When you wish to fill out H--Powers, it's not necessary to install any kind of programs - just try using our PDF editor. The editor is consistently improved by us, getting powerful features and growing to be greater. Here is what you'd have to do to get going:

Step 1: Just press the "Get Form Button" above on this page to access our pdf file editing tool. Here you will find all that is necessary to work with your document.

Step 2: This tool offers the capability to customize PDF documents in a variety of ways. Enhance it with personalized text, adjust original content, and place in a signature - all at your fingertips!

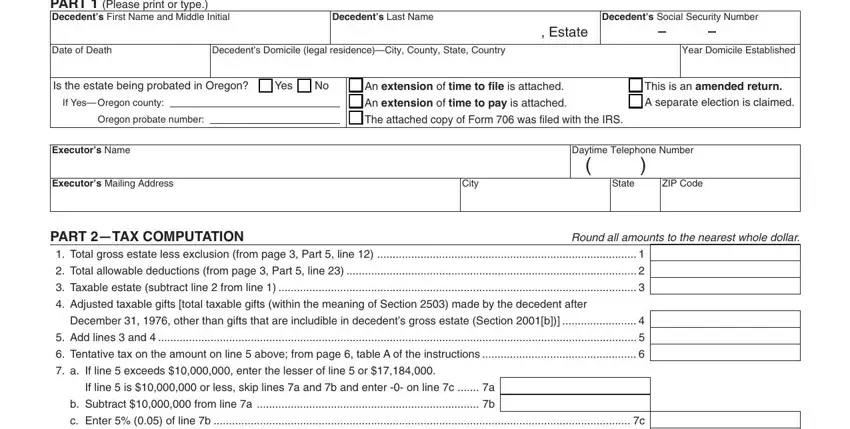

As a way to complete this document, ensure that you provide the right information in every blank:

