How do we use |

First we’ll ask some basic questions about each person. Then we’ll ask about |

your information? |

income, current health insurance, disabilities and Tribal ancestry. |

|

We’ll keep all the information you provide private, as required by law. |

|

See our privacy policy in the Application Guide for more information. |

|

|

Who to include on |

We need you to tell us about yourself and everyone else in your household. |

this application |

Your household includes the people below: |

|

• You. |

|

• Your legal spouse. |

|

• Your children. Include children of all ages who you claim as dependents on |

|

your taxes. |

|

• Your live-in partner if you have a child together. |

|

• Anyone else you include on your federal income tax return; even if they do |

|

not live with you. |

|

Important: Is someone living with you who is not on the list above? If they |

|

want health coverage, they must fill out a separate application. |

|

Please write clearly and provide as much information as possible about each |

|

person when filling out this application. |

|

If you are applying for more than four people, please make copies of |

|

pages 5-6 and complete them for those people. |

|

|

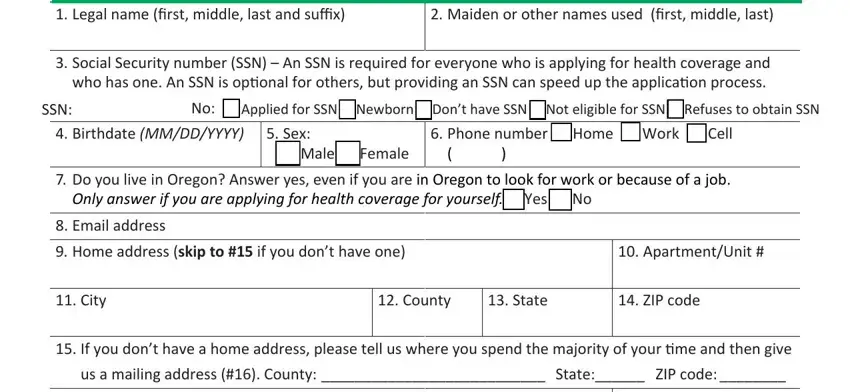

STEP 1 TELL US ABOUT YOURSELF You’ll be our primary contact

TELL US ABOUT YOURSELF You’ll be our primary contact

1. Legal name (first, middle, last and suffix) |

2. Maiden or other names used (first, middle, last) |

|

|

3.Social Security number (SSN) – An SSN is required for everyone who is applying for health coverage and who has one. An SSN is optional for others, but providing an SSN can speed up the application process.

SSN: |

|

No: £Applied for SSN □Newborn Don’t have SSN □Not eligible for SSN □Refuses to obtain SSN |

|

4. |

Birthdate (MM/DD/YYYY) |

5. Sex: |

6. Phone number £ Home |

£ Work £ Cell |

|

|

|

|

|

£ Male £ Female |

( |

) |

|

|

|

|

|

|

|

|

|

|

7. |

Do you live in Oregon? Answer yes, even if you are in Oregon to look for work or because of a job. |

|

|

Only answer if you are applying for health coverage for yourself. £ Yes £ No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

Email address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

Home address (skip to #15 if you don’t have one) |

|

|

|

10. |

Apartment/Unit # |

|

|

|

|

|

|

|

|

|

|

|

11. |

City |

|

12. County |

13. State |

|

14. |

ZIP code |

|

|

|

|

|

|

|

|

|

15. |

If you don’t have a home address, please tell us where you spend the majority of your time and then give |

|

|

|

us a mailing address (#16). County: ___________________________ State:______ ZIP code: ________ |

|

|

|

|

|

|

|

|

16. |

Mailing address (only required if different from home address) |

|

17. |

Apartment/Unit # |

|

|

|

|

|

|

|

|

|

|

|

18. |

City |

|

|

|

19. State |

|

20. |

ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

NEED HELP? Call us at 1-800-699-9075/TTY 711. Monday to Friday 7 a.m. to 6 p.m. |

