It is possible to work with onett computation sheet pdf effortlessly in our online PDF tool. Our team is dedicated to giving you the absolute best experience with our tool by constantly adding new features and upgrades. Our editor has become much more helpful as the result of the latest updates! So now, working with PDF documents is a lot easier and faster than ever. By taking some basic steps, you'll be able to start your PDF journey:

Step 1: Just hit the "Get Form Button" at the top of this webpage to get into our pdf file editor. This way, you'll find all that is necessary to work with your file.

Step 2: This editor lets you customize PDF documents in a range of ways. Enhance it by writing your own text, adjust original content, and add a signature - all possible in minutes!

Be attentive while filling out this pdf. Ensure all necessary fields are completed properly.

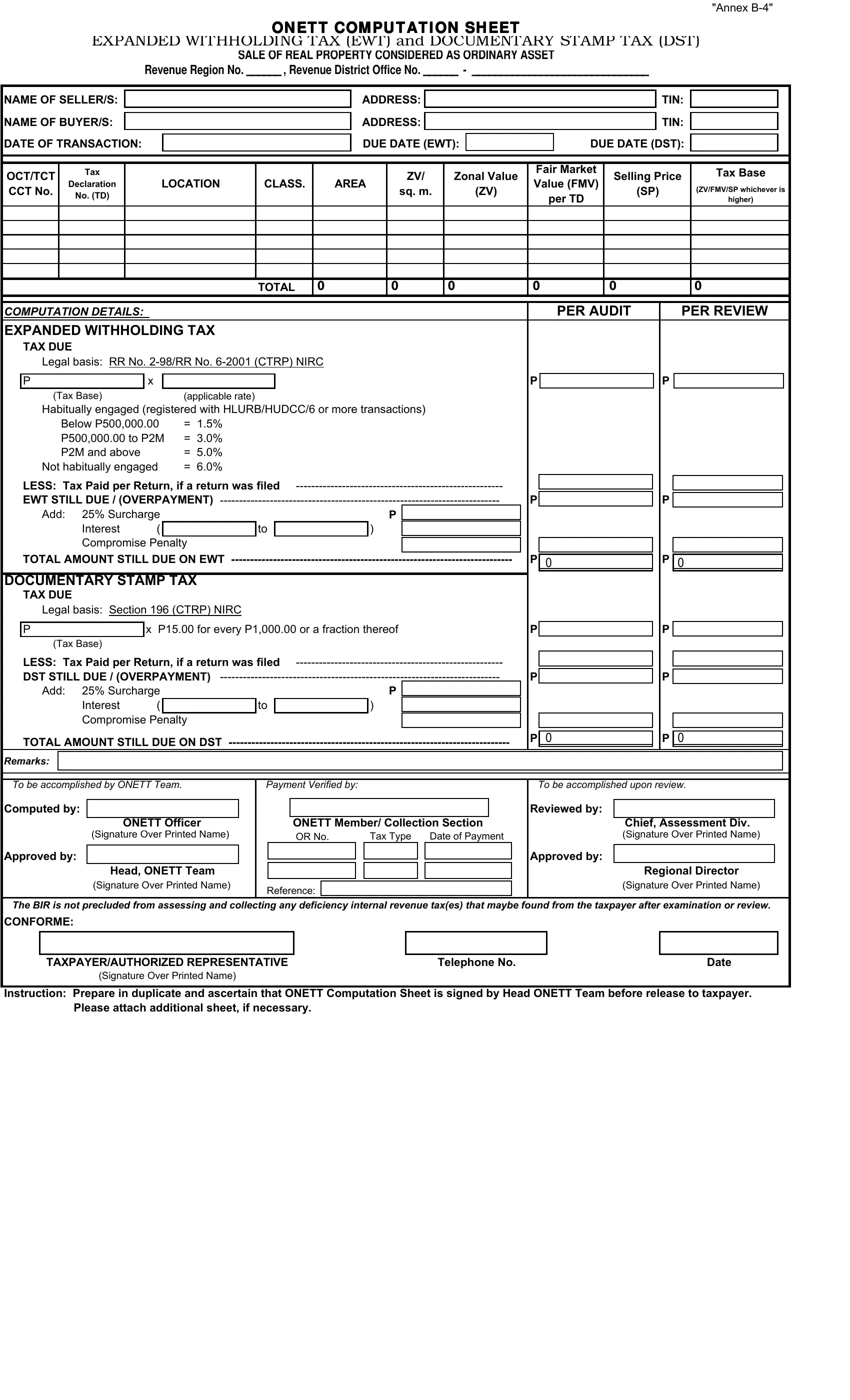

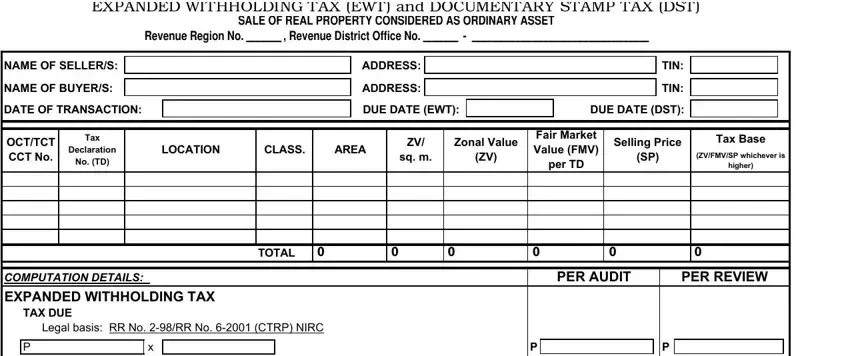

1. To get started, while filling in the onett computation sheet pdf, start with the part that features the subsequent blanks:

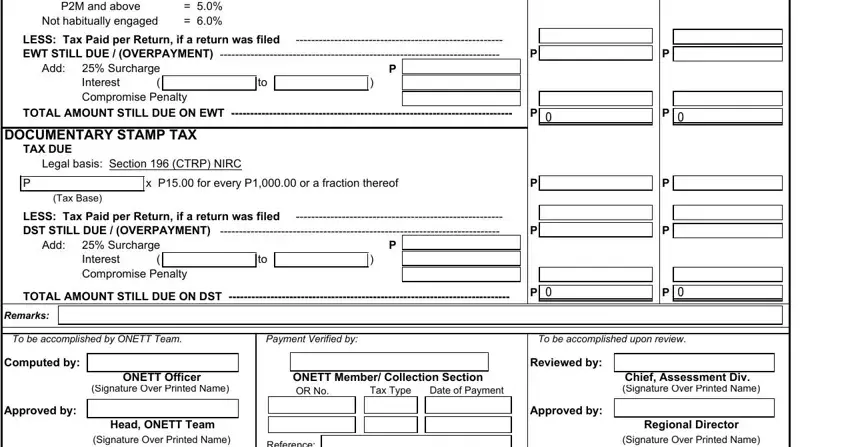