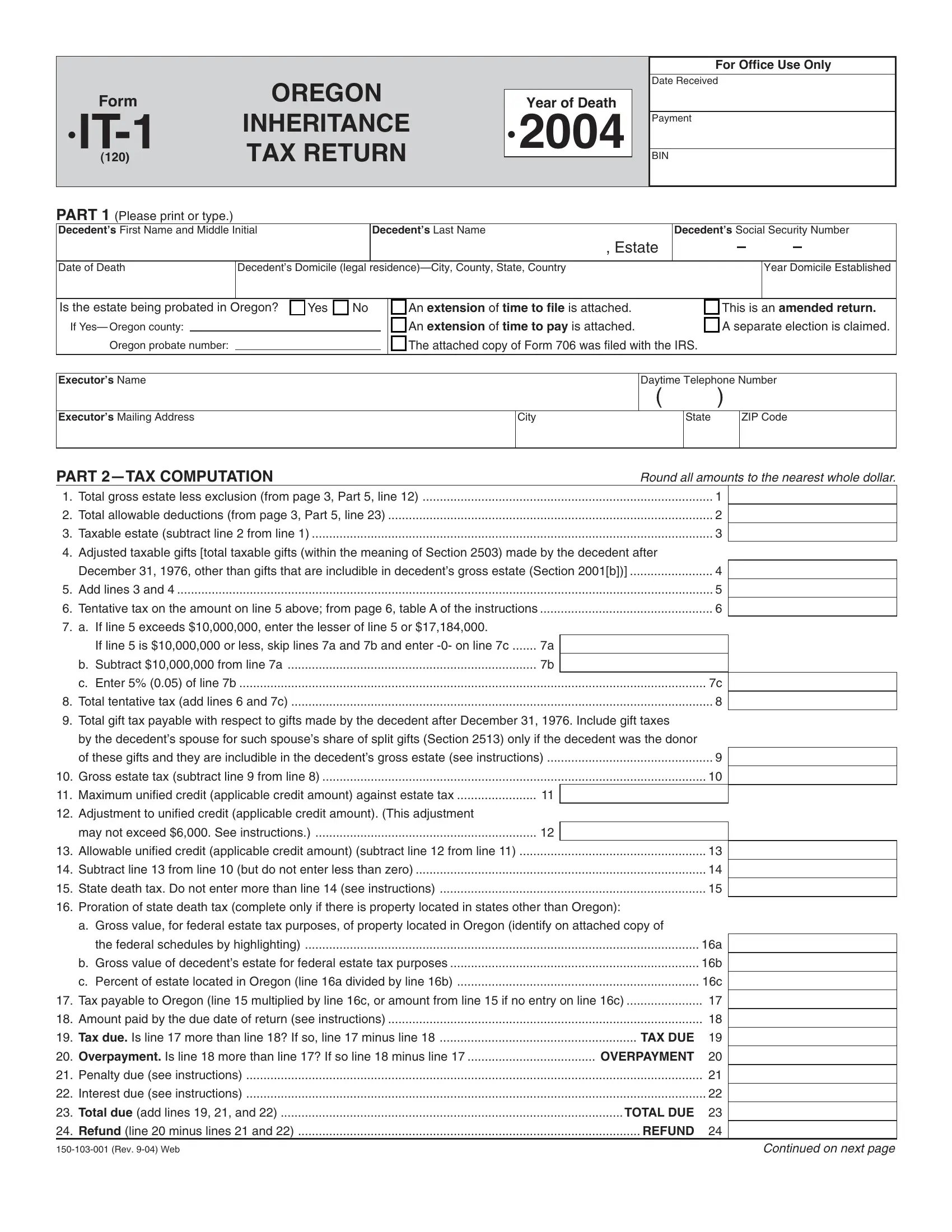

1. It is advisable to fill out the H--Powers accurately, hence be careful when working with the sections including all these blank fields:

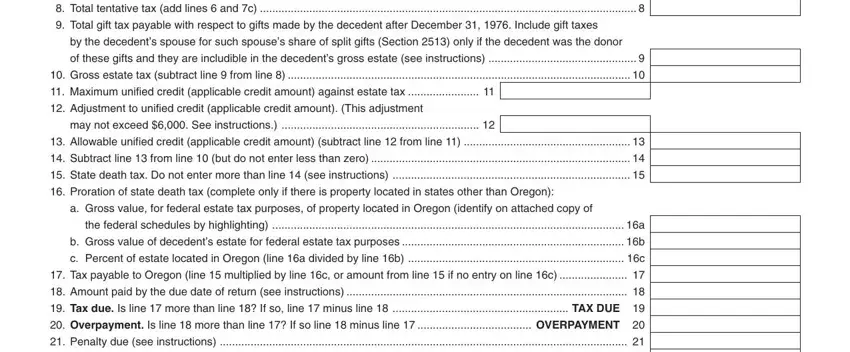

2. The subsequent step is usually to fill in the next few fields: Total tentative tax add lines, Total gift tax payable with, by the decedents spouse for such, of these gifts and they are, Gross estate tax subtract line, Maximum unified credit applicable, Adjustment to unified credit, may not exceed See instructions, Allowable unified credit, Subtract line from line but do, State death tax Do not enter more, Proration of state death tax, a Gross value for federal estate, the federal schedules by, and b Gross value of decedents estate.

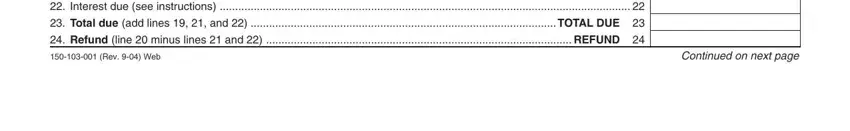

3. Completing Interest due see instructions, Total due add lines and TOTAL, Refund line minus lines and, Rev Web, and Continued on next page is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Lots of people frequently get some points incorrect while filling out Interest due see instructions in this part. Make sure you review what you type in here.

