Making use of the online tool for PDF editing by FormsPal, you're able to fill in or edit oklahoma tax exempt form pdf right here and now. To have our editor on the leading edge of practicality, we work to put into practice user-driven capabilities and improvements regularly. We're at all times glad to receive suggestions - assist us with revolutionizing how we work with PDF forms. All it requires is a couple of simple steps:

Step 1: Press the orange "Get Form" button above. It is going to open our pdf editor so that you could start filling out your form.

Step 2: Using this advanced PDF tool, you're able to accomplish more than just fill out forms. Express yourself and make your docs seem great with custom text put in, or adjust the original input to perfection - all accompanied by an ability to add your own graphics and sign the file off.

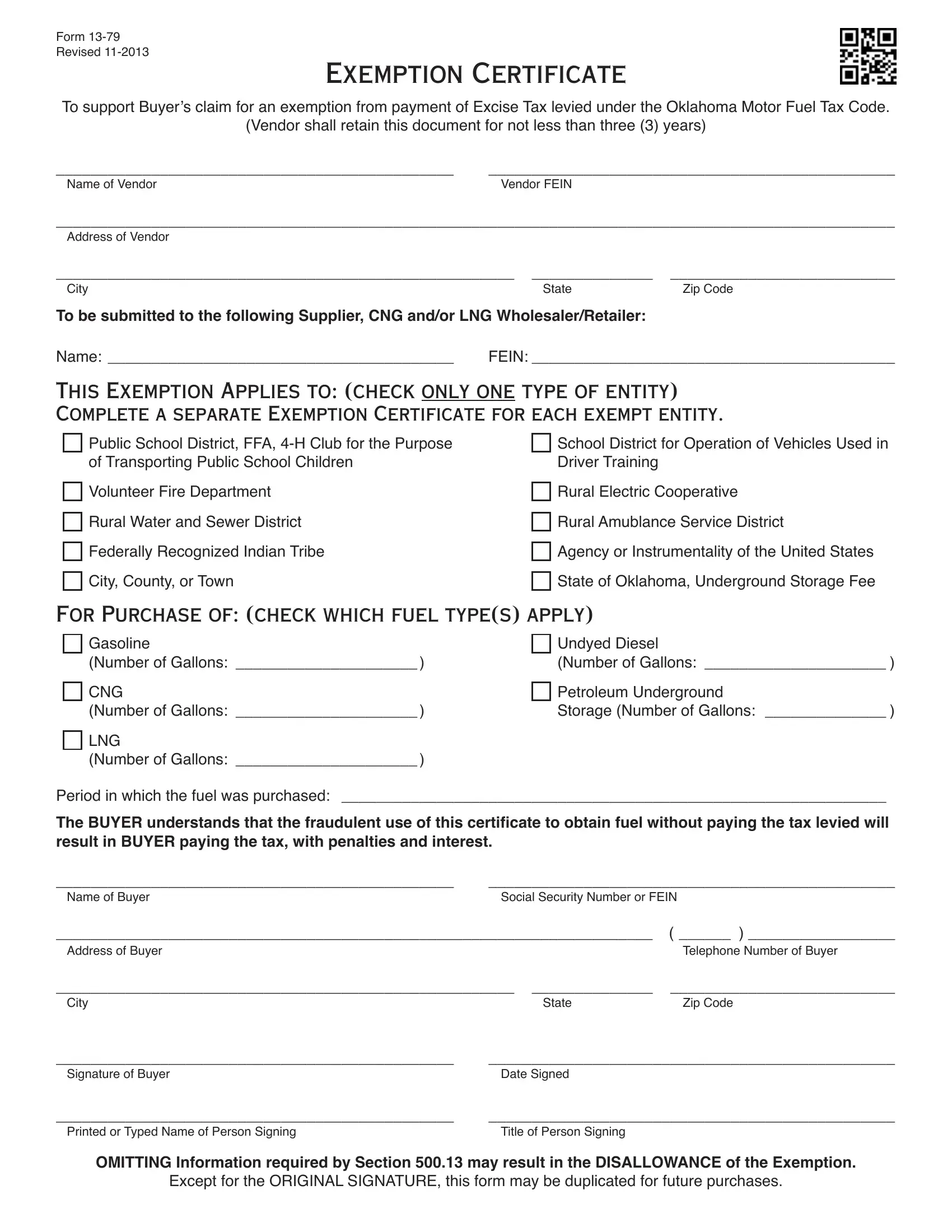

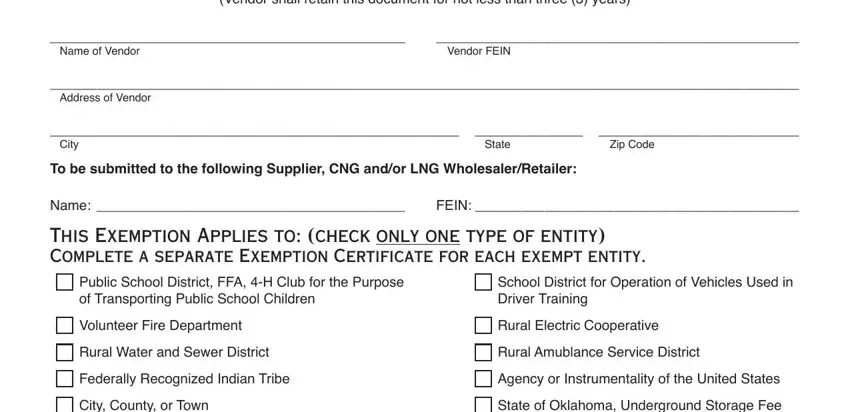

If you want to complete this PDF document, be sure you enter the information you need in every field:

1. When completing the oklahoma tax exempt form pdf, be sure to complete all important blank fields in its relevant part. This will help hasten the process, allowing for your details to be handled quickly and correctly.

