Working with PDF forms online is certainly a piece of cake with our PDF editor. Anyone can fill in probate financial statement in state oregon 2017 here in a matter of minutes. The tool is consistently upgraded by us, receiving new functions and turning out to be greater. Starting is simple! All you need to do is follow the next basic steps down below:

Step 1: Press the "Get Form" button in the top part of this page to get into our tool.

Step 2: This tool lets you work with nearly all PDF files in many different ways. Improve it by adding customized text, adjust existing content, and place in a signature - all within the reach of a few clicks!

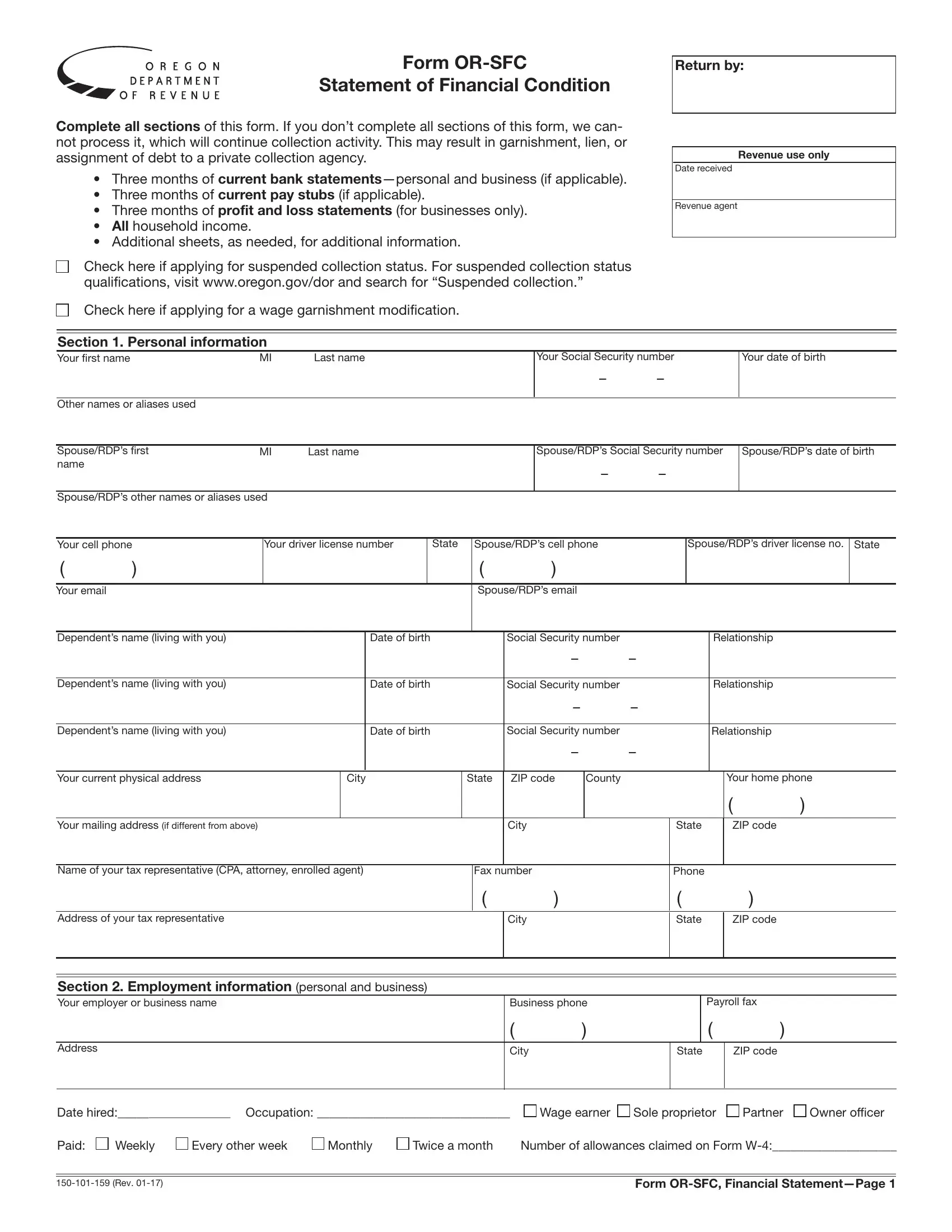

When it comes to blank fields of this precise PDF, this is what you should consider:

1. The probate financial statement in state oregon 2017 usually requires certain details to be typed in. Be sure that the next fields are filled out:

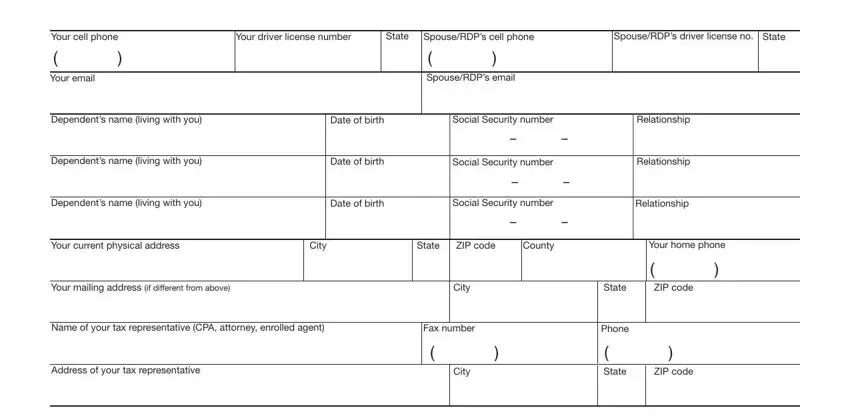

2. The next step is to complete the next few fields: Your cell phone Your email, Your driver license number, State, SpouseRDPs cell phone, SpouseRDPs driver license no, State, SpouseRDPs email, Dependents name living with you, Date of birth, Social Security number, Relationship, Dependents name living with you, Date of birth, Social Security number, and Dependents name living with you.

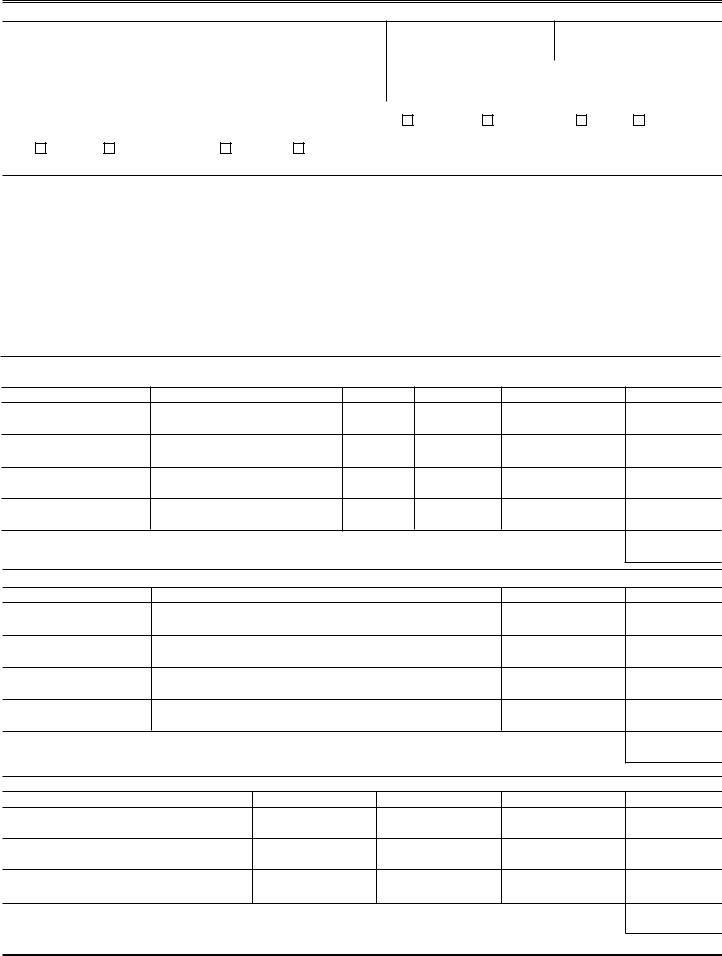

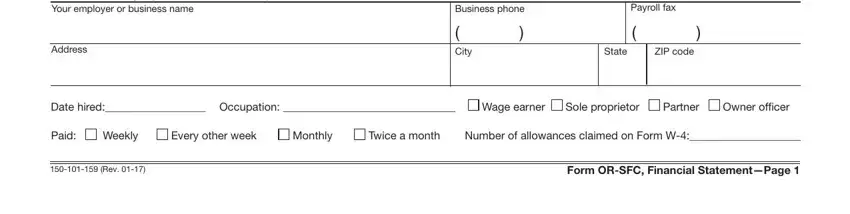

3. In this particular part, have a look at Section Employment information, Address, Business phone, Payroll fax, City, State, ZIP code, Date hired Occupation, Wage earner, Sole proprietor, Partner, Owner oficer, Paid, Weekly, and Every other week. All of these should be filled in with greatest accuracy.

It's easy to get it wrong while filling in your Partner, and so make sure to reread it before you'll finalize the form.

