Whenever you desire to fill out ohio division of liquor control permit print, it's not necessary to download any kind of software - simply try using our PDF editor. We at FormsPal are dedicated to providing you the absolute best experience with our editor by continuously introducing new capabilities and upgrades. With these updates, using our editor becomes better than ever before! Here is what you'd want to do to get going:

Step 1: Just press the "Get Form Button" at the top of this webpage to get into our pdf editing tool. This way, you will find everything that is needed to work with your file.

Step 2: As you access the editor, you will see the document all set to be completed. In addition to filling out various blank fields, you can also perform other sorts of things with the Document, including writing your own text, editing the initial text, inserting graphics, affixing your signature to the PDF, and a lot more.

It will be straightforward to complete the pdf with our helpful guide! Here's what you have to do:

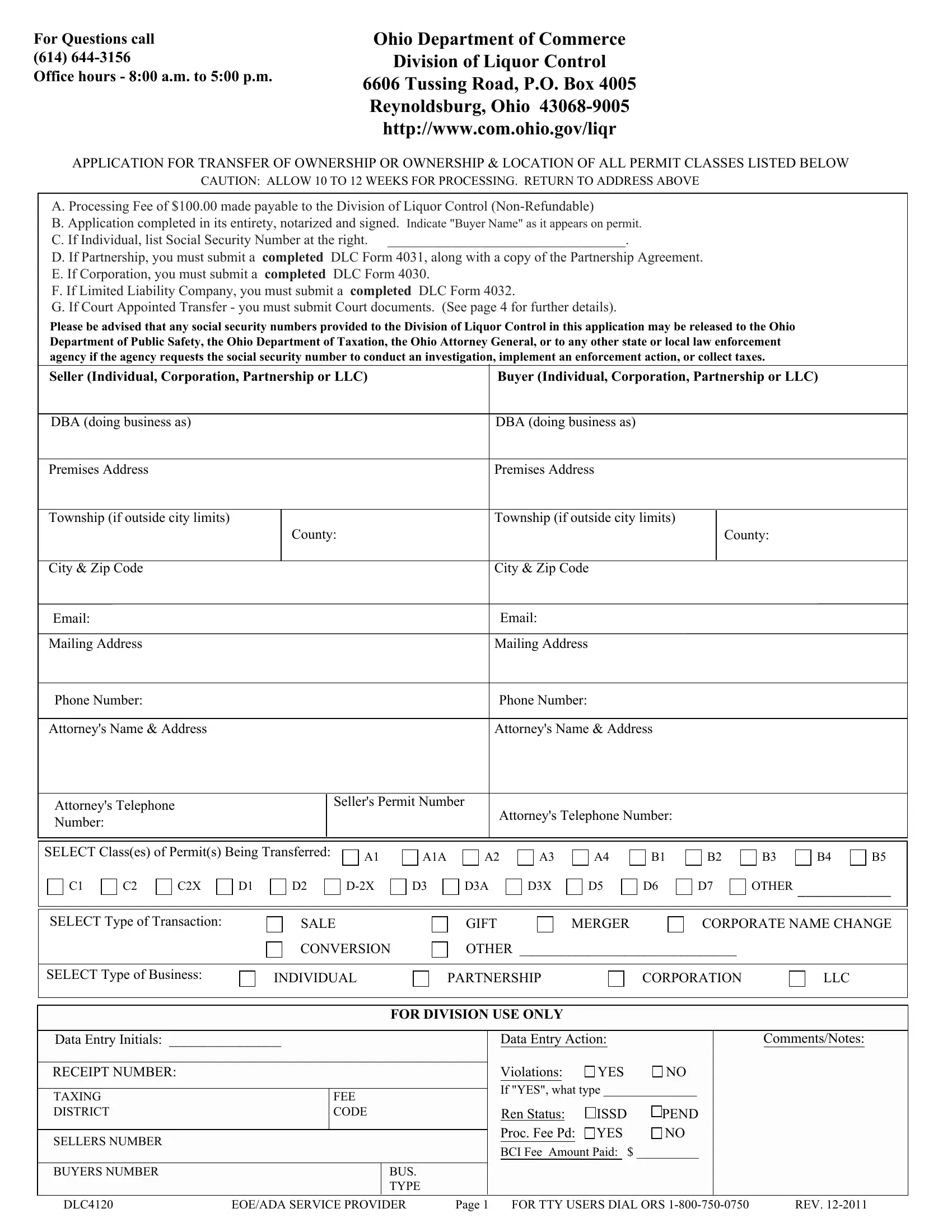

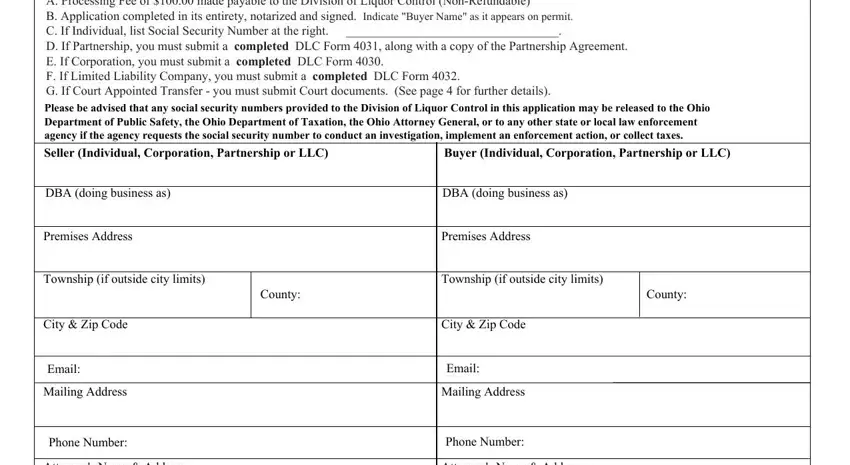

1. It is advisable to complete the ohio division of liquor control permit print accurately, so be attentive while working with the sections that contain these blanks:

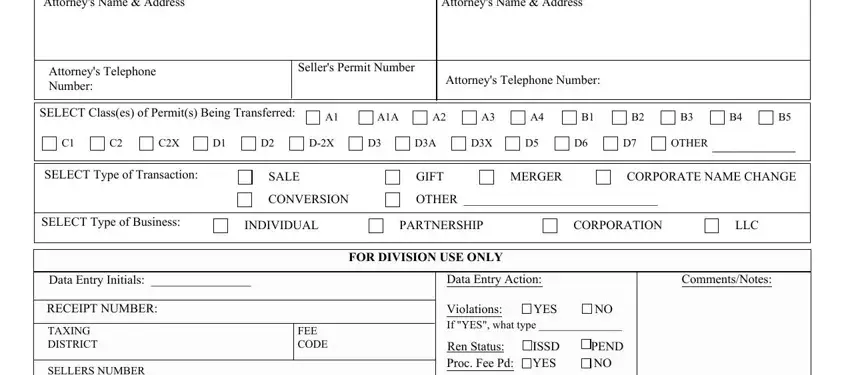

2. The third step is to fill out these particular blanks: Attorneys Name Address, Attorneys Name Address, Attorneys Telephone Number, Sellers Permit Number, Attorneys Telephone Number, SELECT Classes of Permits Being, OTHER, SELECT Type of Transaction, SALE, GIFT, MERGER, CORPORATE NAME CHANGE, SELECT Type of Business, INDIVIDUAL, and PARTNERSHIP.

