Through the online tool for PDF editing by FormsPal, you're able to complete or modify op 236 schedule a here and now. FormsPal is focused on giving you the perfect experience with our tool by consistently presenting new features and enhancements. Our tool is now even more intuitive with the latest updates! Now, working with PDF forms is easier and faster than ever. To start your journey, take these simple steps:

Step 1: Simply press the "Get Form Button" at the top of this page to launch our pdf editing tool. This way, you'll find all that is needed to work with your file.

Step 2: This tool will give you the opportunity to modify your PDF form in many different ways. Enhance it by writing customized text, adjust existing content, and place in a signature - all within the reach of a couple of mouse clicks!

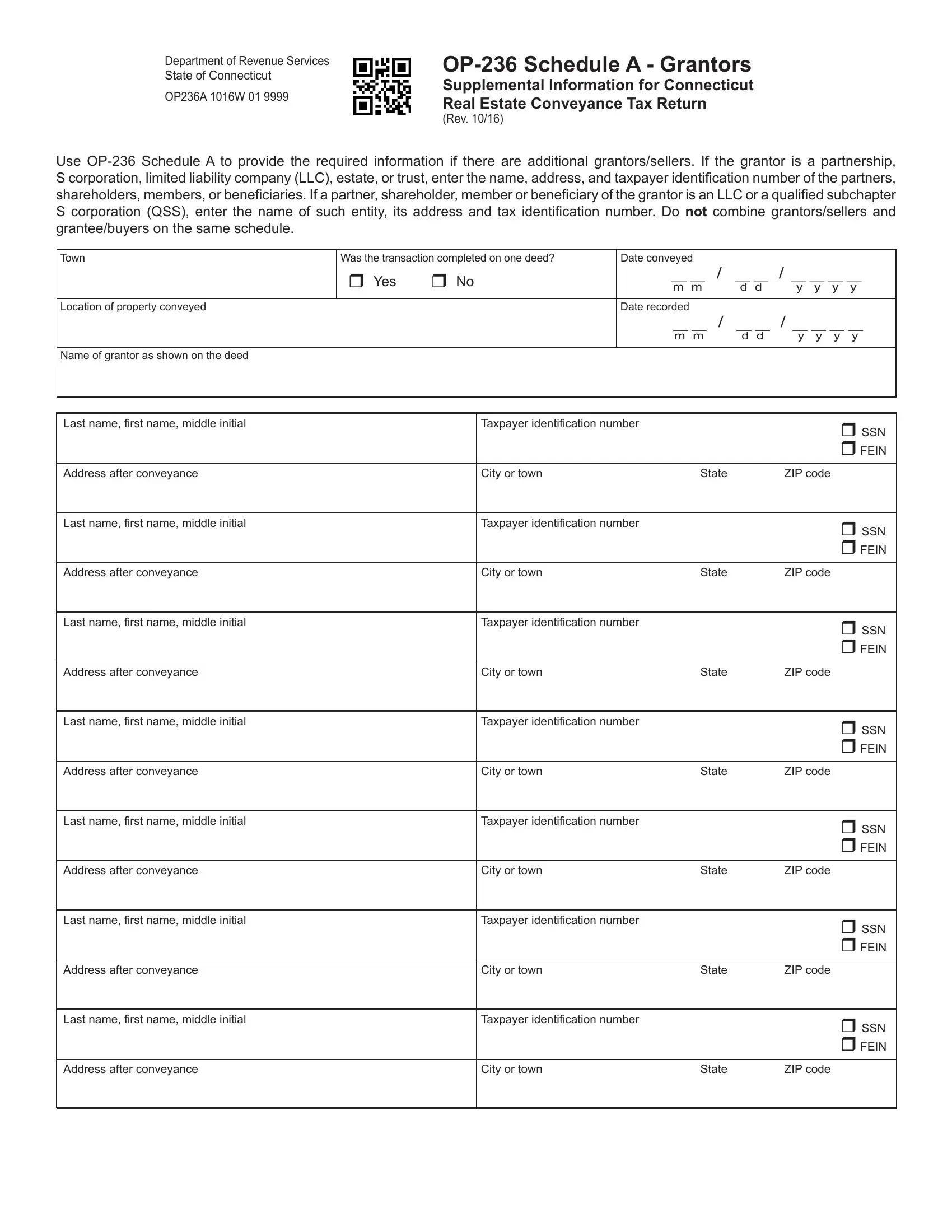

To be able to finalize this form, be sure you provide the information you need in each and every blank:

