You can complete oregon income from easily in our PDFinity® editor. FormsPal team is ceaselessly endeavoring to expand the tool and enable it to be much faster for users with its extensive functions. Uncover an ceaselessly revolutionary experience today - check out and find new possibilities along the way! To begin your journey, take these simple steps:

Step 1: Access the PDF file inside our tool by pressing the "Get Form Button" in the top section of this webpage.

Step 2: Once you launch the editor, you will see the document prepared to be filled in. Besides filling in different blank fields, you may also perform various other actions with the form, particularly putting on your own textual content, changing the initial textual content, inserting illustrations or photos, signing the PDF, and much more.

Completing this form demands attentiveness. Ensure all required blanks are completed properly.

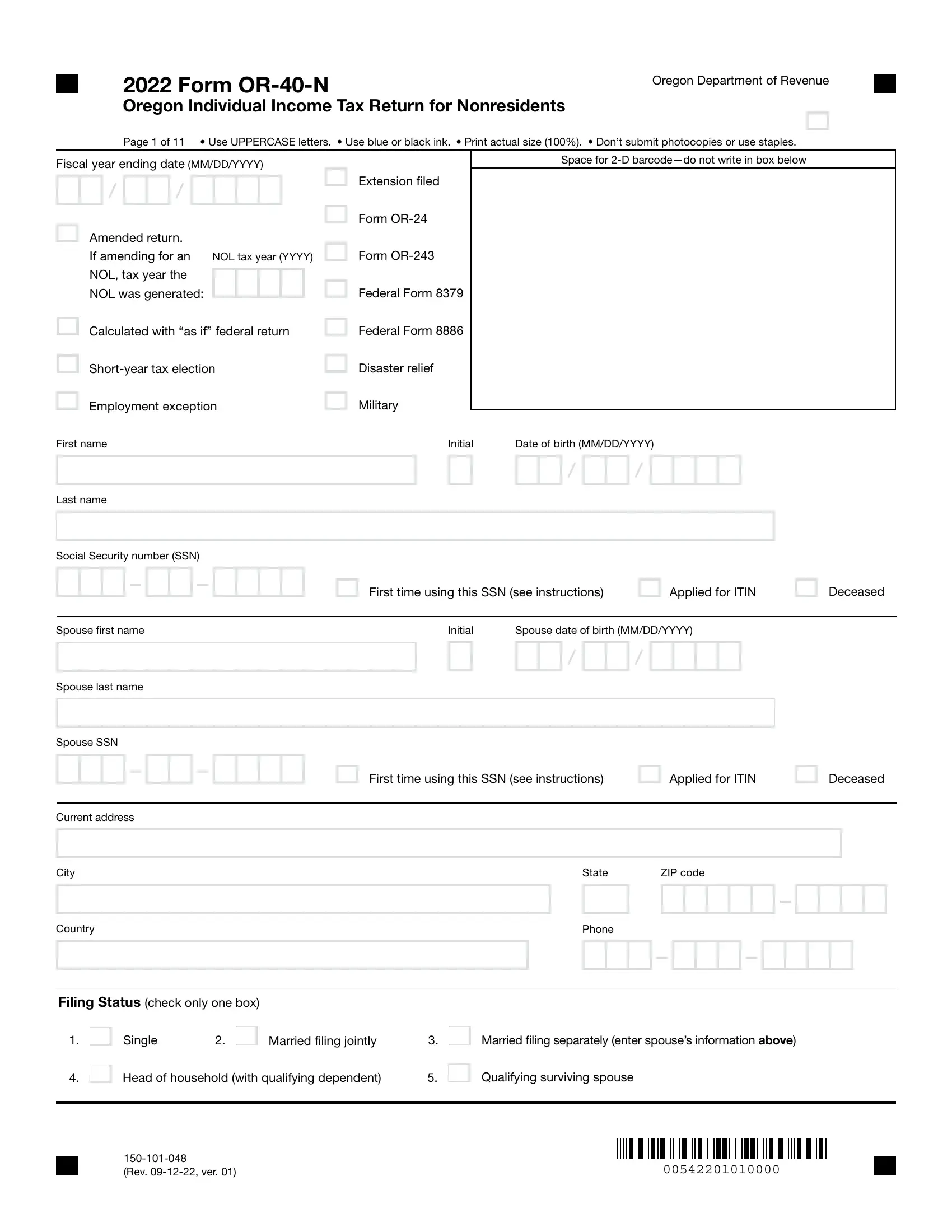

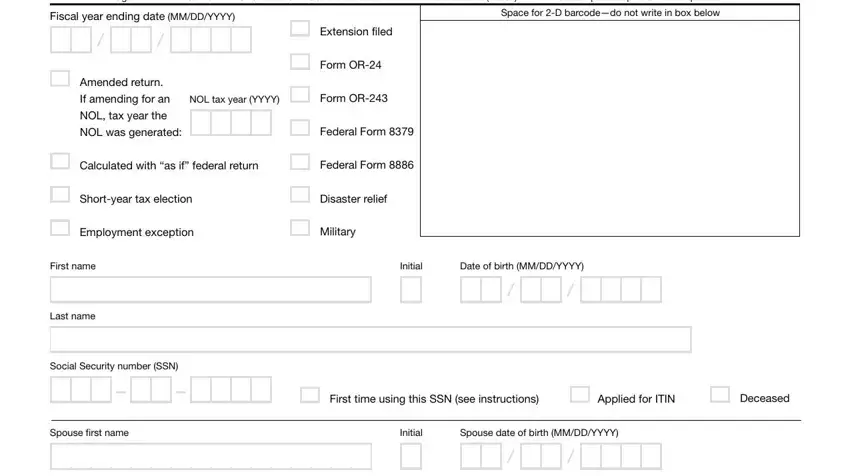

1. You will want to fill out the oregon income from properly, therefore pay close attention when filling out the segments including all of these blank fields:

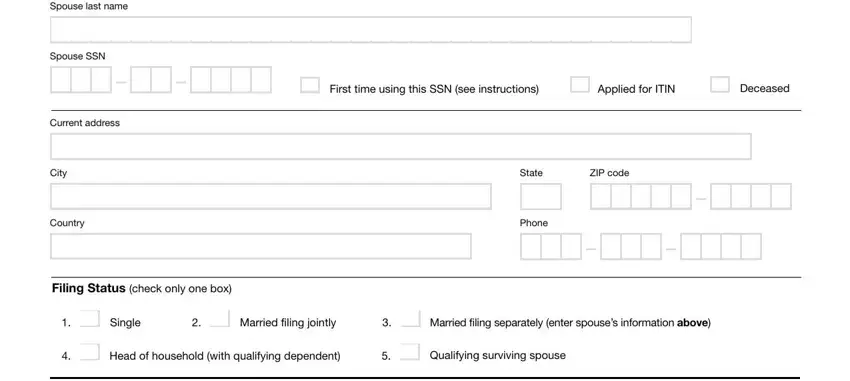

2. Right after finishing the last step, go to the next part and enter all required particulars in all these fields - Spouse last name, Spouse SSN, Current address, City, Country, First time using this SSN see, Applied for ITIN, Deceased, State, ZIP code, Phone, Filing Status check only one box, Single, Married filing jointly, and Head of household with qualifying.