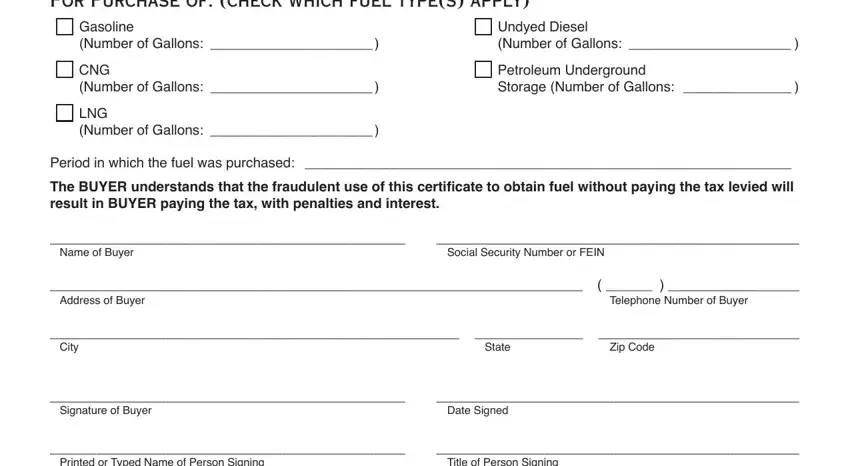

2. After the last array of fields is completed, it's time to add the essential specifics in For Purchase of check which fuel, Gasoline Number of Gallons CNG, Undyed Diesel Number of Gallons, Period in which the fuel was, Name of Buyer, Social Security Number or FEIN, Address of Buyer, Telephone Number of Buyer, City, State, Zip Code, Signature of Buyer, Date Signed, Printed or Typed Name of Person, and Title of Person Signing so you can progress further.

When it comes to Printed or Typed Name of Person and Address of Buyer, be sure you get them right in this section. Both of these are surely the most important fields in the document.

Step 3: Soon after going through the fields you've filled out, press "Done" and you're good to go! After starting a7-day free trial account with us, you will be able to download oklahoma tax exempt form pdf or email it right off. The PDF document will also be accessible in your personal account page with all your edits. FormsPal guarantees risk-free form editing with no personal information record-keeping or sharing. Feel safe knowing that your details are safe with us!