You may complete FEINs effectively in our online PDF tool. To maintain our editor on the leading edge of efficiency, we aim to put into action user-oriented features and improvements regularly. We are routinely grateful for any feedback - play a vital role in revampimg PDF editing. All it requires is a couple of simple steps:

Step 1: First of all, access the pdf editor by pressing the "Get Form Button" at the top of this site.

Step 2: The editor provides you with the capability to customize nearly all PDF files in a range of ways. Enhance it with personalized text, correct original content, and put in a signature - all readily available!

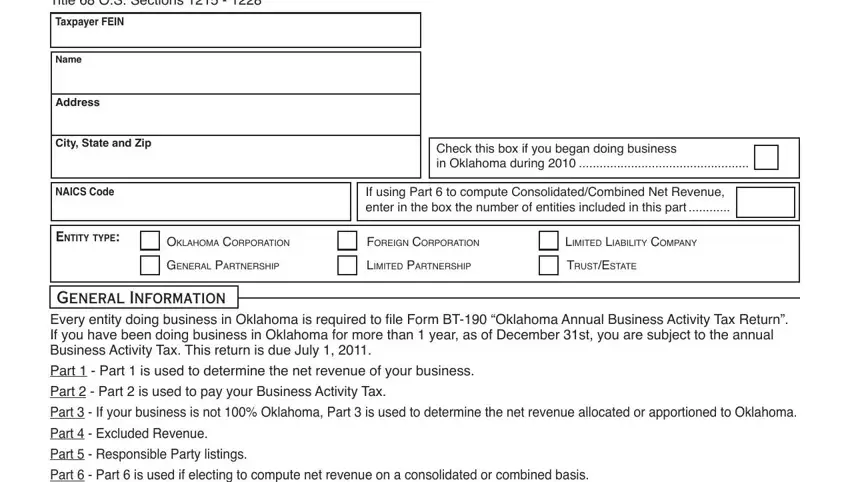

As for the fields of this precise PDF, this is what you need to do:

