You could complete Oregon Form 40P instantly with the help of our online PDF tool. The editor is constantly updated by our staff, getting new features and growing to be greater. This is what you'd want to do to start:

Step 1: Simply click the "Get Form Button" at the top of this webpage to launch our pdf file editor. Here you will find everything that is required to fill out your document.

Step 2: The tool offers the opportunity to modify PDF files in a range of ways. Transform it by writing your own text, adjust existing content, and include a signature - all doable within a few minutes!

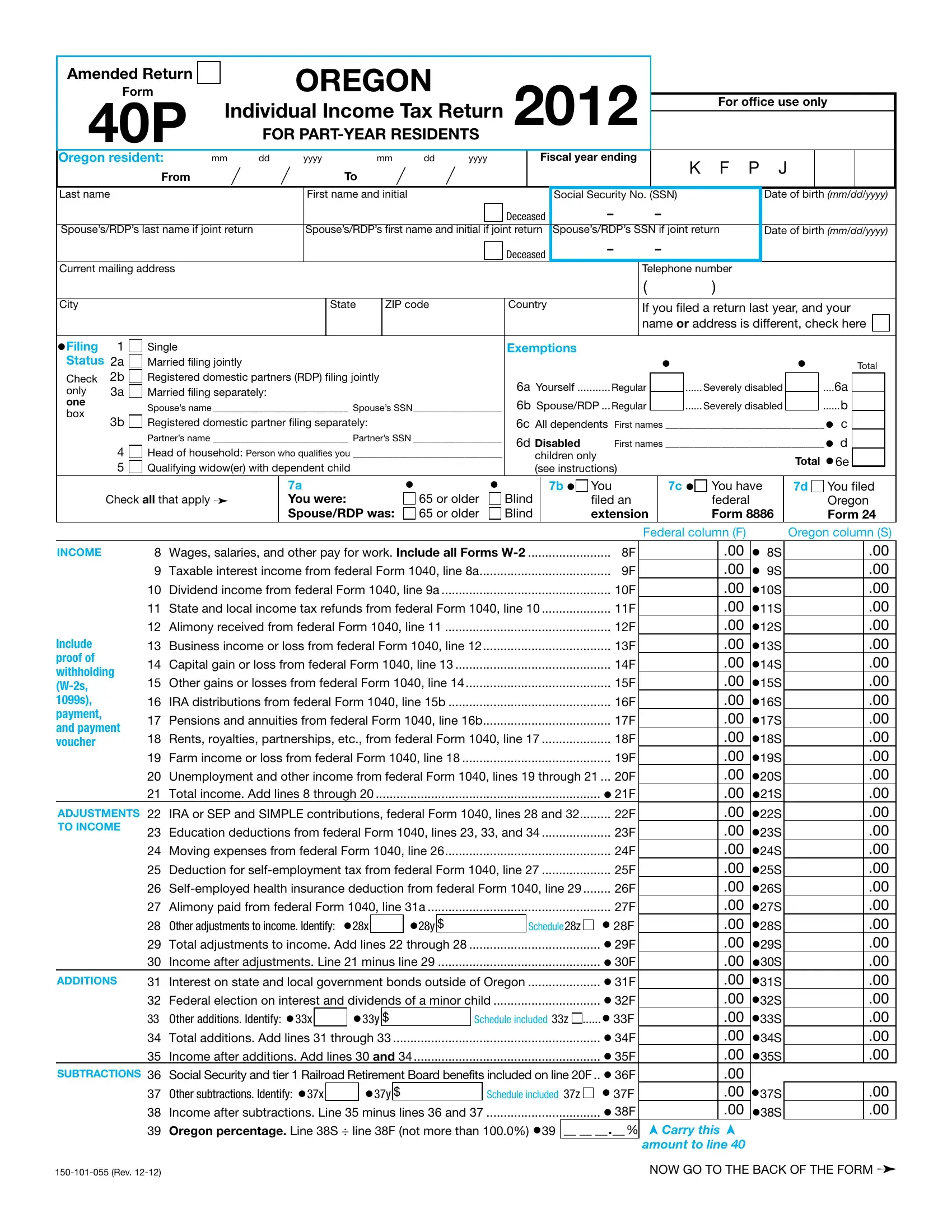

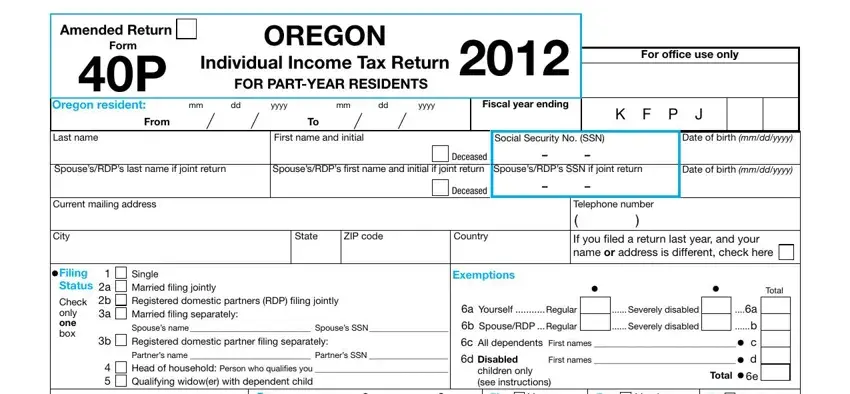

With regards to the blank fields of this precise PDF, this is what you should know:

1. It is very important complete the Oregon Form 40P correctly, therefore be attentive when filling in the parts that contain these blank fields:

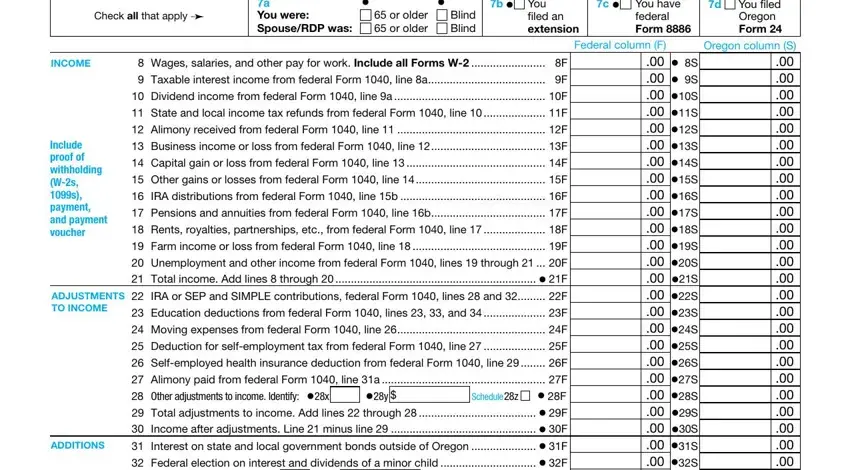

2. The third stage is usually to fill out the next few fields: Check all that apply, a You were SpouseRDP was, or older or older, Blind Blind, a Yourself Regular a b SpouseRDP, c You have federal Form, children only see instructions b, filed an extension, INCOME, Include proof of withholding Ws s, ADJUSTMENTS TO INCOME, ADDITIONS, Wages salaries and other pay for, Schedule z, and Federal column F.

Many people often get some points wrong when filling out filed an extension in this part. Be certain to review everything you enter right here.

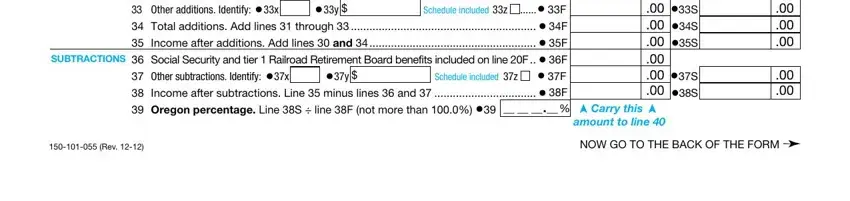

3. This next portion will be about SUBTRACTIONS, Wages salaries and other pay for, Schedule included z, Schedule included z, Rev, Federal column F, S S S S S S S S S S S S S S S S, S S, Oregon column S, and NOW GO TO THE BACK OF THE FORM - fill in every one of these fields.