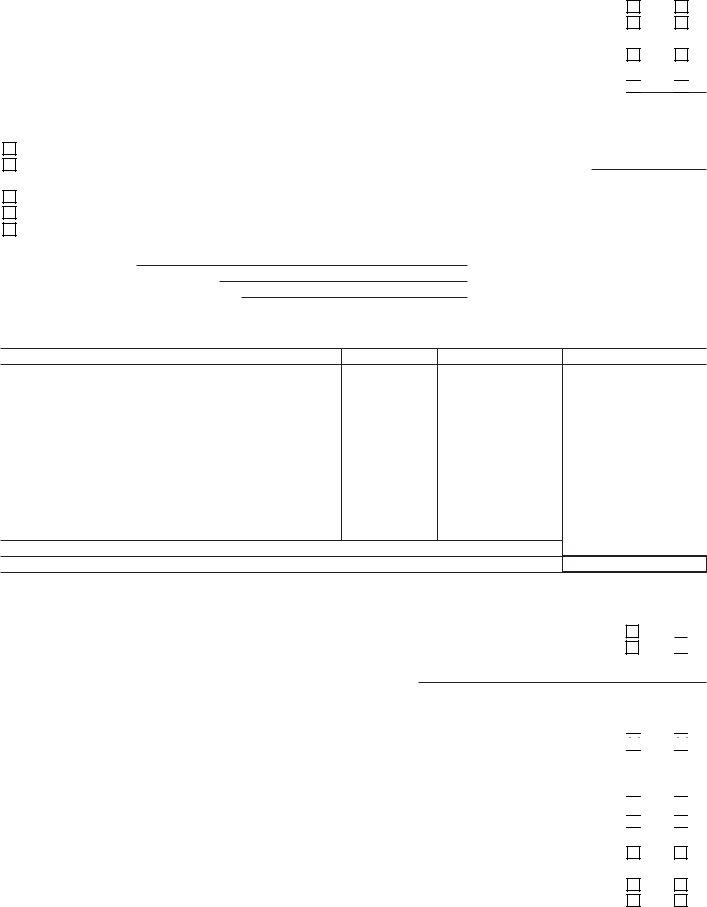

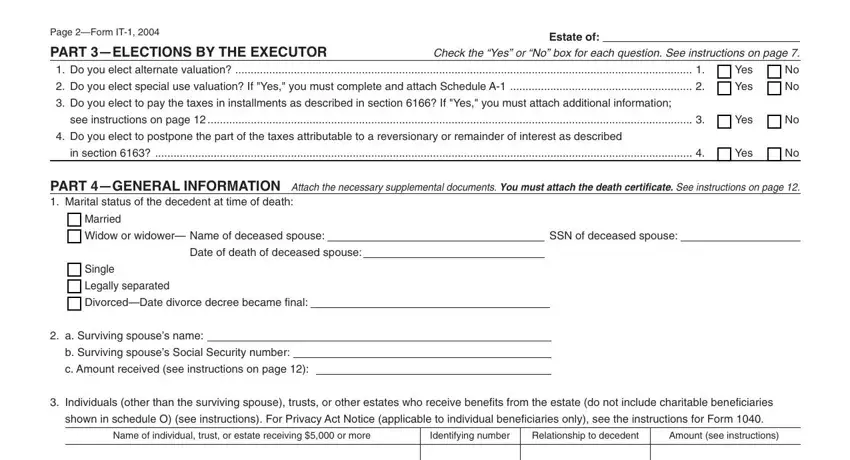

4. Now begin working on this next section! Here you'll have these Page Form IT, Estate of, PART ELECTIONS BY THE EXECUTOR Do, Check the Yes or No box for each, Do you elect special use, Do you elect to pay the taxes in, see instructions on page, Yes, Do you elect to postpone the part, in section, Yes, Yes, Yes, PART GENERAL INFORMATION Attach, and Married fields to fill in.

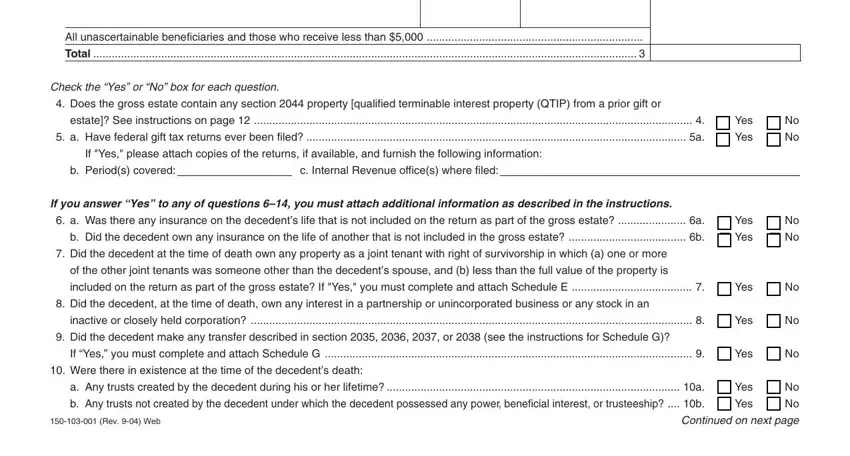

5. To wrap up your document, this last section incorporates a number of extra blank fields. Completing All unascertainable beneficiaries, Total, Check the Yes or No box for each, Does the gross estate contain any, estate See instructions on page, a Have federal gift tax returns, Yes, Yes, If Yes please attach copies of the, b Periods covered, c Internal Revenue offices where, If you answer Yes to any of, a Was there any insurance on the, b Did the decedent own any, and Yes will certainly wrap up the process and you'll definitely be done quickly!

Step 3: As soon as you've glanced through the details entered, just click "Done" to conclude your FormsPal process. Join us right now and immediately gain access to H--Powers, ready for download. All changes made by you are saved , which means you can change the document at a later stage as required. At FormsPal.com, we do our utmost to make certain that all your information is kept protected.