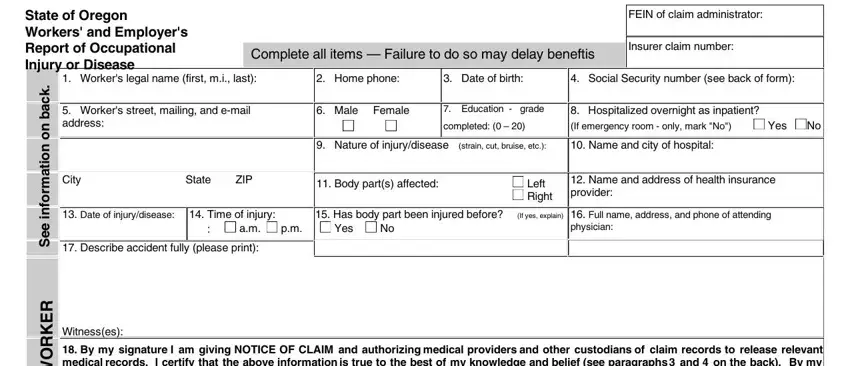

Notice to Worker

Important information about your Social Security Number (SSN)

1.You must provide your SSN. The Workers' Compensation Division (WCD) of the Department of Consumer and Business Services (DCBS) has authority to request your SSN under the Privacy Act of 1974, 5 USC & 552a (West 1977), Section 7(a)(2)(B). Authority under state law is provided in Oregon Revised Statute 656.265, and under Administrative Order WCB 4-1967 codified at OAR 436 Division 060. Your SSN will be used by DCBS to carry out its duties under ORS Chapter 656, which include compliance, research, claims processing, and injured-worker-program administration.

2.Your voluntary authorization for the use of your SSN is also requested for use by various government agencies to carry out their statutory duties, including, but not limited to, planning, research, child support enforcement, employment assistance, benefit coordi- nation, child labor law enforcement, risk management, hazard identification, rate setting, and training programs. If you do not authorize this use, please check the box by your signature in Section 18 on the front of this form.

Authorization to release medical records

3.By signing this 801, you are giving "Notice of Claim" and authorizing medical providers and other custodians of claim record to release records related to the injury or disease claimed on this 801 under ORS Chapter 656 and OAR Chapter 436. Medical information relevant to the claim includes past history of the complaints or treatment of a condition similar to that presented in the claim or other conditions related to the same body part.

Caution against making false statements

4.Any person who knowingly makes any false statement or representation for the purpose of obtaining any benefit or payment is punishable, upon conviction, by imprisonment for a term of not more than one year, a fine of not more than $1,000, or both, under ORS 656.990(1).

This is your receipt, when signed by your employer, that you gave notice of a claim. Keep it as your record.

5.Your employer will submit the claim for you. You will receive written notice from your employer's insurer of any action taken on

your claim. If your employer is self-insured, the notice will be sent by your employer or the company your employer has hired to process its workers' compensation claims. The insurer must notify you of its acceptance or denial within 90 days from the date your employer knows of your claim. If denied, the reason for the denial and your rights will be explained.

Medical care

6.If your claim is accepted, the insurer or self-insured employer will pay injury-related medical bills, including reimbursement for prescription medications, transportation, meals, lodging, and other expenses paid by you for claim-related treatment, up to an established maximum. Your request for reimbursement must be in writing and include receipts. Medical bills are not paid before claim acceptance. Bills are not paid if your claim is denied, with the following exceptions: If you are required by your insurer to receive treatment from a managed care organization (MCO), necessary medical care, not otherwise covered by your health insurance, will be paid by your insurer until you receive a notice of denial or until three days after the insurer mails the notice of denial to you, whichever occurs first.

You must tell your doctor or hospital on your first visit that your injury or illness is work related. The doctor must tell you if there are any limits to the medical services he or she may provide you under the Oregon workers' compensation system.

If you are enrolled in a managed care organization (MCO), your attending physician may be any medical service provider authorized by contract with the MCO. An MCO contracts with insurance companies to provide managed medical care to injured workers of employers covered by the insurance company. Check with the MCO to find out who can be your attending physician. If you are not enrolled in an MCO, your attending physician must be one of the following:

•A licensed medical doctor, a licensed doctor of osteopathy, or a licensed oral and maxillofacial surgeon

•A licensed chiropractor (only for 30 days from the date of the first chiropractic visit on the initial claim or for 12 chiropractic visits during the 30-day period, whichever happens first)

Payments for time lost from work

7.In order for you to receive payments for time lost from work, your attending physician must notify the insurer or self-insured employer of your inability to work. You will not be paid for the first three calendar days you are unable to work unless you are totally disabled for at least 14 consecutive calendar days or you are admitted as an inpatient to a hospital within 14 days of the first onset of total disability.

If you are disabled for more than three calendar days, the insurer or self-insured employer must mail your first compensation check no later than the 14th day after your employer knows of your claim. You will continue to receive a check every two weeks during your recovery period as long as your attending physician verifies your inability to work. These checks will continue until you return to work, or it is determined further treatment is not expected to improve your condition. Your time-loss benefits will be two-thirds of your gross weekly wage at the time of injury up to a maximum equal to Oregon's average weekly wage. However, if your weekly wage is $75 or less, your benefits will be $50 per week or 90 percent of your weekly wage, whichever is less.

If you have questions about your claim that are not resolved by your employer or insurer, you may contact: