Oregon Form 10 can be completed effortlessly. Just use FormsPal PDF tool to do the job promptly. To retain our tool on the cutting edge of practicality, we work to put into practice user-driven features and improvements regularly. We're routinely looking for feedback - help us with revampimg how you work with PDF forms. It merely requires a few simple steps:

Step 1: Simply hit the "Get Form Button" at the top of this webpage to see our form editing tool. Here you'll find everything that is necessary to work with your document.

Step 2: The tool provides the capability to customize your PDF in various ways. Improve it with customized text, adjust existing content, and include a signature - all when it's needed!

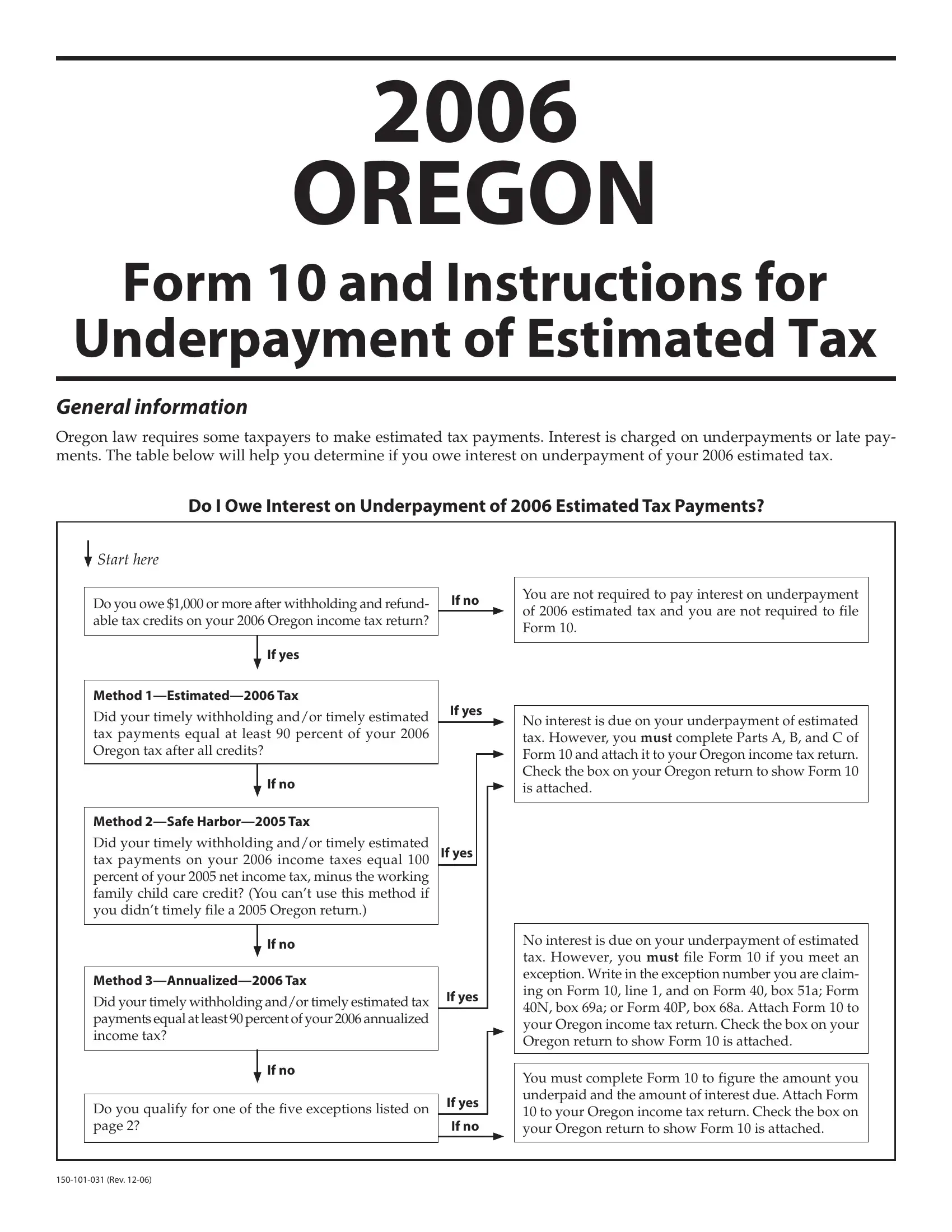

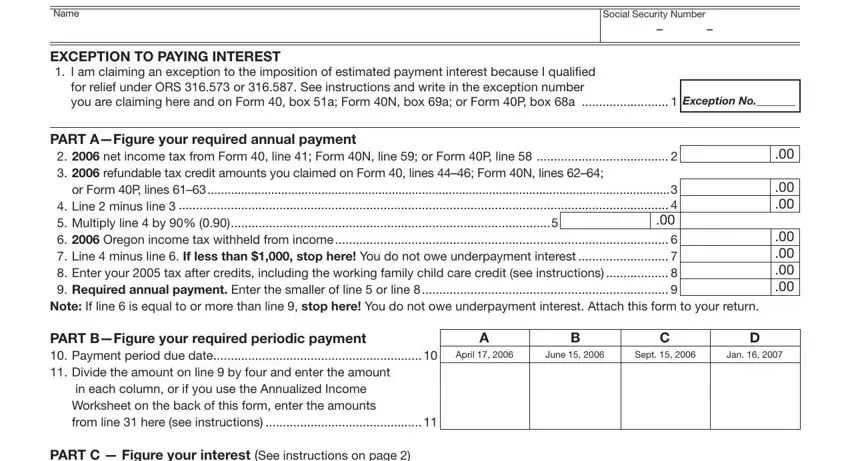

This PDF form will require particular data to be typed in, so you should take some time to fill in what's asked:

