By using the online PDF tool by FormsPal, you can easily fill in or edit oklahoma 511 resident tax return here and now. We at FormsPal are focused on making sure you have the absolute best experience with our tool by regularly introducing new functions and enhancements. Our tool has become a lot more intuitive thanks to the most recent updates! Currently, working with PDF documents is simpler and faster than before. Here's what you would have to do to begin:

Step 1: Click on the "Get Form" button above. It'll open our pdf editor so that you could begin completing your form.

Step 2: This editor helps you change your PDF form in various ways. Modify it by including personalized text, correct existing content, and include a signature - all at your convenience!

It will be an easy task to finish the document using this helpful guide! This is what you should do:

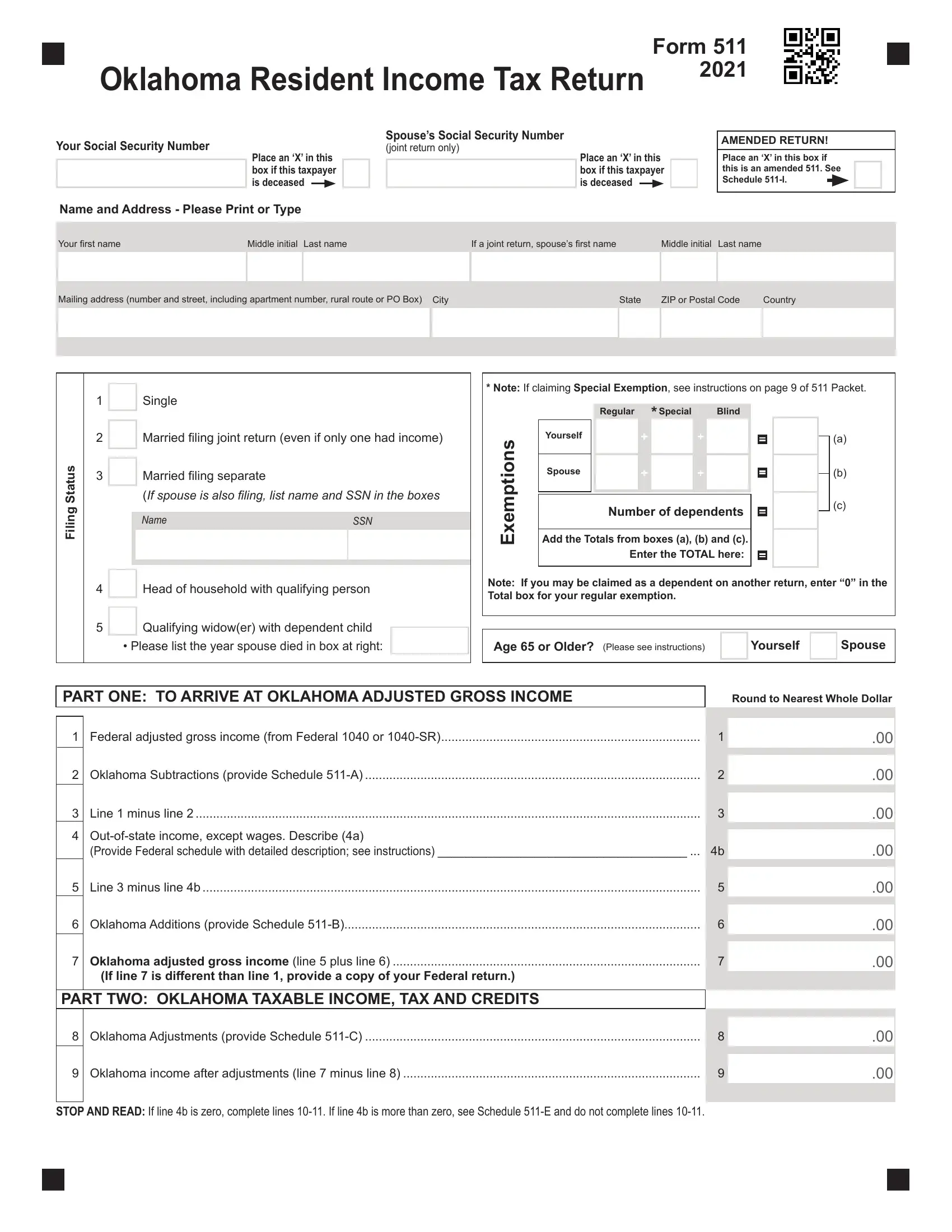

1. Complete your oklahoma 511 resident tax return with a selection of necessary blank fields. Collect all of the important information and make sure there's nothing missed!