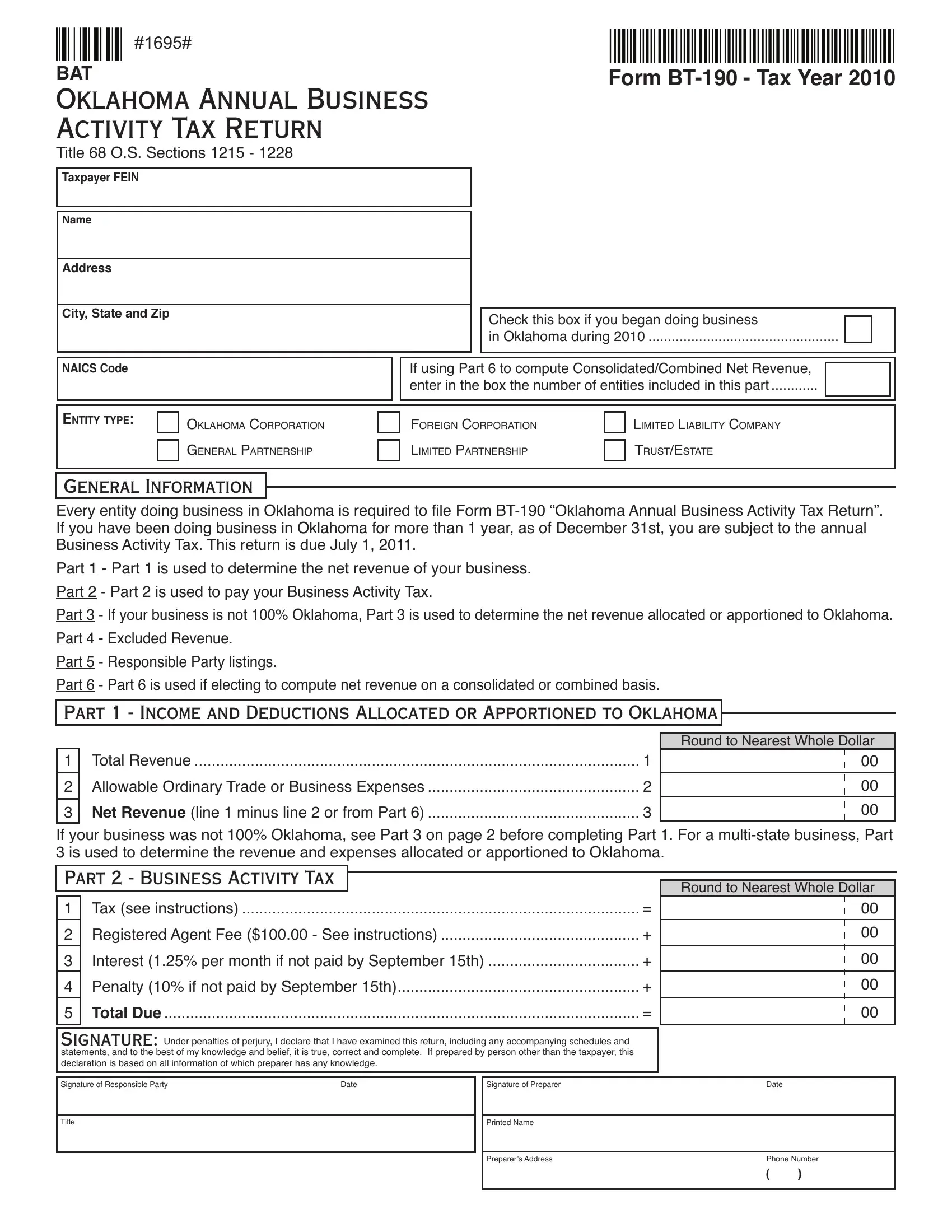

1. First of all, while filling out the FEINs, start in the form section that has the next fields:

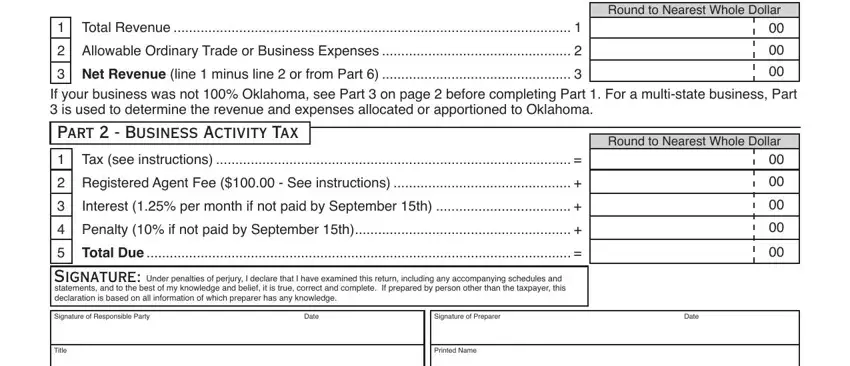

2. Your next step is to fill out these particular fields: Total Revenue, Round to Nearest Whole Dollar, Allowable Ordinary Trade or, Net Revenue line minus line or, Round to Nearest Whole Dollar, Tax see instructions, Registered Agent Fee See, Interest per month if not paid by, Penalty if not paid by September, Total Due Signature, Under penalties of perjury I, Signature of Responsible Party, Date, Signature of Preparer, and Title.