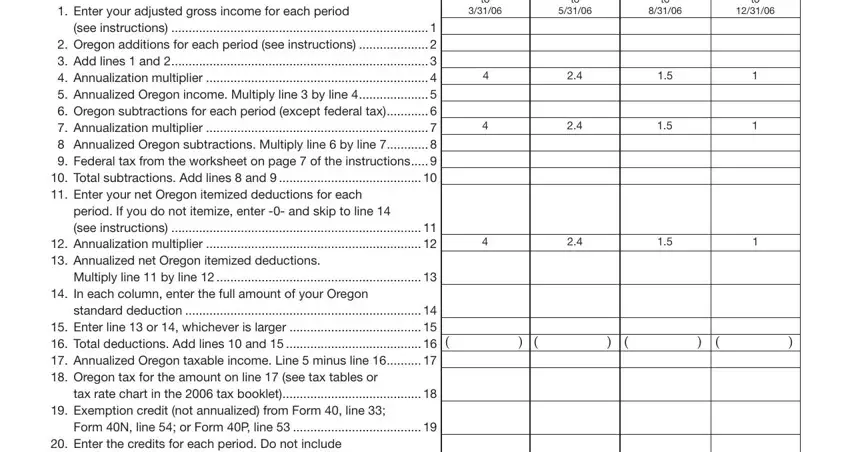

1. You should fill out the Oregon Form 10 properly, so pay close attention while working with the sections comprising all of these blanks:

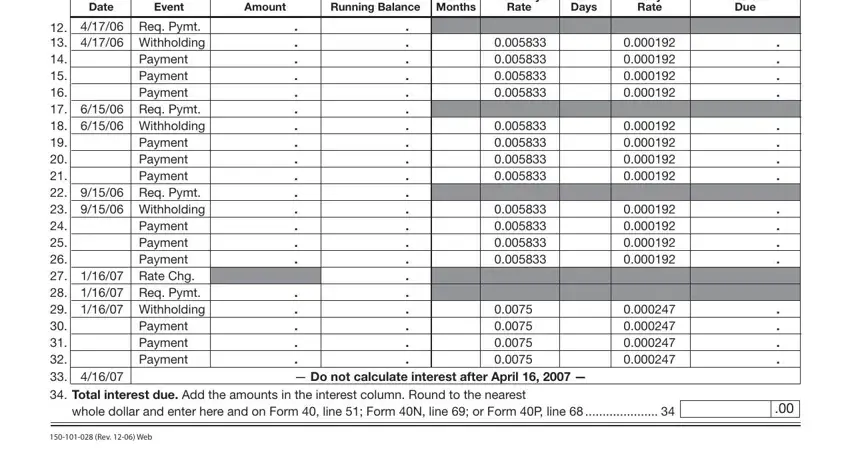

2. Once your current task is complete, take the next step – fill out all of these fields - PART C Figure your interest See, Date, Amount, Event, No of Running Balance Months, Monthly, Rate, No of Days, Daily Rate, Interest, Due, Payment Payment Payment, Payment Payment Payment, Req Pymt Withholding Req, and Do not with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

3. The next step is hassle-free - fill in all of the fields in Enter your adjusted gross income, see in struc tions Oregon, period If you do not itemize enter, Multiply line by line, In each column enter the full, standard deduction Enter line, tax rate chart in the tax booklet, Exemption credit not annualized, Form N line or Form P line, and Enter the credits for each period to conclude this segment.

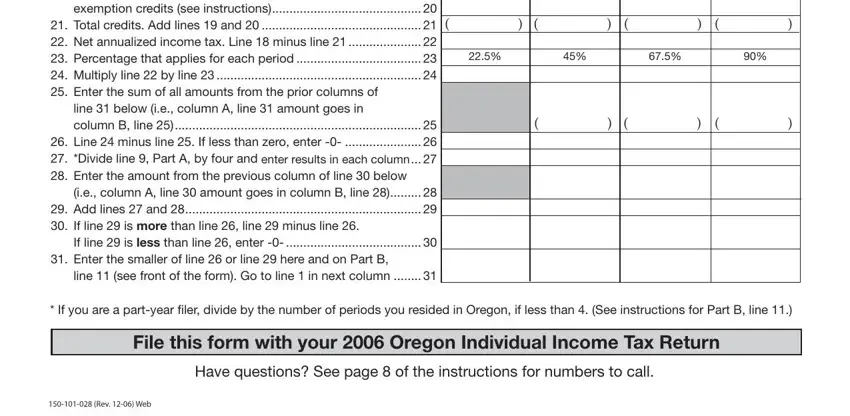

4. This next section requires some additional information. Ensure you complete all the necessary fields - exemption credits see instructions, line below ie column A line, If line is less than line enter, Enter the smaller of line or, line see front of the form Go to, If you are a partyear filer, File this form with your Oregon, Have questions See page of the, and Rev Web - to proceed further in your process!

It's simple to make errors while filling out your Enter the smaller of line or, so make sure you look again before you finalize the form.

Step 3: Before moving on, make certain that blank fields have been filled out the right way. As soon as you think it's all good, click on “Done." After starting afree trial account at FormsPal, you'll be able to download Oregon Form 10 or email it without delay. The file will also be accessible through your personal account menu with all of your modifications. At FormsPal.com, we aim to ensure that all of your details are kept protected.