You'll be able to work with Oregon Form Ds1 instantly in our PDFinity® online tool. Our team is ceaselessly endeavoring to expand the editor and help it become even easier for users with its multiple functions. Make use of the current progressive prospects, and discover a myriad of new experiences! Starting is effortless! What you need to do is take the following basic steps below:

Step 1: Just press the "Get Form Button" in the top section of this page to open our form editor. There you'll find all that is necessary to work with your file.

Step 2: The editor will let you customize PDF documents in various ways. Modify it with any text, adjust what's originally in the document, and include a signature - all at your disposal!

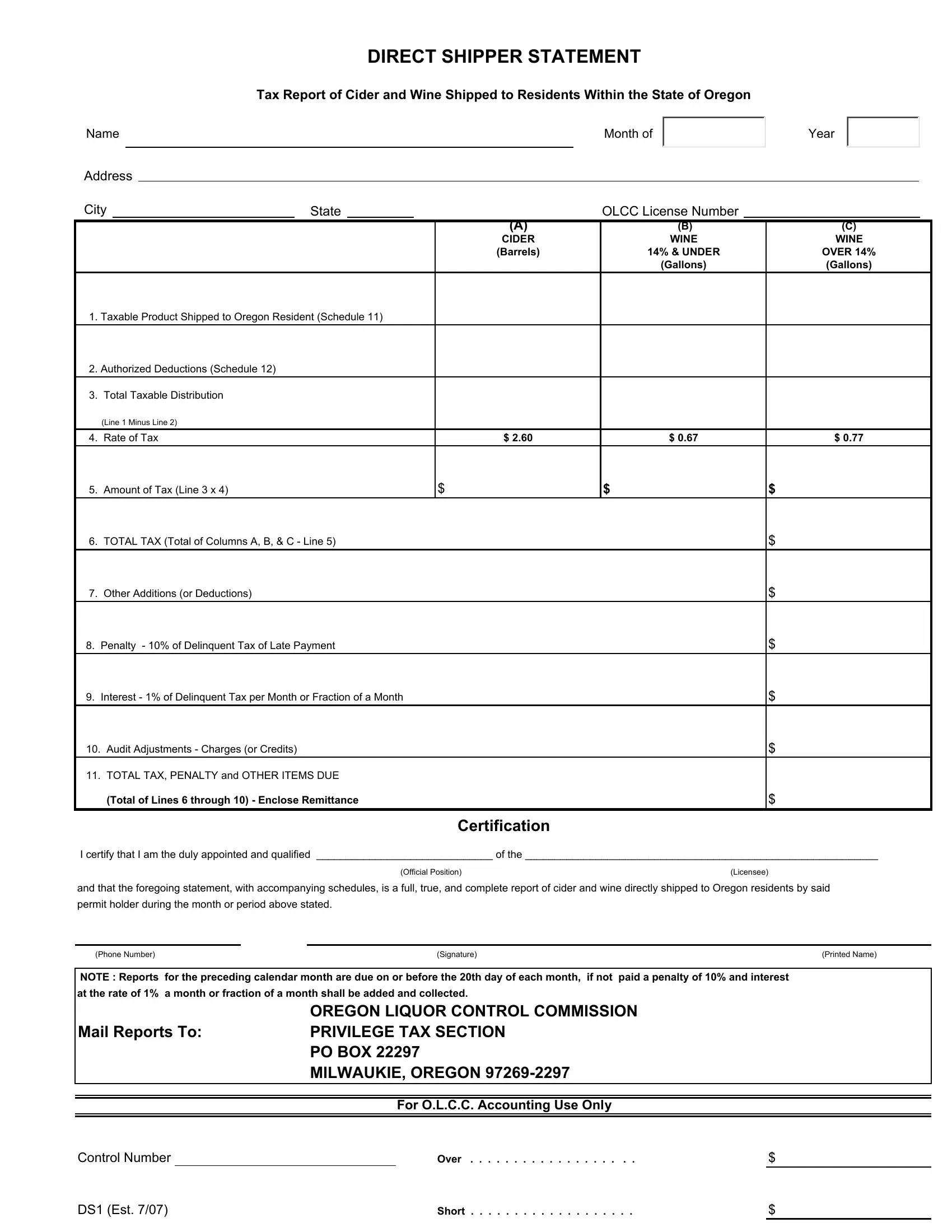

This document will require specific information to be filled in, therefore you should definitely take whatever time to fill in precisely what is requested:

1. First of all, once filling in the Oregon Form Ds1, start out with the part that has the subsequent blanks:

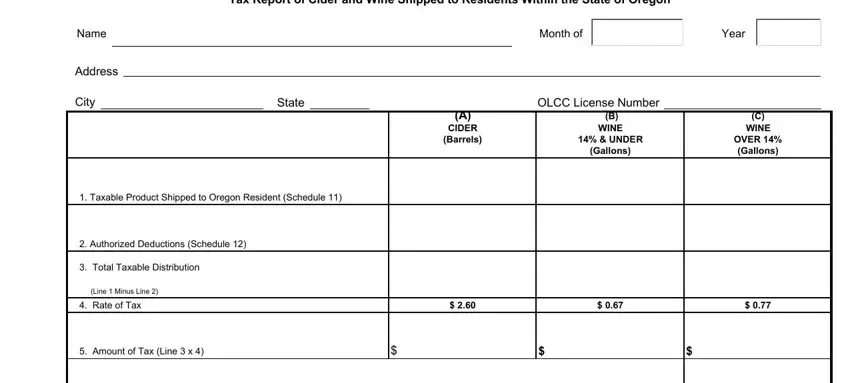

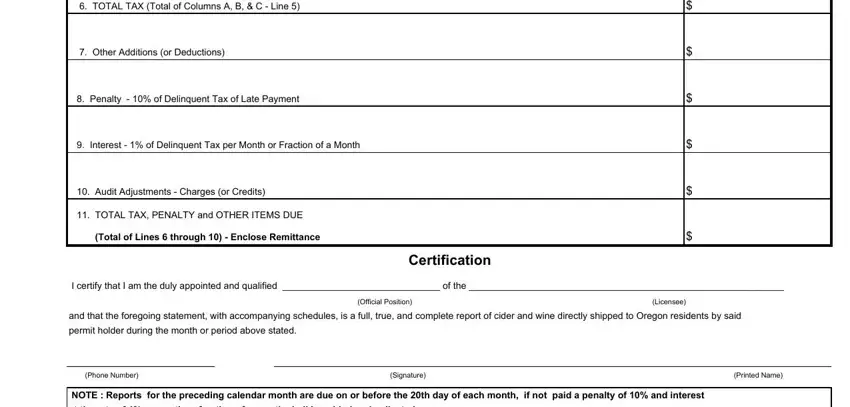

2. Once your current task is complete, take the next step – fill out all of these fields - TOTAL TAX Total of Columns A B C, Other Additions or Deductions, Penalty of Delinquent Tax of, Interest of Delinquent Tax per, Audit Adjustments Charges or, TOTAL TAX PENALTY and OTHER ITEMS, Total of Lines through Enclose, I certify that I am the duly, and that the foregoing statement, Official Position, Licensee, permit holder during the month or, Certification, Phone Number, and Signature with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

It is easy to make a mistake when filling out your Penalty of Delinquent Tax of, for that reason you'll want to reread it prior to deciding to submit it.

Step 3: Right after you've looked over the information in the fields, click "Done" to conclude your document creation. Join us now and easily access Oregon Form Ds1, available for download. All adjustments made by you are saved , enabling you to change the document at a later point as needed. With FormsPal, you can certainly complete documents without the need to get worried about database incidents or entries being shared. Our protected platform helps to ensure that your private information is maintained safe.