Form Rmft 5 Us X can be completed online without any problem. Just open FormsPal PDF editor to perform the job quickly. Our editor is continually evolving to provide the very best user experience achievable, and that's due to our dedication to continuous development and listening closely to comments from customers. It merely requires a couple of simple steps:

Step 1: Hit the orange "Get Form" button above. It will open our editor so that you could start filling out your form.

Step 2: The editor helps you change your PDF document in various ways. Improve it by adding personalized text, correct existing content, and include a signature - all at your convenience!

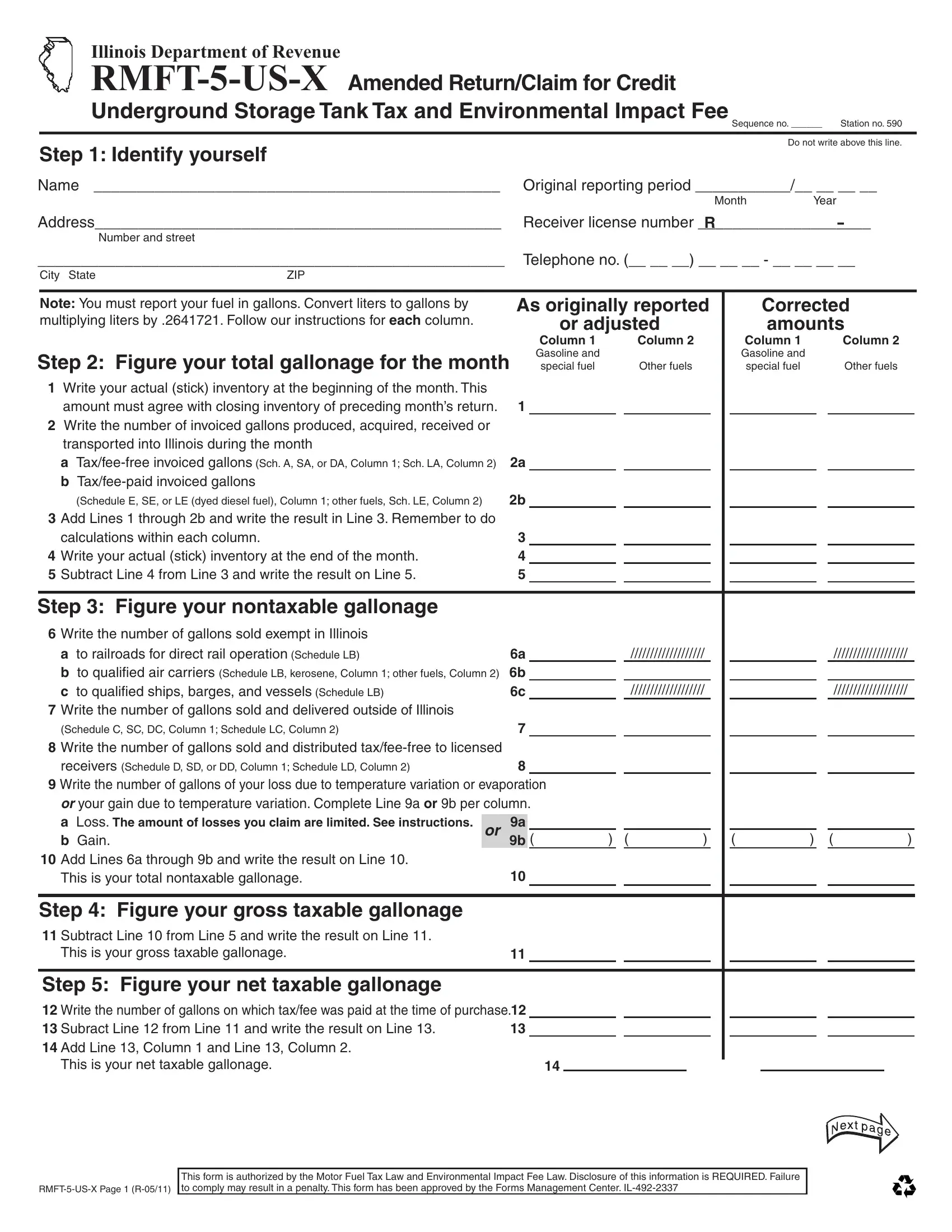

In an effort to fill out this PDF form, be sure you provide the information you need in each and every field:

1. Start filling out the Form Rmft 5 Us X with a number of major blank fields. Get all of the necessary information and make certain absolutely nothing is omitted!

