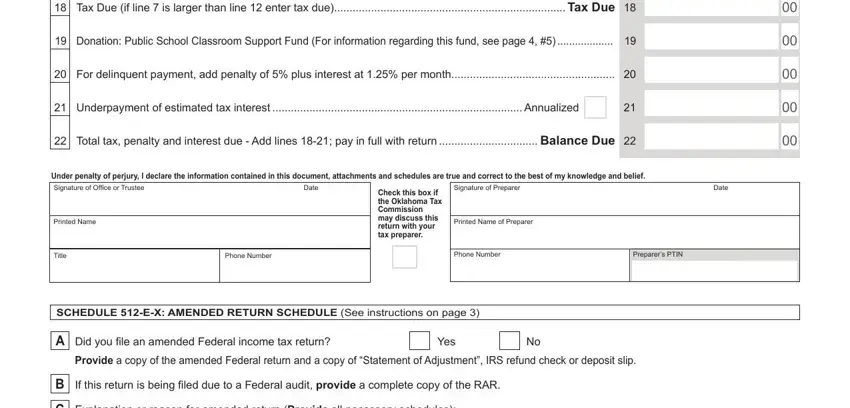

2020 Form 512E - Page 2 - Return of Organization Exempt from Income Tax

Schedule 512E-X: Amended Return Schedule

Did you file an amended Federal income tax return? |

|

Yes |

|

No |

Provide a copy of the amended Federal return and a copy of “Statement of Adjustment”, IRS refund check or deposit slip.

If this return is being filed due to a Federal audit, furnish a complete copy of the RAR.

Explanation or Reason for Amended Return (Provide all necessary schedules):

____________________________________________________________________________________________________

____________________________________________________________________________________________________

Instructions for filing an Amended Return

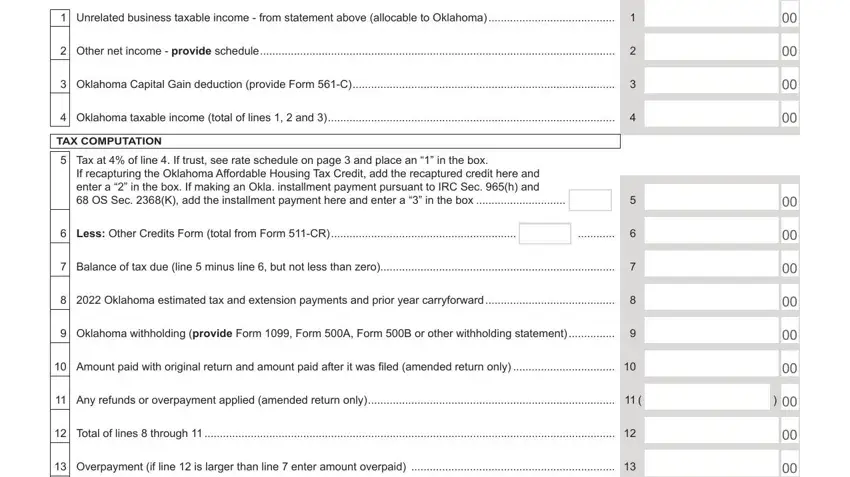

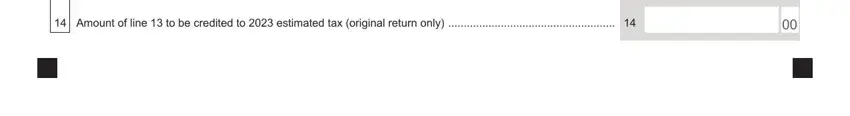

When filing an amended return, place an “X” in the Amended Return check-box at the top of page 1. Enter any amount(s) paid with the original return plus any amount(s) paid after it was filed on line 10. Enter any refund previously received or overpayment applied on line

11. Complete the Amended Return Schedule, Schedule 512E-X above.

Provide the amended Federal return and proof of disposition by the Internal Revenue Service when applicable.

