Handling PDF documents online can be a piece of cake using our PDF tool. Anyone can fill out Oregon Monthly Mileage Tax Form here within minutes. The tool is continually upgraded by our team, acquiring additional functions and turning out to be more versatile. To get the process started, consider these easy steps:

Step 1: Click the orange "Get Form" button above. It'll open up our pdf editor so that you could begin completing your form.

Step 2: The editor helps you work with most PDF forms in a range of ways. Modify it by writing your own text, correct what is originally in the file, and put in a signature - all manageable in no time!

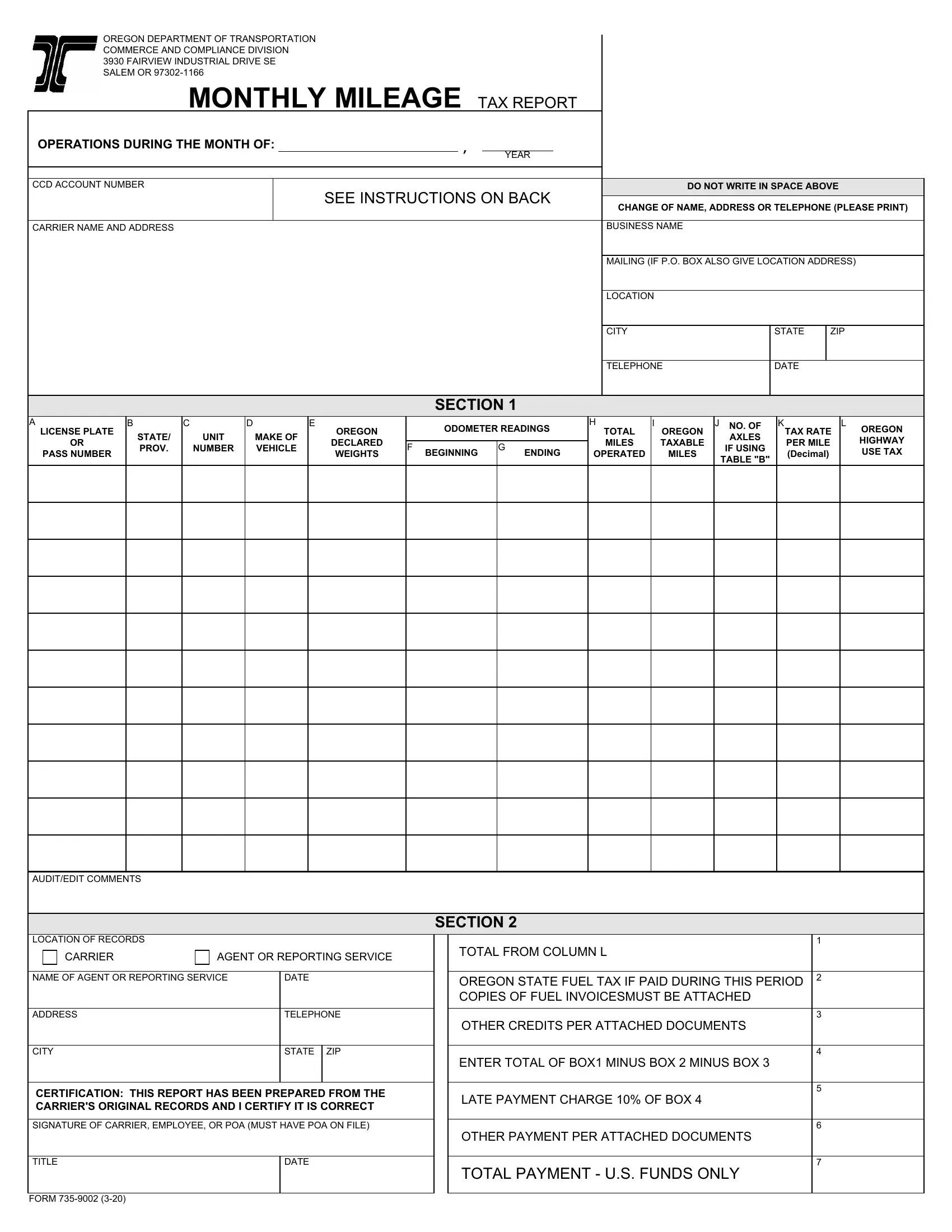

This form will need particular data to be typed in, thus make sure to take some time to provide precisely what is required:

