Any time you intend to fill out elinchrom frx 400 user manual, you won't need to install any kind of applications - simply make use of our PDF editor. Our expert team is constantly endeavoring to develop the editor and ensure it is even easier for users with its many features. Unlock an constantly revolutionary experience now - check out and uncover new possibilities along the way! If you're seeking to begin, here is what it's going to take:

Step 1: Press the "Get Form" button above on this webpage to open our tool.

Step 2: The tool will give you the capability to work with PDF files in various ways. Improve it by including personalized text, correct original content, and add a signature - all possible within a few minutes!

This document will require you to provide some specific details; to guarantee accuracy and reliability, please make sure to adhere to the tips further down:

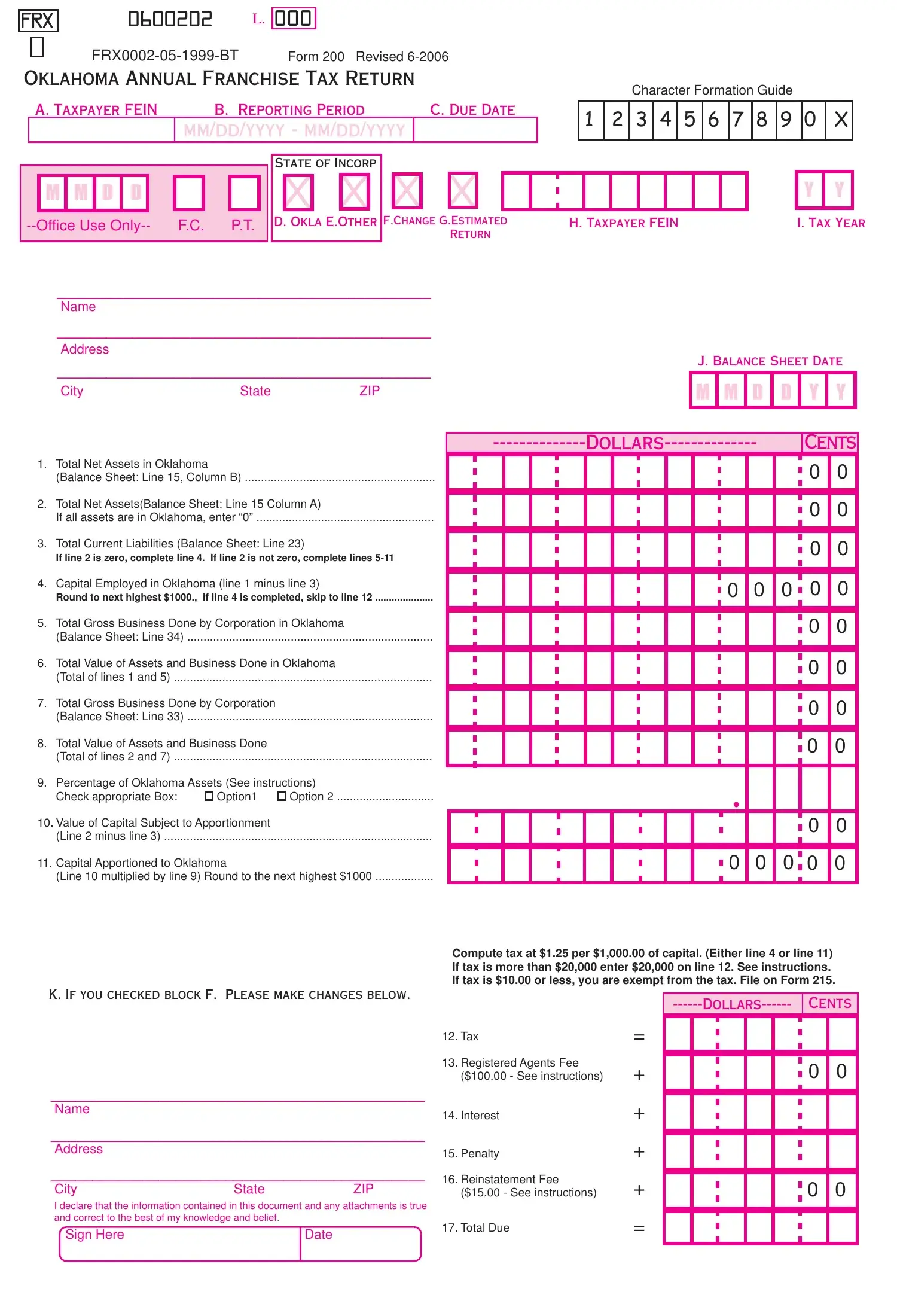

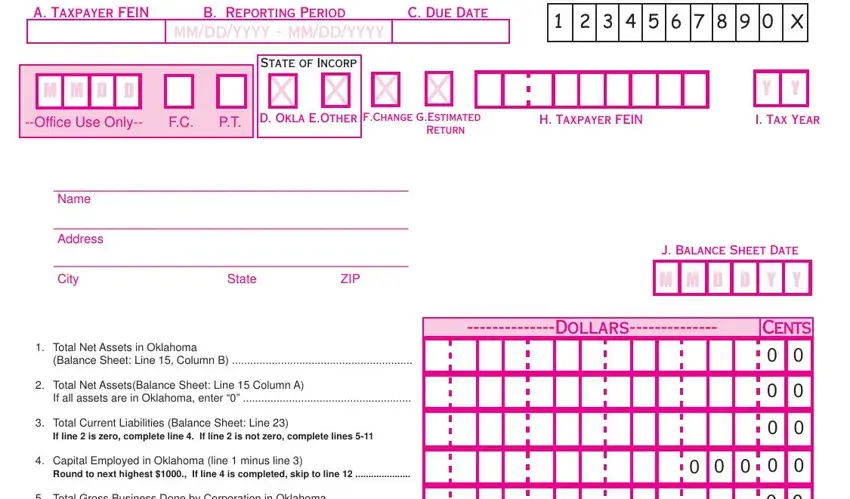

1. The elinchrom frx 400 user manual necessitates particular information to be typed in. Be sure that the following blank fields are filled out:

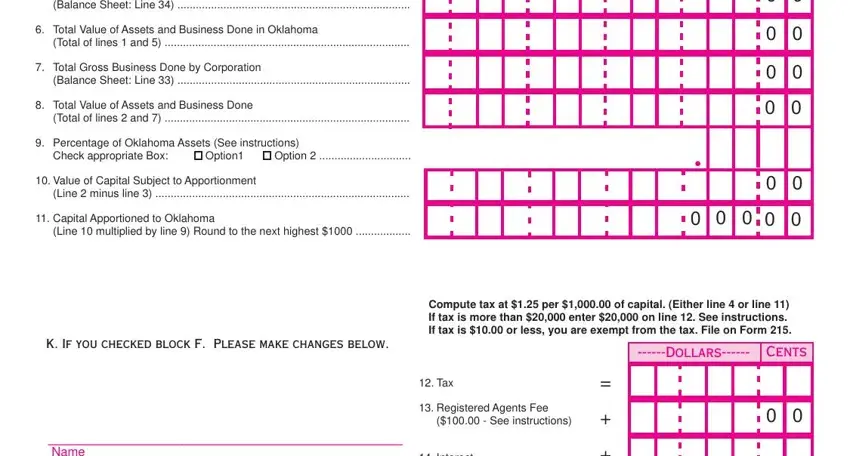

2. The third stage is usually to fill out these particular blanks: Balance Sheet Line, Total Value of Assets and, Total of lines and, Total Gross Business Done by, Balance Sheet Line, Total Value of Assets and, Total of lines and, Percentage of Oklahoma Assets See, Check appropriate Box, Option, Option, Value of Capital Subject to, Line minus line, Capital Apportioned to Oklahoma, and Line multiplied by line Round to.

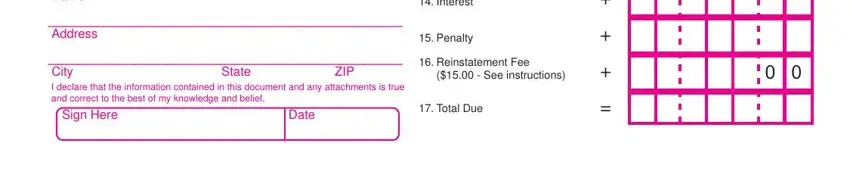

3. The next section should be relatively uncomplicated, Name, Address, Interest, Penalty, City I declare that the, State, ZIP, Sign Here, Date, Reinstatement Fee, See instructions, and Total Due - every one of these form fields has to be filled out here.

As for See instructions and Address, be certain you review things in this section. Both of these are definitely the key fields in the PDF.

