The Oklahoma 511X form plays a crucial role in the tax amendment process for residents of Oklahoma, ensuring that individuals can correct or update their previously filed tax returns with accuracy and compliance. While part-year and nonresidents have a different path for amendments through Form 511NR, the Oklahoma 511X form caters specifically to full-year residents aiming to amend tax returns for the year 2005 and prior. This form enables taxpayers to adjust their income, deductions, and tax liability based on new information or corrections to previously submitted data. It is essential for taxpayers considering an amendment to align with the stipulated timeframe - generally a three-year window from the original payment date for claiming a refund due to the amendment. Furthermore, amendments necessitated by changes to a Federal return must be filed within a year, emphasizing the importance of tracking both Federal and state tax obligations closely. The form also accommodates various tax situations by allowing modifications to exemptions, filing status, and income adjustments, among other elements. However, successfully navigating the amendment process requires attention to detail, including the accurate completion of designated sections, attachment of all relevant documentation such as the IRS Form 1040X or 1045 if applicable, and adhering to Oklahoma Tax Commission guidelines for submission. In essence, the Oklahoma 511X form is a foundational instrument for residents aiming to ensure their state tax responsibilities are met accurately and in compliance with prevailing tax laws and regulations.

| Question | Answer |

|---|---|

| Form Name | Oklahoma Form 511X |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | 511 X A 09 oklahoma amended tax return form |

A

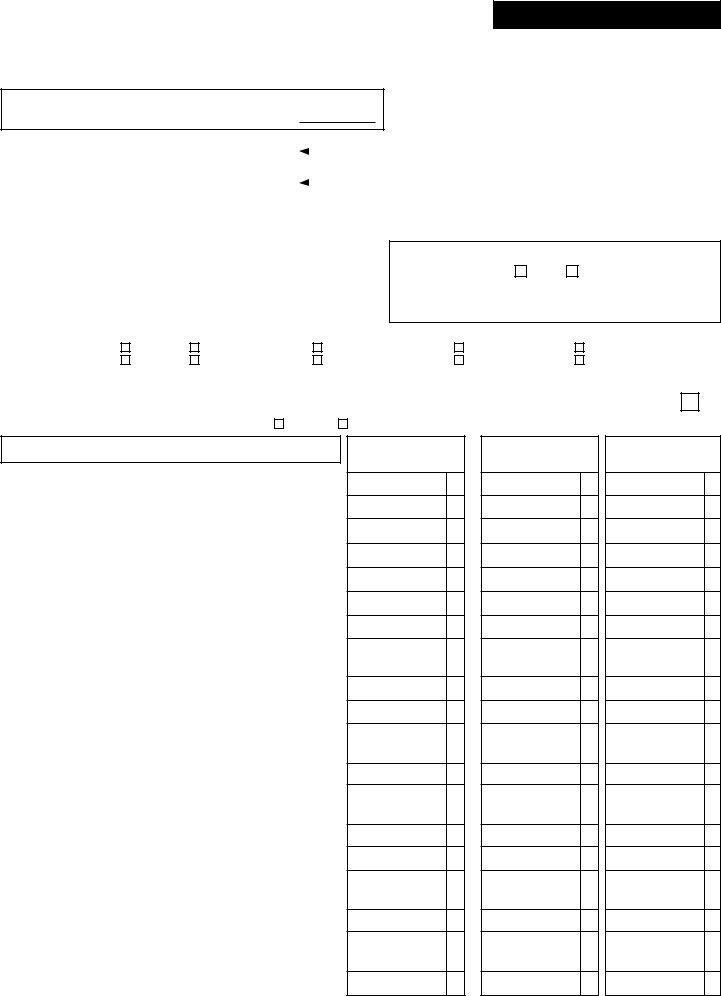

Oklahoma Amended Resident Individual Income Tax Return

BARCODE PLACEMENT

Form 511X Revised 2009

This version of Form 511X is to be

used for Tax Year 2005 and prior: Tax Year

Your Social Security Number |

|

|

|

|

|

|

Check box if |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

this taxpayer |

If a Joint Return, Spouse’s |

|

|

|

|

|

||

Social Security Number |

|

|

|

|

|

|

is deceased |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your irst name and middle initial |

Last name |

|

|

|

|

||

|

|

|

|

|

|

|

|

If a joint return, spouse’s irst name and middle initial |

Last name |

|

|

|

|

||

|

|

|

|

|

|

|

|

Present home address (number and street, including apartment number or rural route) |

|||||||

|

|

|

|

|

|

|

|

City, State and Zip |

|

Phone Number |

|||||

|

|

( |

|

) |

|

|

|

Did you ile an amended Federal return?