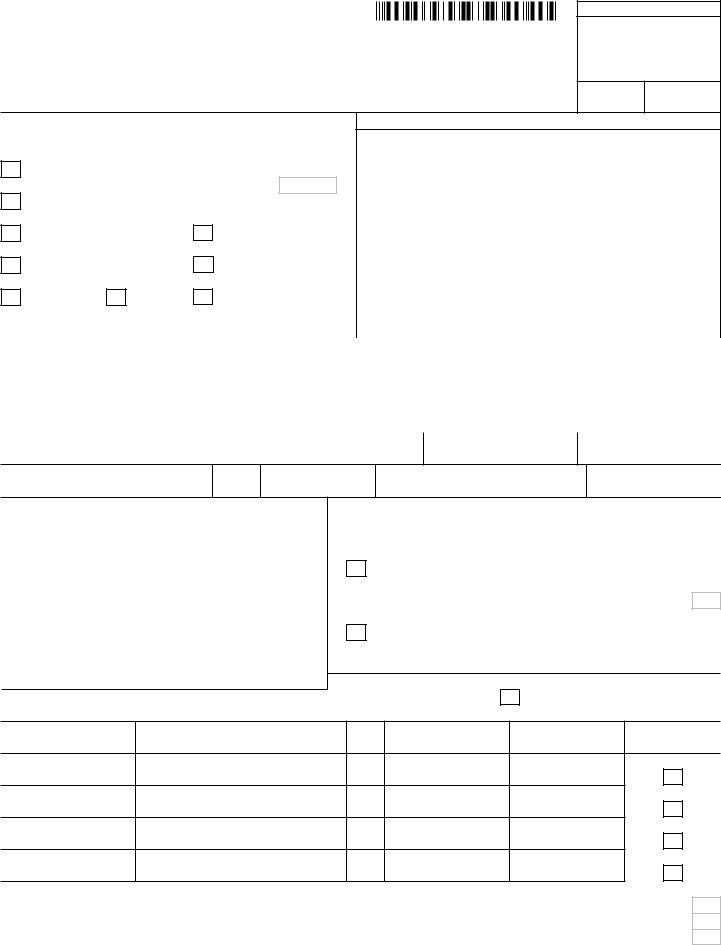

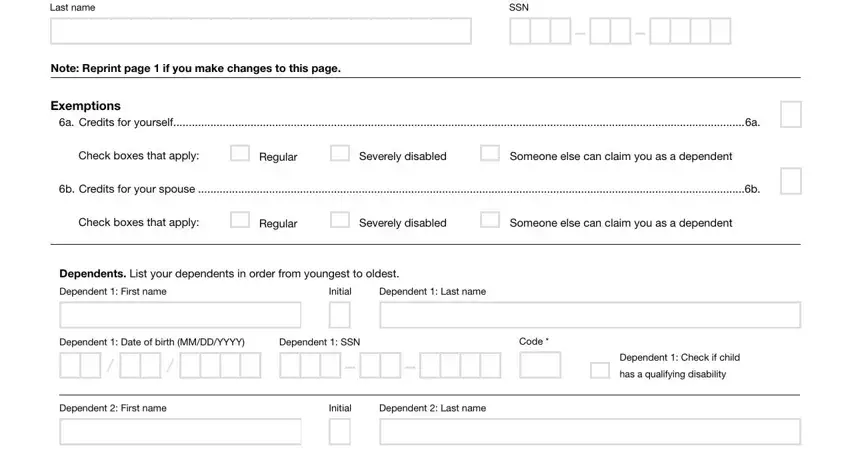

3. The next part is easy - complete all the fields in Last name, SSN, Note Reprint page if you make, Exemptions, a Credits for yourself a, Check boxes that apply, Regular, Severely disabled, Someone else can claim you as a, b Credits for your spouse b, Check boxes that apply, Regular, Severely disabled, Someone else can claim you as a, and Dependents List your dependents in in order to finish the current step.

Always be extremely attentive when filling out b Credits for your spouse b and Severely disabled, since this is where many people make errors.

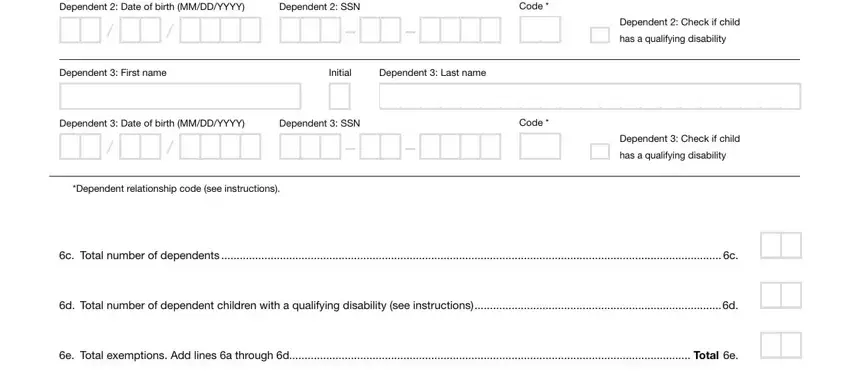

4. To go ahead, this fourth form section will require filling out several blanks. Examples of these are Dependent Date of birth MMDDYYYY, Dependent SSN, Code, Dependent First name, Initial, Dependent Last name, Dependent Date of birth MMDDYYYY, Dependent SSN, Code, Dependent relationship code see, Dependent Check if child, has a qualifying disability, Dependent Check if child, has a qualifying disability, and c Total number of dependents c, which are vital to moving forward with this document.