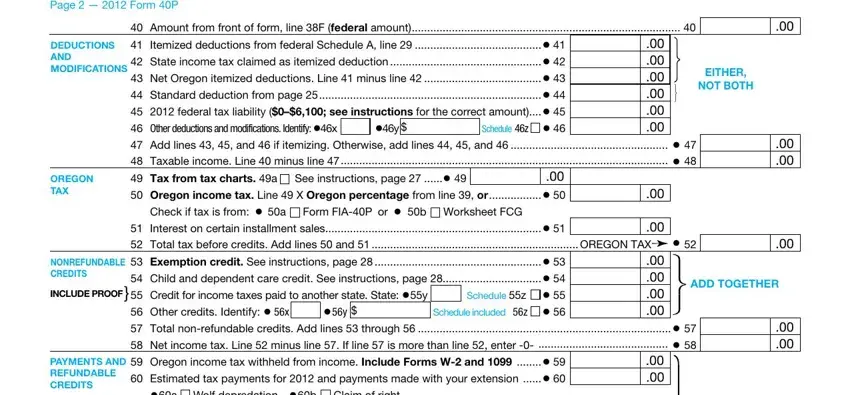

4. You're ready to fill out the next segment! Here you will get all of these EITHER, NOT BOTH, ADD TOGETHER, Page Form P, Claim of right, DEDUCTIONS AND MODIFICATIONS, OREGON TAX, NONREFUNDABLE CREDITS INCLUDE, PAYMENTS AND REFUNDABLE CREDITS, Worksheet FCG, Schedule z, Schedule z Schedule included z, See instructions page, Wolf depredation b, and Check if tax is from a blank fields to fill in.

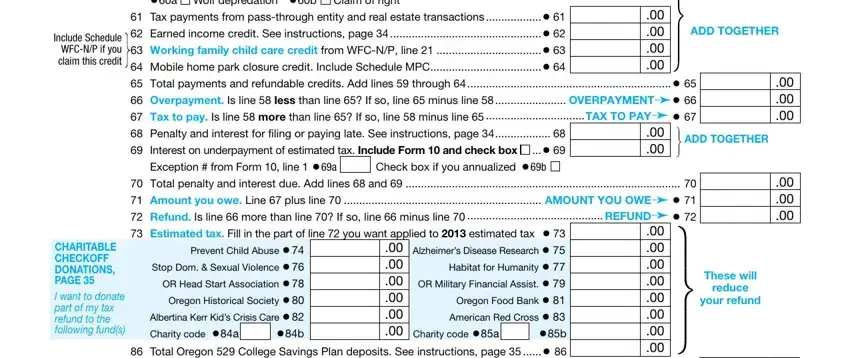

5. Now, this final segment is what you'll want to wrap up before submitting the form. The blank fields at this stage include the next: Claim of right, Include Schedule WFCNP if you, CHARITABLE CHECKOFF DONATIONS PAGE, I want to donate part of my tax, Wolf depredation b, Amount from front of form line F, Prevent Child Abuse Stop Dom, Exception from Form line a, Check box if you annualized b, Charity code a, ADD TOGETHER, ADD TOGETHER, These will, reduce, and your refund.

Step 3: Just after taking another look at the form fields, hit "Done" and you're all set! After creating a7-day free trial account at FormsPal, you will be able to download Oregon Form 40P or send it through email right off. The PDF file will also be at your disposal via your personal cabinet with your edits. FormsPal offers safe form tools without personal information recording or sharing. Be assured that your details are in good hands here!