An overpayment on an amended return may not be credited to estimated tax, but will be refunded. The amount applied to estimated tax on the original return cannot be adjusted.

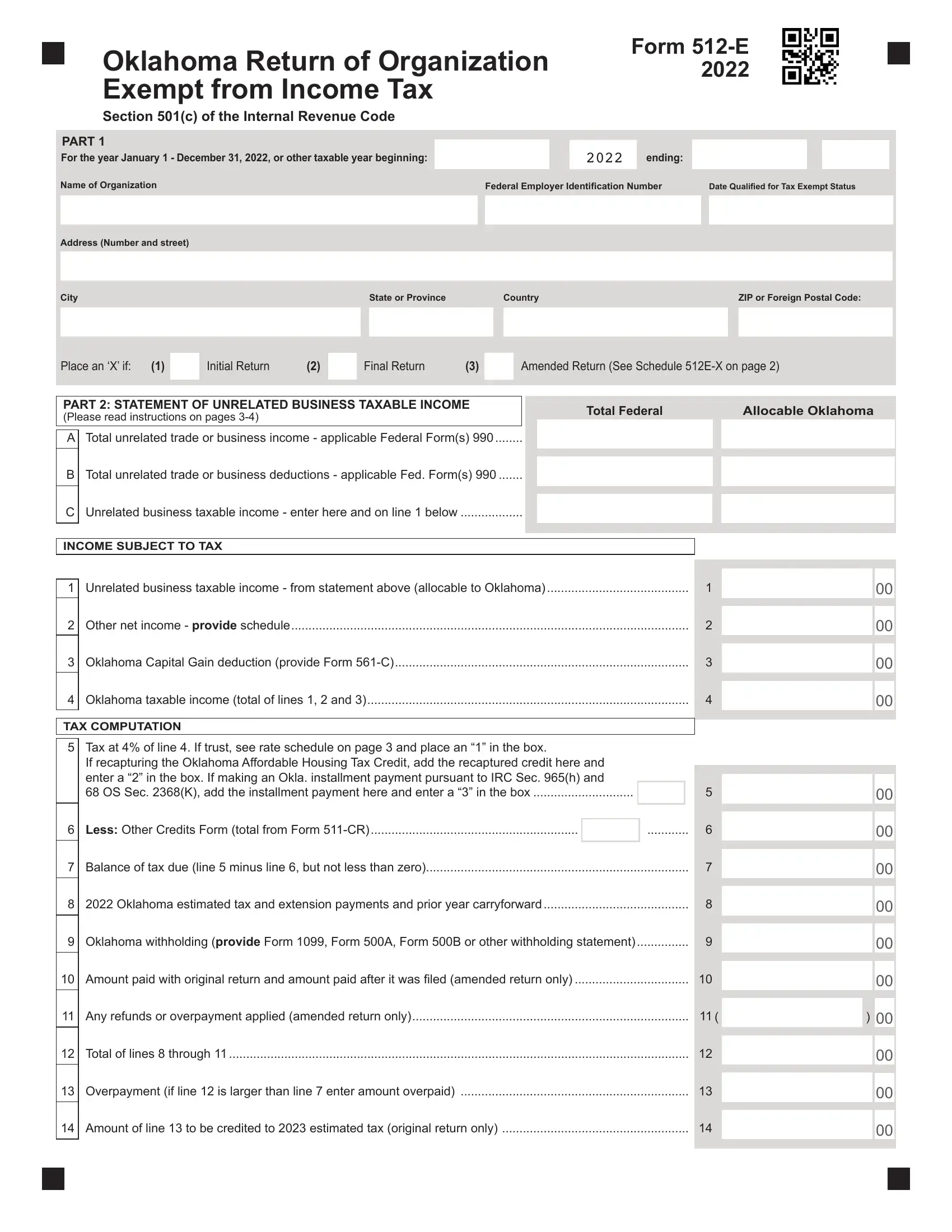

General Instructions

Every organization shall make a return for each year. 68 Oklahoma Statutes (OS) Section 2368.

