orrville ohio city income tax form can be filled in online in no time. Simply try FormsPal PDF editor to do the job right away. Our expert team is ceaselessly working to improve the tool and enable it to be much easier for people with its handy features. Discover an ceaselessly innovative experience now - take a look at and discover new possibilities as you go! To get started on your journey, go through these easy steps:

Step 1: Click the "Get Form" button at the top of this page to get into our tool.

Step 2: The editor enables you to customize almost all PDF documents in various ways. Improve it by writing any text, correct what is already in the PDF, and place in a signature - all within the reach of a couple of clicks!

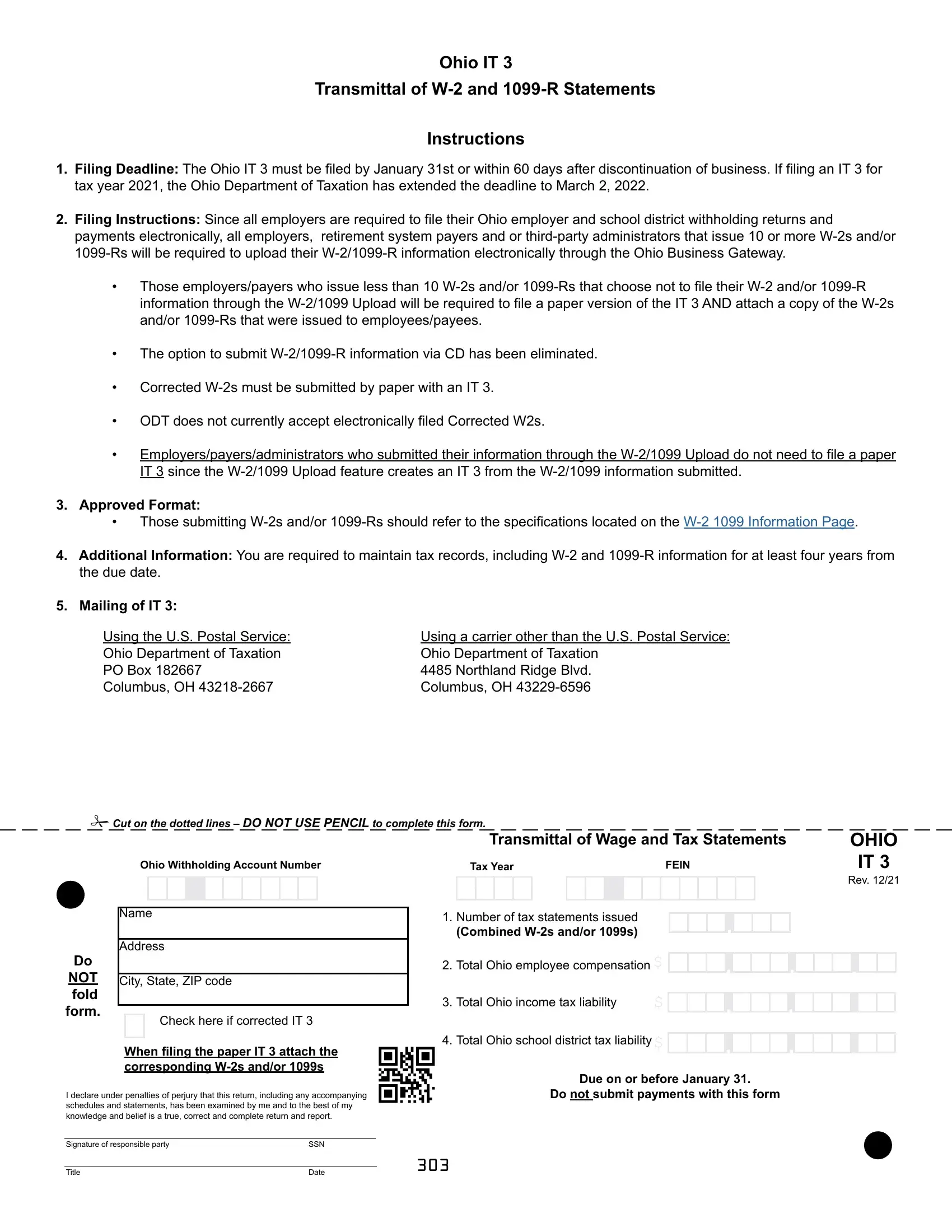

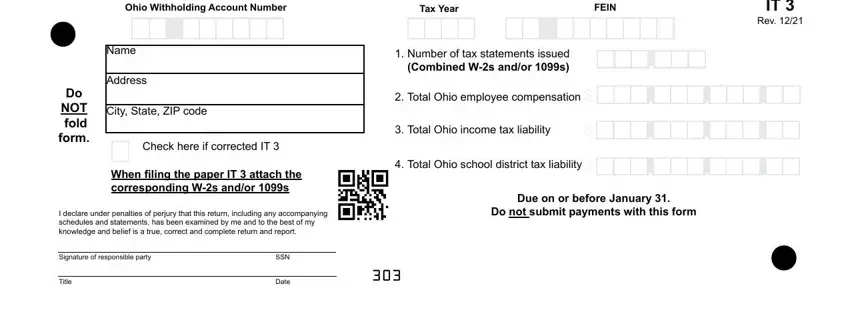

In order to complete this PDF form, make sure that you provide the required details in each blank:

1. The orrville ohio city income tax form usually requires particular details to be inserted. Be sure that the following blank fields are completed:

Step 3: Prior to submitting the form, make certain that form fields have been filled in right. When you’re satisfied with it, click on “Done." Go for a 7-day free trial option at FormsPal and acquire direct access to orrville ohio city income tax form - download or edit in your FormsPal account page. FormsPal is devoted to the confidentiality of all our users; we make certain that all personal data processed by our editor is kept confidential.