The OGE 278 Form, officially known as the Executive Branch Personnel Public Financial Disclosure Report, plays a critical role in maintaining transparency and accountability within the U.S. government's executive branch. Approved by the Office of Management and Budget (OMB No. 3209 - 0001), this comprehensive document requires individuals in significant positions to disclose their financial interests and transactions to avoid conflicts of interest. The form encompasses a wide range of information, including appointments, candidacies, election statuses, and detailed financial data for both the reporting year and the previous calendar year. Among the mandates, it calls for reporting on assets held for investment or income production, earned and unearned income, liabilities, agreements or arrangements, and transactions exceeding certain thresholds. Notably, the form imposes a $200 fee for late filings which are submitted more than 30 days after the due date or the extended filing period. Designed to cover a broad spectrum of financial interests, the OGE 278 Form encapsulates detailed schedules such as assets and income valuations, liabilities, and the reporting of gifts, reimbursements, and travel expenses. These disclosures play a pivotal role in preventing conflicts of interest and fostering public trust in federal leadership and decision-making processes.

| Question | Answer |

|---|---|

| Form Name | Oge Form 278 |

| Form Length | 7 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 45 sec |

| Other names | OGE, MonthDayYear, Washington, sspouseordependentchil |

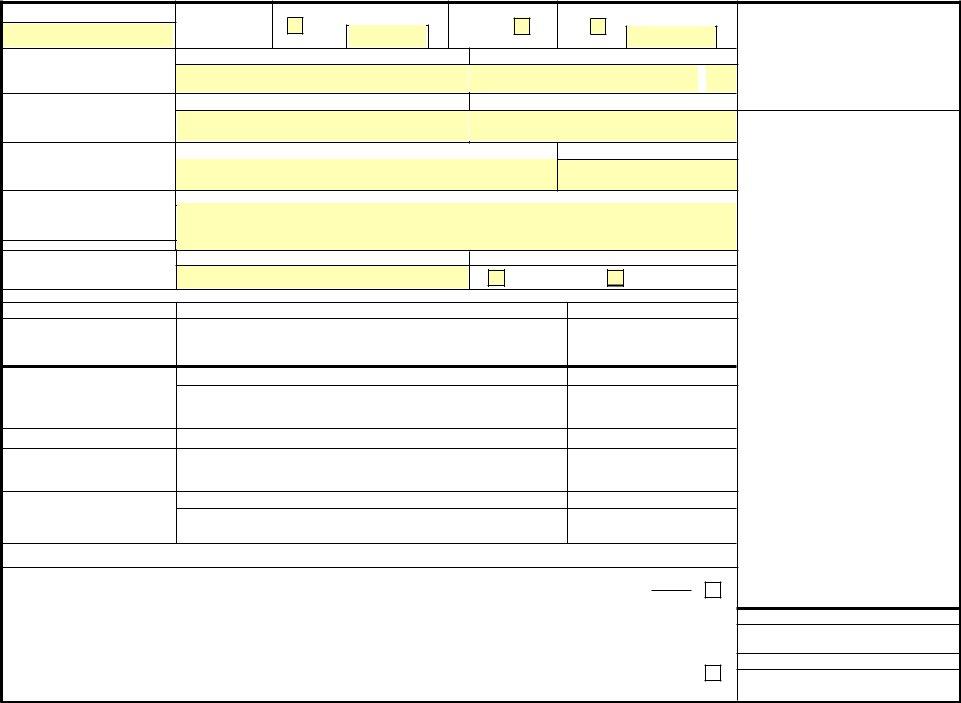

RJH#Irup#5:;#+Uhy1#1225341, |

Executive Branch Personnel PUBLIC FINANCIAL DISCLOSURE REPORT |

Form Approved: |

8#F1I1U1#Sduw#5967# |

|

OMB No. 3209 - 0001 |

X1V1#Riilfh#ri#Jryhuqphqw#Hwkl#fv# |

|

|

DateofAppointment,Candidacy,Election, |

Reporting |

Incumbent |

Calendar Year |

New Entrant, |

Termination |

TerminationDate(IfAppli- |

Fee for Late Filing |

|

orNomination(Month,Day,Year) |

Status |

|

Covered by Report |

Nominee, or |

Filer |

cable)(Month,Day,Year) |

||

|

|

Any individual who is required to file |

||||||

|

(Check Appropriate |

|

|

Candidate |

|

|

|

|

|

|

|

|

|

|

this report and does so more than 30 days |

||

|

Boxes) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

after the date the report is required to be |

|

|

Last Name |

|

|

First Name and Middle Initial |

|

|

||

Reporting |

|

|

|

|

filed, or, if an extension is granted, more |

|||

|

|

|

|

|

|

|

||

Individual's Name |

|

|

|

|

|

|

|

than 30 days after the last day of the |

|

|

|

|

|

|

|

filing extension period, shall be subject |

|

|

|

|

|

|

|

|

|

|

|

Title of Position |

|

|

Department or Agency (If Applicable) |

|

to a $200 fee. |

||

|

|

|

|

|

||||

Position for Which |

|

|

|

|

|

|

|

Reporting Periods |

Filing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Incumbents: The reporting period is |