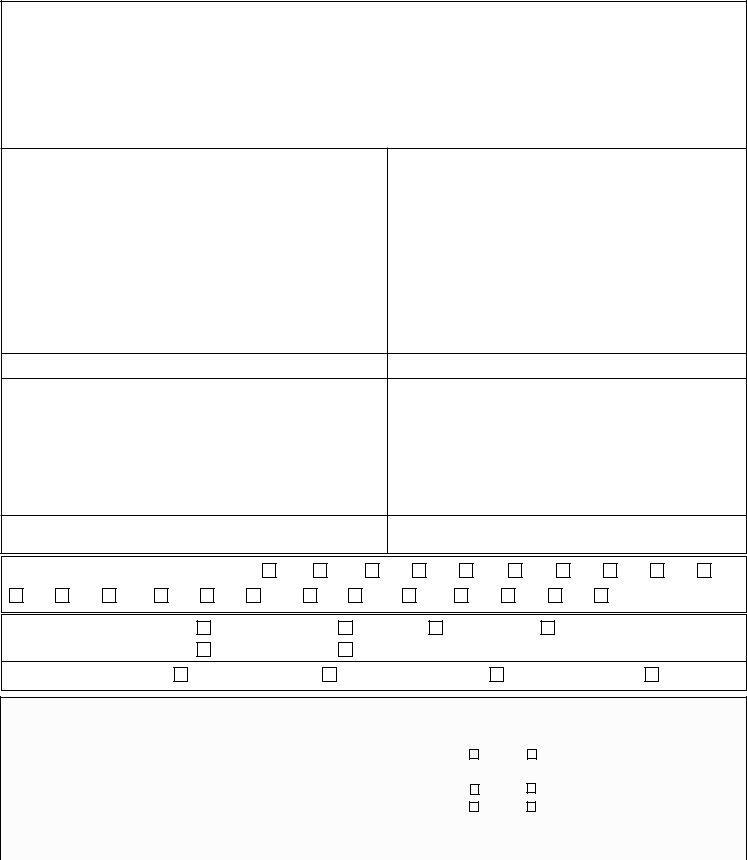

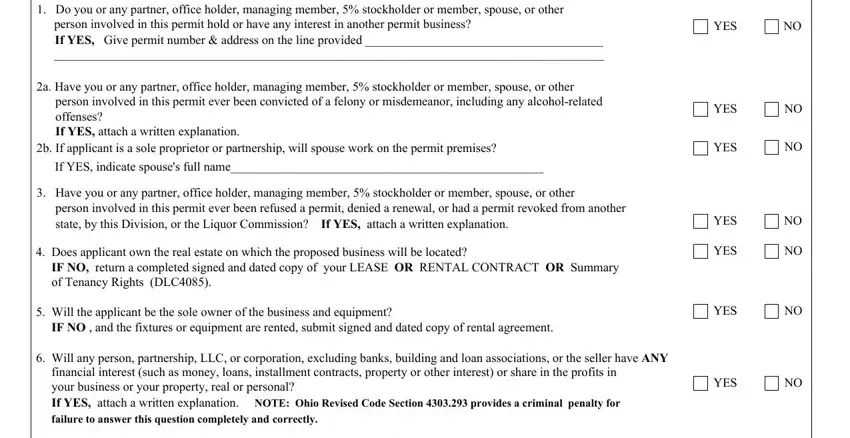

3. This next stage will be straightforward - fill in all of the fields in Do you or any partner office, person involved in this permit, a Have you or any partner office, person involved in this permit, b If applicant is a sole, If YES indicate spouses full name, Have you or any partner office, person involved in this permit, Does applicant own the real, IF NO return a completed signed, Will the applicant be the sole, IF NO and the fixtures or, Will any person partnership LLC, financial interest such as money, and YES to conclude this process.

As to Will any person partnership LLC and Will the applicant be the sole, make sure you review things in this section. These are surely the most important ones in this page.

