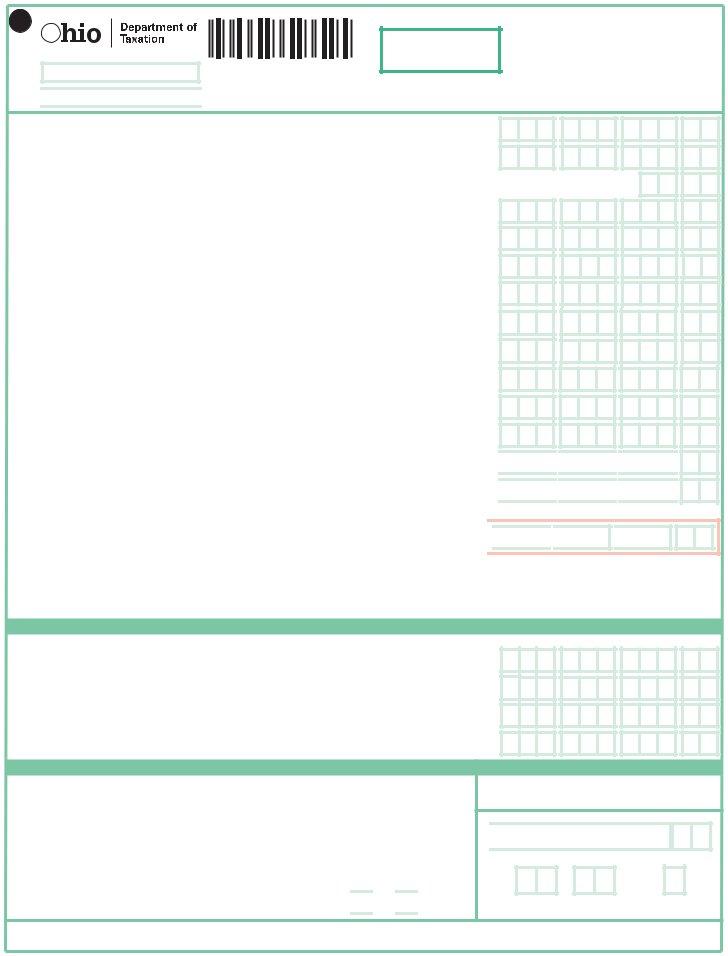

Filing taxes can sometimes feel complicated, and understanding the Ohio SD 100 form is crucial for those who lived in more than one taxing school district during the taxable year. This form, revised in September 2012, is designed specifically for reporting school district income taxes and requires meticulous attention to detail such as the use of black ink and uppercase letters, avoiding staples, tape, or glue. Each taxpayer, including those filing jointly, must provide their Social Security number, and if applicable, include the spouse's details. It's essential for residents to know their school district number, which can be found in the provided instructions. The form varies slightly based on the tax base of the school district—traditional or earned income only, determining how income is reported and what deductions might be available. Those with school district income tax withheld or making estimated payments throughout the year must report these amounts to offset what is owed or calculate their refund. Additionally, the form outlines where to send the completed document, with separate addresses for those enclosing payment and for those not enclosing payment. The prospect of a quick refund via direct deposit is an appealing aspect for electronic filers. For residents unsure about their district or filing status, the included instructions offer guidance to ensure accurate reporting. Key features also include managing overpayments, understanding how to apply credits to future tax liabilities, the handling of interest and penalties on underpayments, and importantly, how to authorize or not authorize a preparer to contact the tax department regarding the return. Understanding the SD 100 form is a step toward fulfilling one's tax obligations while possibly maximizing returns or minimizing liabilities.

| Question | Answer |

|---|---|

| Form Name | Ohio Sd 100 Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | nonresidency, rst, securities and exchange board of india pdf, 2012 |

Do not use staples.

Use only black ink. |

12020102 |

Taxable year beginning in

2012

SD 100 Rev. 9/12

School District Income Tax Return

File a separate Ohio form SD 100 for each taxing school district in which you lived during the taxable year.

