You can complete Ohio Form Et 2 effortlessly in our online tool for PDF editing. The editor is consistently improved by us, receiving handy features and becoming better. With just several basic steps, you can begin your PDF editing:

Step 1: First, access the pdf editor by clicking the "Get Form Button" above on this site.

Step 2: With the help of this state-of-the-art PDF file editor, it's possible to accomplish more than simply fill out blanks. Try all of the functions and make your forms look perfect with customized text added, or tweak the file's original input to perfection - all backed up by an ability to add stunning photos and sign it off.

It will be an easy task to complete the pdf with this practical guide! Here's what you should do:

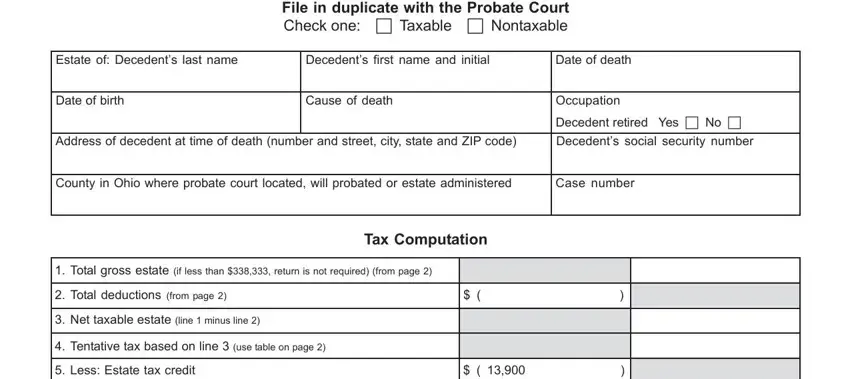

1. Fill out the Ohio Form Et 2 with a group of necessary fields. Collect all the information you need and make sure there's nothing missed!

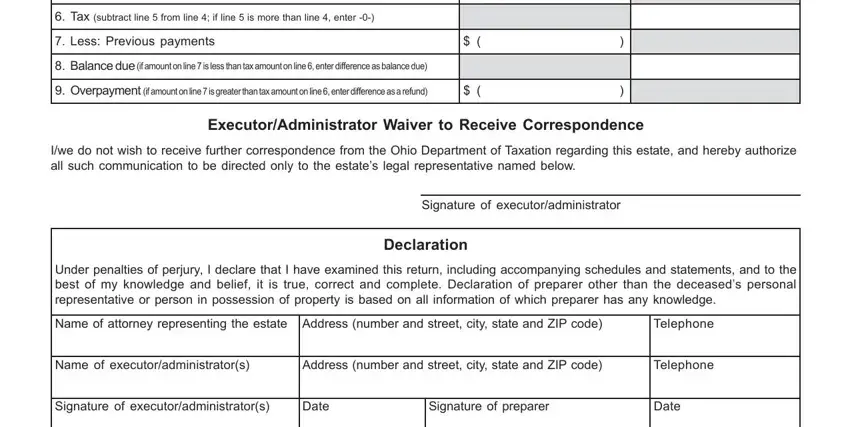

2. Now that this array of fields is completed, it is time to put in the needed particulars in Tax subtract line from line if, Less Previous payments, Balance due if amount on line is, Overpayment if amount on line is, ExecutorAdministrator Waiver to, Iwe do not wish to receive further, Signature of executoradministrator, Declaration, Under penalties of perjury I, Name of attorney representing the, Telephone, Name of executoradministrators, Address number and street city, Telephone, and Signature of executoradministrators so that you can go to the 3rd part.

In terms of Address number and street city and Less Previous payments, ensure you take a second look here. Both these are viewed as the most important fields in the PDF.

3. The next section is considered fairly straightforward, Percentage, and City Village or Township - every one of these empty fields has to be completed here.

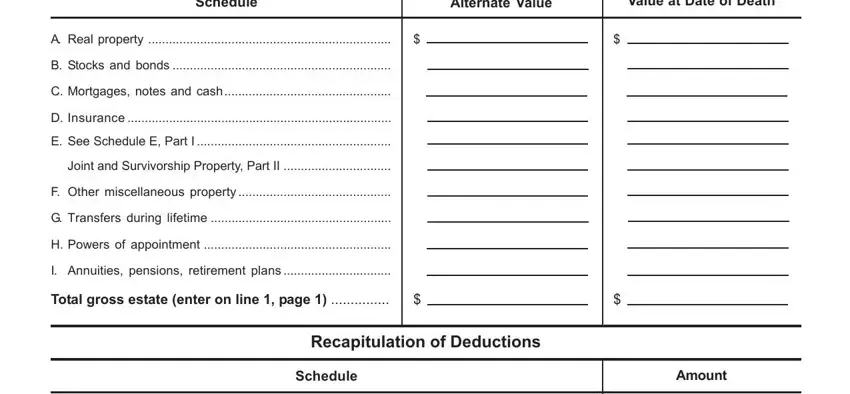

4. This next section requires some additional information. Ensure you complete all the necessary fields - Schedule, Alternate Value, Value at Date of Death, A Real property, B Stocks and bonds, C Mortgages notes and cash, D Insurance, E See Schedule E Part I, Joint and Survivorship Property, F Other miscellaneous property, G Transfers during lifetime, H Powers of appointment, I Annuities pensions retirement, Total gross estate enter on line, and Recapitulation of Deductions - to proceed further in your process!

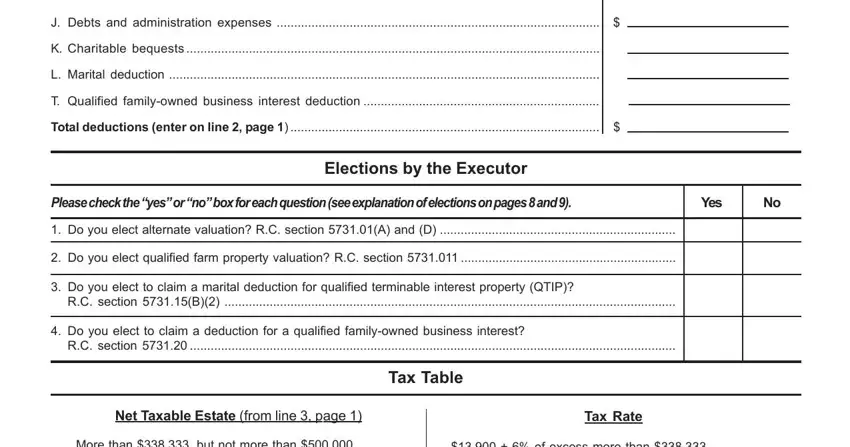

5. Finally, the following final section is what you have to complete before using the form. The blanks at issue include the following: J Debts and administration, K Charitable bequests, L Marital deduction, T Qualified familyowned business, Total deductions enter on line, Elections by the Executor, Please check the yes or no box for, Yes, Do you elect alternate valuation, Do you elect qualified farm, Do you elect to claim a marital, RC section B, Do you elect to claim a deduction, RC section, and Tax Table.

Step 3: Spell-check everything you've inserted in the blanks and then press the "Done" button. Make a free trial option at FormsPal and acquire immediate access to Ohio Form Et 2 - available from your FormsPal account page. FormsPal is committed to the privacy of our users; we always make sure that all information processed by our system is confidential.