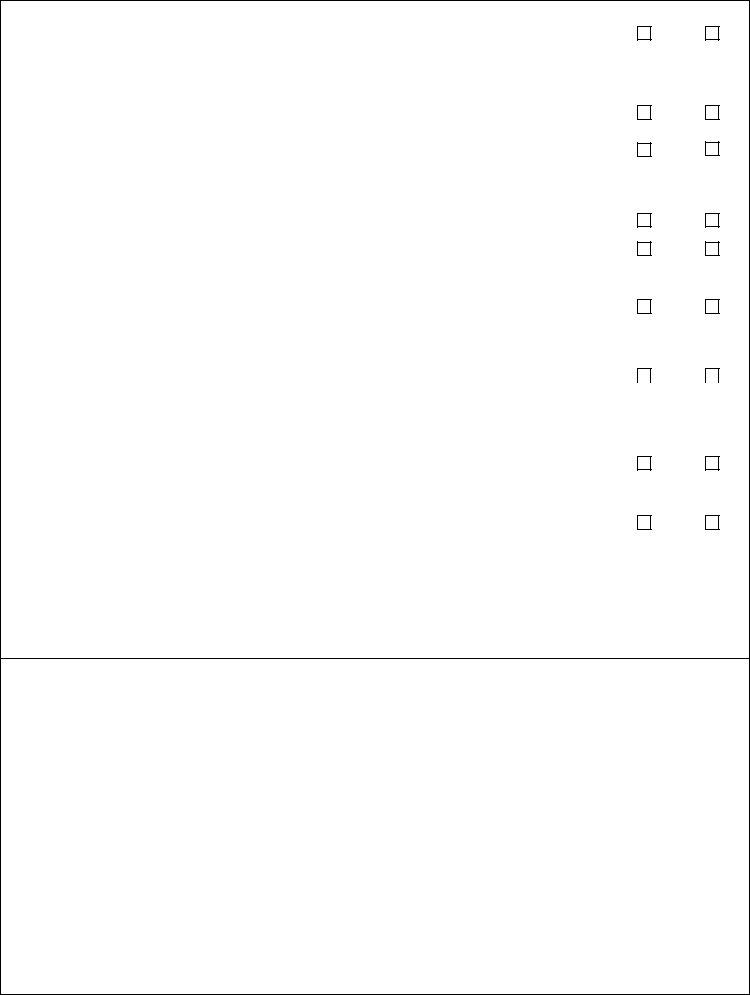

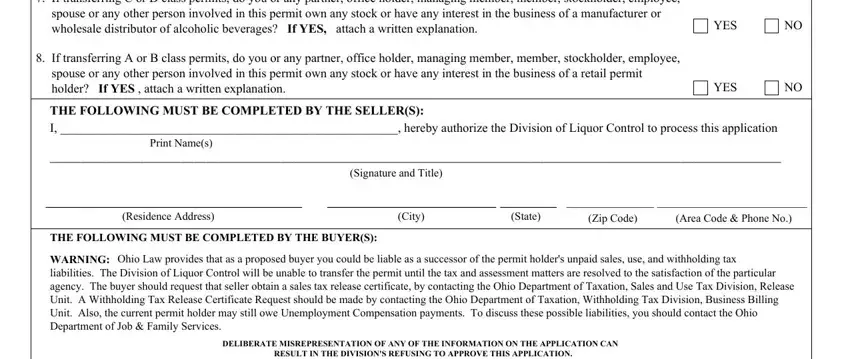

4. This next section requires some additional information. Ensure you complete all the necessary fields - If transferring C or D class, spouse or any other person, YES, If transferring A or B class, spouse or any other person, YES, THE FOLLOWING MUST BE COMPLETED BY, Print Names, Signature and Title, Residence Address, City, State, Zip Code, Area Code Phone No, and THE FOLLOWING MUST BE COMPLETED BY - to proceed further in your process!