Taxpayer Social Security no. (required) |

If deceased |

Spouse’s Social Security no. (only if joint return) |

If deceased |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Use UPPERCASE letters. |

|

check box |

|

|

|

|

|

|

|

|

|

|

|

|

check box |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

Your first name |

|

|

|

|

|

M.I. Last name |

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter school district # for this return (see pages SD

SD#

Spouse’s fi rst name (only if married filing jointly) |

|

M.I. Last name |

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing address (for faster processing, use a street address)

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

ZIP code |

Ohio county (fi rst four letters) |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home address (if different from mailing address) – do NOT show city or state |

|

|

|

ZIP code |

|

|

County (fi rst four letters) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign country (provide this information if the mailing address is outside the U.S.) |

|

|

Foreign postal code |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

School District Residency – File a separate Ohio form SD 100 for each taxing school district in which you lived during the taxable year. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Check applicable box |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check applicable box for spouse (only if married filing jointly) |

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

resident |

|

|

|

of SD# above |

|

|

|

of SD# above |

|

|

resident |

|

|

|

|

of SD# above |

|

|

|

|

|

of SD# above |

||||||||||||||||||||||||||||||||||||||

|

Enter date of nonresidency |

|

to |

|

|

|

Enter date of nonresidency |

|

|

|

|

|

|

to |

|

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Filing Status – Check one (must match Ohio income tax return): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

Single or head of household or qualifying widow(er) |

|

Do not use staples, tape or glue. Place your |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

(payable to School District Income Tax) and Ohio form |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

Married filing jointly |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SD 40P on top of your return. Include forms |

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

Married filing separately |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

documents or statements after the last page of your return. |

||||||||||||||||||||||||||||||||||||||||||

|

|

(enter spouse’s SS#) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Go paperless. It’s FREE! |

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

Tax Type – Check one (for an explanation, see page SD 1 of the instructions) |

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

Visit tax.ohio.gov to try Ohio |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

I am fi ling this return because during the taxable year I lived in a(n): |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

Traditional tax base school district. You must start with line 1 below. |

|

Most electronic fi lers receive their refunds |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Earned income only tax base school district. You must start with |

|

|

in |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Schedule A, line 19 on page 2 of this return. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME INFORMATION – If the amount on line 1 is negative, shade |

|

the negative sign |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. Traditional tax base school district filer. Enter on this line your Ohio

taxable income reported on line 5 of Ohio form IT 1040EZ or IT 1040. |

} |

|

Earned income only tax base school district filer. Complete Schedule A |

1. |

|

on page 2 of this return and then enter on this line the amount you show on |

|

page 2, line 22 of this return.

,

,

. 0 0

2. The amount of Ohio taxable income, if any, you earned while not a resident |

|

|

of the traditional tax base school district whose number you entered above. |

|

, |

Earned income only tax base school district fi lers must leave this line blank |

2. |

3. |

School district taxable income (line 1 minus line 2; enter |

, |

,

,

.0 0

.0 0

NO Payment Enclosed – Mail to:

School District Income Tax

P.O. Box 182197

Columbus, OH

If you have a federal extension of time to fi le, include a copy or the confi rmation number of the extension.

Payment Enclosed – Mail to:

School District Income Tax

P.O. Box 182389

Columbus, OH

2012 SD 100

pg. 1 of 2

2012 SD 100

SS#

12020202

Taxable year beginning in

2012

SD 100 Rev. 9/12

School District Income Tax Return

SD#

3a. |

Amount from line 3, page 1 |

3a. |

|||||||||

4. |

School district tax rate (use the applicable decimal rate from pages SD |

|

|||||||||

|

. 0 |

|

|

|

|

|

|

times line 3a |

4. |

||

|

|

|

|

|

|

|

|

|

|

|

|

5. |

Senior citizen credit (you must be 65 or older to claim this credit; limit $50 per return) |