2 |

|

OHA 7210 (Rev 09/16) |

|

|

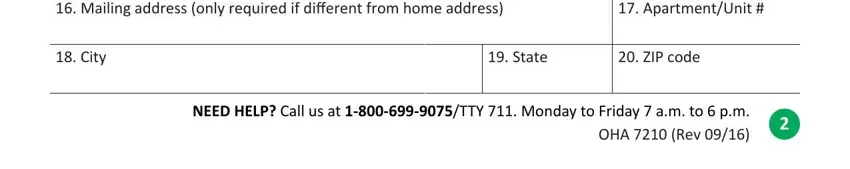

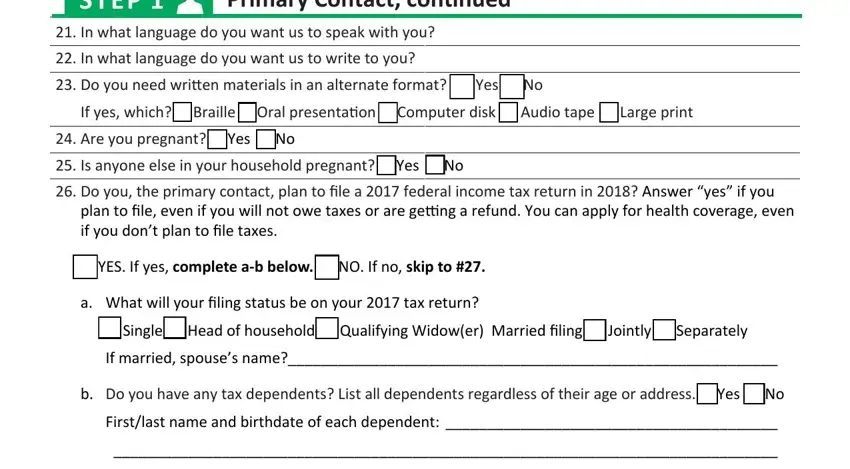

STEP 1 Primary Contact, continued

Primary Contact, continued

21.In what language do you want us to speak with you?

22.In what language do you want us to write to you?

23.Do you need written materials in an alternate format? £ Yes £ No

If yes, which? £ Braille £ Oral presentation £ Computer disk £ Audio tape £ Large print

24.Are you pregnant? £ Yes £ No

25.Is anyone else in your household pregnant? £ Yes £ No

26.Do you, the primary contact, plan to file a 2017 federal income tax return in 2018? Answer “yes” if you plan to file, even if you will not owe taxes or are getting a refund. You can apply for health coverage, even if you don’t plan to file taxes.

£ YES. If yes, complete a-b below. £ NO. If no, skip to #27.

a.What will your filing status be on your 2017 tax return?

£ Single £ Head of household £ Qualifying Widow(er) Married filing: £ Jointly £ Separately

If married, spouse’s name?___________________________________________________________

b.Do you have any tax dependents? List all dependents regardless of their age or address. £ Yes £ No

First/last name and birthdate of each dependent: ________________________________________

________________________________________________________________________________

Note: for each person listed as a dependent, complete Step 2.

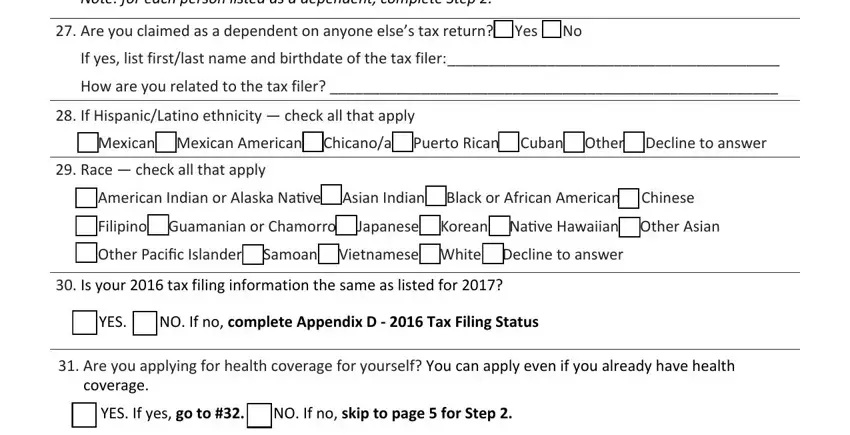

27.Are you claimed as a dependent on anyone else’s tax return? £ Yes £ No

If yes, list first/last name and birthdate of the tax filer:________________________________________

