Oklahoma Form 511Tx can be filled out online easily. Simply open FormsPal PDF editing tool to complete the task without delay. FormsPal team is devoted to providing you the best possible experience with our tool by regularly presenting new functions and improvements. With these improvements, using our tool becomes easier than ever before! Here's what you'd want to do to get started:

Step 1: Open the PDF doc inside our tool by clicking the "Get Form Button" in the top area of this webpage.

Step 2: Using our state-of-the-art PDF file editor, it is easy to accomplish more than merely fill in blank form fields. Try all the functions and make your documents appear sublime with custom textual content added, or optimize the file's original content to perfection - all that accompanied by the capability to add any images and sign it off.

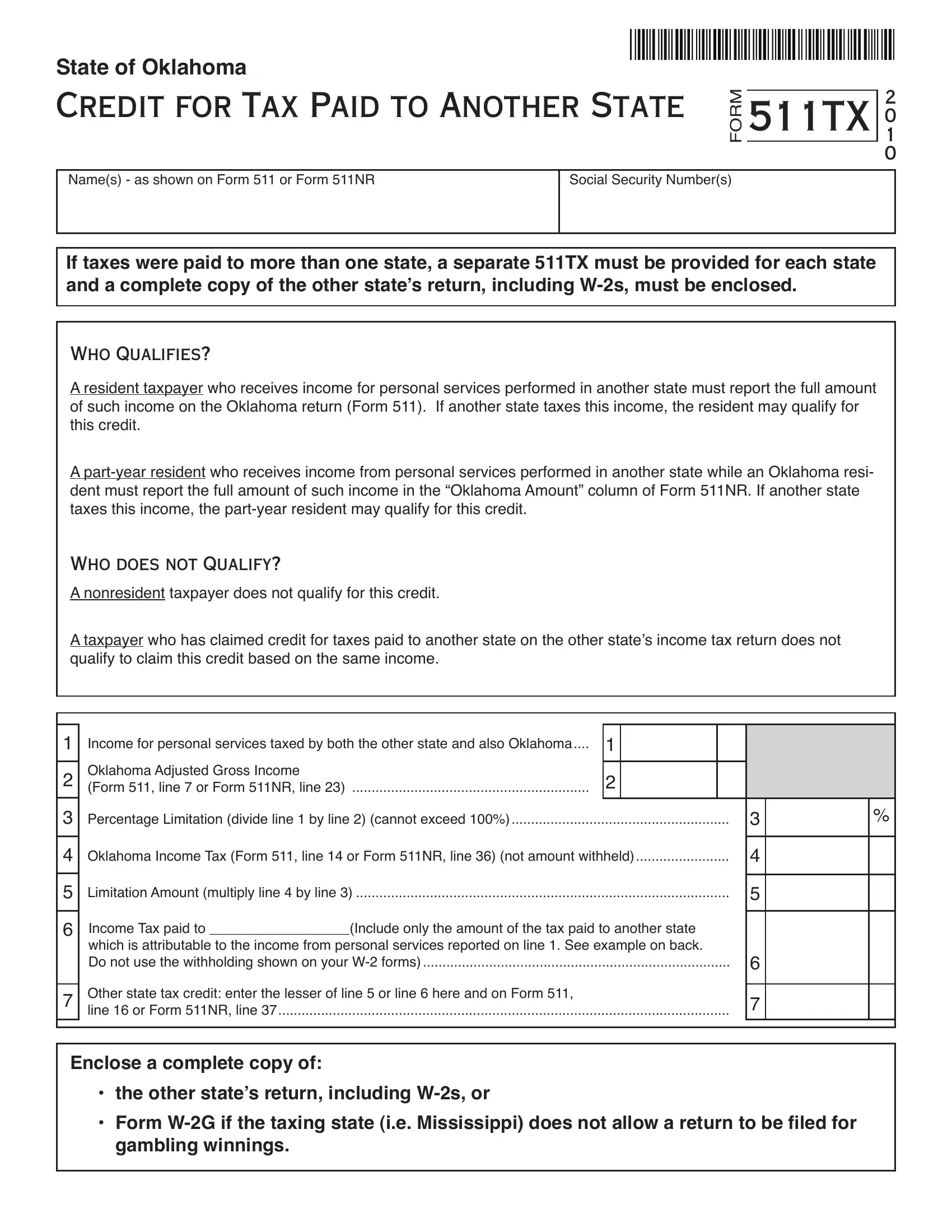

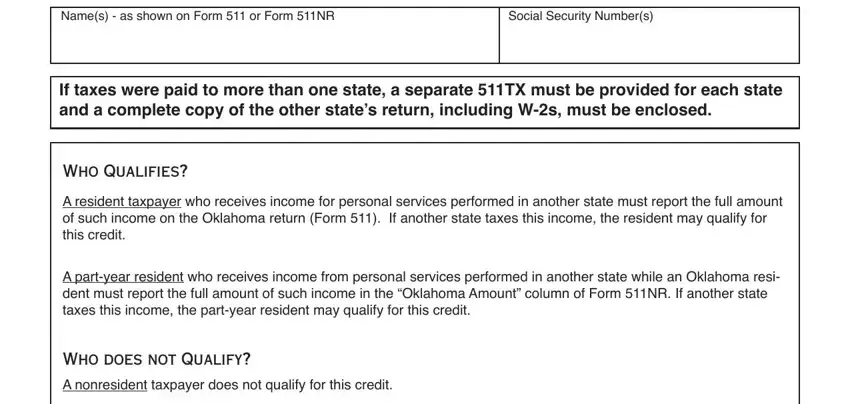

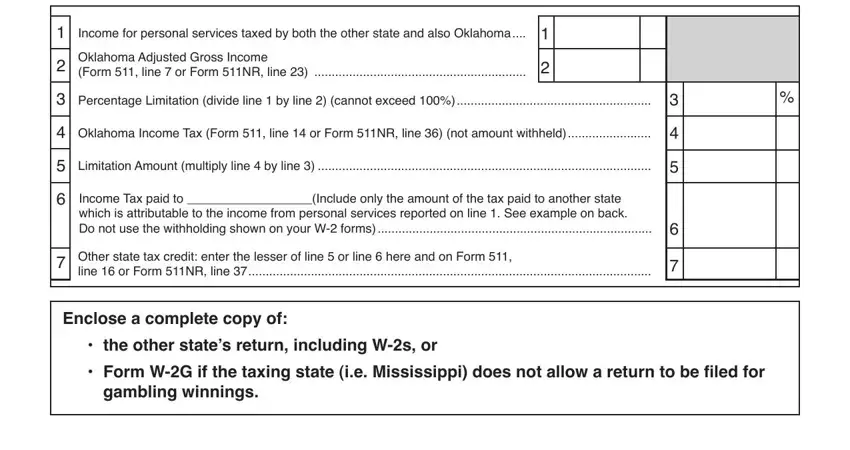

With regards to the blanks of this precise form, here's what you need to know:

1. Complete the Oklahoma Form 511Tx with a selection of major blanks. Consider all of the required information and ensure not a single thing neglected!

2. The subsequent step is usually to fill out the following fields: Income for personal services taxed, Oklahoma Adjusted Gross Income, Percentage Limitation divide line, Oklahoma Income Tax Form line or, Limitation Amount multiply line, Income Tax paid to Include only, Other state tax credit enter the, Enclose a complete copy of, the other states return including, and gambling winnings.

Always be really careful while completing Percentage Limitation divide line and gambling winnings, since this is the section where a lot of people make errors.

Step 3: Right after taking one more look at the fields you have filled in, click "Done" and you are done and dusted! Create a 7-day free trial account at FormsPal and obtain instant access to Oklahoma Form 511Tx - download, email, or change in your personal account page. FormsPal provides risk-free form completion without personal information recording or distributing. Be assured that your details are secure with us!