1. Begin filling out your op 236 schedule a with a selection of necessary fields. Gather all of the information you need and make sure absolutely nothing is omitted!

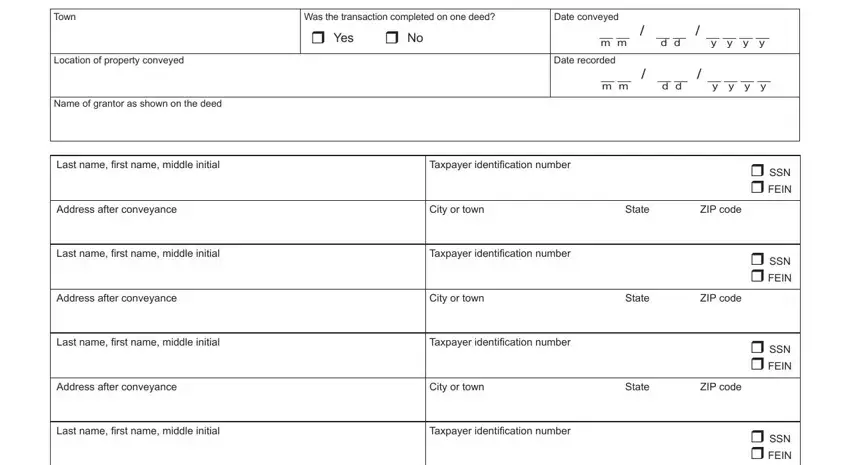

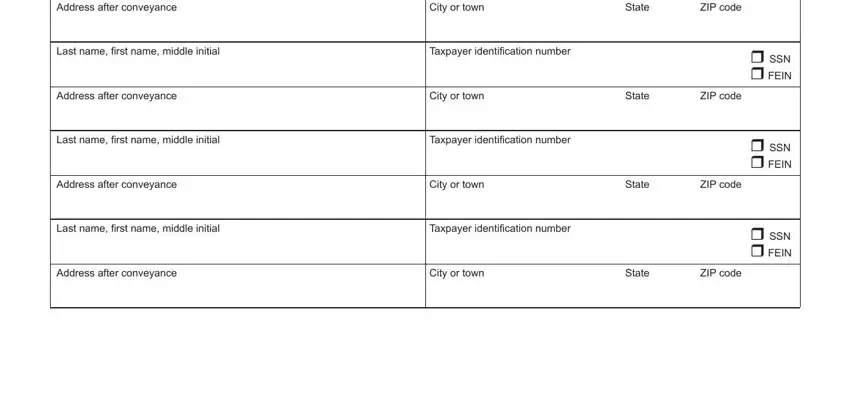

2. Soon after this part is done, go to enter the relevant details in these - Address after conveyance, City or town, State, ZIP code, Last name fi rst name middle initial, Taxpayer identifi cation number, Address after conveyance, City or town, State, ZIP code, Last name fi rst name middle initial, Taxpayer identifi cation number, Address after conveyance, City or town, and State.

You can potentially make errors when filling in the Address after conveyance, hence make sure you reread it prior to when you finalize the form.

Step 3: Prior to moving on, ensure that blanks were filled out as intended. The moment you’re satisfied with it, click on “Done." Go for a free trial plan with us and acquire instant access to op 236 schedule a - download, email, or edit inside your personal account page. FormsPal is committed to the personal privacy of all our users; we make certain that all information coming through our tool continues to be confidential.