How are you related to the tax filer? ______________________________________________________

28.If Hispanic/Latino ethnicity — check all that apply

£Mexican £ Mexican American £ Chicano/a £ Puerto Rican £ Cuban £ Other £ Decline to answer

29.Race — check all that apply

£American Indian or Alaska Native £ Asian Indian £ Black or African American £ Chinese

£Filipino £ Guamanian or Chamorro £ Japanese £ Korean £ Native Hawaiian £ Other Asian

£Other Pacific Islander £ Samoan £ Vietnamese £ White £ Decline to answer

30.Is your 2016 tax filing information the same as listed for 2017?

£YES. £ NO. If no, complete Appendix D - 2016 Tax Filing Status

31.Are you applying for health coverage for yourself? You can apply even if you already have health coverage.

£ YES. If yes, go to #32. £ NO. If no, skip to page 5 for Step 2.

|

NEED HELP? Call us at 1-800-699-9075/TTY 711. Monday to Friday 7 a.m. to 6 p.m. |

3 |

|

OHA 7210 (Rev 09/16) |

|

|

STEP 1 Primary Contact, continued

Primary Contact, continued

32.Are you a U.S. citizen or national? £ YES. If yes, skip to #34. £ NO

33.If you are not a U.S. citizen or national, do you have an eligible immigration status?

We only use this information to determine eligibility. See the Application Guide for more information

about eligible immigration statuses.

£YES. If yes, complete a-f. £ NO. If no, skip to #34.

a.Immigration document type: ____________________________________

b.Document ID #: _______________________________________________

c.Status: ______________________________________________________

d.Date status gained: _________________

e.Have you lived in the U.S. since 1996? £ Yes £ No

f.Are you, your spouse or a parent a veteran or an active-duty member of the U.S. military? £ Yes £ No

34.Are you the primary caretaker for any children under age 19 who: 1) live with you and 2) are related to you but are not your own children? For example, a grandparent who is the primary caretaker for a grandchild.

£ Yes £ No

If yes, list first/last name of child(ren). Do not include your adopted, biological or step children: ________

______________________________________________________________________________________

______________________________________________________________________________________

|

NEED HELP? Call us at 1-800-699-9075/TTY 711. Monday to Friday 7 a.m. to 6 p.m. |

4 |

|

OHA 7210 (Rev 09/16) |

|

|

|

STEP 2 |

ADDITIONAL HOUSEHOLD MEMBER – PERSON 2 |

Complete Step 2 for everyone in your household. See page 2 for more information about who to include on your application.

If you are listing more than four people in your household, please make copies of pages 5-6 and complete them for those people.

|

1. |

Legal name (first, middle, last and suffix) |

2. Maiden or other names used (first, middle, last) |

|

|

|

|

|

|

3. |

Relationship to you |

|

|

|

|

|

|

4. |

Social Security number (SSN) – An SSN is required for everyone who is applying for health coverage and |

|

|

who has one. An SSN is optional for others, but providing an SSN can speed up the application process. |

SSN: |

No: £Applied for SSN □Newborn Don’t have SSN □Not eligible for SSN □Refuses to obtain SSN |

7.Does Person 2 live in Oregon? Answer yes, even if you are in Oregon to look for work or because of a job. Only answer if you are applying for health coverage for Person 2. £ Yes £ No

8.Does Person 2 live at the same address as you? £ Yes £ No

a.If no, why not? (choose one) £ Alcohol/drug rehab facility £ Foster care £ Incarcerated

£Job £ Long term medical care £ Mental health facility £ Military £ Other facility £ School

£Separate residence £ Short term medical care £ No home address

b.If no, list home address: _______________________________________________________________

9.Does Person 2 plan to file a 2017 federal income tax return in 2018? Answer “yes” if Person 2 plans to file, even if they will not owe taxes or are getting a refund. Person 2 can apply for health coverage, even if they don’t plan to file taxes.

£YES. If yes, complete a-b below. £ NO. If no, skip to #10.

a.What will Person 2's filing status be on their 2017 tax return?

