If you live in Ohio, chances are you’ve heard of the form UA 3. It’s a document used by employers to access unemployment insurance benefits for their employees. Although submitting this form can seem like an intimidating process, it doesn't have to be if you are well-informed and take the time to understand what is required of both employer and employee when filing it. In this blog post, we will break down all the details that go into understanding Ohio’s UA 3 Form—from who should file it as well as if they qualify—to where they can get help with filling out or submitting their forms online. Whether you're just starting your job search in Ohio or already have an existing place of employment, getting familiar with this Ua3 Form is important!

| Question | Answer |

|---|---|

| Form Name | Ohio Form Ua 3 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | what is a ua3 form for oh, accrual, 22nd, PEO |

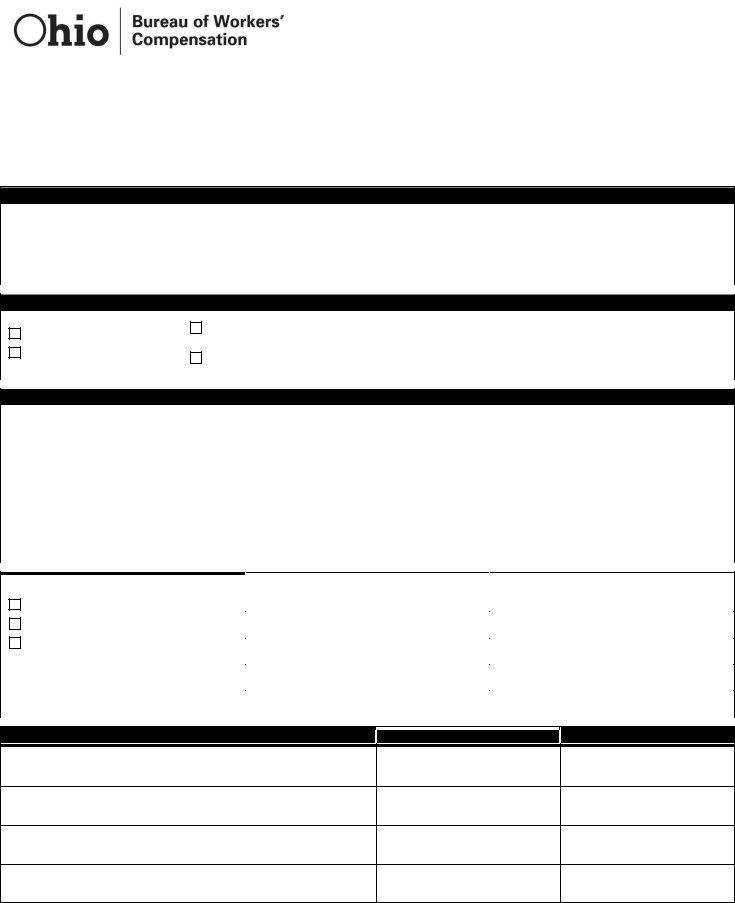

Professional Employer Organization

Client Relationship Notification

Instructions

∙Use this form to notify BWC of a new client, change of relationship with a current client or termination of a client.

∙Mail this form to BWC, PEO Unit, 22nd Floor, 30 W. Spring St., Columbus, OH

∙BWC must receive new contract notification within 30 days of the effective date of the contract. BWC must receive contract termination notifications within 14 days of the effective date of the termination.

∙Notice: Pursuant to Ohio Administrative Code

Professional employer organization (PEO) information

Company name |

Policy number |

|

|

Contact person name |

Telephone number |

|

|

|

|

PEO lease information

Check only one |

Change existing policy number reporting client |

Effective date of lease, termination or change in |

|

New lease |

|||

payroll/claims |

Ohio |

||

|

|||

Lease termination |

Change to portion of client’s employees assumed by PEO |

|

|

|

|

||

|

(No splitting of employees within a manual classification) |

|

Client company information

Client company name |

Client policy number |

|||

|

|

|

|

|

DBA |

Federal ID number |

|||

|

|

|

|

|

Mailing address (P.O. Box if applicable) |

Client phone number |

|||

|

|

|

|

|

City |

State |

|||

|

|

|

|

|

|

|

|

|

|

|

Employee reporting (payroll and claims) |

|

|

List class codes reportable by PEO |

|

List class codes reportable by client |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All under the PEO policy |

|

|

PEO |

|

|

Client |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All under the client policy |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A portion under the PEO policy |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Partial wages reported to BWC under the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

client policy must be reported under the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FEIN of the client employer) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signatures are required by both parties

Title

Date

Print client signatory

Client signature

Print PEO signatory

PEO signature

Note: Signing this form is an acknowledgement that all the information listed on this form is complete and true to the best of your knowledge. Omission of any of the items required or intentional misrepresentation of any of the above information on this form may lead to registration revocation as outlined in Ohio Revised Code Section 4125.