5. |

|||||||||

6. |

Total due (line 4 minus line 5; enter |

6. |

|||||||||

7. |

Interest penalty on underpayment of estimated tax. Enclose Ohio form IT/SD 2210 and the |

|

|||||||||

|

appropriate worksheet if you annualize |

7. |

|||||||||

8. |

Total due plus IT/SD 2210 interest penalty (add lines 6 and 7) |

TOTAL TAX |

8. |

||||||||

9. |

School district income tax withheld (school district number on |

|

|||||||||

|

must agree with school district number in the upper |

9. |

|||||||||

10. |

Add the 2012 Ohio form SD 100ES payment(s), 2012 Ohio form SD 40P extension payment(s) |

|

|||||||||

|

and 2011 school district overpayment credited to 2012 |

10. |

|||||||||

11. |

Add lines 9 and 10 |

TOTAL PAYMENTS |

11. |

||||||||

If line 11 is MORE THAN line 8, go to line 12. If line 11 is LESS THAN line 8, skip to line 15. |

|

||||||||||

12. |

If line 11 is MORE THAN line 8, subtract line 8 from line 11 |

AMOUNT OVERPAID |

12. |

||||||||

13. |

Amount of line 12 to be credited to 2013 school district income tax liability |

...... CREDIT TO 2013 |

13. |

||||||||

14. |

Line 12 minus line 13. Enter here, then skip to line 16 |

14. |

|||||||||

15. |

If line 11 is LESS THAN line 8, subtract line 11 from line 8 |

AMOUNT DUE |

15. |

||||||||

16. Interest and penalty due on

If you entered an amount on line 14, skip to line 18. If you entered an amount on line 15, go to line 17.

, |

, |

. 0 0 |

, |

, |

. 0 0 |

. 0 0 |

, |

, |

. 0 0 |

, |

, |

. 0 0 |

, |

, |

. 0 0 |

, |

, |

. 0 0 |

, |

, |

. 0 0 |

, |

, |

. 0 0 |

, |

, |

. 0 0 |

, |

, |

. 0 0 |

, |

, |

. 0 0 |

,,. 0 0

,,. 0 0

17.Amount due plus interest and penalty (add lines 15 and 16). If payment is enclosed, make check payable to School District Income Tax and include Ohio form SD 40P (see our Web site

at tax.ohio.gov) |

AMOUNT DUE PLUS INTEREST AND PENALTY 17. |

,

,

. 0 0 |

18. Refund less interest and penalty (line 14 minus line 16). Enter the amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

here. (If line 16 is more than line 14, you have an amount due. Subtract |

|

|

|

|

, |

|

|

|

, |

|

|

|

. |

0 |

0 |

|

|

line 14 from line 16 and enter this amount on line 17.) |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YOUR REFUND 18. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If your refund is less than $1.01, no refund will be issued. If you owe less than $1.01, no payment is necessary. |

|||||||||||||||||

SCHEDULE A – EARNED INCOME ONLY TAX BASE SCHOOL DISTRICT AMOUNTS (See page SD 6 of the instructions.)

Complete this schedule only if you entered an earned income only tax base school district number in the upper

19. |

Wages and other compensation described on page SD 6 of the instructions |

19. |

||

20. |

Net earnings from |

|

|

|

|

|

|

||

|

Shade the negative sign |

|

|

.... 20. |

21. |

Depreciation expense adjustment, if any, described on page SD 6 of the instructions |

21. |

||

22. |

Add lines 19, 20 and 21. Enter the total here and on line 1 of this return |

|

|

|

|

.... 22. |

|||

, |

, |

. 0 0 |

, |

, |

. 0 0 |

, |

, |

. 0 0 |

, |

, |

. 0 0 |

SIGN HERE (required) – See page 1 of this return for mailing information.

I have read this return. Under penalties of perjury, I declare that, to the best of my knowledge and belief, the return and all enclosures are true, correct and complete.

|

|

|

SIGN HERE (required) |

Date |

|

|

Your signature |

|

|

|

|

|

Spouse’s signature (see page SD 3 of the instructions) |

Phone number (optional) |

|

|

|

|

Preparer’s printed name (see page SD 3 of the instructions) |

Phone number |

Do you authorize your preparer to contact us regarding this return? Yes No

For Department Use Only

, , .

Code

2012 SD 100

pg. 2 of 2

2012 SD 100