£ Single £ Head of household £ Qualifying Widow(er) Married filing: £ Jointly £ Separately

If married, spouse’s name?___________________________________________________________

b.Does Person 2 have any tax dependents? List all dependents regardless of their age or address. £ Yes £ No

First/last name and birthdate of each dependent: ________________________________________

________________________________________________________________________________

Note: for each person listed as a dependent, complete Step 2.

10.Is Person 2 claimed as a dependent on anyone else’s tax return? £ Yes £ No

If yes, list first/last name and birthdate of the tax filer:________________________________________

How is Person 2 related to the tax filer? ___________________________________________________

11.Is Person 2's 2016 tax filing information the same as listed for 2017?

£YES. £ NO. If no, complete Appendix D - 2016 Tax Filing Status

|

NEED HELP? Call us at 1-800-699-9075/TTY 711. Monday to Friday 7 a.m. to 6 p.m. |

5 |

|

OHA 7210 (Rev 09/16) |

|

|

|

STEP 2 |

Person 2, continued |

|

|

|

12.If Hispanic/Latino ethnicity — check all that apply

£Mexican £ Mexican American £ Chicano/a £ Puerto Rican £ Cuban £ Other £ Decline to answer

13.Race — check all that apply

£American Indian or Alaska Native £ Asian Indian £ Black or African American £ Chinese

£Filipino £ Guamanian or Chamorro £ Japanese £ Korean £ Native Hawaiian £ Other Asian

£Other Pacific Islander £ Samoan £ Vietnamese £ White £ Decline to answer

14.Is Person 2 applying for health coverage? Person 2 can apply even if they already have health coverage.

£YES. If yes, go to #15.

£NO. If no, and there is someone else you need to include on this application, skip to page 7. If there is no one else you need to include on this application, skip to page 11 for Step 3.

15.Is Person 2 a U.S. citizen or national? £ YES. If yes, skip to #17. £ NO

16.If Person 2 is not a U.S. citizen or national, does Person 2 have an eligible immigration status?

We only use this information to determine eligibility. See the Application Guide for more information

about eligible immigration statuses.

£YES. If yes, complete a-f. £ NO. If no, skip to #17.

a.Immigration document type: ____________________________________

b.Document ID #: _______________________________________________

c.Status: ______________________________________________________

d.Date status gained: _________________

e.Has Person 2 lived in the U.S. since 1996? £ Yes £ No

f.Is Person 2, their spouse or a parent a veteran or an active-duty member of the U.S. military? £ Yes £ No

17.Is Person 2 the primary caretaker for any children under age 19 who: 1) live with Person 2 and 2) are related to Person 2 but are not Person 2's own children? For example, a grandparent who is the primary caretaker for a grandchild.

£ Yes £ No

If yes, list first/last name of child(ren). Do not include Person 2's adopted, biological or step children:

______________________________________________________________________________________

______________________________________________________________________________________

|

NEED HELP? Call us at 1-800-699-9075/TTY 711. Monday to Friday 7 a.m. to 6 p.m. |

6 |

|

OHA 7210 (Rev 09/16) |

|

|

|

|

|

STEP 2 |

ADDITIONAL HOUSEHOLD MEMBER – PERSON 3 |

|

1. |

Legal name (first, middle, last and suffix) |

|

2. Maiden or other names used (first, middle, last) |

|

|

|

|

|

|

|

|

|

3. |

Relationship to you |

|

|

|

|

|

|

|

|

|

|

|

4. |

Social Security number (SSN) – An SSN is required for everyone who is applying for health coverage and |

|

|

|

who has one. An SSN is optional for others, but providing an SSN can speed up the application process. |

SSN: |

|

No: £Applied for SSN |

□Newborn Don’t have SSN □Not eligible for SSN □Refuses to obtain SSN |

7.Does Person 3 live in Oregon? Answer yes, even if you are in Oregon to look for work or because of a job.

