You may fill out form ct 245 without difficulty in our PDFinity® editor. FormsPal is dedicated to making sure you have the perfect experience with our editor by continuously presenting new features and upgrades. With all of these updates, working with our tool becomes better than ever! All it requires is a couple of simple steps:

Step 1: Simply click on the "Get Form Button" in the top section of this page to start up our pdf editing tool. Here you will find everything that is necessary to work with your file.

Step 2: The editor will give you the opportunity to work with your PDF in a range of ways. Improve it with your own text, correct what's originally in the file, and place in a signature - all when it's needed!

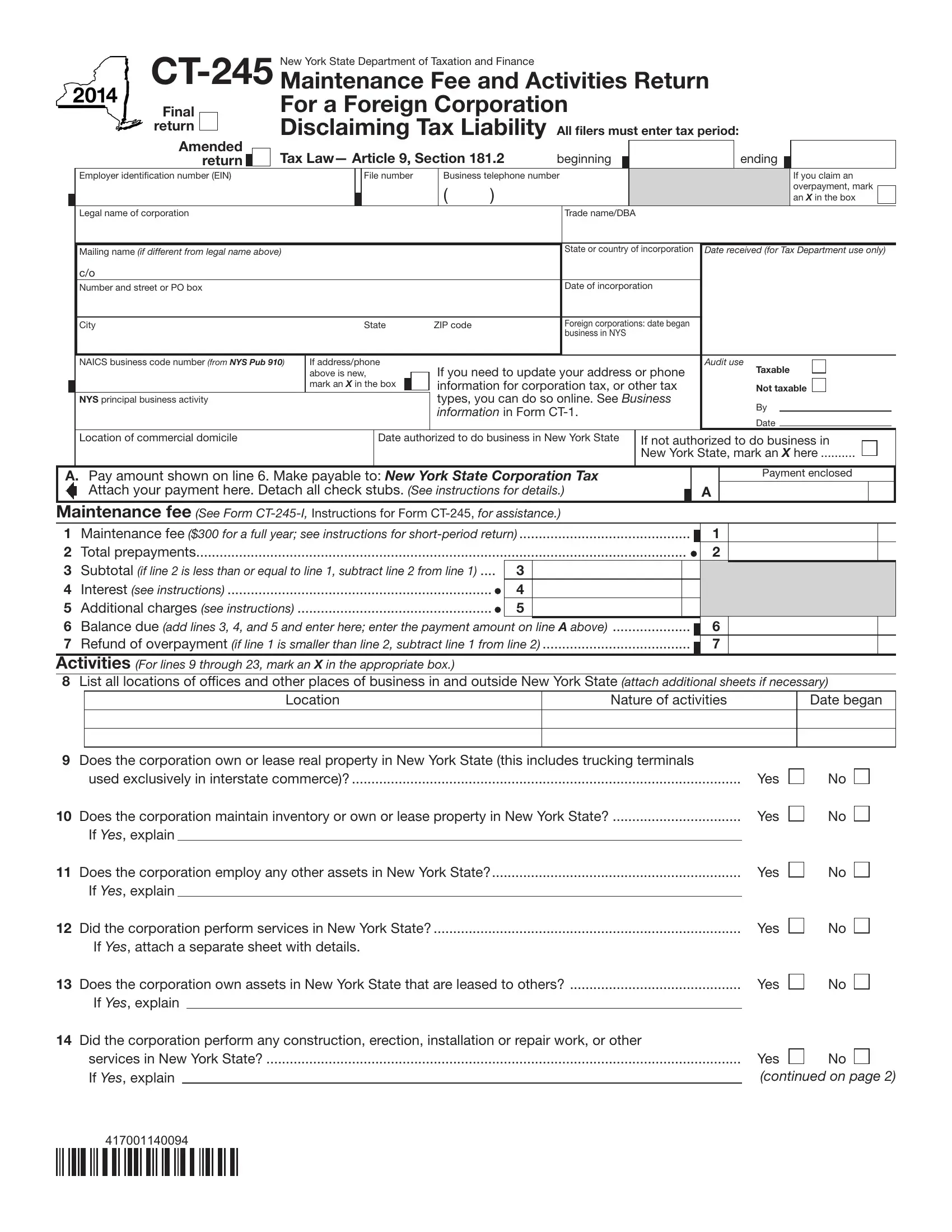

This PDF will need specific information to be filled out, therefore be sure to take the time to enter precisely what is requested:

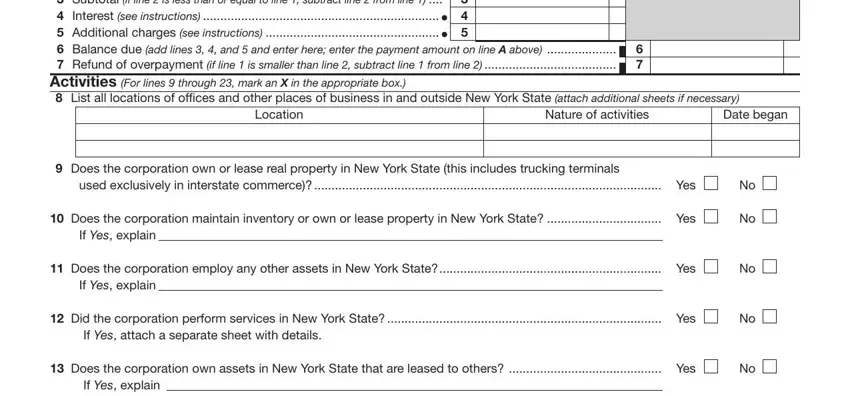

1. When filling out the form ct 245, be certain to incorporate all of the needed blanks in its associated form section. This will help speed up the process, allowing for your details to be processed efficiently and properly.

2. Soon after completing the previous step, go on to the next stage and fill in all required particulars in all these fields - A Pay amount shown on line Make, Location, Nature of activities, Date began, Does the corporation own or lease, used exclusively in interstate, If Yes explain, Does the corporation maintain, If Yes explain, Did the corporation perform, If Yes attach a separate sheet, Does the corporation own assets, and If Yes explain.

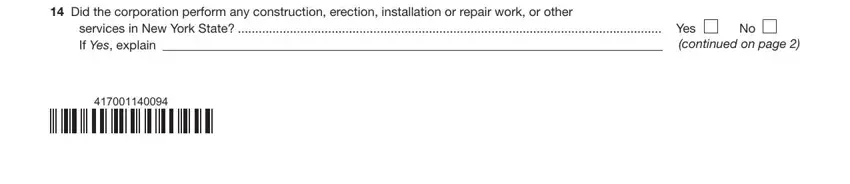

3. Completing Did the corporation perform any, services in New York State Yes If, and continued on page is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

It's very easy to get it wrong while filling out the Did the corporation perform any, so make sure to look again prior to deciding to submit it.