Yes |

No |

Enclose a copy of IRS Form 1040X or 1045 AND a copy of the “Statement of Adjustment”, IRS check, or deposit slip. IRS documents submitted after iling Form 511X may delay the processing of your return.

•Filing status claimed: (Note: Generally, your iling status must be the same as on your Federal return. See Form 511 instructions.)

|

On original return: |

Single |

Married iling joint |

|

Married iling separate |

|

||||||||||

|

On this return: |

Single |

Married iling joint |

|

Married iling separate |

|

||||||||||

• |

Number of Exemptions: Regular |

|

|

|

|

Special |

|

Blind |

|

|

Dependents |

|

||||

|

On original return: |

|

|

|

|

+ |

|

|

+ |

|

|

+ |

|

|

= |

|

|

On this return: |

|

|

|

+ |

|

|

+ |

|

+ |

|

|

= |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

Check if you or your spouse are 65 or over: |

Yourself |

Spouse |

|

||||||||||||

Head of Household |

Qualifying widow(er) |

Head of Household |

Qualifying widow(er) |

Total |

|

|

Not Required to File... |

|

|

|

Check this box if you do not |

|

|||

|

|

|

have suficient gross income |

|

|

||

|

|

|

to require you to ile a Federal Return. |

Income and Deductions...

1 |

.Federal adjusted gross income |

2 |

.Oklahoma subtractions (see instructions) |

3 |

Subtract line 2 from line 1 |

4 |

|

5 |

Subtract line 4 from line 3 |

6 |

.Oklahoma additions (see instructions) |

7 |

Oklahoma adjusted gross income (add lines 5 and 6) |

8 |

Adjustments to Oklahoma adjusted gross income |

|

(see instructions) |

9 |

.Subtract line 8 from line 7 |

10 |

Deductions and exemptions |

11 |

Percentage allowable (divide line 7 by line 3) |

|

(not to exceed 100 percent) |

12 |

.Multiply line 10 by line 11 |

13 |

Oklahoma taxable income - (method 1) |

|

subtract line 12 from 9 |

14 |

.Tax Method 1 (see instructions) |

15 |

Federal income tax liability (see instructions) |

16 |

Percentage allowable (divide line 7 by line 1) |

|

(not to exceed 100 percent) |

17 |

.Multiply line 15 by line 16 |

18 |

Oklahoma taxable income - (method 2) |

|

subtract line 17 from 13 |

19 |

.Tax Method 2 (see instructions) |

A: As Originally

Reported or as

Previously Adjusted

00 1

00 2

00 3

00 4

00 5

00 6

00 7

00 8

00 9

00 10

% 11 00 12

00 13

00 14

00 15

% 16

00 17

00 18

00 19

B: Amended

00

00

00

00

00

00

00

00

00

00

%

00

00

00

00

%

00

00

00

C: Ofice Use Only

00

00

00

00

00

00

00

00

00

00

%

00

00

00

00

%

00

00

00

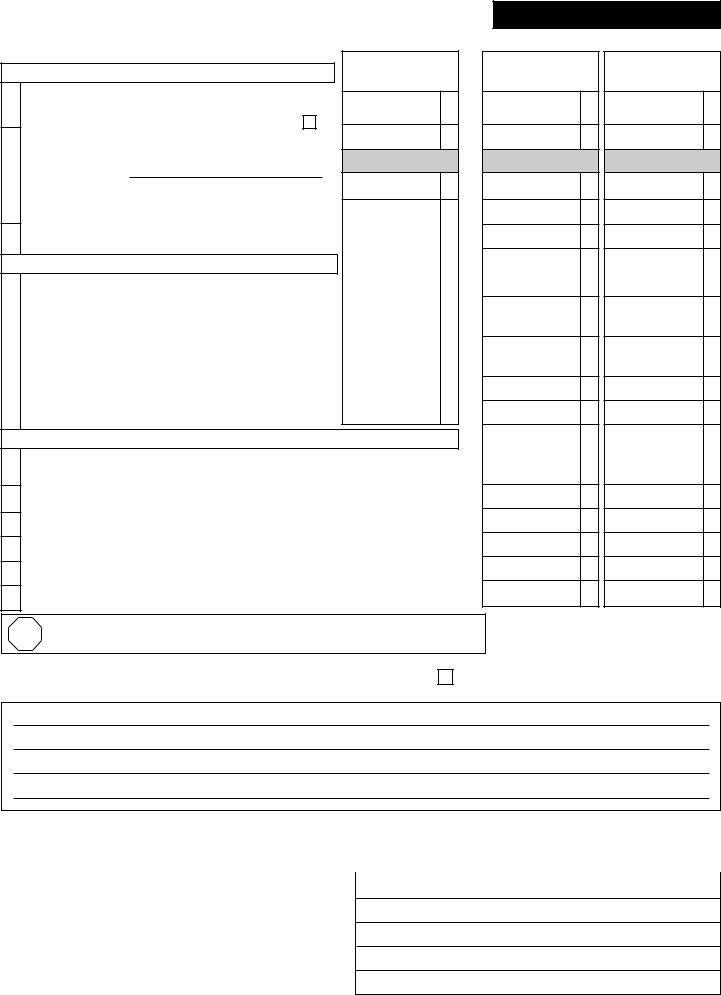

Form 511X (A) - Page 2

BARCODE PLACEMENT

Tax Liability...