Only answer if you are applying for health coverage for Person 3. £ Yes £ No

8.Does Person 3 live at the same address as you? £ Yes £ No

a.If no, why not? (choose one) £ Alcohol/drug rehab facility £ Foster care £ Incarcerated

£Job £ Long term medical care £ Mental health facility £ Military £ Other facility £ School

£Separate residence £ Short term medical care £ No home address

b.If no, list home address: _______________________________________________________________

9.Does Person 3 plan to file a 2017 federal income tax return in 2018? Answer “yes” if Person 3 plans to file, even if they will not owe taxes or are getting a refund. Person 3 can apply for health coverage, even if they don’t plan to file taxes.

£YES. If yes, complete a-b below. £ NO. If no, skip to #10.

a.What will Person 3's filing status be on their 2017 tax return?

£ Single £ Head of household £ Qualifying Widow(er) Married filing: £ Jointly £ Separately

If married, spouse’s name?___________________________________________________________

b.Does Person 3 have any tax dependents? List all dependents regardless of their age or address. £ Yes £ No

First/last name and birthdate of each dependent: ________________________________________

________________________________________________________________________________

Note: for each person listed as a dependent, complete Step 2.

10.Is Person 3 claimed as a dependent on anyone else’s tax return? £ Yes £ No

If yes, list first/last name and birthdate of the tax filer:________________________________________

How is Person 3 related to the tax filer? ___________________________________________________

11.If Hispanic/Latino ethnicity — check all that apply

£Mexican £ Mexican American £ Chicano/a £ Puerto Rican £ Cuban £ Other £ Decline to answer

12.Race — check all that apply

£American Indian or Alaska Native £ Asian Indian £ Black or African American £ Chinese

£Filipino £ Guamanian or Chamorro £ Japanese £ Korean £ Native Hawaiian £ Other Asian

£Other Pacific Islander £ Samoan £ Vietnamese £ White £ Decline to answer

|

NEED HELP? Call us at 1-800-699-9075/TTY 711. Monday to Friday 7 a.m. to 6 p.m. |

7 |

|

OHA 7210 (Rev 09/16) |

|

|

|

STEP 2 |

Person 3, continued |

|

|

|

13.Is Person 3 applying for health coverage? Person 3 can apply even if they already have health coverage.

£YES. If yes, go to #14.

£NO. If no, and there is someone else you need to include on this application, skip to page 9. If there is no one else you need to include on this application, skip to page 11 for Step 3.

14.Is Person 3 a U.S. citizen or national? £ YES. If yes, skip to #16. £ NO

15.If Person 3 is not a U.S. citizen or national, does Person 3 have an eligible immigration status?

We only use this information to determine eligibility. See the Application Guide for more information about eligible immigration statuses.

£YES. If yes, complete a-f. £ NO. If no, skip to #16.

a. Immigration document type: ____________________________________

b. Document ID #: _______________________________________________

c.Status: ______________________________________________________

d.Date status gained: _________________

e.Has Person 3 lived in the U.S. since 1996? £ Yes £ No

f.Is Person 3, their spouse or a parent a veteran or an active-duty member of the U.S. military? £ Yes £ No

16.Is Person 3 the primary caretaker for any children under age 19 who: 1) live with Person 3 and 2) are related to Person 3 but are not Person 3's own children? For example, a grandparent who is the primary

caretaker for a grandchild.

£Yes £ No

If yes, list first/last name of child(ren). Do not include Person 3's adopted, biological or step children:

______________________________________________________________________________________

______________________________________________________________________________________

17.Is Person 3's 2016 tax filing information the same as listed for 2017?

£YES. £ NO. If no, complete Appendix D - 2016 Tax Filing Status

|

NEED HELP? Call us at 1-800-699-9075/TTY 711. Monday to Friday 7 a.m. to 6 p.m. |

8 |

|

OHA 7210 (Rev 09/16) |

|

|

|

|

|

STEP 2 |

ADDITIONAL HOUSEHOLD MEMBER – PERSON 4 |

|

1. |

Legal name (first, middle, last and suffix) |

|

2. Maiden or other names used (first, middle, last) |

|

|

|

|

|

|

|

|

|

3. |

Relationship to you |

|

|

|

|

|

|

|

|

|

|

|

4. |

Social Security number (SSN) – An SSN is required for everyone who is applying for health coverage and |

|

|

|

who has one. An SSN is optional for others, but providing an SSN can speed up the application process. |

SSN: |

|

No: £Applied for SSN |

□Newborn Don’t have SSN □Not eligible for SSN □Refuses to obtain SSN |

7.Does Person 4 live in Oregon? Answer yes, even if you are in Oregon to look for work or because of a job.