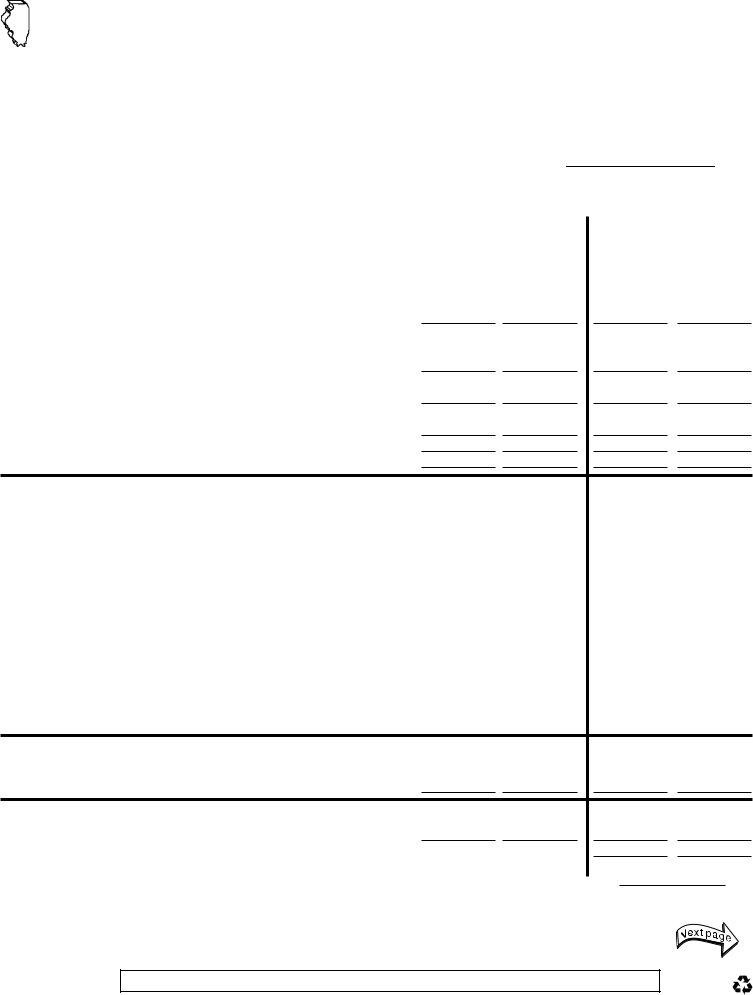

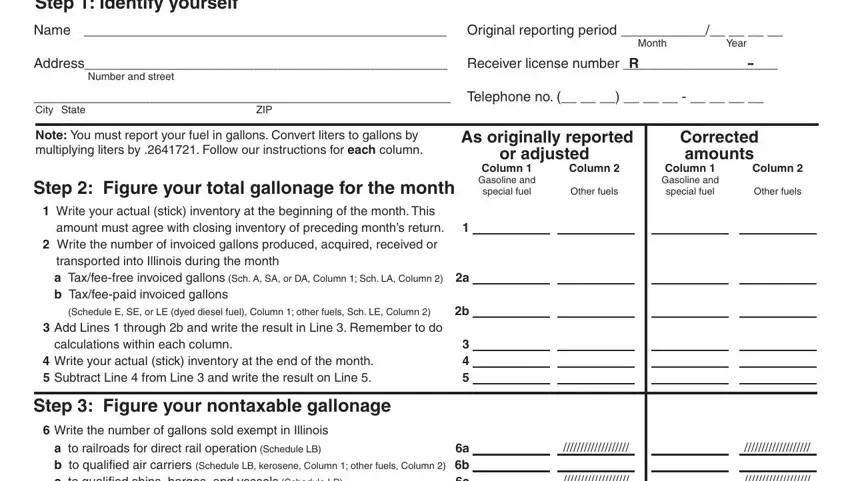

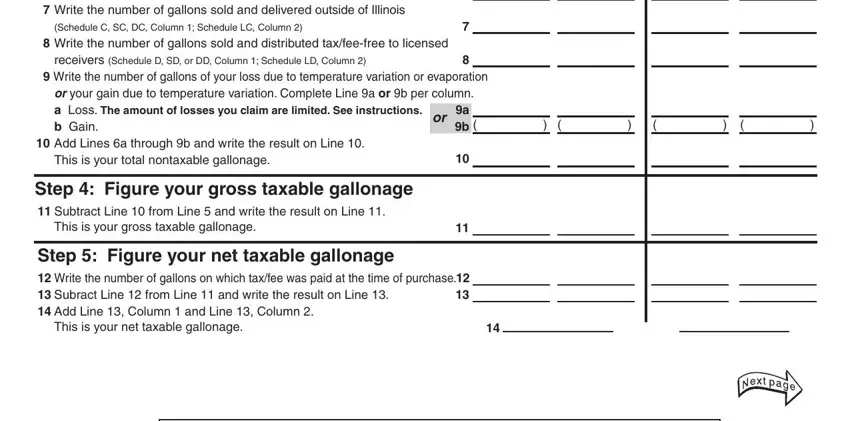

2. Now that the last segment is completed, you're ready include the needed specifics in a b to qualified air carriers, receivers Schedule D SD or DD, Write the number of gallons of, or your gain due to temperature, b Gain, Add Lines a through b and write, Step Figure your gross taxable, This is your gross taxable, Step Figure your net taxable, and This is your net taxable gallonage allowing you to progress to the third step.