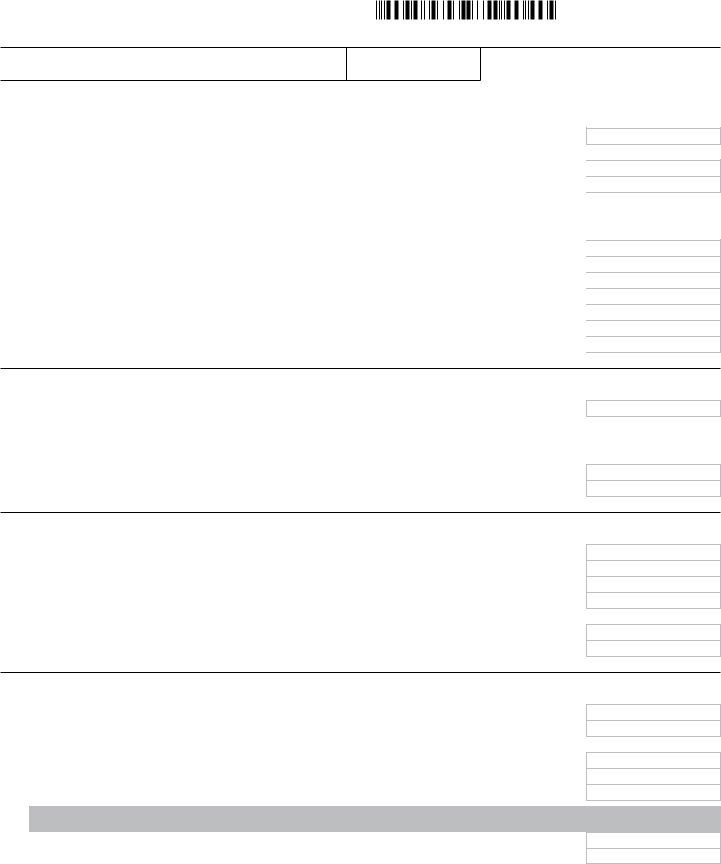

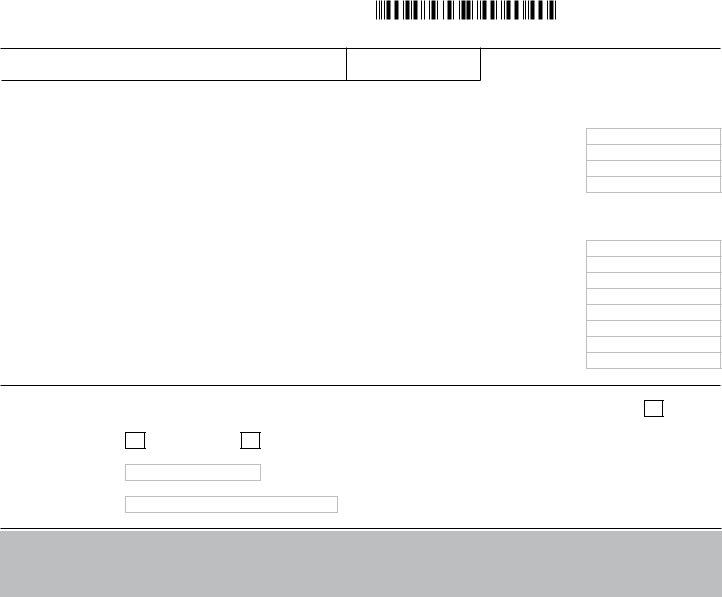

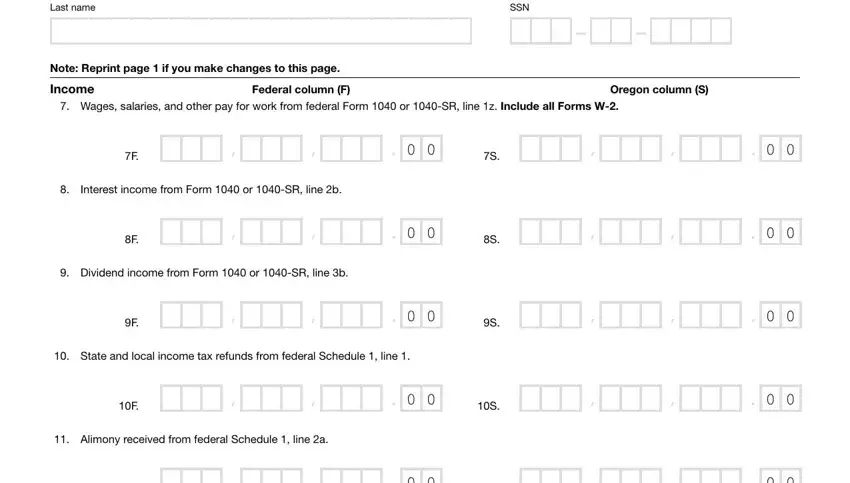

5. Since you draw near to the end of this form, there are a couple more points to do. Mainly, Last name, SSN, Note Reprint page if you make, Income Wages salaries and other, Federal column F, Oregon column S, Interest income from Form or SR, Dividend income from Form or SR, State and local income tax, and Alimony received from federal must be filled out.

Step 3: Always make sure that the information is accurate and click on "Done" to proceed further. Go for a 7-day free trial subscription at FormsPal and get instant access to oregon income from - which you can then make use of as you wish from your FormsPal cabinet. FormsPal guarantees secure form completion with no personal data recording or any kind of sharing. Be assured that your information is safe with us!