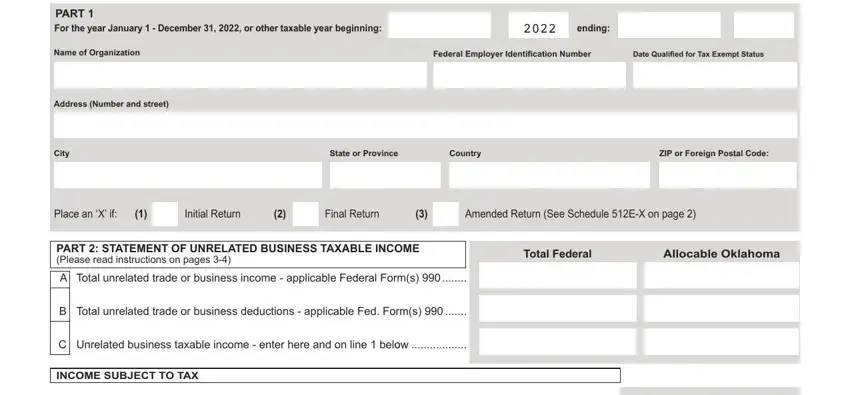

Part 1 and the signature section must be completed by all organizations. If you were required to file an annual information return with the Internal Revenue Service, enclose a copy of the information return including any supporting schedules (e.g. Form 990, 990-EZ, 990-PF).

Part 2 is to be completed by organizations who have unrelated trade or business income. If you were required to file an income tax return with the Internal Revenue Service, enclose a copy of the tax return including any supporting schedules (e.g. Form 990-T).

Corporate returns shall be due no later than 30 days after the due date established under the Internal Revenue Code. Exempt Organizations are subject to tax on unrelated business income. 68 OS Sec. 2359.

Investment income of Exempt Organizations subject to Federal Excise tax is not subject to Oklahoma Income Tax; however, any in- come subject to income tax under the Internal Revenue Code is subject to Oklahoma Income Tax.

Complete the Oklahoma Statement of Unrelated Business Income and attach a schedule of any other taxable income.

Total Unrelated Trade or Business Deductions includes the “specific deduction” allowed on the Federal return.

If you do not have a Federal Employer Identification Number, you may obtain one by visiting the IRS website at www.irs.gov.

If you are a member, either directly or indirectly, of an electing pass-through entity (PTE) subtract Oklahoma income and add Oklahoma

losses covered by the election pursuant to the provisions of the Pass-Through Entity Act of 2019. Attach a schedule listing the PTE, federal identification number, the year of the election, federal taxable income (loss) and Oklahoma taxable income (loss) that is covered by the election pursuant to this Act. Also attach a copy of the OTC acknowledgement letter received by the PTE. (68 O.S. §2355.1P-4).

Line 5 - TAX

The income tax rate is 6%.

Trust: If the exempt organization is a trust, the following rates apply. Enter a ‘1’ in the box on Form 512-E, line 5.

If taxable income is: At least |

- |

But less than |

|

|

|

|

|

|

-0- |

- |

1,000 |

|

Pay |

1/2 of 1% of Taxable Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

1,000 |

- |

2,500 |

|

Pay |

5.00 |

+ |

1% |

over |

1,000 |

|

|

|

|

|

|

|

|

|

|

|

2,500 |

- |

3,750 |

|

Pay |

20.00 |

+ |

2% |

over |

2,500 |

|

|

|

|

|

|

|

|

|

|

|

3,750 |

- |

4,900 |

|

Pay |

45.00 |

+ |

3% |

over |

3,750 |

|

|

|

|

|

|

|

|

|

|

|

4,900 |

- |

7,200 |

|

Pay |

79.50 |

+ |

4% |

over |

4,900 |

|

|

|

|

|

|

|

|

|

|

7,200 |

|

over |

Pay |

171.50 |

+ |

5% |

over |

7,200 |

Recapture of the Oklahoma Affordable Housing Tax Credit:

If under IRC Section 42 a portion of any federal low-income housing credits taken on a qualified project is required to be recaptured during the first 10 years after a project is placed in service, the taxpayer claiming Oklahoma Affordable Housing Tax Credits with respect

to such project shall also be required to recapture a portion of such credits. The amount of Oklahoma Affordable Housing Tax Credits subject to recapture is proportionally equal to the amount of federal low-income housing credits subject to recapture. Add the recap- tured credit to the Oklahoma income tax and enter a “2” in the box on Form 512-E, line 5.

Making an Oklahoma installment payment pursuant to IRC Section 965(h):

If a taxpayer elected to make installment payments of tax due pursuant to the provisions of subsection (h) of Section 965 of the IRC, such election may also apply to the payment of Oklahoma income tax, attributable to the income upon which such installment payments are based. Add the installment payment to the Oklahoma income tax and enter a “3” in the box on Form 512-E, line 5. Provide a sched- ule of the tax computation. 68 O.S. Sec. 2368(K).

Mail to: Oklahoma Tax Commission • PO Box 26800 • Oklahoma City, OK 73126-0800

2020 Form 512E - Page 3 - Return of Organization Exempt from Income Tax

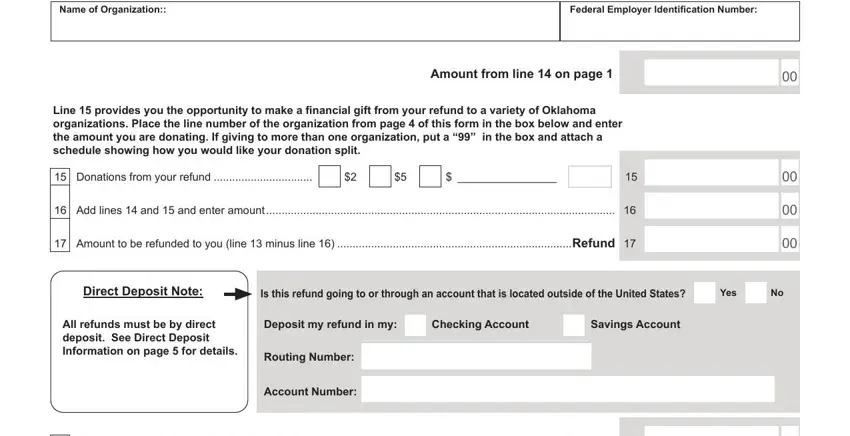

Donations from Refund

1 - Support of Programs for Volunteers to Act as Court Appointed Special Advocates for Abused or Neglected Children

You may donate from your tax refund to support programs for volunteers to act as Court Appointed Special Advocates for abused or

neglected children. Donations will be placed in the Income Tax Checkoff Revolving Fund for Court Appointed Special Advocates. Monies will be expended by the Office of the Attorney General for the purpose of providing grants to the Oklahoma CASA Association.

2 - Indigent Veteran Burial Program

You may donate from your tax refund to support the Oklahoma Department of Veterans Affairs Indigent Veteran Burial Program. Monies will be expended by the Oklahoma Department of Veterans Affairs to provide reimbursement to a cemetery or funeral home for costs incurred

burying an indigent veteran; provided, the maximum reimbursement shall not exceed $500 per veteran. If you are not receiving a refund, you may still donate. Mail your contribution to: Oklahoma Department of Veterans Affairs, P.O. Box 53067, Oklahoma City, OK 73152.

3 - Support the Oklahoma General Revenue Fund

You may donate from your tax refund to support the General Revenue Fund of the State of Oklahoma. Appropriation of such funds will be

subject to the provisions of Section 23 of Article X of the Oklahoma Constitution. Expenditures from the fund will be made upon warrants issued by the State Treasurer against claims filed as prescribed by law with the Director of the Office of Management and Enterprise Services

for approval and payment.

