ohio form tax withheld can be filled in online effortlessly. Just try FormsPal PDF tool to complete the job right away. To maintain our editor on the forefront of efficiency, we aim to put into practice user-driven capabilities and enhancements regularly. We're routinely pleased to receive suggestions - join us in revampimg how you work with PDF forms. Getting underway is easy! All you need to do is adhere to the following basic steps below:

Step 1: Firstly, open the pdf tool by pressing the "Get Form Button" above on this webpage.

Step 2: This tool will allow you to work with your PDF document in a variety of ways. Improve it by including personalized text, correct what's originally in the document, and add a signature - all when it's needed!

It really is easy to fill out the pdf following this helpful guide! This is what you should do:

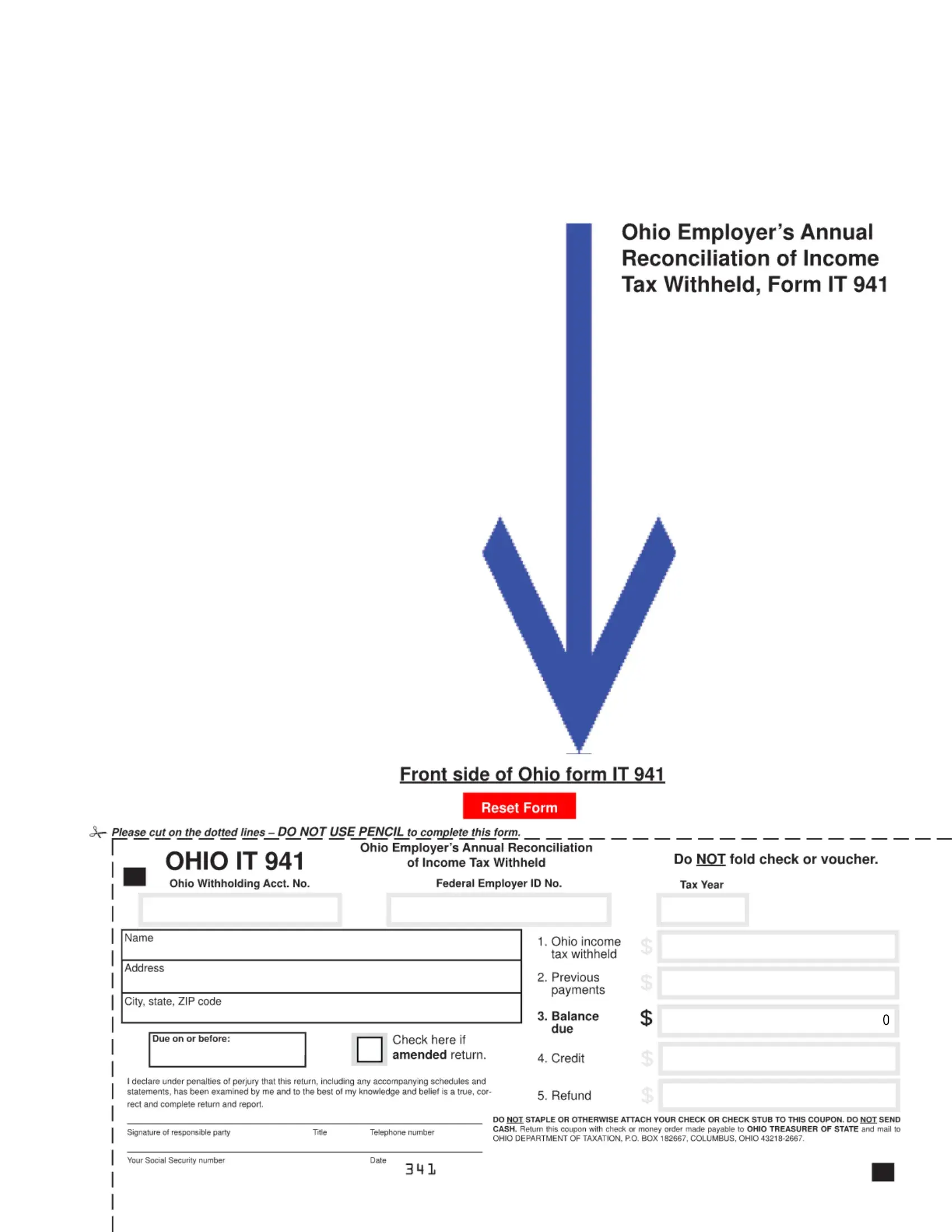

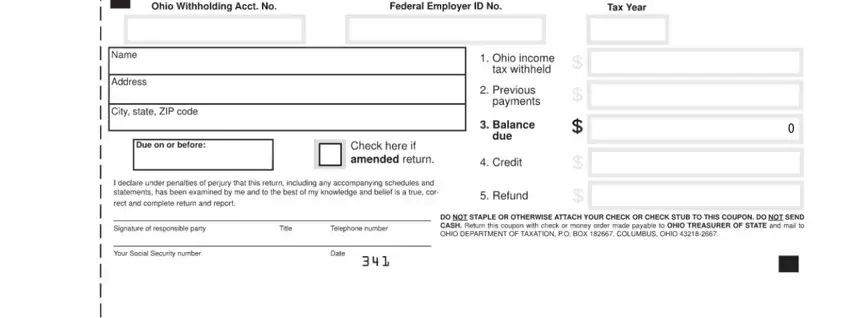

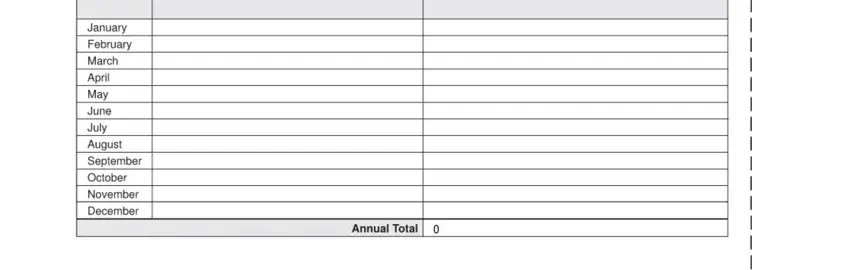