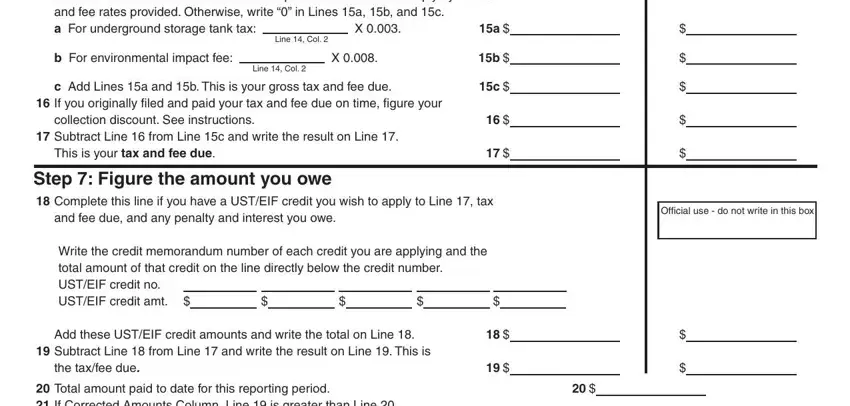

3. Completing Step Figure your tax and fee, Line Col, b For environmental impact fee, Line Col, c Add Lines a and b This is your, If you originally filed and paid, collection discount See, This is your tax and fee due, Step Figure the amount you owe, and fee due and any penalty and, total amount of that credit on the, Write the credit memorandum number, Add these USTEIF credit amounts, Subtract Line from Line and, and the taxfee due is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

