With the help of the online PDF tool by FormsPal, you're able to fill in or modify Oklahoma Form 512 X right here. In order to make our tool better and less complicated to utilize, we constantly design new features, considering suggestions coming from our users. For anyone who is looking to get going, this is what it takes:

Step 1: Just press the "Get Form Button" above on this page to get into our form editing tool. There you'll find everything that is needed to fill out your document.

Step 2: The editor provides the ability to change your PDF form in a range of ways. Enhance it with any text, adjust what's already in the file, and put in a signature - all within a few clicks!

Be mindful while filling out this form. Make certain each field is filled in properly.

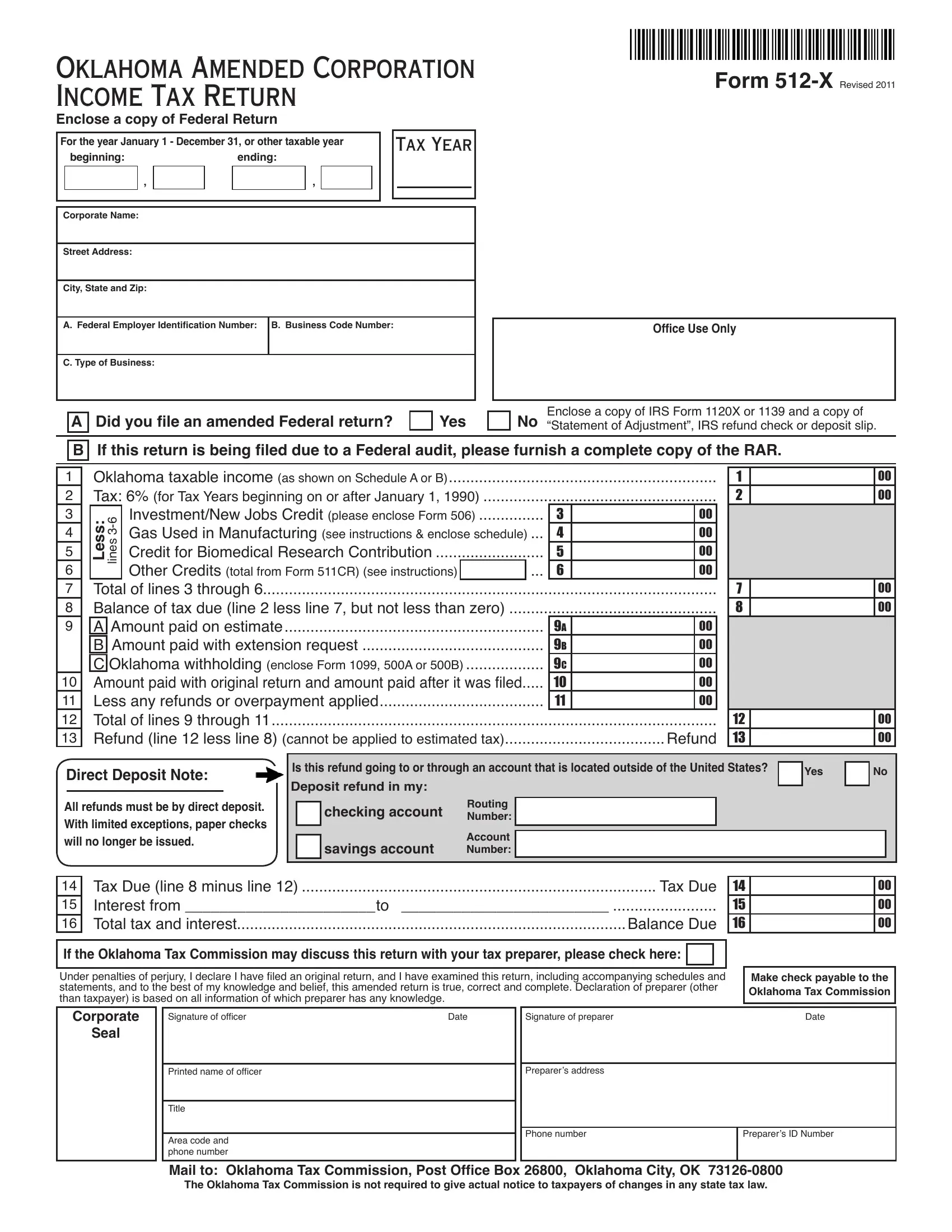

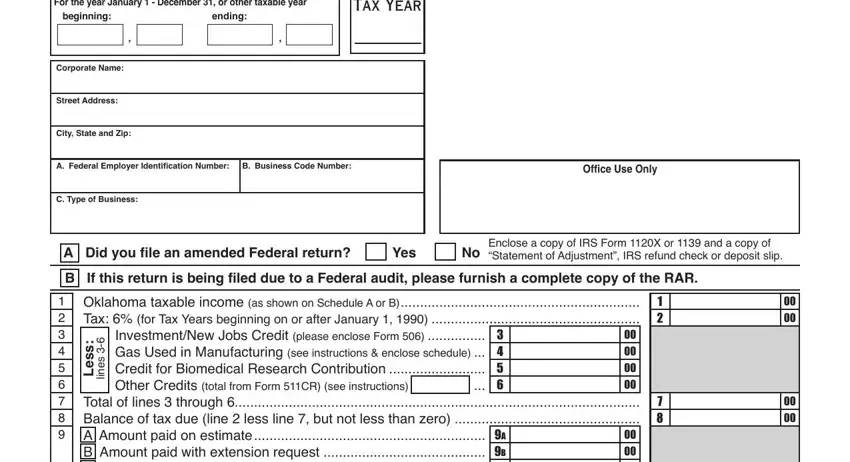

1. You have to complete the Oklahoma Form 512 X correctly, thus take care while filling in the parts that contain all these fields:

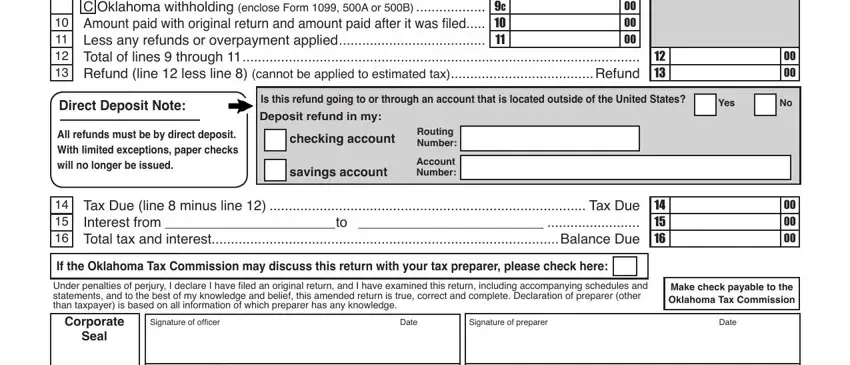

2. Your next step is usually to complete the next few blanks: Yes, If this return is being iled due, Direct Deposit Note All refunds, Is this refund going to or through, savings account, Routing Number Account Number, Tax Due line minus line Tax Due, If the Oklahoma Tax Commission may, Make check payable to the Oklahoma, Corporate, Seal, Signature of oficer, Date, Signature of preparer, and Date.

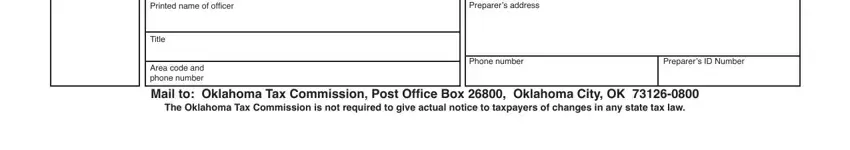

3. In this particular stage, take a look at Printed name of oficer, Title, Area code and phone number, Preparers address, Phone number, Preparers ID Number, Mail to Oklahoma Tax Commission, and The Oklahoma Tax Commission is not. Every one of these should be taken care of with highest precision.

In terms of The Oklahoma Tax Commission is not and Preparers address, make certain you do everything properly here. These two are definitely the key fields in the file.