20Income Tax: Enter lesser of line 14 or 19 (from front of form)

If using Farm Income Averaging, enter Form 573, line 42 and check here

21A. Oklahoma

B.Subtotal: Subtract line 21A from line 20 (not less than zero)

C.Use tax (beginning with Tax Year 2003) . . . . . . . .

22Total tax - (add lines 21B and 21C) . . . . . . . . . . . . .

Payments...

23 |

Oklahoma income tax withheld |

|

24 |

Oklahoma estimated tax paid plus amount paid |

|

|

|

with extension |

25 |

Amount paid with original return plus additional paid |

|

|

|

after it was iled |

26 |

.Refundable credits (see instructions) |

|

27 |

Total of lines 23 through 26 |

|

Refund or Amount You Owe...

A: As Originally

Reported or as

Previously Adjusted

00 20

00 21A

00 21B

00 21C |

|

00 |

22 |

|

|

00 |

23 |

00 |

24 |

00 |

25 |

00 |

26 |

00 |

27 |

B: Amended

00

00

00

00

00

00

00

00

00

00

C: Ofice Use Only

00

00

00

00

00

00

00

00

00

00

28Overpayment, if any, as shown on original return or as previously adjusted

|

by Oklahoma (see instructions) |

. . . . . . . . . 28 |

|

|

29 |

29 |

Subtract line 28 from line 27 |

. . . . . . . . . |

30 |

Refund: If line 29 is more than line 22 enter difference |

. . . . . . . . . 30 |

|

|

31 |

31 |

Tax liability: If line 22 is more than line 29 enter difference . . . . |

. . . . . . . . . |

32Interest: 1.25% per month from _______________ to ________________ 32

33Total amount due (add lines 31 and 32) please pay in full with this return . 33

00

00

00

00

00

00

00

00

00

00

00

00

STOP |

If you are changing your Oklahoma return due to a change to your |

|

Federal return, enclose proof that the IRS approved the change. |

Explain below or attach a separate schedule, if necessary, explaining the changes to income, deductions, and/or credits: (Enter the line reference number for which you are reporting a change and give the reason for each change in column “B”)

Please check here if the Oklahoma Tax Commission may discuss this return with your tax preparer.

The Oklahoma Tax Commission is not required to give actual notice to taxpayers of changes in any state tax law.

Remit to: Oklahoma Tax Commission, P.O. Box 26800, Oklahoma City, Oklahoma

Under penalties of perjury, I declare that I have iled an original return and that I have examined this return including accompanying schedules and statements, and to the best of my knowledge this amended return is true, correct and complete.

Taxpayer signature |

|

Date |

|

|

|

Spouse’s signature (if iling jointly both must sign) |

Date |

|

|

|

|

Daytime Phone Number (optional) |

|

|

( |

) |

|

|

|

|

Preparer’s signature |

Date |

Preparer’s printed name

Preparer’s Address

Preparer’s ID Number

Phone Number (if box is checked above)

()

Instructions for Form 511X

This form is for residents only.

When to File an Amended Return

Generally, to claim a refund your amended return must be iled within three years from the date tax, penalty and interest was paid. For most taxpayers, the three year period begins on the original due date of the Oklahoma tax return. Estimated tax and withholding are deemed paid on the original due date (excluding extensions).

If your Federal return for any year is changed, an amended Oklahoma return shall be iled within one year. If you amend your Federal return, it is recommended you obtain conirmation the IRS approved your Federal amendment before iling Oklahoma Form 511X. Filing Form 511X without such IRS conirmation may delay the processing of your return, however, this may be necessary to avoid the expiration of the statute of limitation.

File a separate Form 511X for each year you are amending. No amended return may encompass more than one single year.