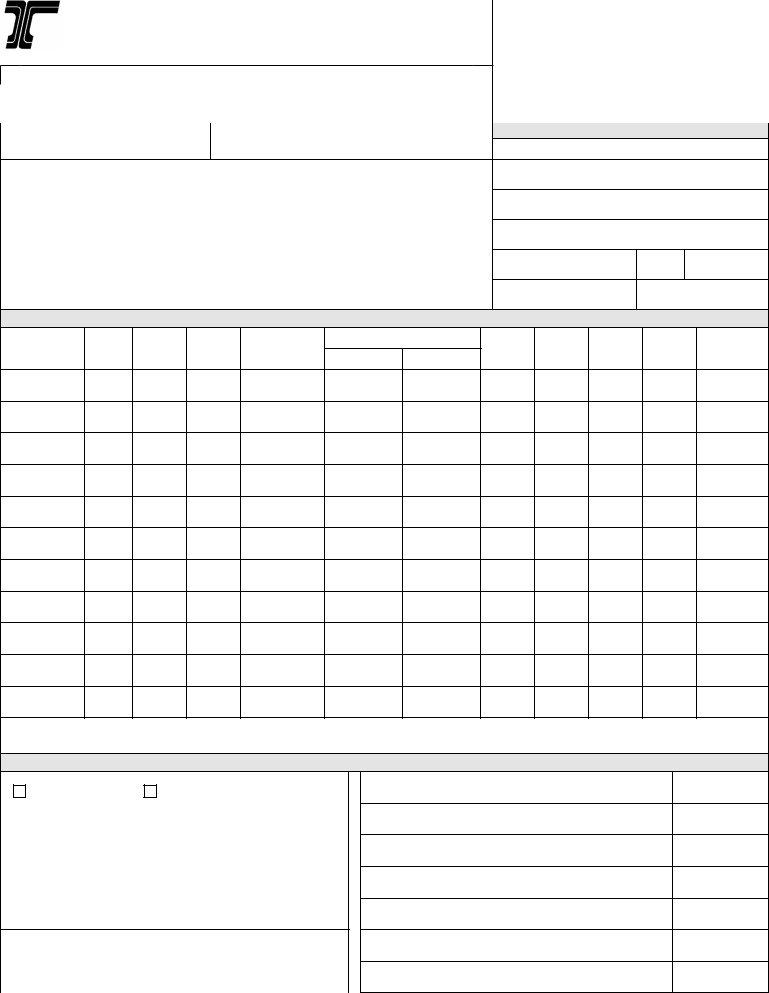

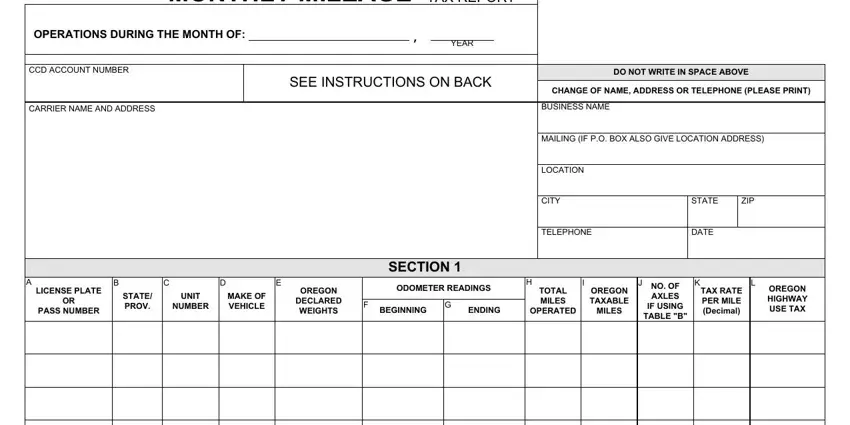

1. Fill out the Oregon Monthly Mileage Tax Form with a number of essential fields. Consider all the required information and ensure absolutely nothing is left out!

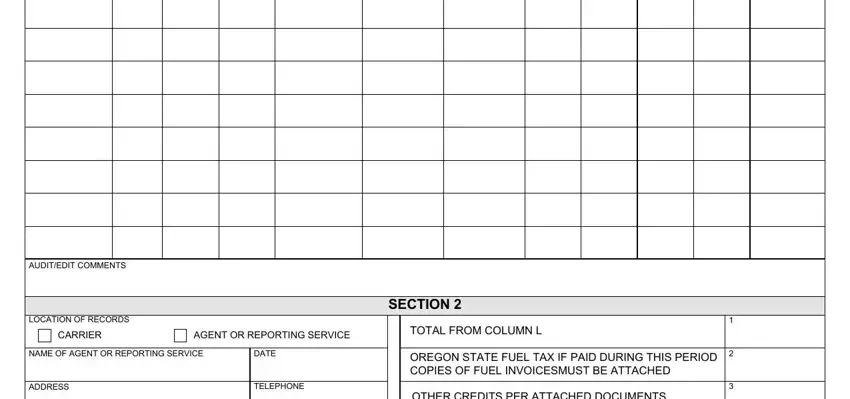

2. Immediately after this section is done, proceed to type in the relevant details in these: AUDITEDIT COMMENTS, LOCATION OF RECORDS, CARRIER, AGENT OR REPORTING SERVICE, TOTAL FROM COLUMN L, SECTION, NAME OF AGENT OR REPORTING SERVICE, DATE, ADDRESS, TELEPHONE, OREGON STATE FUEL TAX IF PAID, and OTHER CREDITS PER ATTACHED.

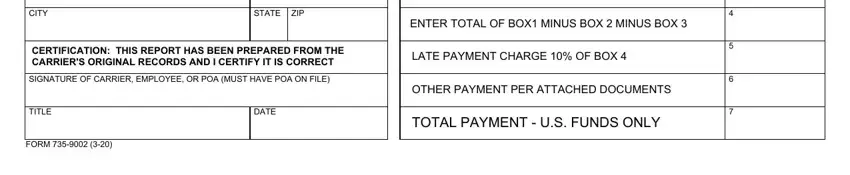

3. The next part is quite straightforward, CITY, STATE ZIP, CERTIFICATION THIS REPORT HAS BEEN, SIGNATURE OF CARRIER EMPLOYEE OR, TITLE, DATE, FORM, ENTER TOTAL OF BOX MINUS BOX, LATE PAYMENT CHARGE OF BOX, OTHER PAYMENT PER ATTACHED, and TOTAL PAYMENT US FUNDS ONLY - these form fields needs to be completed here.

It's very easy to make errors while filling in your STATE ZIP, thus make sure you go through it again before you decide to submit it.

Step 3: Immediately after going through the filled in blanks, click "Done" and you are done and dusted! After getting a7-day free trial account at FormsPal, you'll be able to download Oregon Monthly Mileage Tax Form or send it via email promptly. The form will also be accessible through your personal cabinet with your edits. FormsPal provides secure document completion with no data recording or distributing. Be assured that your information is in good hands here!