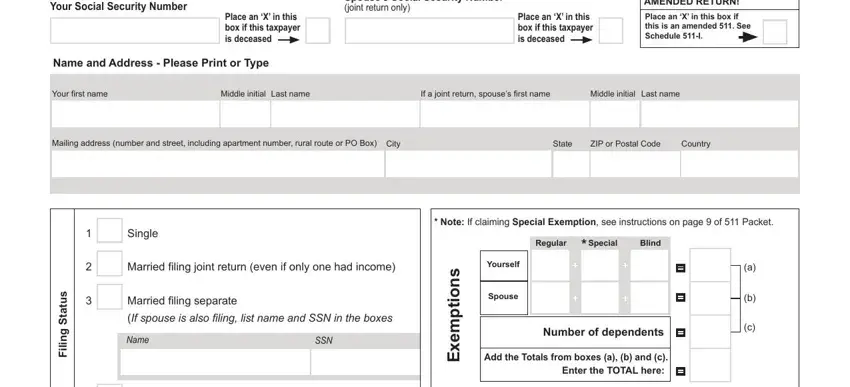

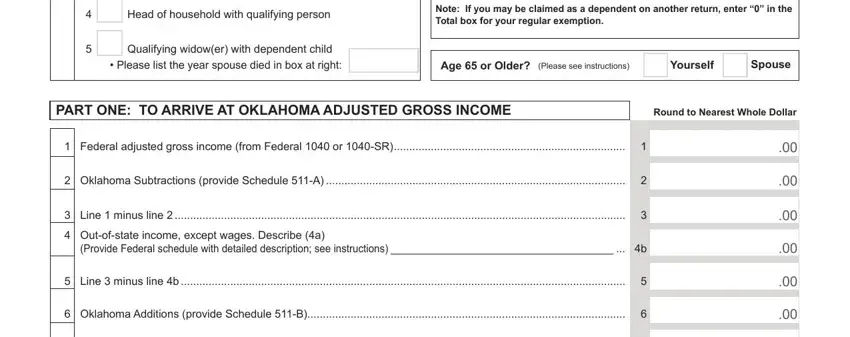

2. The subsequent stage would be to fill in these particular fields: Head of household with qualifying, Note If you may be claimed as a, Qualifying widower with dependent, Please list the year spouse died, Age or Older, Please see instructions, Yourself, Spouse, PART ONE TO ARRIVE AT OKLAHOMA, Round to Nearest Whole Dollar, Federal adjusted gross income, Oklahoma Subtractions provide, Line minus line, Outofstate income except wages, and Provide Federal schedule with.

Regarding Outofstate income except wages and PART ONE TO ARRIVE AT OKLAHOMA, make certain you review things here. The two of these are the most significant ones in the page.

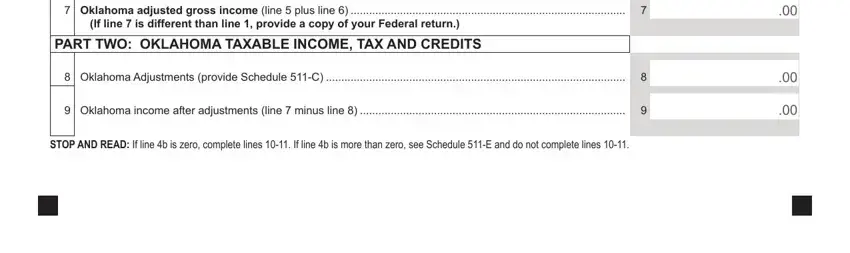

3. This third step is generally hassle-free - fill in every one of the blanks in Oklahoma adjusted gross income, If line is different than line, PART TWO OKLAHOMA TAXABLE INCOME, Oklahoma Adjustments provide, Oklahoma income after adjustments, and STOP AND READ If line b is zero to complete this part.

