Dealing with PDF files online is certainly super easy with this PDF editor. You can fill in ohio ust return here effortlessly. Our editor is constantly developing to present the best user experience achievable, and that's due to our commitment to continuous improvement and listening closely to feedback from users. All it requires is just a few easy steps:

Step 1: Access the PDF file in our tool by hitting the "Get Form Button" in the top part of this page.

Step 2: As soon as you access the editor, you will get the document prepared to be filled out. Apart from filling in various blank fields, you can also perform other sorts of things with the form, including putting on any words, changing the original textual content, adding images, placing your signature to the PDF, and a lot more.

Completing this PDF will require care for details. Make certain each and every blank is filled in properly.

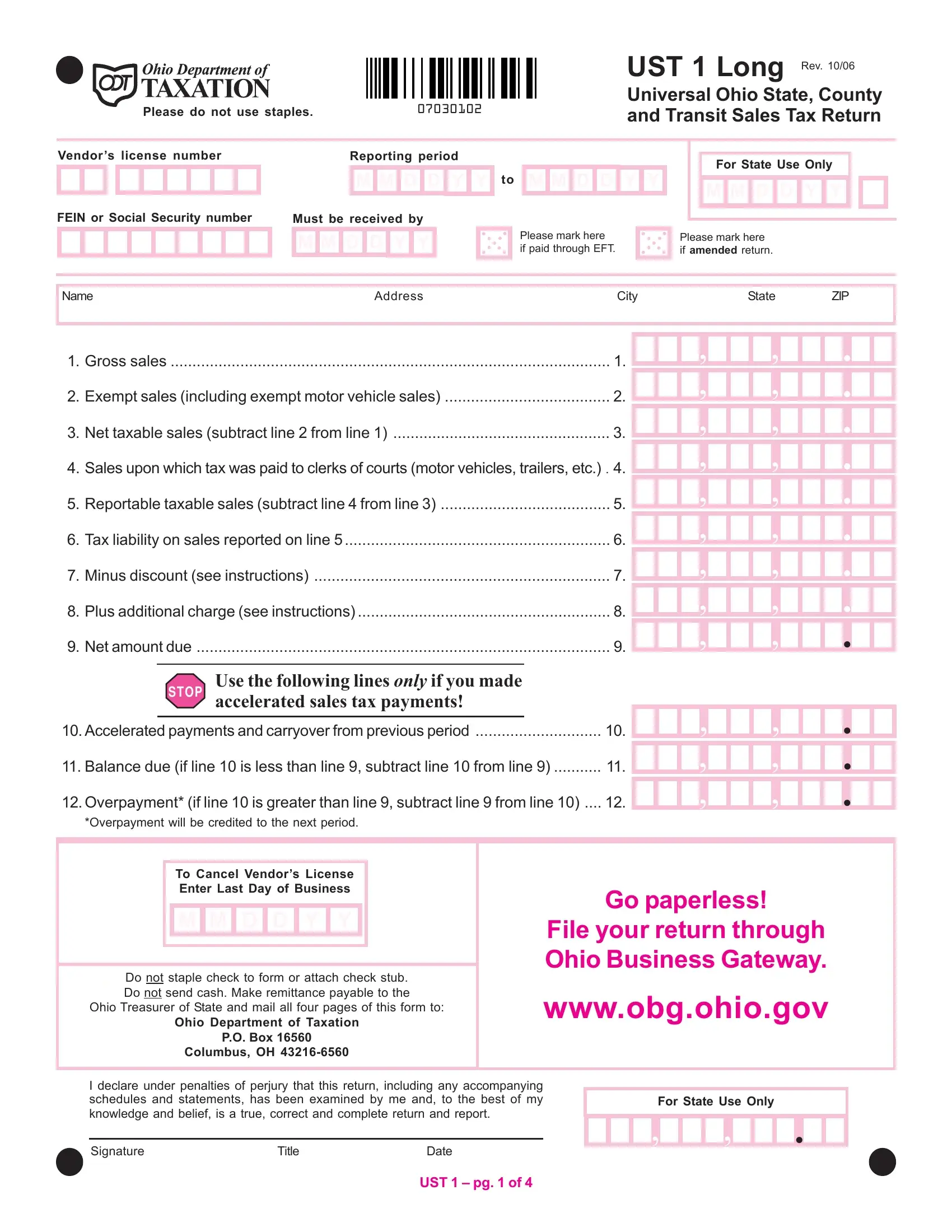

1. To start with, once completing the ohio ust return, begin with the area that features the next fields:

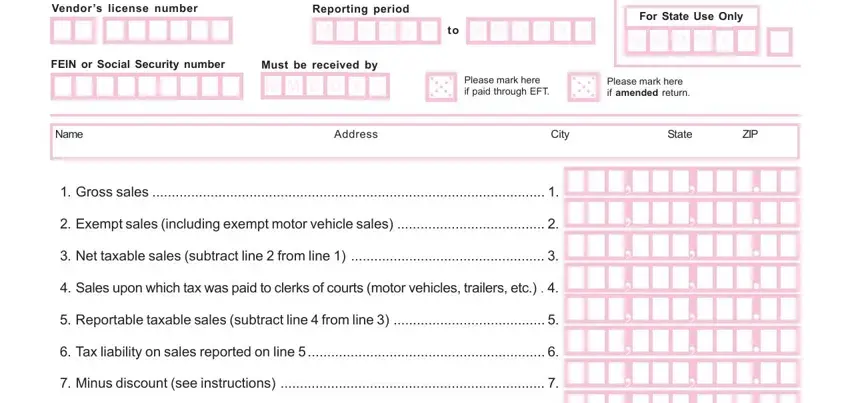

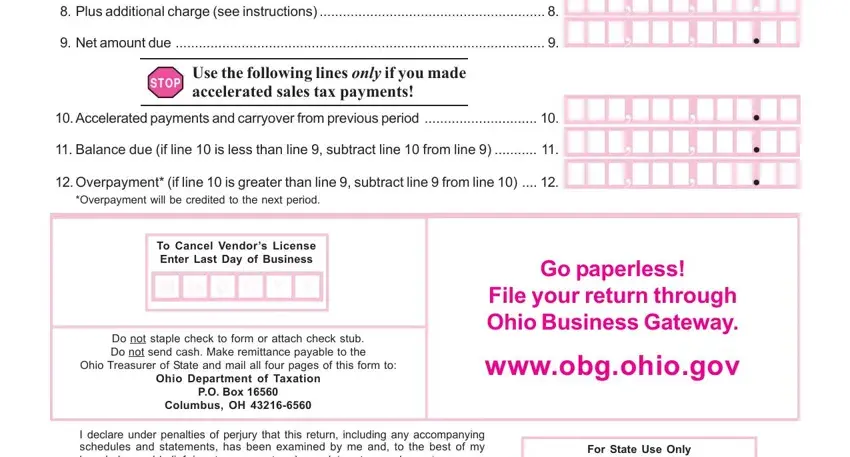

2. Once your current task is complete, take the next step – fill out all of these fields - Plus additional charge see, Net amount due, STOP, Use the following lines only if, Accelerated payments and, Balance due if line is less than, Overpayment if line is greater, Overpayment will be credited to, cid, cid, cid, cid cid, cid, To Cancel Vendors License Enter, and M M D D Y Y with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