Only answer if you are applying for health coverage for Person 4. £ Yes £ No

8.Does Person 4 live at the same address as you? £ Yes £ No

a.If no, why not? (choose one) £ Alcohol/drug rehab facility £ Foster care £ Incarcerated

£Job £ Long term medical care £ Mental health facility £ Military £ Other facility £ School

£Separate residence £ Short term medical care £ No home address

b.If no, list home address: _______________________________________________________________

9.Does Person 4 plan to file a 2017 federal income tax return in 2018? Answer “yes” if Person 4 plans to file, even if they will not owe taxes or are getting a refund. Person 4 can apply for health coverage, even if they don’t plan to file taxes.

£YES. If yes, complete a-b below. £ NO. If no, skip to #10.

a.What will Person 4's filing status be on their 2017 tax return?

£ Single £ Head of household £ Qualifying Widow(er) Married filing: £ Jointly £ Separately

If married, spouse’s name?___________________________________________________________

b.Does Person 4 have any tax dependents? List all dependents regardless of their age or address. £ Yes £ No

First/last name and birthdate of each dependent: ________________________________________

________________________________________________________________________________

Note: for each person listed as a dependent, complete Step 2.

10.Is Person 4 claimed as a dependent on anyone else’s tax return? £ Yes £ No

If yes, list first/last name and birthdate of the tax filer:________________________________________

How is Person 4 related to the tax filer? ___________________________________________________

11.If Hispanic/Latino ethnicity — check all that apply

£Mexican £ Mexican American £ Chicano/a £ Puerto Rican £ Cuban £ Other £ Decline to answer

12.Race — check all that apply

£American Indian or Alaska Native £ Asian Indian £ Black or African American £ Chinese

£Filipino £ Guamanian or Chamorro £ Japanese £ Korean £ Native Hawaiian £ Other Asian

£Other Pacific Islander £ Samoan £ Vietnamese £ White £ Decline to answer

|

NEED HELP? Call us at 1-800-699-9075/TTY 711. Monday to Friday 7 a.m. to 6 p.m. |

9 |

|

OHA 7210 (Rev 09/16) |

|

|

|

STEP 2 |

Person 4, continued |

|

|

|

13.Is Person 4 applying for health coverage? Person 4 can apply even if they already have health coverage.

£YES. If yes, go to #14.

£NO. If no, skip to page 11 for Step 3.

14.Is Person 4 a U.S. citizen or national? £ YES. If yes, skip to #16. £ NO

15.If Person 4 is not a U.S. citizen or national, does Person 4 have an eligible immigration status?

We only use this information to determine eligibility. See the Application Guide for more information about eligible immigration statuses.

£YES. If yes, complete a-f. £ NO. If no, skip to #16.

a. Immigration document type: ____________________________________

b. Document ID #: _______________________________________________

c.Status: ______________________________________________________

d.Date status gained: _________________

e.Has Person 4 lived in the U.S. since 1996? £ Yes £ No

f.Is Person 4, their spouse or a parent a veteran or an active-duty member of the U.S. military? £ Yes £ No

16.Is Person 4 the primary caretaker for any children under age 19 who: 1) live with Person 4 and 2) are related to Person 4 but are not Person 4's own children? For example, a grandparent who is the primary

caretaker for a grandchild.

£Yes £ No

If yes, list first/last name of child(ren). Do not include Person 4's adopted, biological or step children:

______________________________________________________________________________________

______________________________________________________________________________________

17.Is Person 4's 2016 tax filing information the same as listed for 2017?

£YES. £ NO. If no, complete Appendix D - 2016 Tax Filing Status

|

NEED HELP? Call us at 1-800-699-9075/TTY 711. Monday to Friday 7 a.m. to 6 p.m. |

10 |

|

OHA 7210 (Rev 09/16) |

|

|

Primary Contact, continued

Primary Contact, continued

Primary Contact, continued

Primary Contact, continued