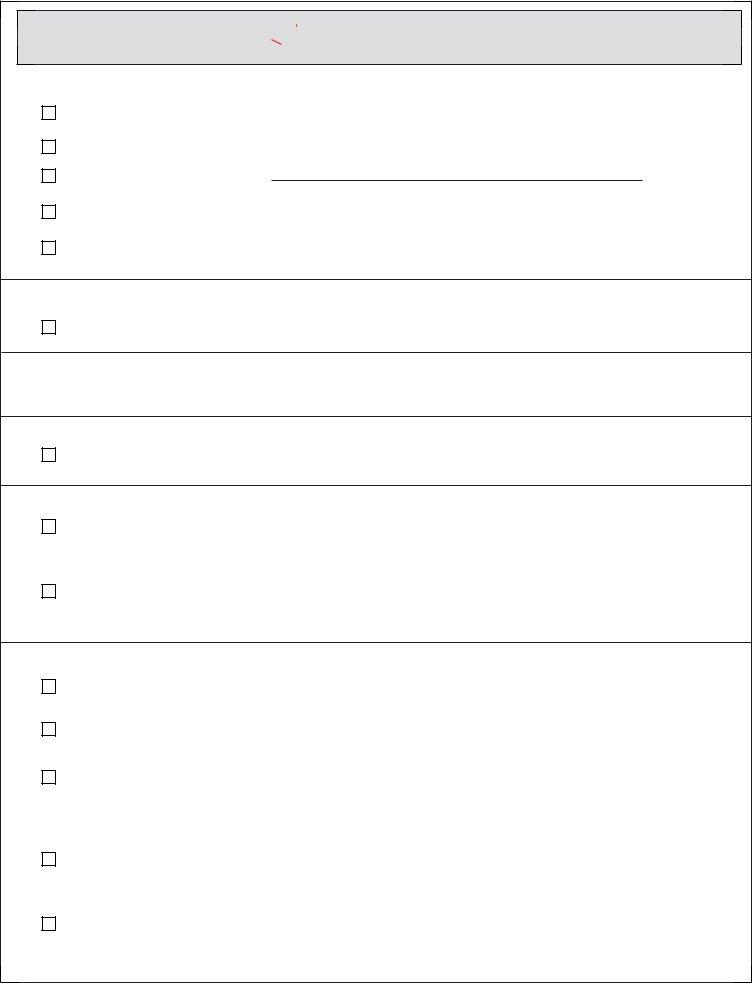

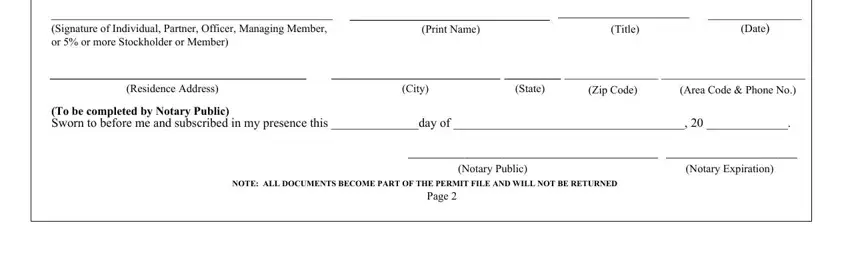

5. The final section to finalize this PDF form is essential. Be sure to fill out the appropriate blanks, consisting of RESULT IN THE DIVISIONS REFUSING, Signature of Individual Partner, Print Name, Title, Date, Residence Address, City, State, Zip Code, Area Code Phone No, To be completed by Notary Public, Notary Public, Notary Expiration, NOTE ALL DOCUMENTS BECOME PART OF, and Page, prior to finalizing. Otherwise, it can give you an incomplete and probably nonvalid document!

Step 3: Revise all the information you have typed into the blanks and click on the "Done" button. After starting a7-day free trial account at FormsPal, you'll be able to download ohio division of liquor control permit print or email it right away. The PDF will also be available via your personal account page with all of your changes. We don't sell or share any details that you provide while dealing with documents at FormsPal.