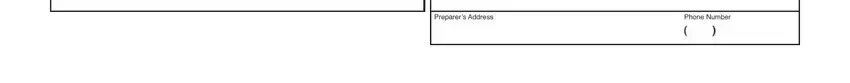

3. Completing Preparers Address, and Phone Number is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

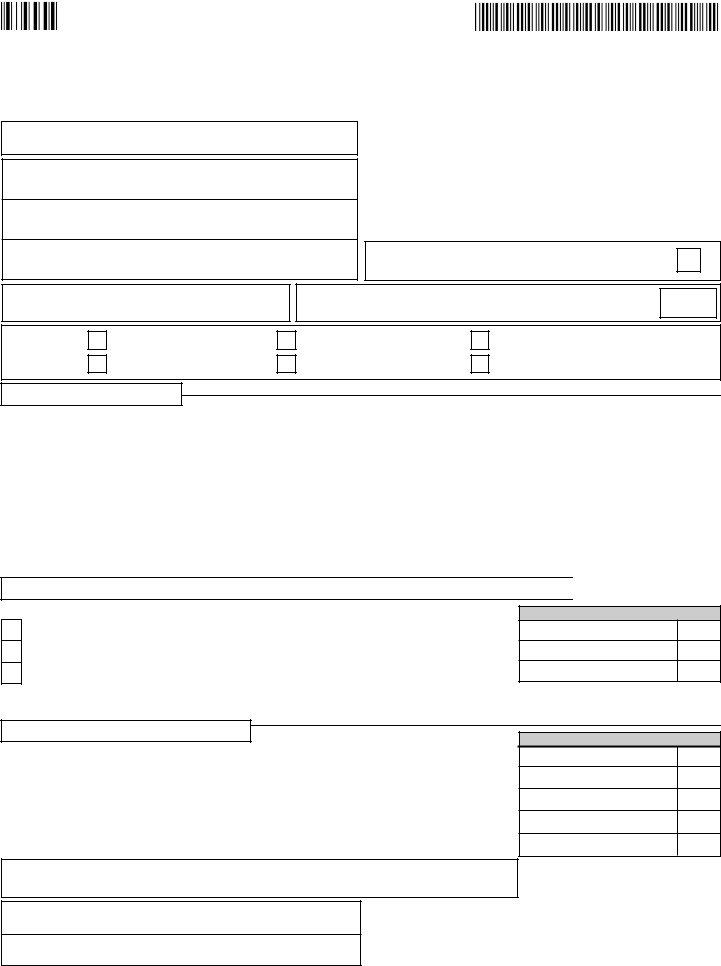

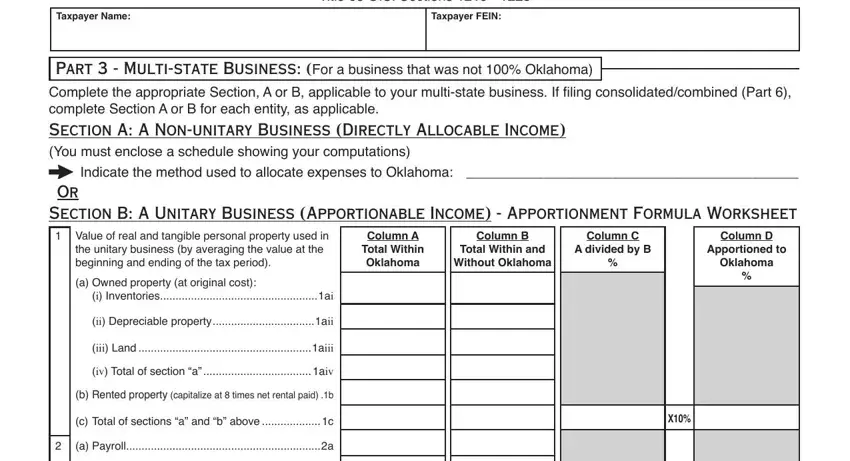

4. The form's fourth subsection comes with the following blank fields to look at: Title OS Sections, Taxpayer Name, Taxpayer FEIN, Part Multistate Business For a, Indicate the method used to, Or Section B A Unitary Business, the unitary business by averaging, Column A Total Within Oklahoma, Total Within and, A divided by B, Without Oklahoma, Column D, Apportioned to, Oklahoma, and Column B.

You can easily make errors while filling in your Or Section B A Unitary Business, and so you'll want to go through it again prior to deciding to submit it.