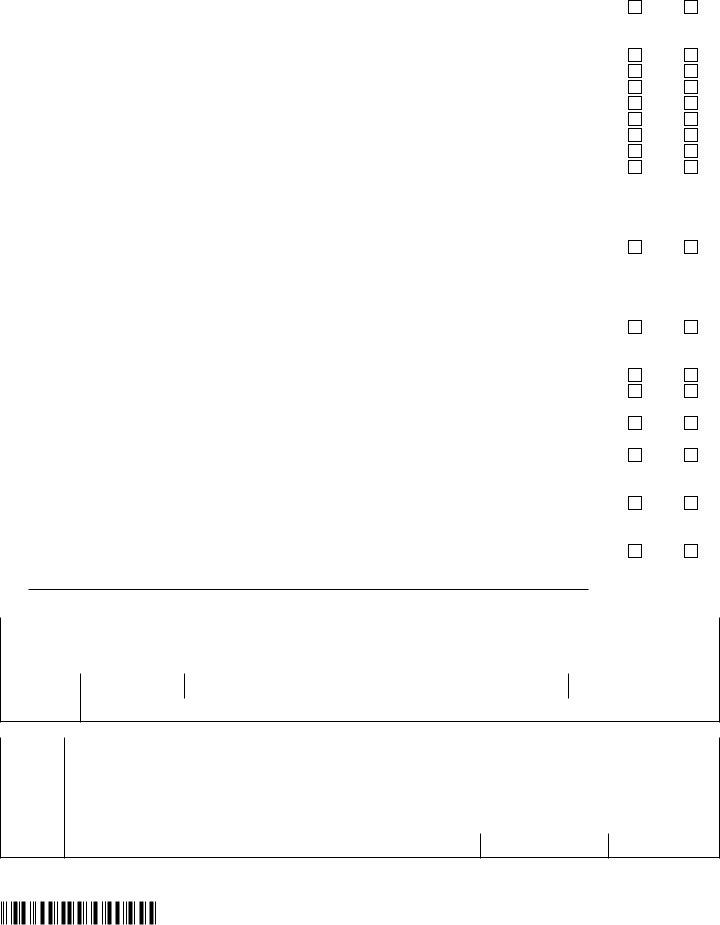

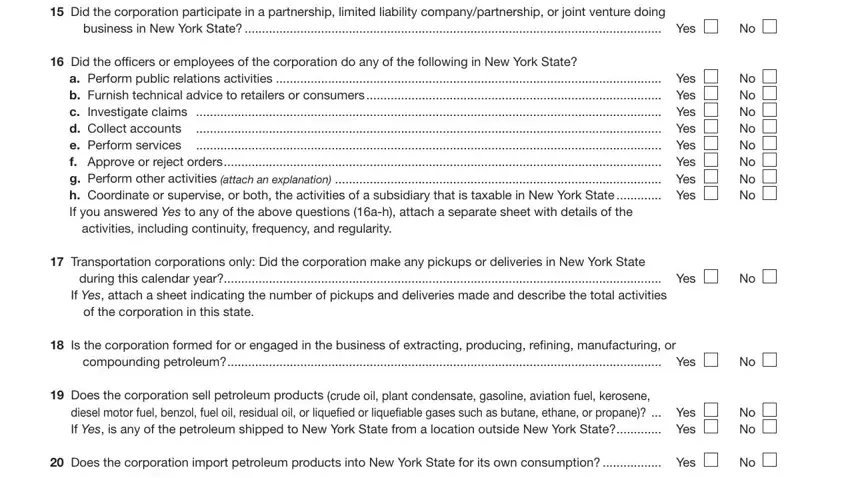

4. This next section requires some additional information. Ensure you complete all the necessary fields - Did the corporation participate, Did the oficers or employees of, a Perform public relations, Transportation corporations only, during this calendar year Yes If, Is the corporation formed for or, compounding petroleum Yes, Does the corporation sell, diesel motor fuel benzol fuel oil, Does the corporation import, No No No No No No No No, and No No - to proceed further in your process!

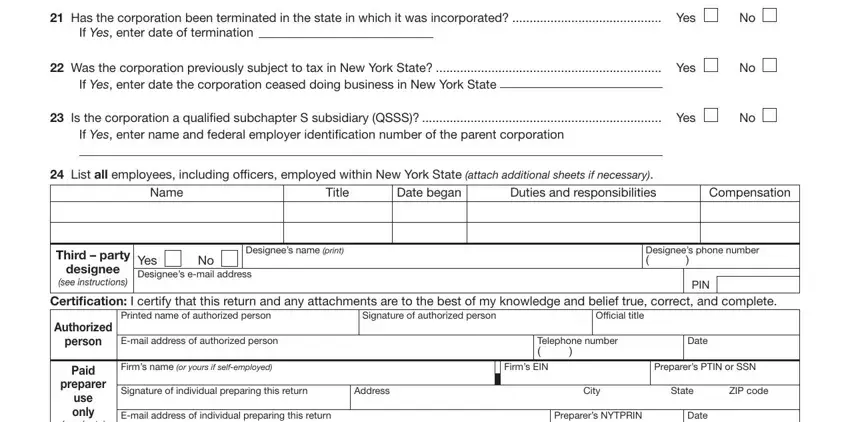

5. This form needs to be finalized by filling out this section. Here you'll find a detailed listing of blank fields that require accurate information in order for your document usage to be accomplished: Has the corporation been, If Yes enter date of termination, Was the corporation previously, If Yes enter date the corporation, Is the corporation a qualiied, If Yes enter name and federal, List all employees including, Date began, Name, Title, Compensation, Third party Yes Designees email, see instructions, designee, and Designees name print.

Step 3: Look through all the details you have typed into the form fields and click the "Done" button. Acquire your form ct 245 as soon as you register online for a 7-day free trial. Conveniently access the form inside your personal account, along with any edits and adjustments automatically saved! FormsPal is committed to the confidentiality of our users; we always make sure that all personal information used in our tool is kept secure.