Dealing with PDF files online is actually very easy with our PDF editor. Anyone can fill out Oregon Form 41 V here painlessly. We at FormsPal are committed to providing you with the perfect experience with our tool by consistently presenting new functions and improvements. Our editor has become much more helpful with the newest updates! At this point, editing PDF forms is easier and faster than before. With just a couple of easy steps, you can start your PDF editing:

Step 1: Press the orange "Get Form" button above. It's going to open our pdf tool so that you could begin filling out your form.

Step 2: When you access the file editor, you will notice the form made ready to be completed. Besides filling in various blank fields, you may also perform some other actions with the Document, such as adding any textual content, modifying the original textual content, adding graphics, putting your signature on the PDF, and a lot more.

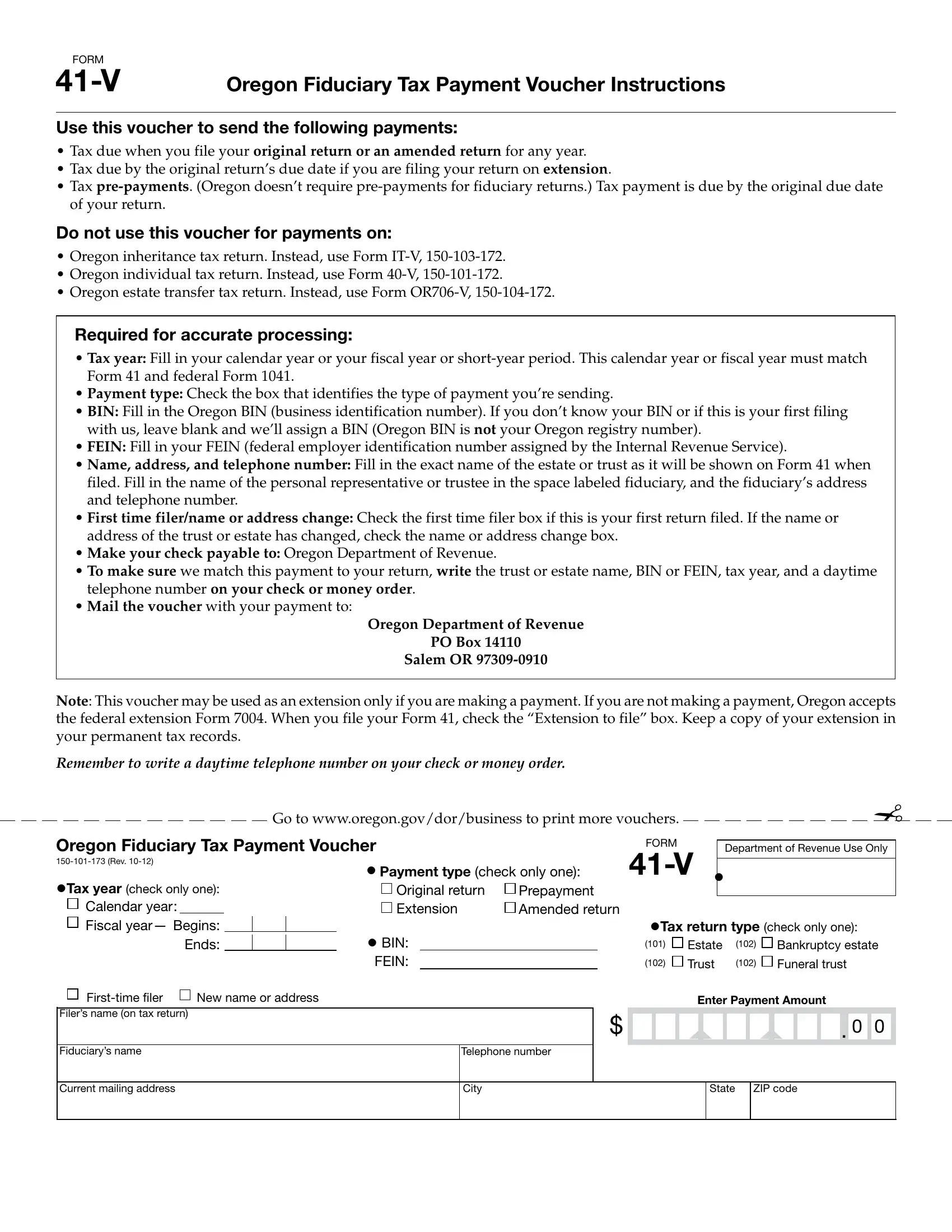

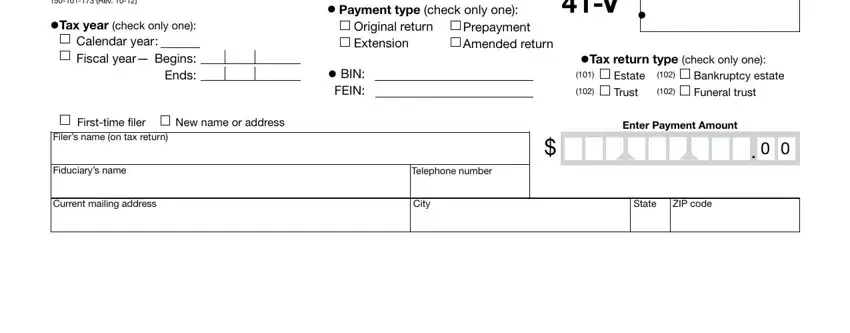

As for the blank fields of this particular document, here's what you should know:

1. Start completing your Oregon Form 41 V with a group of necessary fields. Collect all of the information you need and be sure not a single thing forgotten!

Step 3: Revise what you've inserted in the blank fields and click the "Done" button. Right after creating a7-day free trial account with us, you will be able to download Oregon Form 41 V or email it right away. The document will also be readily accessible through your personal account page with your changes. We do not share any details that you use whenever dealing with forms at our site.