Oklahoma Form 511 V can be filled in online easily. Simply use FormsPal PDF tool to finish the job right away. Our editor is consistently evolving to present the best user experience possible, and that's thanks to our commitment to continual development and listening closely to user feedback. Starting is simple! All that you should do is follow the next simple steps directly below:

Step 1: Simply click on the "Get Form Button" above on this site to get into our form editor. This way, you will find all that is required to work with your file.

Step 2: With our handy PDF editing tool, you may do more than merely fill out blanks. Edit away and make your forms seem sublime with custom text put in, or adjust the file's original content to perfection - all that comes with an ability to incorporate your own photos and sign the PDF off.

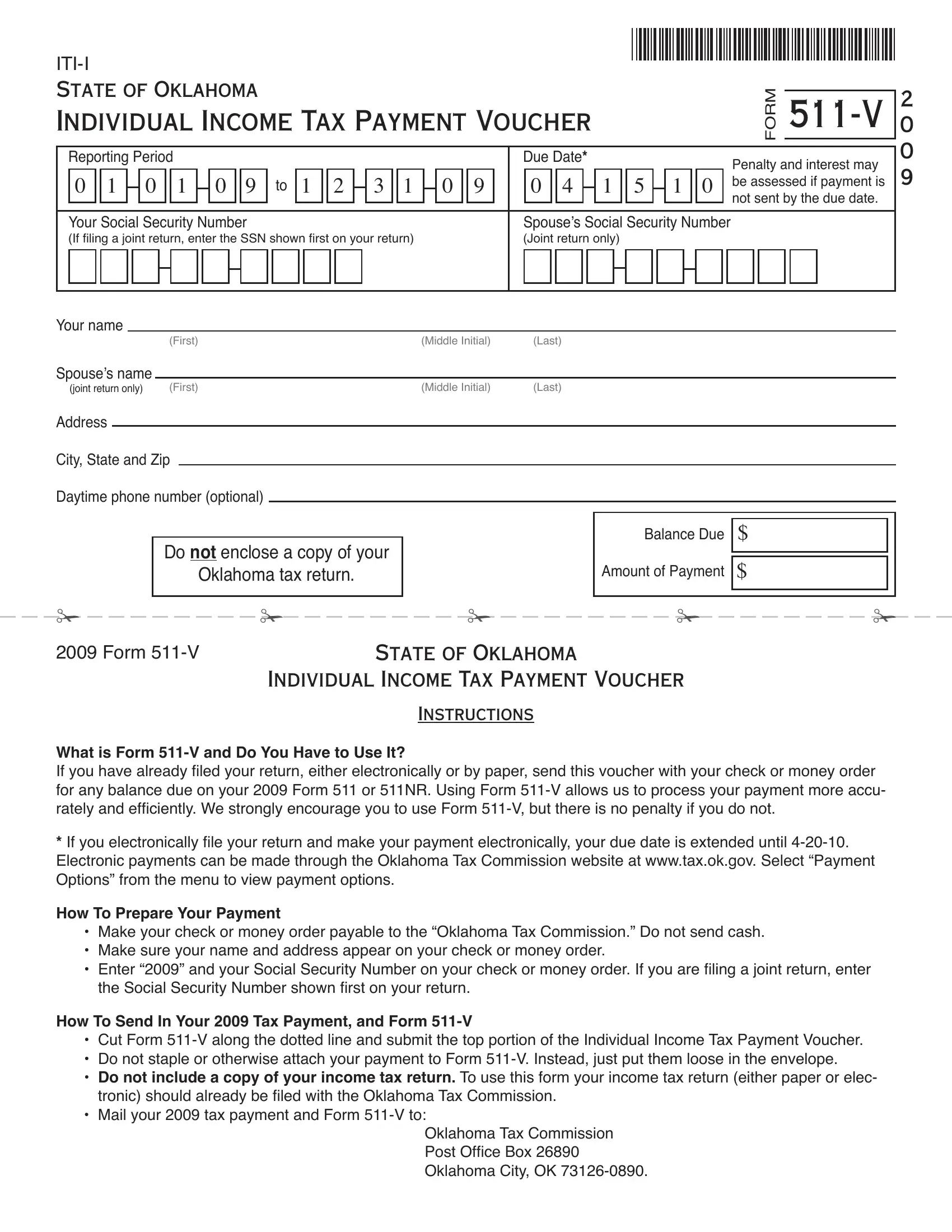

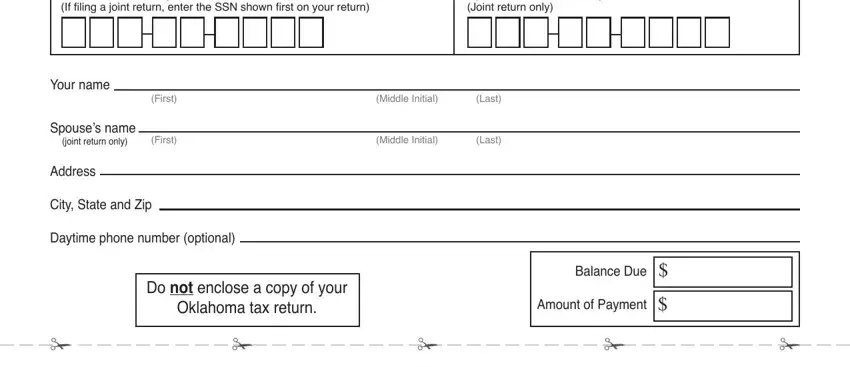

This document will require particular data to be filled in, so you need to take your time to provide precisely what is asked:

1. The Oklahoma Form 511 V usually requires specific information to be entered. Ensure the subsequent blank fields are filled out:

Step 3: After going through the fields and details, press "Done" and you are all set! Find the Oklahoma Form 511 V the instant you register online for a free trial. Readily use the pdf form from your FormsPal account, with any edits and changes automatically synced! At FormsPal.com, we strive to be sure that all of your details are kept private.