1. Begin filling out your ohio form tax withheld with a number of necessary blank fields. Get all the information you need and make sure not a single thing forgotten!

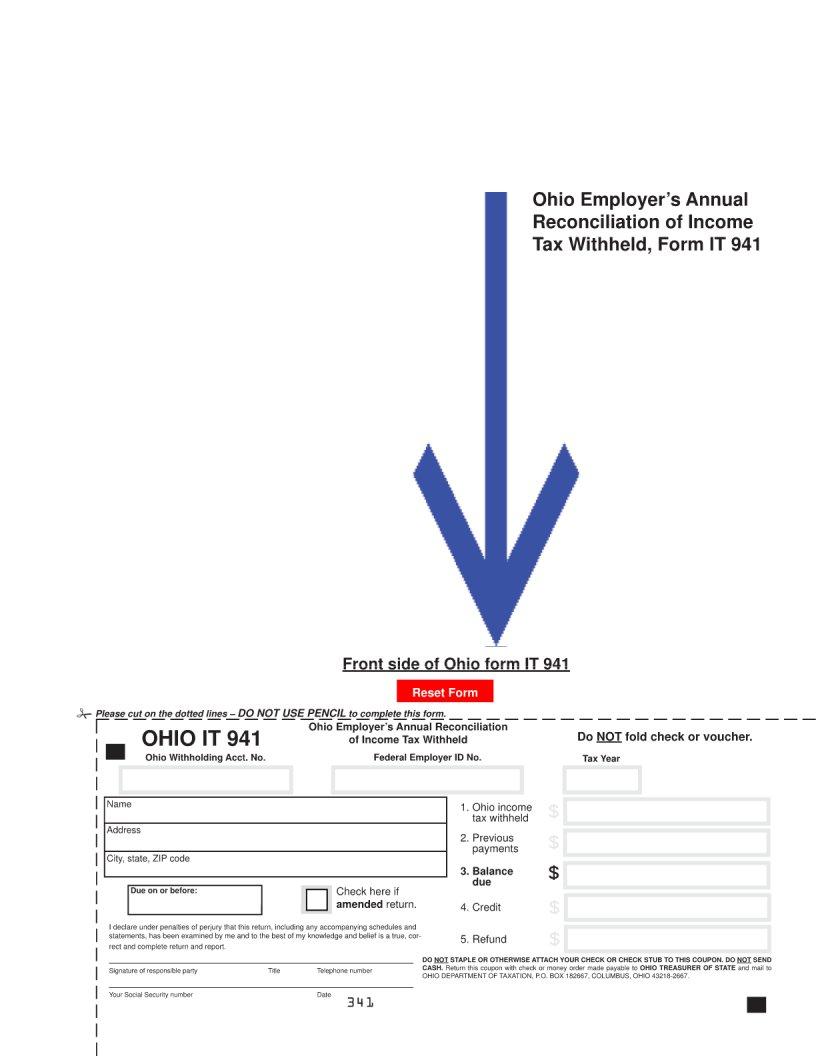

2. The next stage would be to fill in these fields: .

A lot of people frequently make mistakes while filling in this field in this section. Don't forget to read again what you type in right here.

Step 3: Reread all the information you have entered into the blank fields and then click on the "Done" button. Grab your ohio form tax withheld the instant you join for a free trial. Readily access the pdf file within your personal cabinet, together with any modifications and adjustments conveniently synced! FormsPal ensures your information privacy with a protected method that in no way records or distributes any type of sensitive information provided. Feel safe knowing your docs are kept confidential when you use our services!