|

|

|

|

|

|

|

|

|

|

Location of |

Address (Number, Street, City, State , and ZIP Code) |

|

Telephone No. (Include Area Code) |

the preceding calendar year except Part |

||||

|

II of Schedule C and Part I of Schedule D |

|||||||

|

|

|

|

|||||

Present Office |

|

|

|

|

|

|

|

where you must also include the filing |

(or forwarding address) |

|

|

|

|

|

|

|

year up to the date you file. Part II of |

|

Title of Position(s) and Date(s) Held |

|

|

|

|

Schedule D is not applicable. |

||

Position(s) Held with the Federal |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

Government During the Preceding |

|

|

|

|

|

|

|

Termination Filers: The reporting |

12 Months (If Not Same as Above) |

|

|

|

|

|

|

|

period begins at the end of the period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

covered by your previous filing and ends |

|

|

|

|

|

|

|

|

at the date of termination. Part II of |

Presidential Nominees Subject |

Name of Congressional Committee Considering Nomination Do You Intend to Create a Qualified Diversified Trust? |

Schedule D is not applicable. |

||||||

|

|

|

|

|

|

|

|

|

to Senate Confirmation |

|

|

|

Yes |

|

No |

|

Nominees, New Entrants and |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Candidates for President and |

Certification |

Signature of Reporting Individual |

|

|

Date (Month, Day, Year) |

|

Vice President: |

||

|

|

|

|

|||||

I CERTIFY that the statements I have |

|

|

|

|

|

|

|

Schedule |

madeonthisformandallattached |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

for income (BLOCK C) is the preceding |

|

schedulesaretrue,completeandcorrect |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

calendar year and the current calendar |

|

tothebestofmyknowledge. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

year up to the date of filing. Value assets |

|

|

|

|

|

|

|

|

|

|

OtherReview |

Signature of Other Reviewer |

|

|

Date (Month, Day, Year) |

|

as of any date you choose that is within |

||

|

|

|

31 days of the date of filing. |

|||||

|

|

|

|

|

|

|

||

(Ifdesiredby |

|

|

|

|

|

|

|

|

agency) |

|

|

|

|

|

|

|

Schedule |

|

|

|

|

|

|

|

|

|

AgencyEthicsOfficial'sOpinion |

Signature of Designated Agency Ethics Official/Reviewing Official |

Date (Month, Day, Year) |

|

Schedule C, Part I |

||||

|

reporting period is the preceding calendar |

|||||||

|

|

|

|

|

|

|

|

|

On the basis of information contained in this |

|

|

|

|

|

|

|

year and the current calendar year up to |

|

|

|

|

|

|

|

any date you choose that is within 31 days |

|

report, I conclude that the filer is in compliance |

|

|

|

|

|

|

|

|

with applicable laws and regulations (subject to |

|

|

|

|

|

|

|

of the date of filing. |

any comments in the box below). |

|

|

|

|

|

|

|

|

Office of Government Ethics |

Signature |

|

|

|

Date (Month, Day, Year) |

|

Schedule C, Part II (Agreements or |

|

|

|

|

|

|

|

|

||

Use Only |

|

|

|

|

|

|

|

arrangements as of the date of filing. |

|

|

|

|

|

|

|

|

Schedule D |

Comments of Reviewing Officials (If additional space is required, use the reverse side of this sheet) |

|

|

|

the preceding t w o calendar years and |

||||

|

|

|

|

|

|

|

|

the current calendar year up to the date |

|

|

|

|

|

|

|

|

of filing. |

|

|

|

(Check box if filing extension granted & indicate number of days |

) |

|

|||

|

|

|

|

|

|

|

|

Agency Use Only |

(Check box if comments are continued on the reverse side)

