The Oklahoma 511EF form, officially known as the Oklahoma Individual Income Tax Declaration for Electronic Filing, serves as a critical document for residents seeking to file their state tax returns electronically. This form, integral to the streamlining of the electronic filing process, requires detailed personal information including names, social security numbers, addresses, and precise financial figures. It facilitates the calculation and reporting of Oklahoma Adjusted Gross Income, Income Tax and Use Tax, as well as Income Tax Payments and Credits, ultimately determining if a taxpayer is due a refund or owes a balance. Particularly noteworthy is its section regarding taxpayer declarations, which underscores the importance of accuracy under penalties of perjury, and includes provisions for direct deposit of refunds and the authorization for electronic fund withdrawals for tax payments. Moreover, it delineates the roles and responsibilities of Electronic Return Originators (ERO) and paid preparers, ensuring the accuracy, completeness, and compliance of the tax return with state regulations. The directives on whether to mail or retain the form further exemplify the move towards a more efficient, paperless process, reserved only for instances requiring additional documentation. Overall, the Oklahoma 511EF form encapsulates a comprehensive approach to electronic tax filing, embedding declarations and consents within a framework aimed at facilitating a smoother, more accessible filing experience for Oklahomans.

| Question | Answer |

|---|---|

| Form Name | Oklahoma Form 511Ef |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | pdf filler oklahoma for 511, FEIN, oklahoma form 511 ef, 2005 |

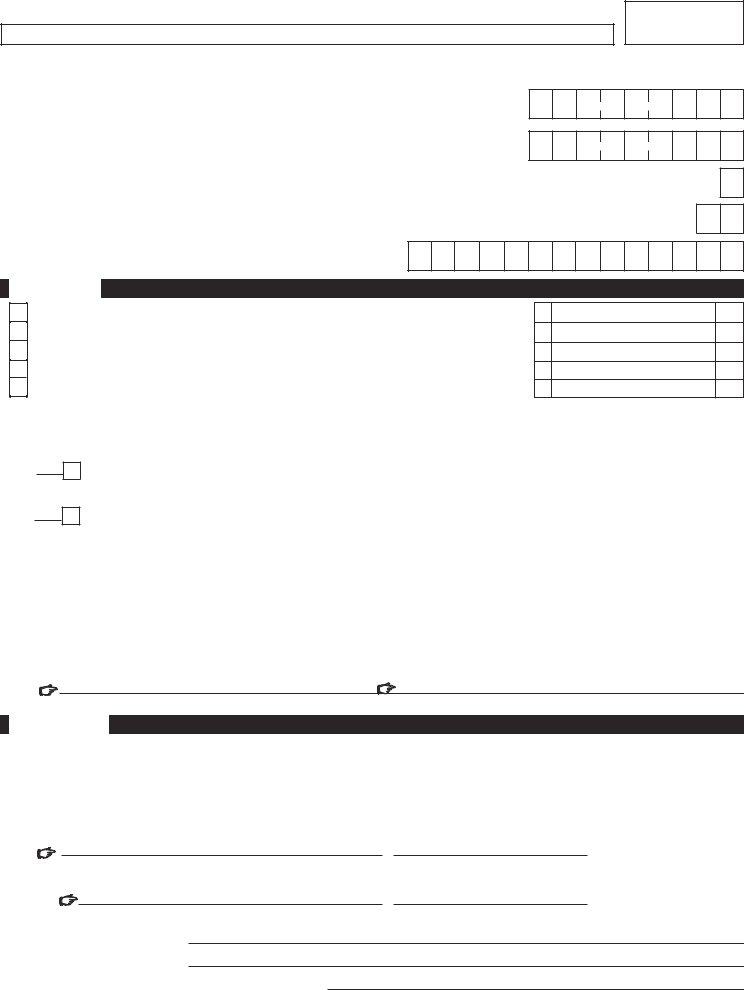

Do not mail your Oklahoma tax return - Form 511

Please see instruction on back to see if you are required to send this form to the OTC.