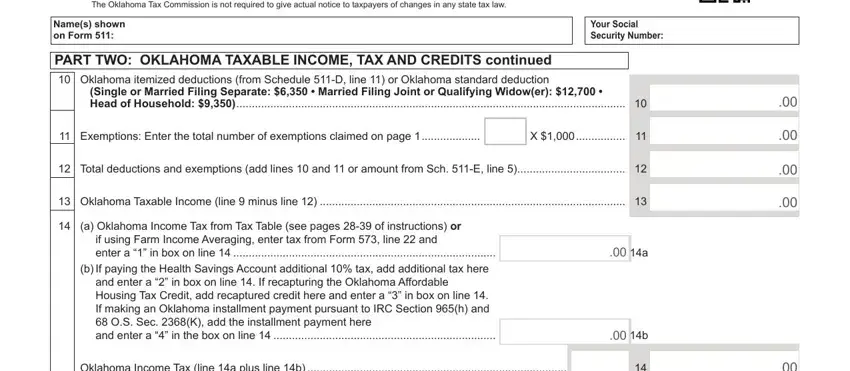

4. This particular subsection arrives with all of the following fields to consider: Form Resident Income Tax Return, Names shown on Form, Your Social Security Number, PART TWO OKLAHOMA TAXABLE INCOME, Single or Married Filing Separate, Exemptions Enter the total number, Total deductions and exemptions, Oklahoma Taxable Income line, if using Farm Income Averaging, enter a in box on line, a Oklahoma Income Tax from Tax, b If paying the Health Savings, and enter a in box on line If, and Oklahoma Income Tax line a plus.

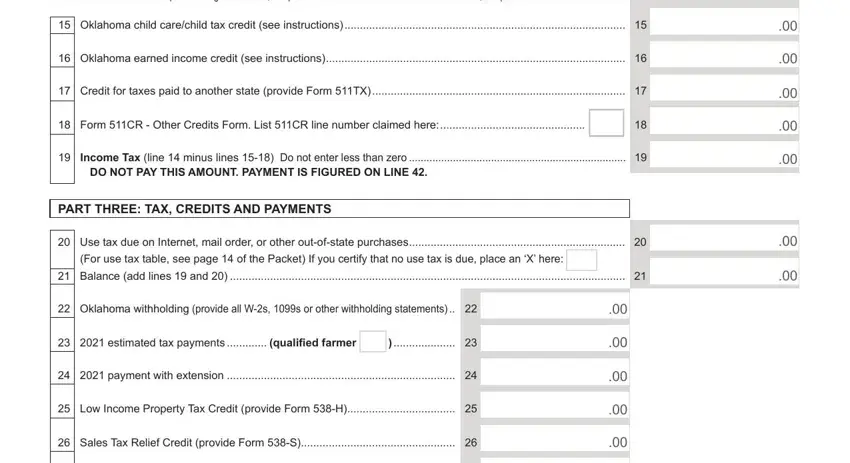

5. The pdf has to be concluded by dealing with this section. Here there's an extensive listing of fields that must be completed with specific details in order for your document usage to be faultless: STOP AND READ If line is equal to, Oklahoma child carechild tax, Oklahoma earned income credit see, Credit for taxes paid to another, Form CR Other Credits Form List, Income Tax line minus lines Do, DO NOT PAY THIS AMOUNT PAYMENT IS, PART THREE TAX CREDITS AND PAYMENTS, Use tax due on Internet mail, For use tax table see page of the, Balance add lines and, Oklahoma withholding provide all, estimated tax payments, payment with extension, and Low Income Property Tax Credit.

Step 3: Before finishing this document, ensure that all form fields have been filled in right. Once you verify that it's correct, press “Done." Sign up with us now and easily obtain oklahoma 511 resident tax return, ready for downloading. Every edit you make is handily preserved , letting you customize the form at a later point when necessary. We do not share the information you enter when completing forms at FormsPal.