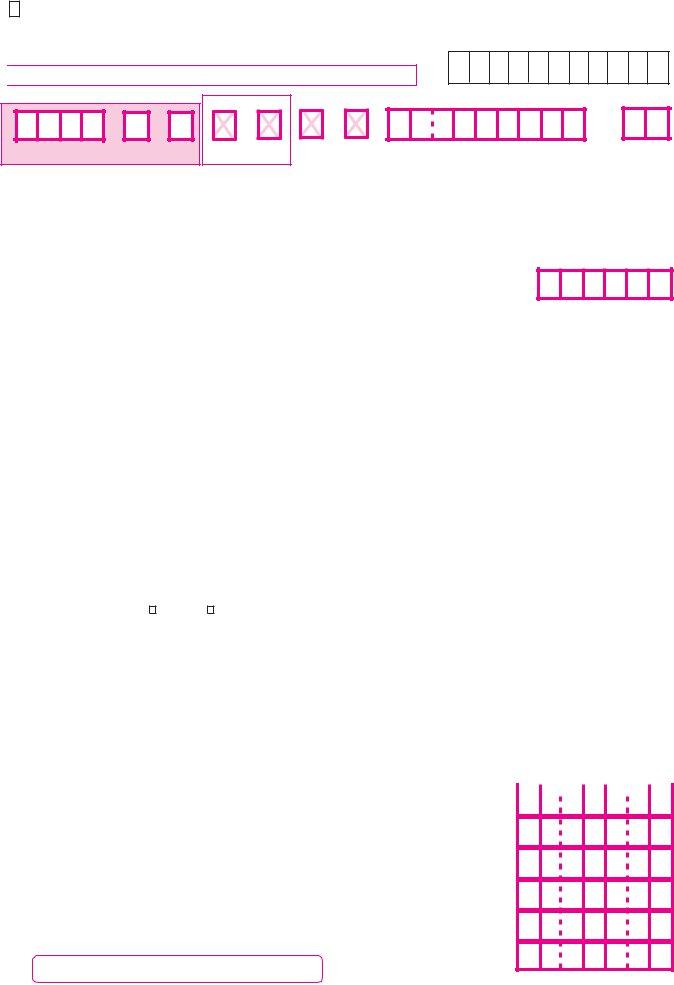

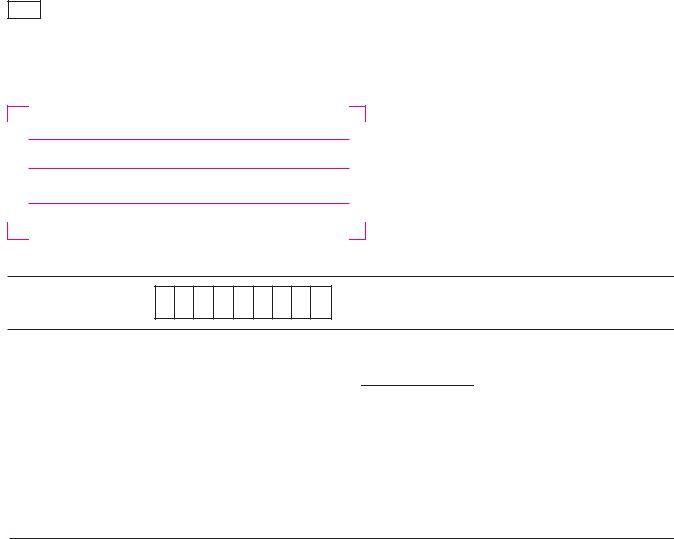

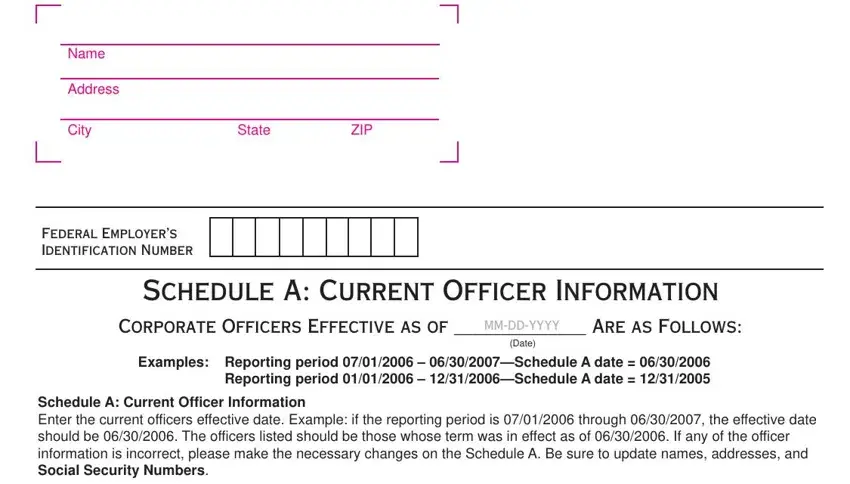

4. This next section requires some additional information. Ensure you complete all the necessary fields - Name, Address, City, State, ZIP, Federal Employers Identification, Schedule A Current Officer, Corporate Officers Effective as of, MMDDYYYY, Date, Examples Reporting period, and Schedule A Current Officer - to proceed further in your process!