2005

Form 511EF

OKLAHOMA INDIVIDUAL INCOME TAX DECLARATION FOR ELECTRONIC FILING

Your first name and initial |

Last name |

|

|

If a joint return, spouse’s first name |

Last name |

|

|

Home address (number and street) |

Apartment number |

|

|

City, State, and Zip |

|

|

|

Your social security number

Spouse’s social security number

Filing status

Total number of exemptions

|

|

Declaration Control Number (DCN) 0 0 |

|

PART ONE |

TAX RETURN INFORMATION (WHOLE DOLLARS ONLY) |

|

|

1 |

Oklahoma Adjusted Gross Income (511, Line 7) |

1 |

|

2 |

Oklahoma Income Tax and Use Tax (511, Line 26) |

2 |

|

3 |

Oklahoma Income Tax Payments and Credits (511, Line 34) |

3 |

|

4 |

Refund (511, Line 39) |

4 |

|

5 |

Balance Due (511, Line 44) |

5 |

|

*For balance due return, complete line 6b below or attach payment to

6

00

00

00

00

00

|

|

|

|

PART TWO |

DECLARATION OF TAXPAYER |

|

|

|

6a

6b

I consent that my refund be directly deposited as designated in the electronic portion of my 2005 Oklahoma income tax return. If I have filed a joint return, this is an irrevocable appointment of the other spouse as an agent to receive the refund.

I authorize the Oklahoma State Treasury and its designated Financial Agent to initiate an ACH electronic funds withdrawal (direct debit) entry to the financial institution account indicated in the tax preparation software for payment of my Oklahoma taxes owed on this return. I also authorize the financial institutions involved in the processing of the electronic payment of taxes to receive confidential information necessary to answer inquiries and resolve issues related to the payment.

If I have filed a balance due return, I understand that if the Oklahoma Tax Commission does not receive full and timely payment of my tax liability, I will remain liable for the tax liability and all applicable interest and penalties.

Under penalties of perjury, I declare that I have compared the information contained on my return, with information I have provided to my Electronic Return Originator (ERO), and that the amounts described in Part One above, agree with the amounts shown on the corresponding lines of my 2005 Oklahoma income tax return. To the best of my knowledge and belief, my return is true, correct, and complete. I consent that my return, including this declaration and accompanying schedules and statements, be sent to the OTC by my ERO.

Sign

Here

Your SignatureDateSpouse’s Signature (If joint return, both must sign) Date

PART THREE DECLARATION OF ELECTRONIC RETURN ORIGINATOR (ERO) AND PAID PREPARER

I declare that I have reviewed the above taxpayer’s return and that the entries on Form

ERO Use |

|

|

Only |

|

|

ERO or Paid Preparer’s Signature |

Date |

Social Security Number or FEIN |

Paid Preparer |

|

|

Use Only |

|

|

Paid Preparer Signature |

Date |

Social Security Number or FEIN |

Firm name (or yours if |

|

|

address and zip code |

|

|

Phone number ( |

|

) |

|

Instructions on Requirement to Mail or Retain this Form

Most people do not mail the Form 511EF or any documentation to the Oklahoma Tax Commission. For most taxpayers, electronic filing is a completely paperless process in Oklahoma.

However, if your return contains any of the forms or supporting schedules shown in the table below, you are required to mail the documentation to the Oklahoma Tax Commission. Mail any items shown in the table below along with the Form 511EF to the address shown at the bottom of this form.

Please mail with the Form 511EF as a cover page. Do not mail your Oklahoma tax return (Form 511), your Federal return (Form 1040, 1040A or 1040EZ) or any withholding statements

Form Number |

Form Title |

|

|

Form |

Annualized Income Installment Method for Individuals |

|

|

Form 509 |

October 9, 2001 Tornado Tax Credit |

|

|

Form 510 |

May 3, 1999 Tornado Tax Credit |

|

|

Form 575 |

May 8 or 9, 2003 Tornado Tax Credit |

|

|

Form |

Oklahoma Net Operating Loss |

|

|

Form 573 |

Farm Income Averaging |

|

|

OSFA’s Form 1A |

Oklahoma Volunteer Firefighter Tax Credit |

|

|

Form 561 |

Oklahoma Capital Gain Deduction |

|

|

|

Include a copy of other state’s income tax return if Form 511TX is filed |

|

|

|

Any Oklahoma statements containing additional information |

|

|

If you are required to mail documentation and the Form 511EF into the OTC, please mail to:

Oklahoma Tax Comission

Income Tax

PO Box 26800

Oklahoma City OK

If no additional forms or documentation is required for your electronically filed return, do not mail Form 511EF. Retain for your records for three years.

Do not mail your Oklahoma tax return (Form 511), your Federal return (Form 1040, 1040A or 1040EZ) or any withholding statements