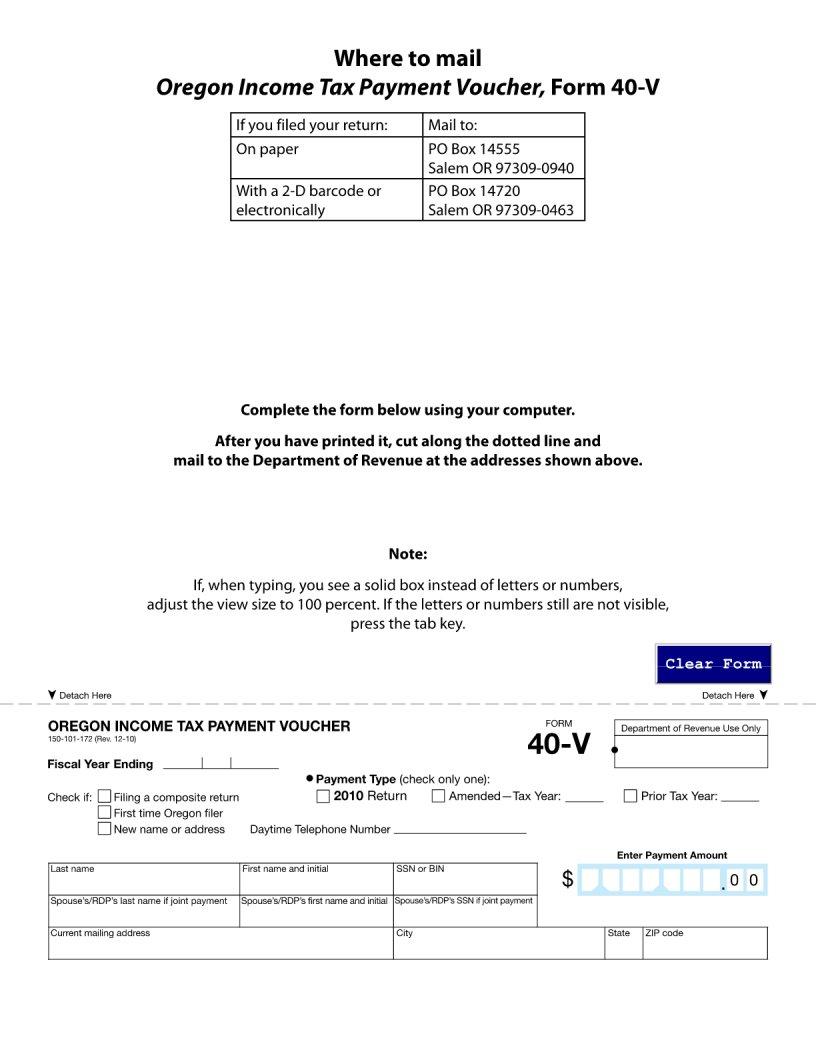

In the intricate landscape of tax payments and filings, the Oregon 40V form emerges as a crucial document for taxpayers in the state. This form serves as the vehicle through which individuals can submit their tax payments separately when electronic filing is not their chosen path or when a payment accompanies a previously e-filed return. The significance of the Oregon 40V form cannot be overstated; its proper completion ensures the accurate processing of payments, thereby avoiding potential delays or discrepancies in one's tax records. Given the precision required in the world of tax filings, understanding the nuances of how, when, and why to use the Oregon 40V form is indispensable for Oregon taxpayers. Its role in the broader system of state taxation underscores the importance of staying informed and compliant with local tax obligations, reinforcing its status as a pivotal piece of documentation in the annual financial routines of residents. With tax laws frequently subject to changes and updates, the relevance of such forms is a constant, offering a structured pathway for fulfilling one's tax liabilities.

| Question | Answer |

|---|---|

| Form Name | Oregon 40V Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | oregon form 40 v 2020, or 40 v mailing address, oregon or 40 v, form or 40 v |