3. In this part, look at I declare under penalties of, Signature, Title, Date, cid, and UST pg of. Every one of these have to be filled out with greatest precision.

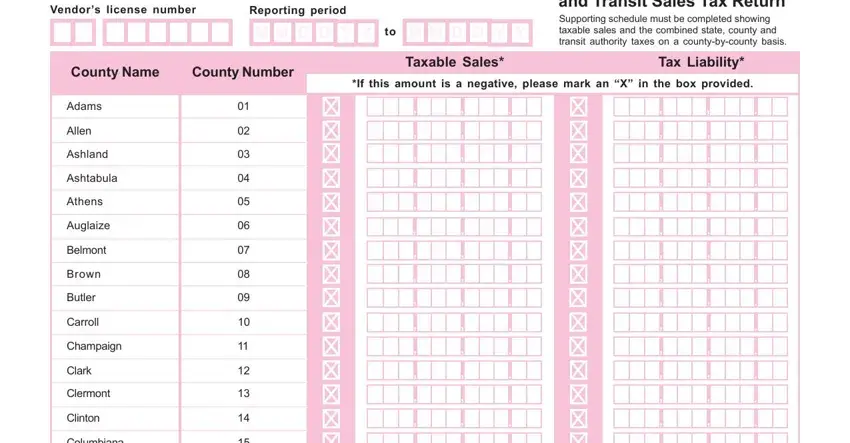

4. The following paragraph requires your involvement in the subsequent areas: Vendors license number, Reporting period, D D, Y Y, D D, Y Y, UST Long Universal Ohio State, County Name, County Number, Taxable Sales, Tax Liability, If this amount is a negative, Adams, Allen, and Ashland. Make certain you enter all required details to go onward.

Concerning Reporting period and D D, ensure you get them right in this current part. These two are thought to be the most significant fields in the PDF.

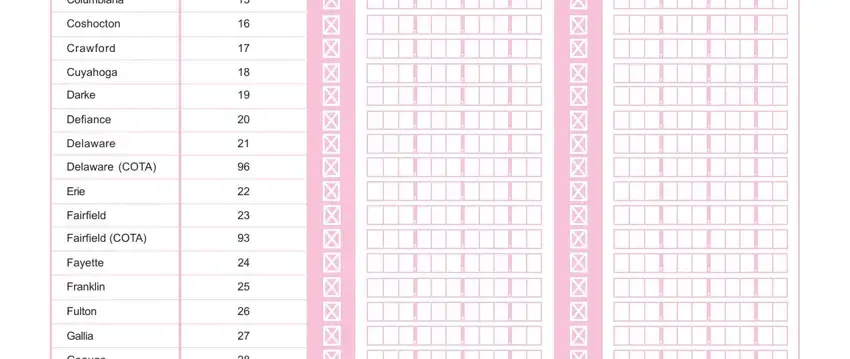

5. Finally, this final segment is what you have to finish prior to submitting the document. The fields in question include the next: Columbiana, Coshocton, Crawford, Cuyahoga, Darke, Defiance, Delaware, Delaware COTA, Erie, Fairfield, Fairfield COTA, Fayette, Franklin, Fulton, and Gallia.

Step 3: Prior to finalizing the form, make certain that all blanks were filled in the right way. When you confirm that it is good, click “Done." After creating a7-day free trial account with us, it will be possible to download ohio ust return or send it via email promptly. The form will also be readily accessible in your personal cabinet with your every single modification. We don't sell or share the information that you provide whenever filling out documents at FormsPal.