OGE Use Only

Vuphuvhdhv#Prior#Hdlwlrqv1#

RJH#Irup#5:;#+Uhy1#1225341, 8#F1I1U1#Sduw#5967#

X1V1#Riilfh#ri#Jryhuqphqw#Hwkl#fv#

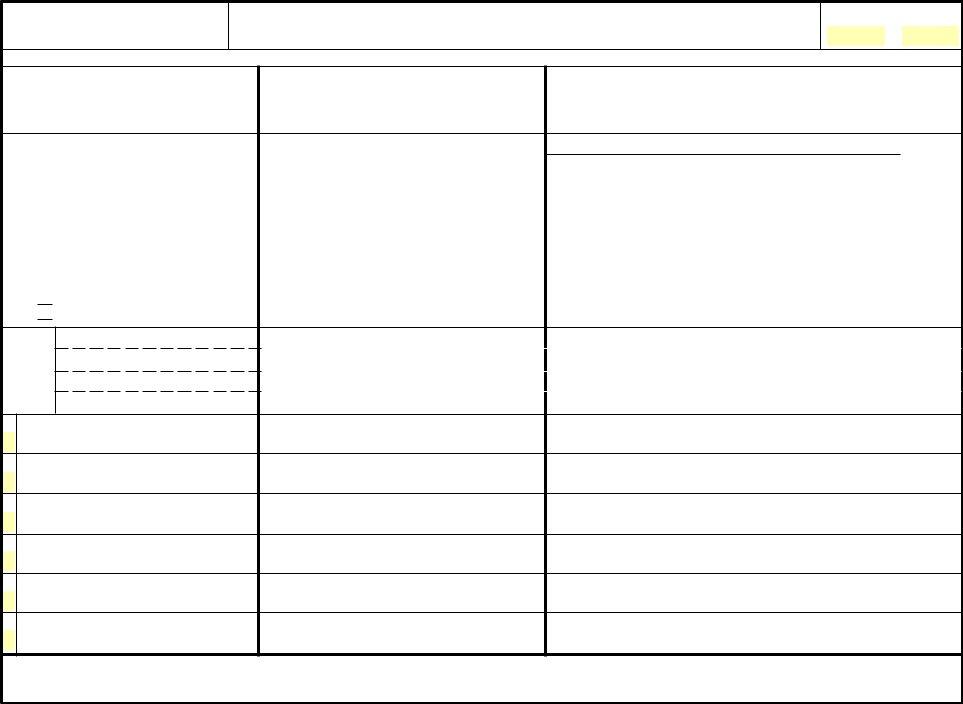

Reporting Individual's Name

SCHEDULE A

Page Number

Assets and Income

BLOCK A

For you, your spouse, and dependent children, report each asset held for investment or the production of income which had a fair market valueexceeding$1,000atthecloseofthereport- ing period, or which generated more than $200 in income during the reporting period, together with such income.

For yourself, also report the source and actual amount of earned income exceeding $200 (other thanfromtheU.S.Government). Foryourspouse, report the source but not the amount of earned income of more than $1,000 (except report the actual amount of any honoraria over $200 of your spouse).

None

Central Airlines Common

Examples DoeJones&Smith, Hometown,State

Kempstone Equity Fund

IRA: Heartland 500 Index Fund

1

2

3

4

5

6

|

|

|

|

Valuation of Assets |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

at close of reporting period |

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

BLOCK B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

None (or less than $1,001) |

$1,001 - $15,000 |

$15,001 - $50,000 |

$50,001 - $100,000 |

|

$100,001 - $250,000 |

$250,001 - $500,000 |

|

$500,001 - $1,000,000 |

Over $1,000,000* |

$1,000,001 - $5,000,000 |

$5,000,001 - $25,000,000 |

$25,000,001 - $50,000,000 |

Over $50,000,000 |

Excepted Investment Fund |

|

Excepted Trust |

Qualified Trust |

||||||||||||||

|

|

|

|

|

|

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income: type and amount. If “None (or less than $201)” is checked, no other entry is needed in Block C for that item.

BLOCK C

|

|

Type |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

$201)thanless(orNone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Dividends |

RoyaltiesandRent |

Interest |

GainsCapital |

|

|

*$1,000,000Over |

$5,000,000Over |

|

|

Other |

|

|

Date |

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income |

(Mo., Day, |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Specify |

|

|

Yr.) |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Type & |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Actual |

|

Only if |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount) |

Honoraria |

||||||||||||

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Law Partnership |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income $130,000 |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*This category applies only if the asset/income is solely that of the filer's spouse or dependent children. If the asset/income is either that of the filer or jointly held by the filer with the spouse or dependent children, mark the other higher categories of value, as appropriate.