4 - Oklahoma Emergency Responders Assistance Program

You may donate from your tax refund to support the Oklahoma Emergency Responders Assistance Program. Monies will be expended by the Department of Public Safety for the purpose of providing grants to the Program for post critical incident care to all emergency first responders

and their families who are experiencing emotional trauma. If you are not receiving a refund, you may still donate. Mail your contribution to: Oklahoma Department of Public Safety, Finance Department, Re: Oklahoma Emergency Responders Assistance Program, P.O. Box 11415, Oklahoma City, OK 73136-0415.

5 - Support of Folds of Honor Scholarship Program

You may donate from your tax refund to support the Folds of Honor Foundation. Folds of Honor is a 501(c)(3) charitable organization that

provides scholarships for K through 12 and post-secondary education for children and spouses of military service men and women fallen or disabled while serving on active duty. If you are not receiving a refund, you may still donate to Folds of Honor. Mail your contribution to: Folds of Honor Foundation, 5800 North Patriot Drive, Owasso, OK 74055.

6 - Support the Wildlife Diversity Fund

You may donate from your tax refund to support the conservation of rare or declining fish and wildlife along with common species not hunted or fished. Donations to the Oklahoma Department of Wildlife Conservation’s Wildlife Diversity program supports field surveys of animals

considered to be of greatest conservation need, as well as educational wildlife programs for all Oklahomans. Tax deductible donations to the Wildlife Diversity Fund also can be made at wildlifedepartment.com or by mail: P.O. Box 53465, Oklahoma City, Oklahoma 73152.

7 - Support of Programs for Regional Food Banks in Oklahoma

You may donate from your tax refund to support the Regional Food Bank of Oklahoma and the Community Food Bank of Eastern Oklahoma

(Oklahoma Food Banks). The Oklahoma Food Banks are the largest hunger-relief organizations in the state – distributing food to charitable

and faith-based feeding programs throughout all 77 counties in Oklahoma. Your donation will be used to help provide food to the more than

500,000 Oklahomans at risk of hunger on a daily basis. If you are not receiving a refund, you may still donate. Mail your contribution to: Oklahoma Department of Human Services, Revenue Processing Unit, Re: Programs for OK Food Banks, P.O. Box 248893, Oklahoma City, OK 73124.

8 - Public School Classroom Support Fund

You may donate from your tax refund to support the Public School Classroom Support Revolving Fund, which will be used by the State Board of Education to provide one or more grants annually to public school classroom teachers. Grants will be used by the classroom teacher

for supplies, materials, or equipment for the class or classes taught by the teacher. Grant applications will be considered on a statewide competitive basis. You may also mail a donation to: Oklahoma State Board of Education, Public School Classroom Support Fund, Office of

the Comptroller, 2500 North Lincoln Boulevard, Room 415, Oklahoma City, OK 73105-4599.

9 - Oklahoma Pet Overpopulation Fund

You may donate from your tax refund to support the Oklahoma Pet Overpopulation Fund. Monies placed in this fund will be expended for

the purpose of developing educational programs on pet overpopulation and for implementing spay/neuter efforts in this state. If you are not receiving a refund, you may still donate. Mail your contribution to: Oklahoma Department of Agriculture, Food and Forestry, Animal Industry Division, 2800 North Lincoln Blvd., Oklahoma City, OK 73105.

10 - Support the Oklahoma AIDS Care Fund

You may donate from your tax refund to support the Oklahoma AIDS Care Fund. Monies will be expended by the Department of Human Services for the purpose of providing grants to the Fund for purposes of emergency assistance, advocacy, education, prevention and collaboration with other entities. If you are not receiving a refund, you may still donate. Mail your contribution to: Oklahoma Department of Human Services, Revenue Processing Unit, Re: OK Aids Care Fund, P.O. Box 248893, Oklahoma City, OK 73124.

