You could fill in oge 450 financial disclosure effortlessly by using our online editor for PDFs. Our team is committed to giving you the best possible experience with our tool by regularly releasing new capabilities and upgrades. With all of these updates, using our editor gets easier than ever! With a few simple steps, you may begin your PDF editing:

Step 1: Hit the "Get Form" button above on this webpage to get into our tool.

Step 2: After you start the editor, you'll see the form made ready to be completed. Aside from filling in various blank fields, you could also perform other sorts of things with the file, particularly adding your own words, editing the original text, adding illustrations or photos, putting your signature on the PDF, and more.

This form will require specific info to be filled out, so ensure you take whatever time to enter what is required:

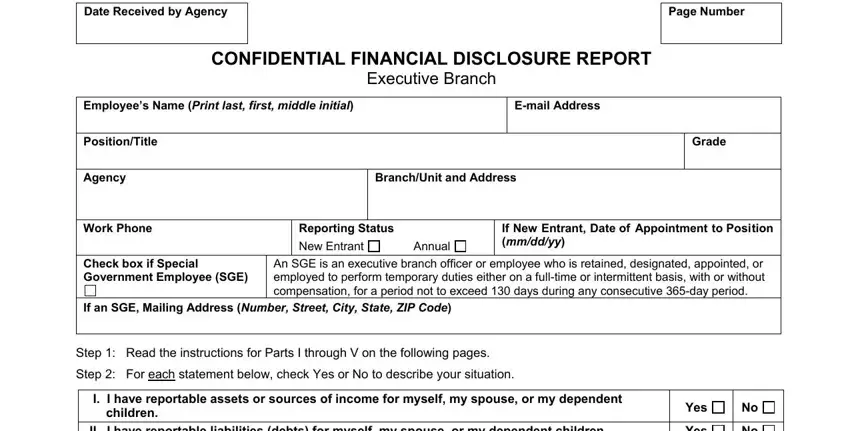

1. To start with, while filling in the oge 450 financial disclosure, start out with the area with the next fields:

2. After performing the previous part, head on to the subsequent step and fill out the necessary details in all these fields - OGE Form CFR Part Subpart I US, Use arrow keys to read all text, Form Approved OMB No Page Number, CONFIDENTIAL FINANCIAL DISCLOSURE, Executive Branch, Employees Name Print last first, Email Address, PositionTitle, Agency, Work Phone, Check box if Special Government, BranchUnit and Address, Grade, Reporting Status New Entrant, and Annual.

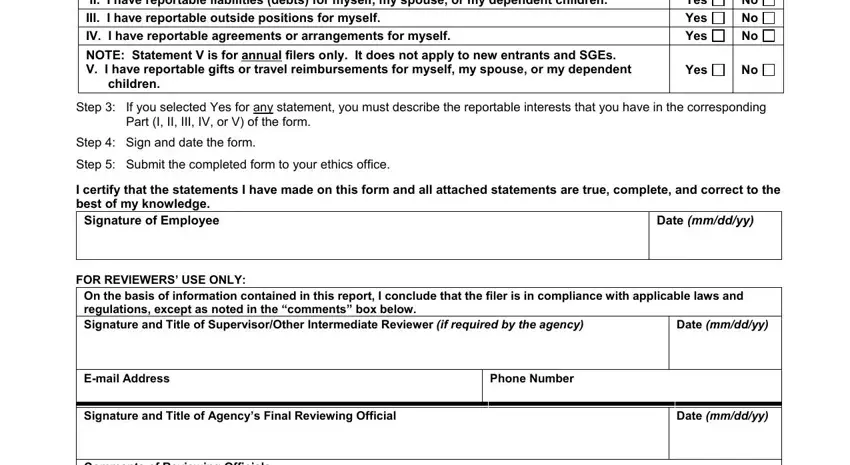

3. Completing I have reportable outside, II I have reportable liabilities, children, Yes Yes Yes Yes, Yes, No No No No, Step If you selected Yes for any, Part I II III IV or V of the form, Step Sign and date the form Step, I certify that the statements I, Date mmddyy, FOR REVIEWERS USE ONLY On the, Date mmddyy, Email Address, and Phone Number is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

4. To go forward, the following section requires filling out a few form blanks. Included in these are Comments of Reviewing Officials, and Check box if continued on, which you'll find key to going forward with this particular form.

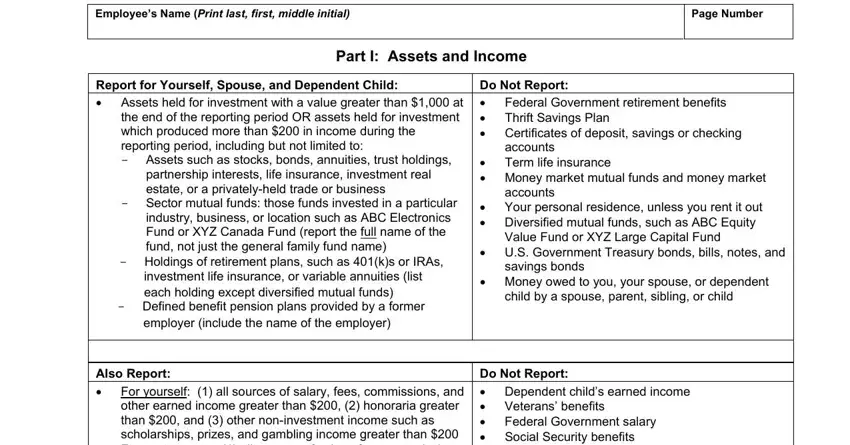

5. To finish your form, the last area has a couple of additional blanks. Typing in Employees Name Print last first, Form Approved OMB No Page Number, Part I Assets and Income, Report for Yourself Spouse and, Assets held for investment with a, Assets such as stocks bonds, Holdings of retirement plans such, investment life insurance or, Defined benefit pension plans, employer include the name of the, Also Report, For yourself all sources of, Do Not Report, Federal Government retirement, and Money market mutual funds and will certainly finalize the process and you're going to be done very quickly!

It is easy to get it wrong while completing your Report for Yourself Spouse and, so make sure that you reread it before you finalize the form.

Step 3: Right after you've looked over the details entered, click "Done" to conclude your form. Right after starting afree trial account here, you'll be able to download oge 450 financial disclosure or email it right off. The PDF document will also be readily accessible from your personal account page with your each modification. FormsPal guarantees secure document tools without personal data record-keeping or sharing. Be assured that your details are safe with us!