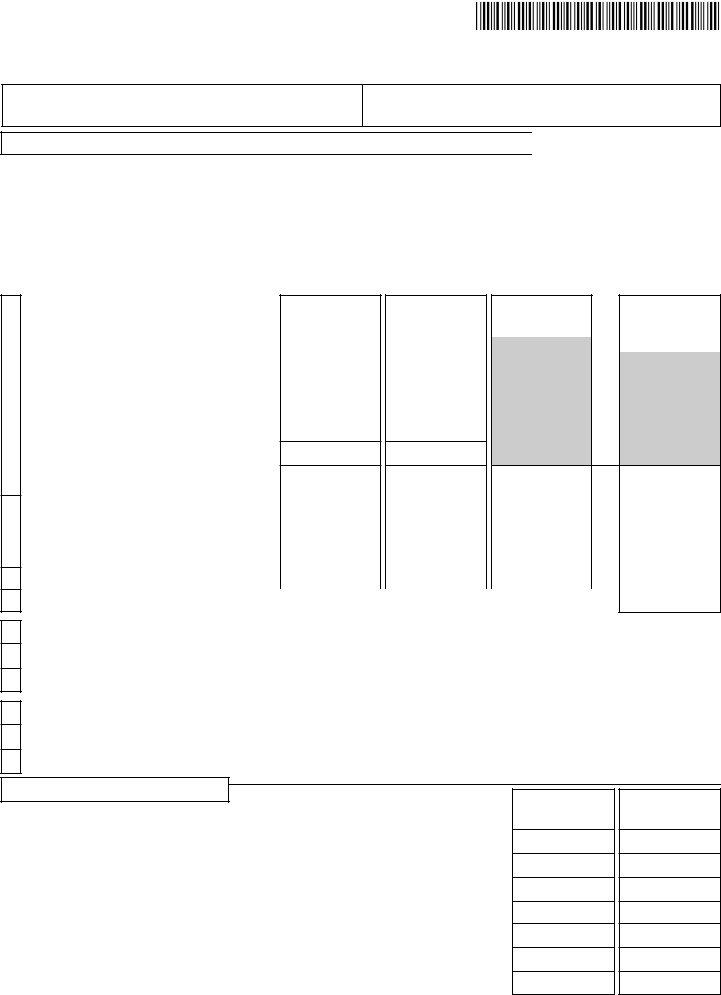

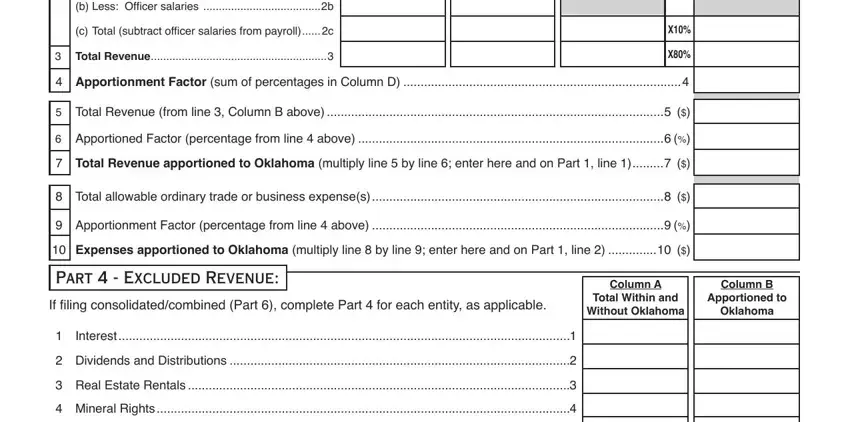

5. This form should be finished by filling out this part. Here you will see a full listing of form fields that require specific information to allow your document usage to be accomplished: b Less Oficer salaries b, c Total subtract oficer salaries, Total Revenue, Apportionment Factor sum of, Total Revenue from line Column B, Apportioned Factor percentage, Total Revenue apportioned to, Total allowable ordinary trade or, Apportionment Factor percentage, Expenses apportioned to Oklahoma, Part Excluded Revenue, If iling consolidatedcombined Part, Column A, Column B, and Total Within and.

Step 3: Once you have glanced through the information in the file's blank fields, click "Done" to complete your FormsPal process. Right after setting up a7-day free trial account with us, it will be possible to download FEINs or email it right away. The PDF file will also be readily available in your personal account menu with your each change. We don't share any information you type in whenever working with documents at FormsPal.