2. Given that the previous array of fields is done, it's time to add the required particulars in Below P P to PM PM and above, LESS Tax Paid per Return if a, Add, Surcharge Interest Compromise, TOTAL AMOUNT STILL DUE ON EWT, DOCUMENTARY STAMP TAX, TAX DUE, Legal basis Section CTRP NIRC, x P for every P or a fraction, Tax Base, LESS Tax Paid per Return if a, Add, Surcharge Interest Compromise, TOTAL AMOUNT STILL DUE ON DST, and Remarks so you can proceed to the third step.

You can potentially get it wrong when completing your Surcharge Interest Compromise, for that reason be sure to reread it before you'll finalize the form.

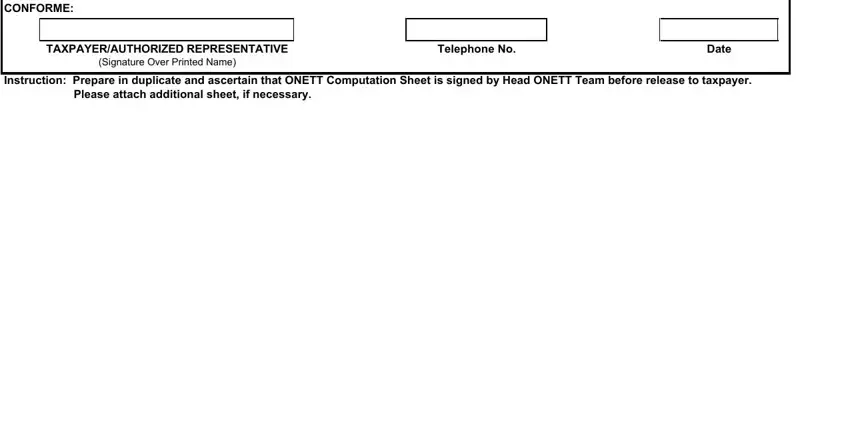

3. This next portion focuses on CONFORME, TAXPAYERAUTHORIZED REPRESENTATIVE, Telephone No, Date, Signature Over Printed Name, Instruction Prepare in duplicate, and Please attach additional sheet if - type in each of these empty form fields.

Step 3: Reread the information you have typed into the blanks and hit the "Done" button. Go for a 7-day free trial plan at FormsPal and acquire direct access to onett computation sheet pdf - which you'll be able to then work with as you wish inside your FormsPal cabinet. We do not share or sell any details you type in while working with forms at our site.