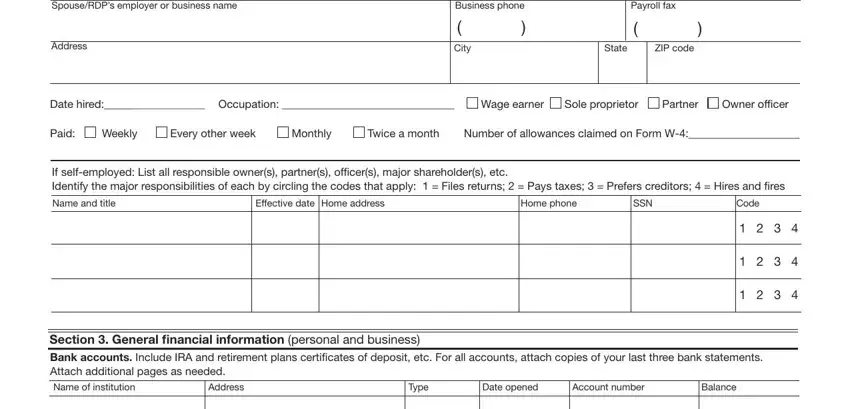

4. The fourth part comes next with all of the following blank fields to complete: Section continued Employment, Business phone, Address, City, Payroll fax, State, ZIP code, Date hired Occupation, Wage earner, Sole proprietor, Partner, Owner oficer, Paid, Weekly, and Every other week.

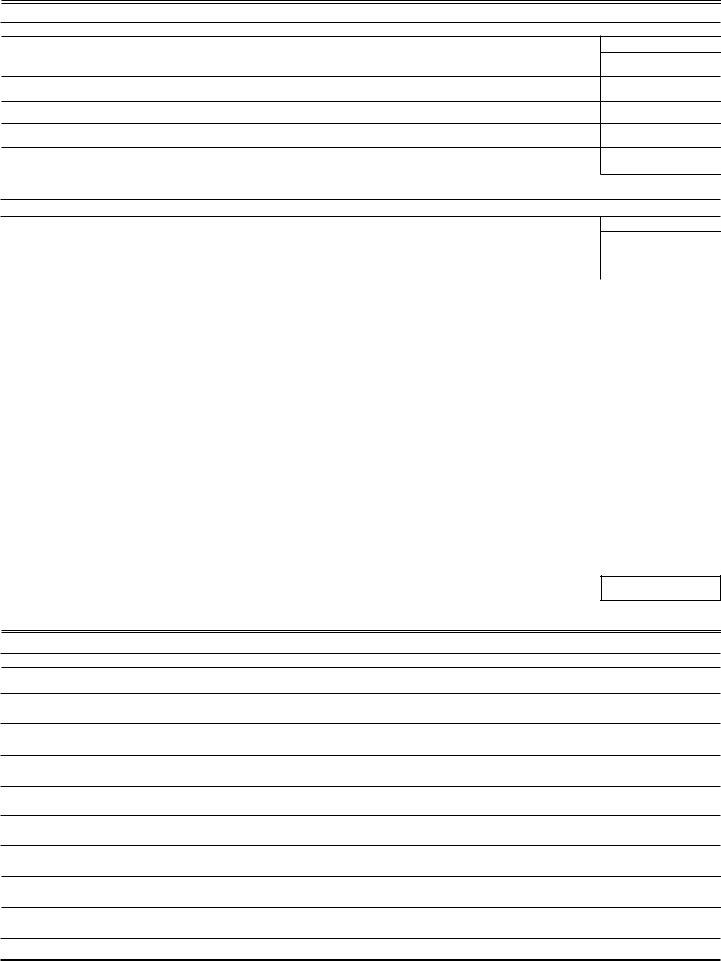

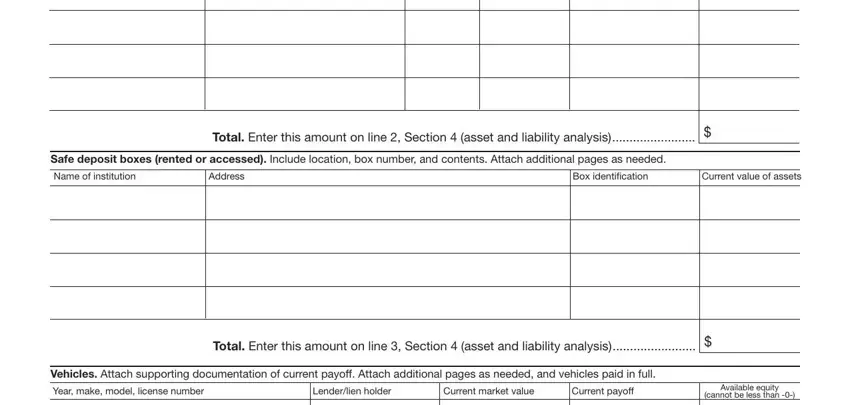

5. Finally, the following final part is precisely what you will have to finish before closing the form. The blank fields under consideration include the next: Total Enter this amount on line, Safe deposit boxes rented or, Name of institution, Address, Box identiication, Current value of assets, Total Enter this amount on line, Vehicles Attach supporting, Year make model license number, Lenderlien holder, Current market value, Current payoff, Available equity, and cannot be less than.

Step 3: When you've looked over the details in the file's blank fields, click "Done" to complete your form. Go for a free trial subscription with us and gain direct access to probate financial statement in state oregon 2017 - downloadable, emailable, and editable from your FormsPal cabinet. FormsPal is devoted to the privacy of all our users; we always make sure that all personal data going through our system remains confidential.