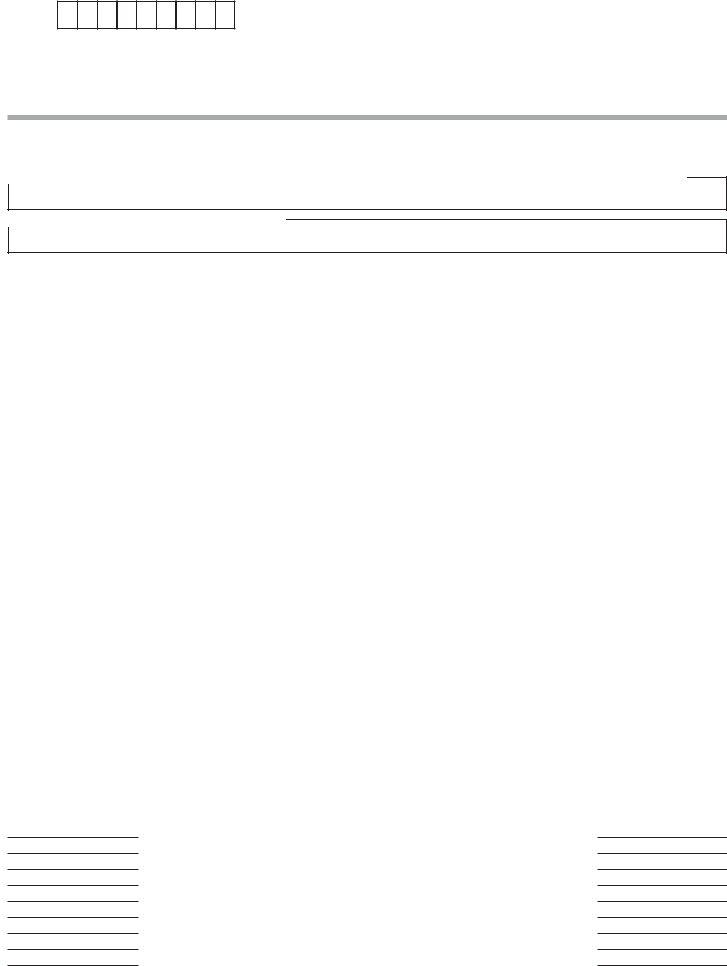

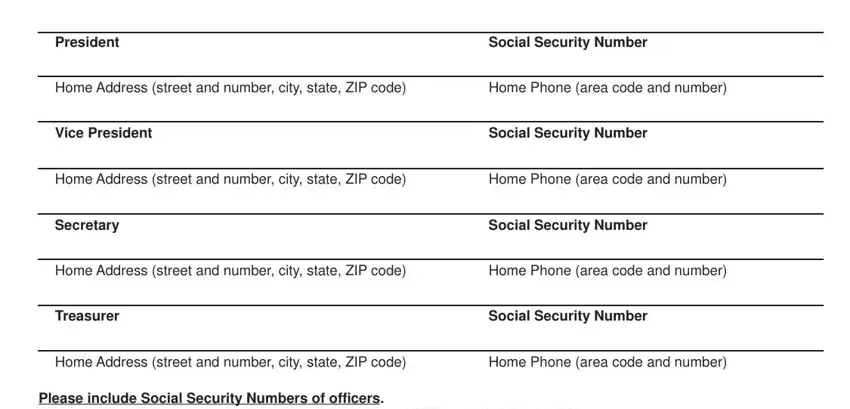

5. Last of all, the following last portion is precisely what you will need to wrap up before submitting the form. The blank fields you're looking at include the next: President, Social Security Number, Home Address street and number, Home Phone area code and number, Vice President, Social Security Number, Home Address street and number, Home Phone area code and number, Secretary, Social Security Number, Home Address street and number, Home Phone area code and number, Treasurer, Social Security Number, and Home Address street and number.

Step 3: After double-checking your fields and details, click "Done" and you are done and dusted! Sign up with us right now and immediately gain access to elinchrom frx 400 user manual, prepared for downloading. Each change you make is handily kept , which enables you to modify the document at a later point if required. FormsPal ensures your data confidentiality by using a secure method that never records or distributes any type of sensitive information used in the file. You can relax knowing your documents are kept safe when you use our services!