11- Oklahoma Silver Haired Legislature and Alumni Association Programs

You may donate from your tax refund to support the Oklahoma Silver Haired Legislature and their Alumni Association activities. The Oklahoma Silver Haired Legislature was created in 1981 as a forum to educate senior citizens in the legislative process and to highlight the needs of older persons to the Oklahoma State Legislature. Monies generated from donations will be used to fund expenses of the Silver Haired Legislators, training sessions, interim studies and advocacy activities. If you are not receiving a refund, you may still donate. Mail your contribution to: Oklahoma Silver Haired Legislature and Alumni, P.O. Box 25352, Oklahoma City, OK 73125.

2020 Form 512E - Page 4 - Return of Organization Exempt from Income Tax

Direct Deposit Information

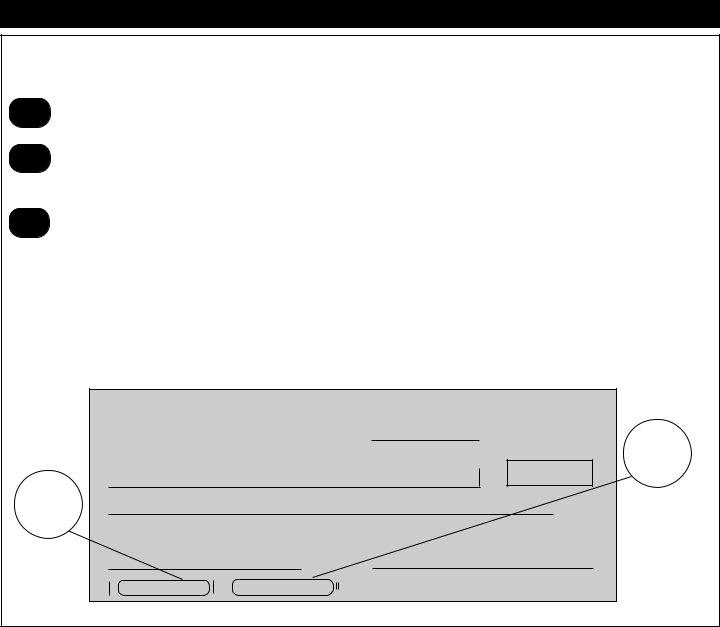

Complete the direct deposit section on the tax return to have the refund directly deposited into your account at a bank or financial institution. Refunds, with limited exceptions, must be made by direct deposit.

1Place an ‘X’ in the appropriate box as to whether the refund will be going into a checking or savings account. Please keep in mind you will not receive notification of the deposit.

2Fill out the routing number. The routing number must be nine digits. Using the sample check shown below, the routing number is 120120012. If the first two digits are not 01 through 12 or 21 through 32, the direct deposit will fail to process.

3 |

Enter your account number. The account number can be up to 17 characters (both numbers and |

letters). Include hyphens but omit spaces and special symbols. Enter the number from left to right |

and leave any unused boxes blank. On the sample check shown below, the account number is 2020268620.

Please Note: The OTC is not responsible if a financial institution refused a direct deposit. If a direct deposit is refused, a check

will be issued to the address shown on the tax return.

WARNING! Due to electronic banking rules, the OTC will NOT allow direct deposits to or through foreign financial institutions. If you use a foreign financial institution, you will be issued a paper check.

|

ABC Corporation |

1234 |

|

|

123 Main Street |

15-0000/0000 |

|

|

Anyplace, OK 00000 |

|

Account |

|

|

|

|

|

PAY TO THE |

SAMPLE |

$ |

Number |

|

|

|

ORDER OF |

|

|

Routing |

|

DOLLARS |

|

|

Number |

|

|

|

|

|

|

|

ANYPLACE BANK |

|

|

|

Anyplace, OK 00000 |

SAMPLE |

Note: The routing |

|

For |

|

and account numbers |

|

|

may appear in |

|

|

|

|

|

:120120012 : 2020268620 |

1234 |

different places on |

|

your check. |

|

|

|

|