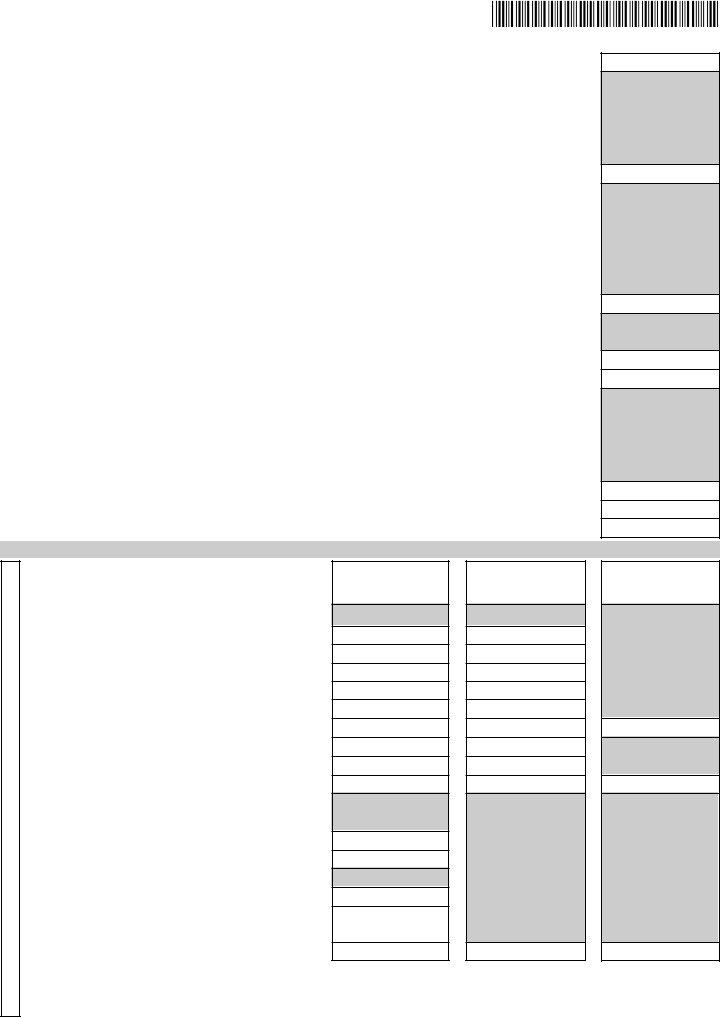

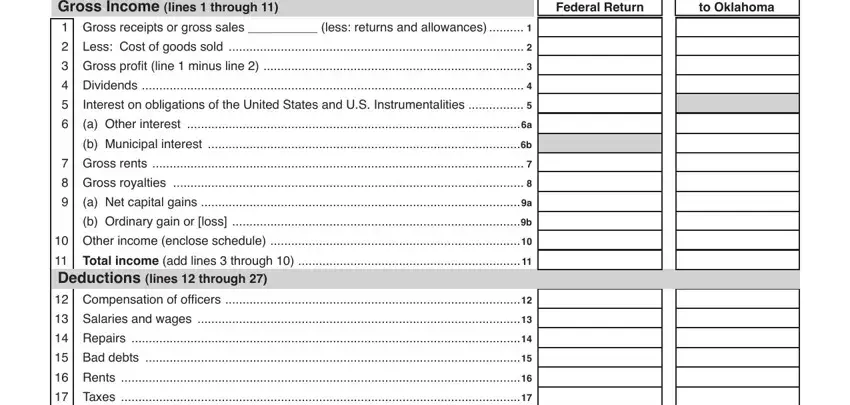

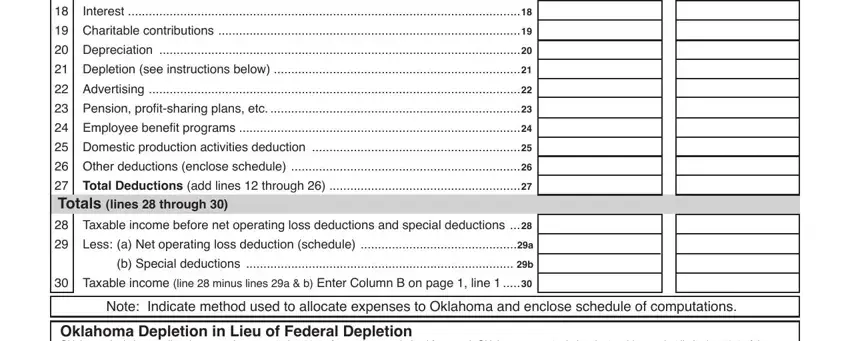

4. You're ready to fill in the next part! In this case you will have these As reported on Federal Return, Total applicable to Oklahoma, and Important All applicable lines and empty form fields to fill out.

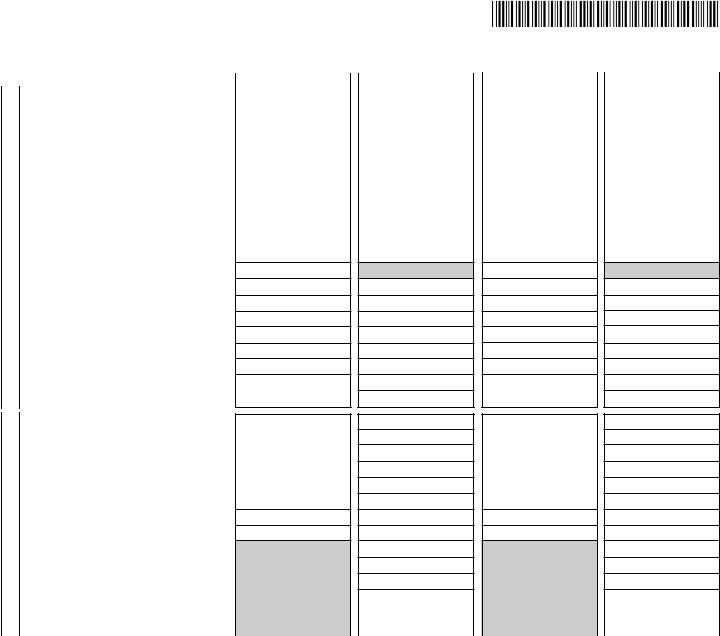

5. The pdf must be finished within this part. Here you will notice a full set of blank fields that require appropriate information for your form submission to be accomplished: Important All applicable lines and, Note Indicate method used to, and Oklahoma Depletion in Lieu of.

Step 3: Ensure the details are correct and click "Done" to complete the project. Right after registering afree trial account here, you will be able to download Oklahoma Form 512 X or send it through email immediately. The form will also be at your disposal via your personal account menu with your adjustments. FormsPal offers safe form tools without personal data record-keeping or distributing. Feel safe knowing that your details are safe with us!