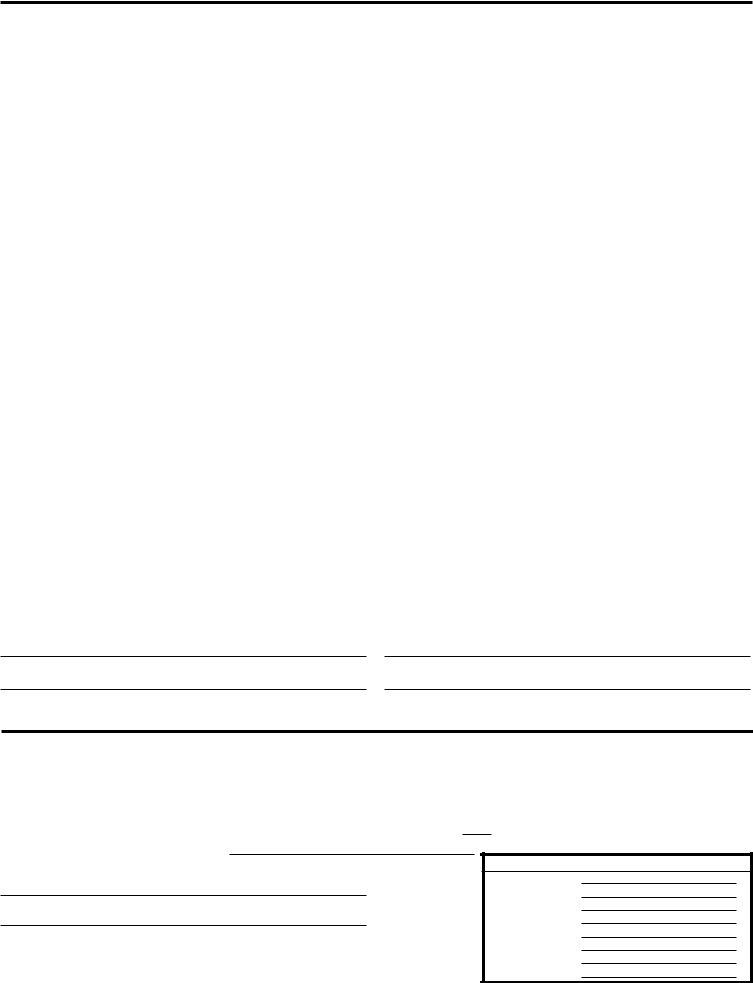

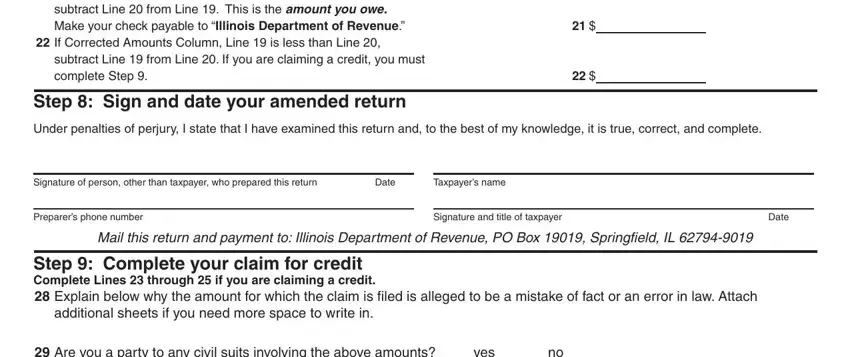

4. This specific subsection arrives with all of the following blanks to fill out: subtract Line from Line This is, Total amount paid to date for, subtract Line from Line If you, Step Sign and date your amended, Under penalties of perjury I state, Signature of person other than, Date, Preparers phone number, Taxpayers name, Signature and title of taxpayer, Date, Mail this return and payment to, Step Complete your claim for, additional sheets if you need more, and Are you a party to any civil.

Always be extremely careful when completing Signature of person other than and Under penalties of perjury I state, since this is the part in which most users make errors.

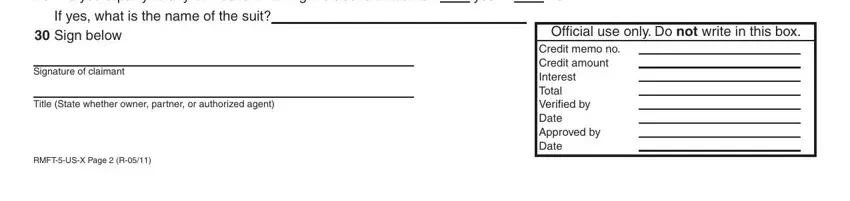

5. The very last point to submit this form is integral. You'll want to fill in the displayed blank fields, which includes Are you a party to any civil, yes, If yes what is the name of the suit, Sign below, Signature of claimant, Title State whether owner partner, RMFTUSX Page R, Official use only Do not write in, and Credit memo no Credit amount, prior to using the pdf. Failing to do it can end up in a flawed and possibly unacceptable document!

Step 3: Just after proofreading the filled out blanks, press "Done" and you're all set! Join FormsPal now and instantly get access to Form Rmft 5 Us X, ready for download. All modifications made by you are saved , enabling you to edit the document later as required. FormsPal guarantees risk-free document editor without personal data recording or distributing. Rest assured that your information is secure with us!