If you discover you have made an error only on your Oklahoma return we may be able to make the corrections over the phone instead of iling Form 511X. For additional information, call our Taxpayer Assistance Division at (405)

When completing this form, it is recommended you have the Resident Individual Income Tax Instructions booklet (511 Packet) for the tax year you are amending. The packet will provide detailed explanation. If you do not have a copy, one may be downloaded from our website (www.tax.ok.gov) beginning with tax year 1997 or you may order a packet for any tax year by calling our forms request line at (405)

Before You Begin

This version of Form 511X is for Tax Year 2005 and prior years. If you need to amend for Tax Year 2006 or thereafter, visit our website and download the Form 511X for 2006 and thereafter. You may also order the form at (405)

The tax rates did not change during the tax years of 1990 - 1998. The tax rates also remained unchanged for the tax years 1999 - 2001, for tax years 2002 - 2003 and for tax years 2004 - 2005. Thus, if you are amending a 2000 return, you may refer to the tax tables for any year from 1999 - 2001.

All entries in column “B” must be substantiated by an enclosed document or your refund may be delayed. After completing your amended return, see the “When You Are Finished” section of the instructions for a complete list of necessary docu- ments you must enclose with this return.

Any additional forms, necessary to complete this amended return, can be downloaded from our website (www.tax.ok.gov) beginning with tax year 1997 or can be ordered by calling our forms request line at (405)

Select Line Instructions

Column A: Enter the amounts from your original return. However, if you previously amended that return or it was changed by the Oklahoma Tax Commission, enter the adjusted amounts.

Column B: Enter the amended amounts and explain each change on Page 2. If you need more space, attach a statement. Also, attach any schedule or form relating to the change. For any item you do not change, enter the amount from Column A in Column B. All entries in Column B must be substantiated

by an enclosed document or your refund may be delayed. Column C: Do not use. This column is for Oklahoma Tax Commission use only.

1

2

Enter the Federal adjusted gross income. Note: Enclose supporting documents for any adjustments to your Federal adjust- ed gross income.

Enter subtractions to Federal adjusted gross income, such as interest from U.S. government obligations (no IRS interest), retire- ment income, social security beneits and depletion. A complete list of subtractions can be found in the Schedule

4

Enter

spreadsheets.

6

Enter additions to Federal adjusted gross income, such as

8

Enter all adjustments to your Oklahoma adjusted gross income, such as military pay exclusion, political contributions, interest qualifying for exclusion and Indian employment exclusion. A complete list of adjustments can be found in the Schedule

10

Enter the total amount of your deductions and exemptions. Add your “Oklahoma standard deduction or Federal itemized deduc- tions” and your Oklahoma “exemption amounts”.

14The tax rates did not change during the tax years of 1990 - 1998. The tax rates also remained unchanged for tax years 1999 -

and 2001, for tax years 2002 - 2003 and for tax years 2004 - 2005. Thus, if you are amending a 2000 return, you may refer to the tax

19tables for any year from 1999 - 2001.

15

20

21

25

26

28

Enter the Federal income tax liability from your Federal return. Do not include

your Federal return for veriication.

If you have farm income, beginning in tax year 2001, you may elect to igure your tax by averaging your farm income over the previous three years. If you choose this option, you must use Form 573 to compute the tax. Note: Enclose Form 573.

A. Enter all

B. Enter the subtotal.

C. Beginning in tax year 2003, you have the ability to remit “use tax” with your income tax return. Use tax is due on purchases from

Enclose a schedule of payments by amount and date paid. Underpayment interest is based on the tax on the original return. Do not include underpayment interest in your calculations.

Oklahoma refundable credits, such as low income property tax credit (enclose Form

This includes all amounts refunded to you, applied to next year’s estimated tax and donated from your refund (for example, a donation to the Wildlife Diversity Program).

If you originally iled a Form 511, use the amount from the line shown here: |

|

|

|||

2000: line 57 |

2001: line 31 |

2002: line 32 |

2003: line 34 |

2004: line 34 |

2005: line 35 |

30Total amount of overpayment must be refunded. None can be placed in estimated tax for the following year.

32Compute interest on your income tax liability only. Do not compute interest on the portion of your tax liability that represents use tax.

When You are Finished

Enclose a copy of the following support documents, if applicable:

•Form 1040X (Amended Federal Income Tax Return) or Form 1045 (Application for Federal Tentative Return),

•Proof that IRS has approved the claim, such as the statement of adjustment, any correspondence from IRS, or the deposit slip of your Federal refund,

•Revenue Agent Report (RAR), CP2000 or other notiication of an assessment or a change made by the IRS,

•Additional Forms

•Forms, schedules or other documentation to substantiate any of the entries in Column B of Form 511X as indicated in the Select Line Instructions.

Do not enclose any correspondence other than those documents required for your amended return. Do not enclose amendments for different years in the same envelope. Use a separate envelope for each tax year.

Sign your return and mail it, along with all required documents to: Oklahoma Tax Commission, P.O. Box 26800, Oklahoma City, OK