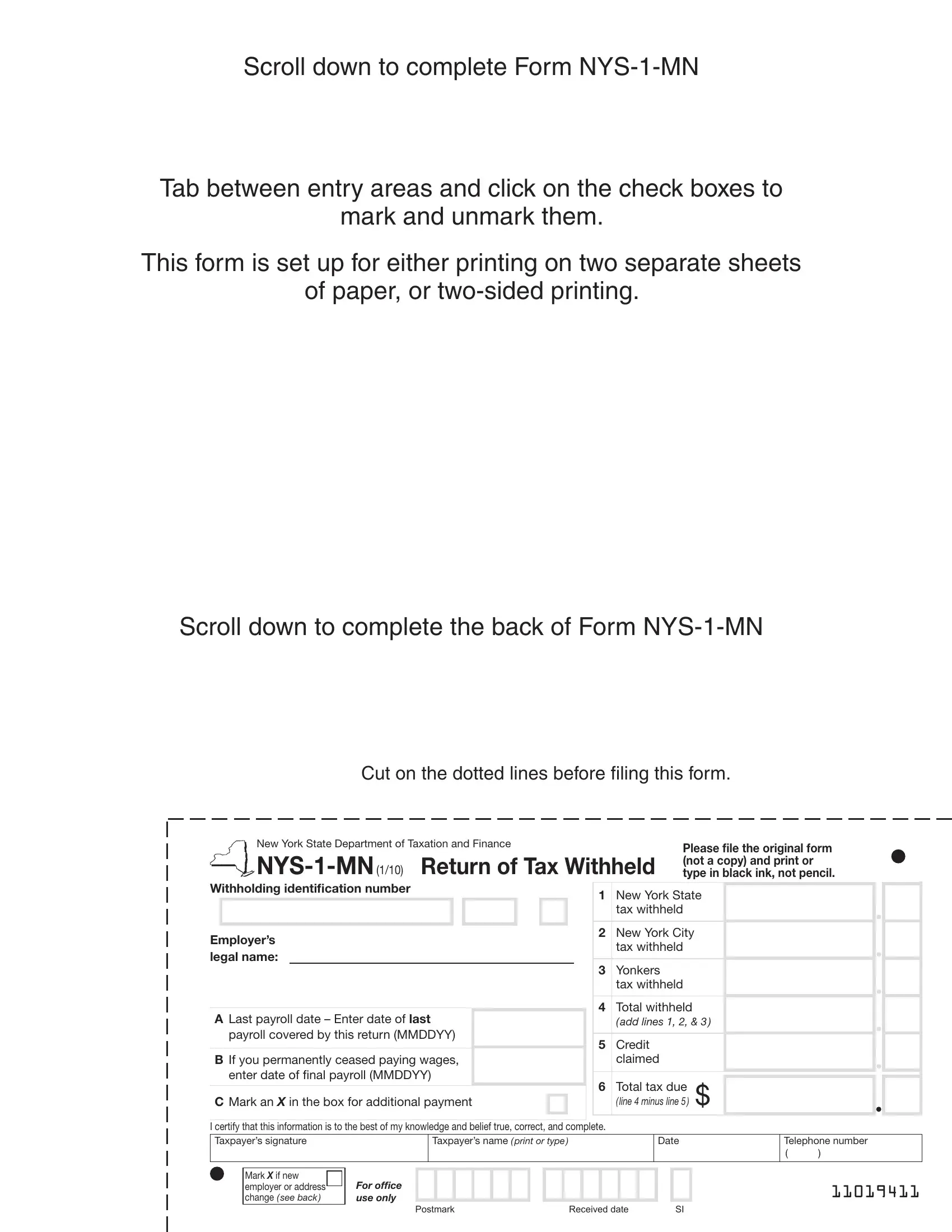

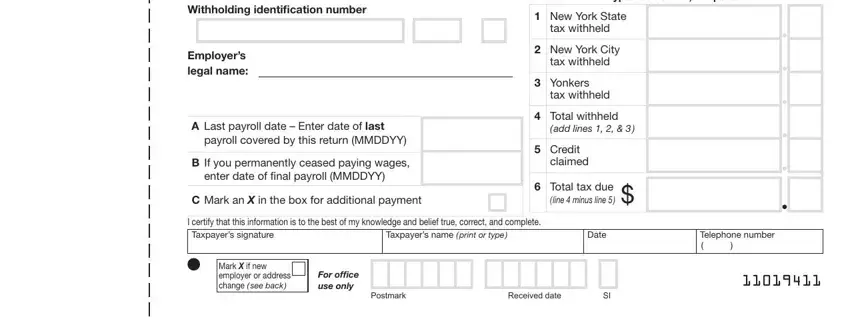

When it comes to fields of this particular PDF, here is what you should consider:

1. To start with, while filling in the nys 1 form printable form, beging with the part with the following fields:

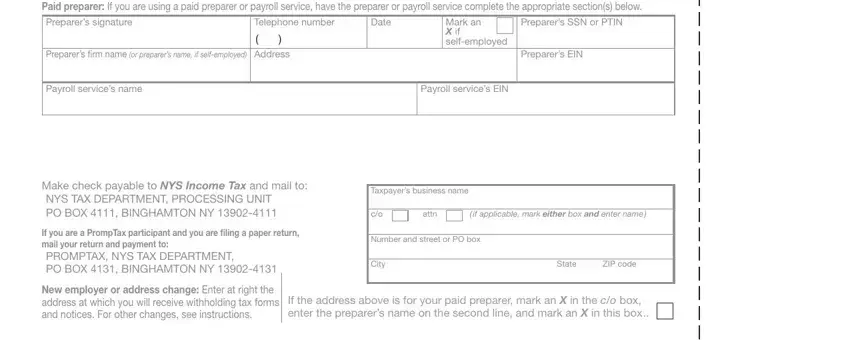

2. Once your current task is complete, take the next step – fill out all of these fields - NYSMN back, Paid preparer If you are using a, Preparers SSN or PTIN, Telephone number, Date, Mark an X if selfemployed, Preparers irm name or preparers, Preparers EIN, Payroll services name, Payroll services EIN, Make check payable to NYS Income, If you are a PrompTax participant, Taxpayers business name, attn, and if applicable mark either box and with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

You can potentially make errors when completing your attn, hence make sure to go through it again prior to deciding to send it in.

Step 3: Soon after rereading your completed blanks, click "Done" and you are done and dusted! After starting afree trial account here, it will be possible to download nys 1 form printable form or email it right away. The PDF document will also be readily available via your personal cabinet with your each change. We do not share or sell the information you enter while completing documents at FormsPal.